- English (UK)

November 2025 US Employment Report: Further Signs Of Stalling

Payrolls Growth Remains Subdued

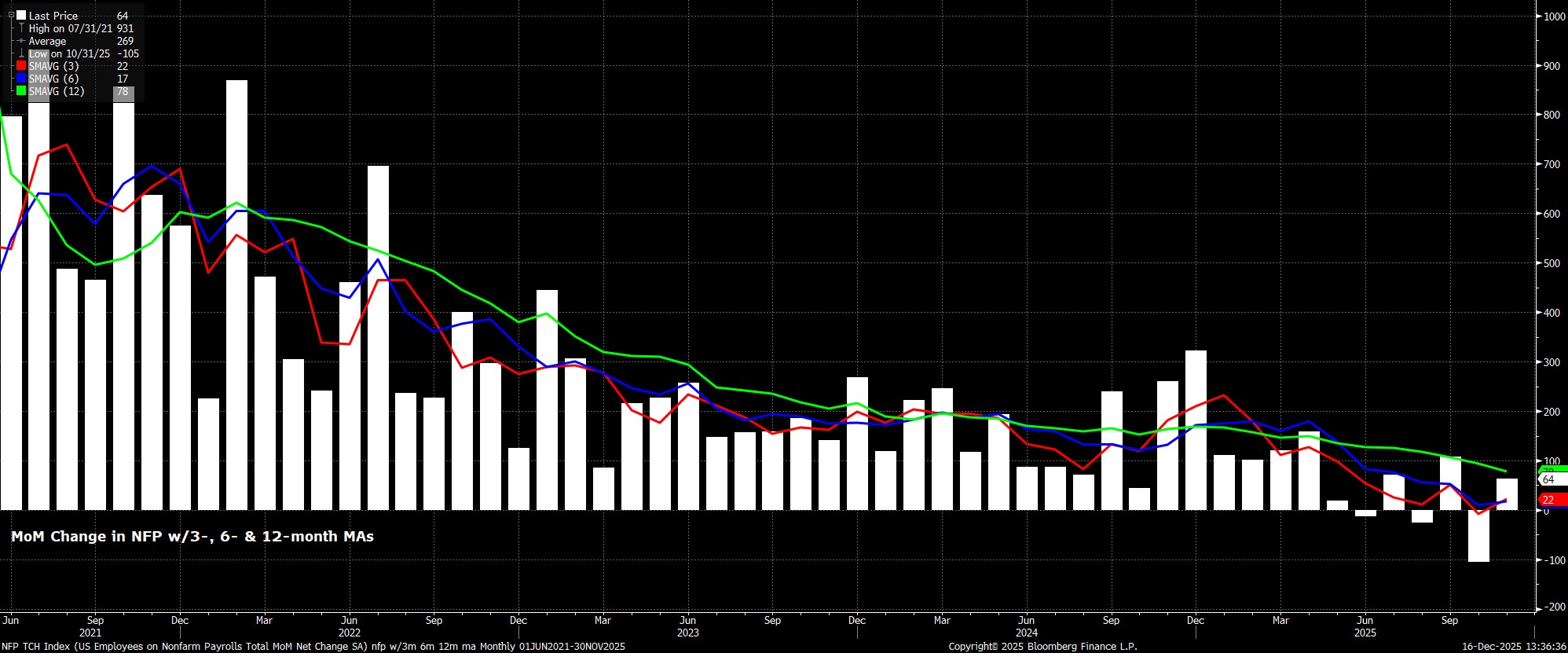

Headline nonfarm payrolls rose by +64k in November, modestly above consensus expectations for an increase of +50k, and following payrolls having fallen by a sizeable -105k in October, with that latter datapoint being released in conjunction with the November report, owing to delays resulting from the government shutdown.

In any case, zooming out a little, the release of those two figures now sees the 3-month average of job gains standing at +22k, again reflecting a stalling labour market, and below the breakeven rate, which currently stands around the 30-70k mark.

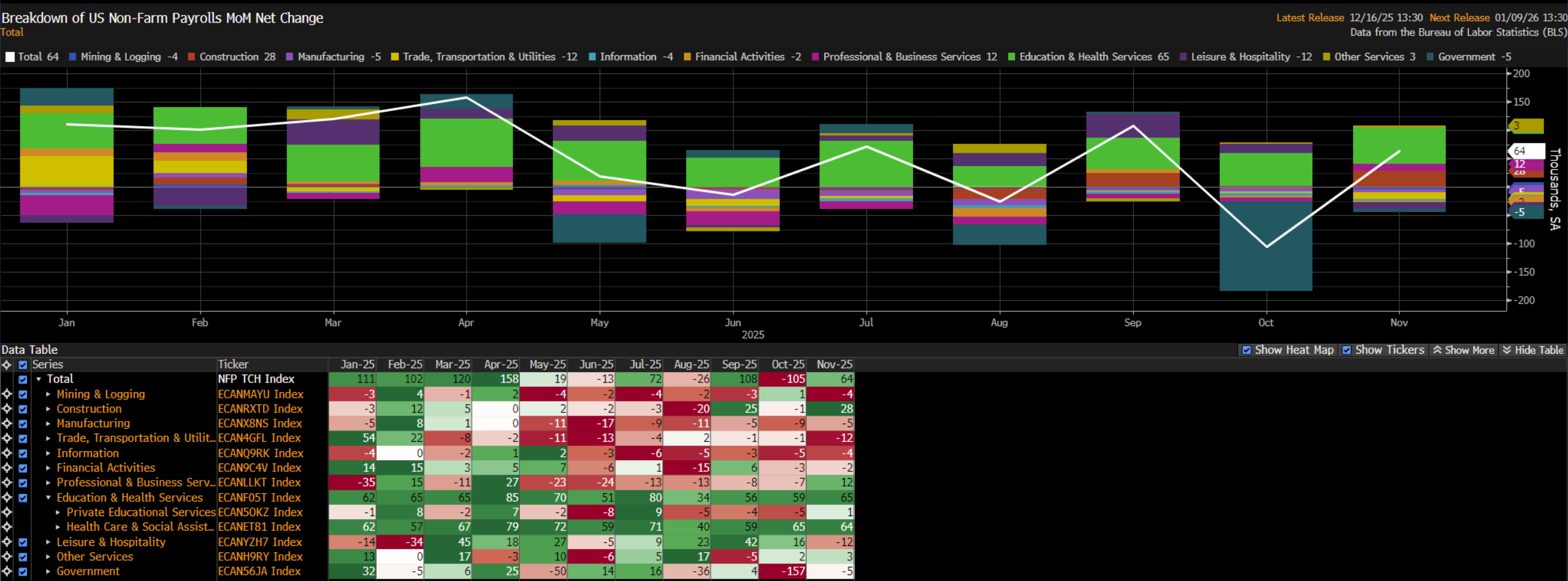

Under The Surface

Digging further into the report, with a focus on the November data, the figures pointed to the healthcare sector continuing to prop up employment, having added +64k jobs on the month. In other words, if the population wasn’t aging, there would’ve been zero net new jobs growth last month.

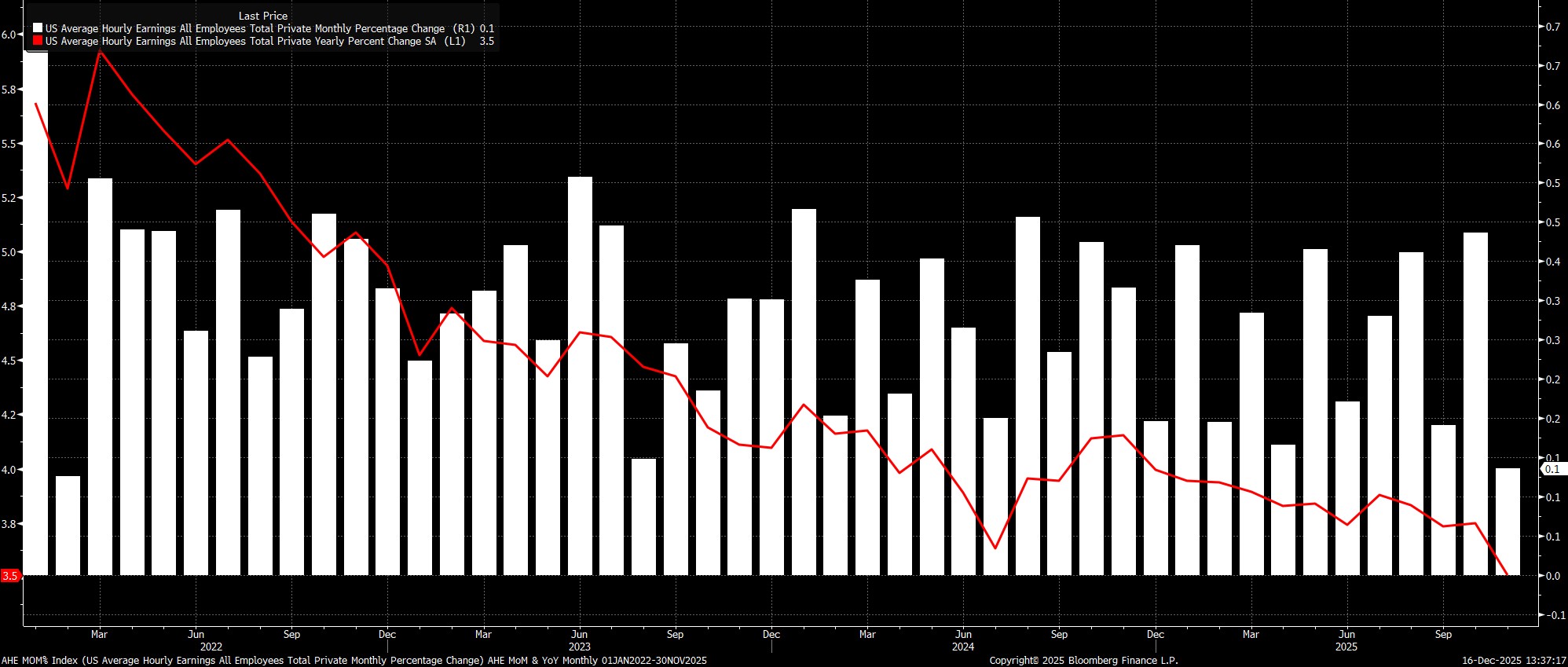

Earnings Pressures Subdued

Remaining with the November establishment survey, the jobs report pointed to pay pressures once again remaining relatively well-contained, further helping to support the FOMC’s long-running view that the labour market isn’t a significant source of upside inflation risk at the present time.

Last month, average hourly earnings rose 0.1% MoM, considerably cooler than the 0.3% MoM consensus, which in turn saw the annual pace fall to 3.5% YoY.

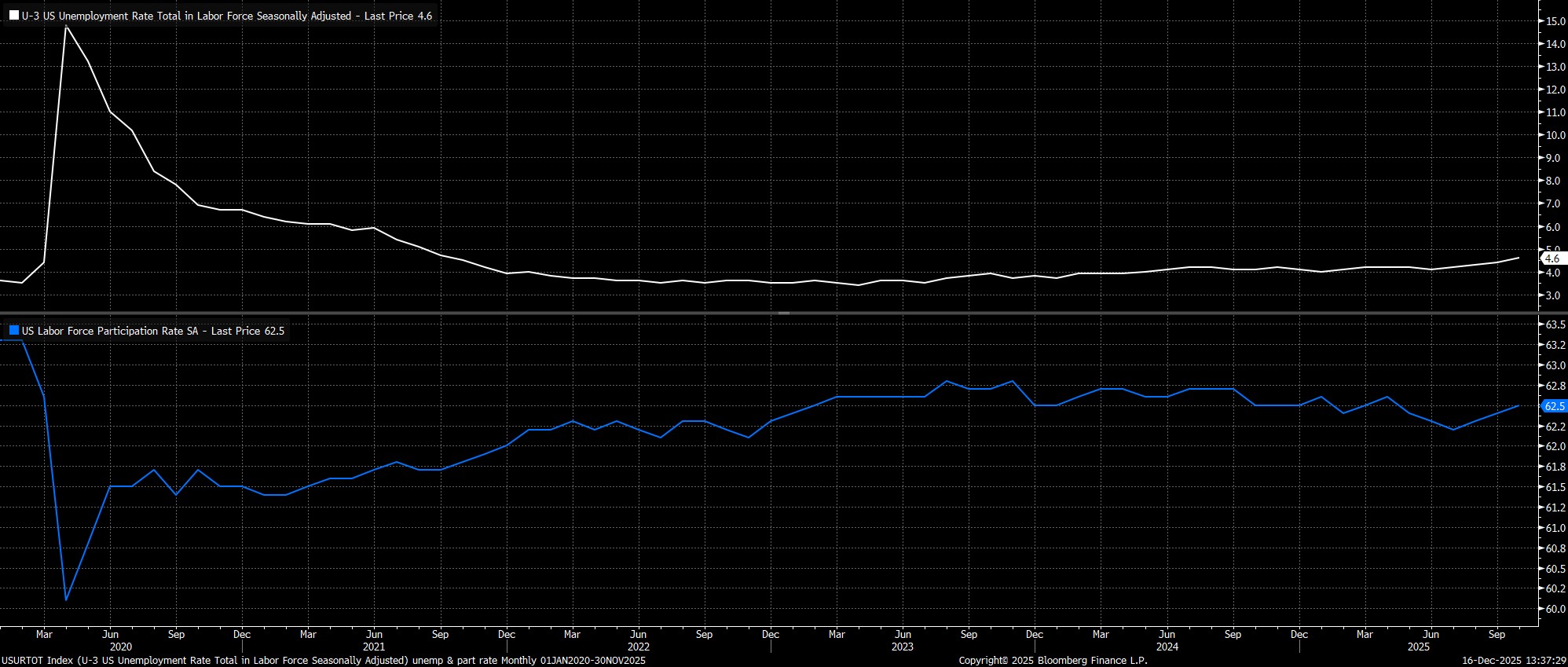

Household Survey Points To Further Weakness

Turning to the household survey, only November data is available, after the BLS was unable to collect the figures for October, owing to the aforementioned government shutdown. The data that was released, furthermore, must be accompanied with something of a ‘health warning’, owing not only to the BLS continuing to struggle with the changing

In any case, the report pointed to headline unemployment having risen to a fresh cycle high 4.6% in November, up from the 4.4% seen in September. However, a chunk of this continues to be driven by increased labour force participation, which rose further to 62.5% last month, up 0.1pp from the September print.

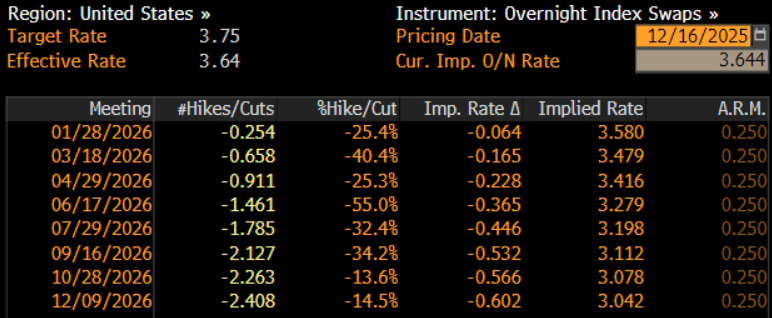

Money Markets Dovishly Reprice

As the data was released, money markets repriced marginally in a dovish direction post-payrolls. While the USD OIS curve continues to discount around a 1-in-4 chance of a 25bp cut in January, the next 25bp cut is now fully discounted by April, compared to the June meeting as was priced before the data dropped.

Conclusion

Stepping back, while a deluge of data has just been released, I question the extent to which any of the figures are likely to materially alter either the near-, or longer-run, FOMC policy outlooks.

In the ‘here and now’, recall that the FOMC have already wrapped up the year by delivering a third straight 25bp cut at the conclusion of the December confab, without having had sight of any official labour market data referencing the fourth quarter. Furthermore, as we look ahead to the January meeting, policymakers will receive the December jobs report beforehand, which is likely to have greater sway in terms of next year’s first policy deliberations.

Longer-term, the direction of travel for policy remains clear, with the fed funds rate set to continue on the present path back towards neutral, say 3%. Such a neutral rate is likely to be achieved at some stage in 2026, with the timing of further cuts hinging almost entirely on labour market developments, meaning that another reduction at the January meeting cannot be ruled out at this stage.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.