- English (UK)

November 2025 UK Jobs Report: Unemployment Stays Elevated As Slack Builds

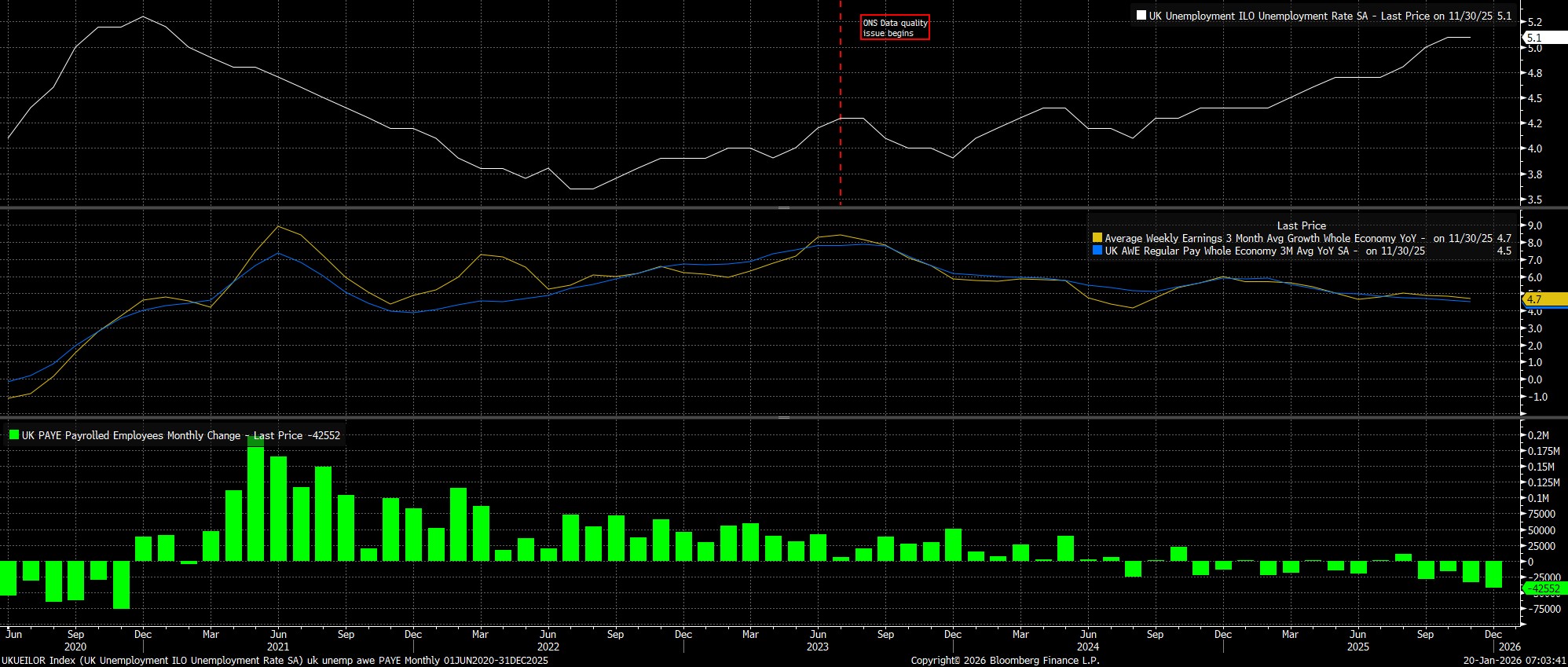

Headline unemployment, in the three months to November, held steady at 5.1%, unchanged from the pace seen in November, but still at its highest level since the start of 2021.

Meanwhile, earnings pressures continued to moderate. Overall earnings rose 4.7% YoY over the aforementioned period, 0.1pp slower than the pace seen in October, while regular pay rose by 4.5% YoY, the slowest pace since early-2022. Furthermore, in keeping with recent trends, public sector earnings growth continued to considerably outpace that of the private sector; while, obviously, not a sustainable situation, private sector pay growth, at 3.6% YoY, is broadly compatible with a sustainable return to the BoE's 2% inflation aim over the medium term, and is now at a 5-year low.

As for more timely metrics, the PAYE payrolls metric pointed to employment having fallen further in December, with payrolls shrinking by a chunky 43k, not only the 4th consecutive monthly decline, but also the biggest one-month decline since November 2020.

Taking a step back, this morning's data emphasises the still-fragile nature of the UK labour market, with a notable margin of slack continuing to emerge, and with further such slack likely to make itself known, as growth remains anaemic, and as risks to the broader economic outlook continue to tilt to the downside.

While data of the ilk seen today should help to soothe some concerns among BoE policymakers as to the risk of price pressures proving persistent, it is unlikely to be enough to force the MPC into delivering another rate cut at the February meeting. Given the relatively hawkish nature of the cut delivered in December, policymakers are likely seeking further evidence of disinflationary pressures having become embedded before taking further steps to remove policy restriction. Tomorrow's inflation data will, clearly, be a key piece of the puzzle on that front.

Regardless, the direction of travel for Bank Rate remains lower, with my base case presently having pencilled in the next 25bp cut for the March meeting, before further cuts as the year progresses, taking the benchmark rate back to a neutral level, around the 3% mark. However, given the incredibly divided nature of the MPC, with the last two meetings having been decided by 5-4 votes, having a high degree of conviction in the outlook is somewhat difficult, with just one or two policymakers shifting their stance potentially flipping the entire outlook on its head.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.