- English (UK)

November 2025 UK GDP: Upside Surprise Amid Downside Risks

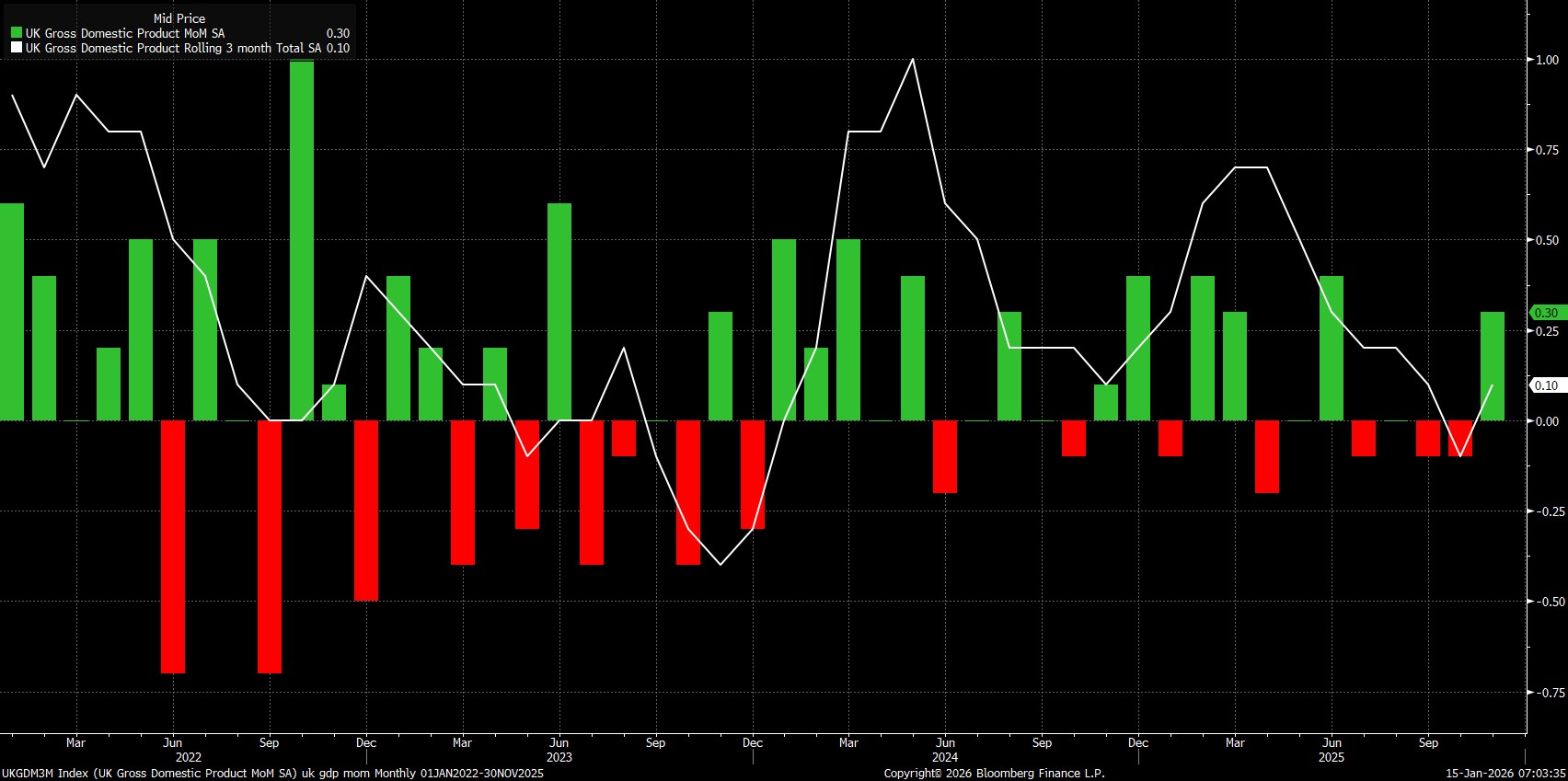

The economy expanded at a decent clip in November, by 0.3% MoM, in turn marking the first monthly expansion since all the way back in June. However, this MoM data remains volatile, and statistically noisy, meaning that a rolling 3-month average remains a cleaner way to view the underlying trend of the UK economy. On this basis, though, the economy also returned to growth, with the UK economy expanding by 0.1% in the three months to November, contrary to market expectations of an 0.2% contraction.

By and large, the rebound in growth seen in the middle of Q4 was mechanical in nature, stemming primarily from the continued re-opening of the Jaguar Land Rover plants as the firm continues to recover from last year's cyber attack. In any case, risks to the outlook more broadly continue to tilt firmly to the downside, not only considering the anaemic pace of growth to which leading indicators, such as the most recent PMI surveys, currently point, but also bearing in mind that the fiscal 'doom loop' seems set to deepen, amid reports that around two-thirds of the Chancellor's headroom may have already evaporated owing to various policy U-turns since the Budget.

As for the monetary policy outlook, today's growth data is frankly too stale to materially alter the near-term BoE policy path, with next week's jobs (Tues) and inflation (Weds) stats having a much greater role to play on that front. That said, despite delivering a 25bp Bank Rate cut in December, the 'Old Lady' does appear to have pivoted somewhat hawkish at the same time, with Governor Bailey openly talking about slowing down the easing cycle.

Taking that into account, and barring a material downside surprise in next week's data releases, it seems too soon to expect another 25bp cut at the February MPC meeting, even if - in my view - the MPC should be seeking to get Bank Rate to neutral, around 3%, as soon as possible. However, with policymakers seemingly reluctant to do so, pencilling in the next 25bp cut for March, by which point the MPC should have greater confidence in the fading risks of inflation persistence, seems plausible, with further cuts likely to be delivered beyond then.

That said, given the incredibly divided nature of the MPC at the current juncture, with the last two decisions coming via 5-4 votes, it remains difficult to have a particularly high conviction view in terms of the outlook for Bank Rate, with just one policymaker altering their stance having the potential to dramatically alter the overall outlook.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.