Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

May 2025 US Employment Report: Goldilocks, But Tariff Uncertainty Remains

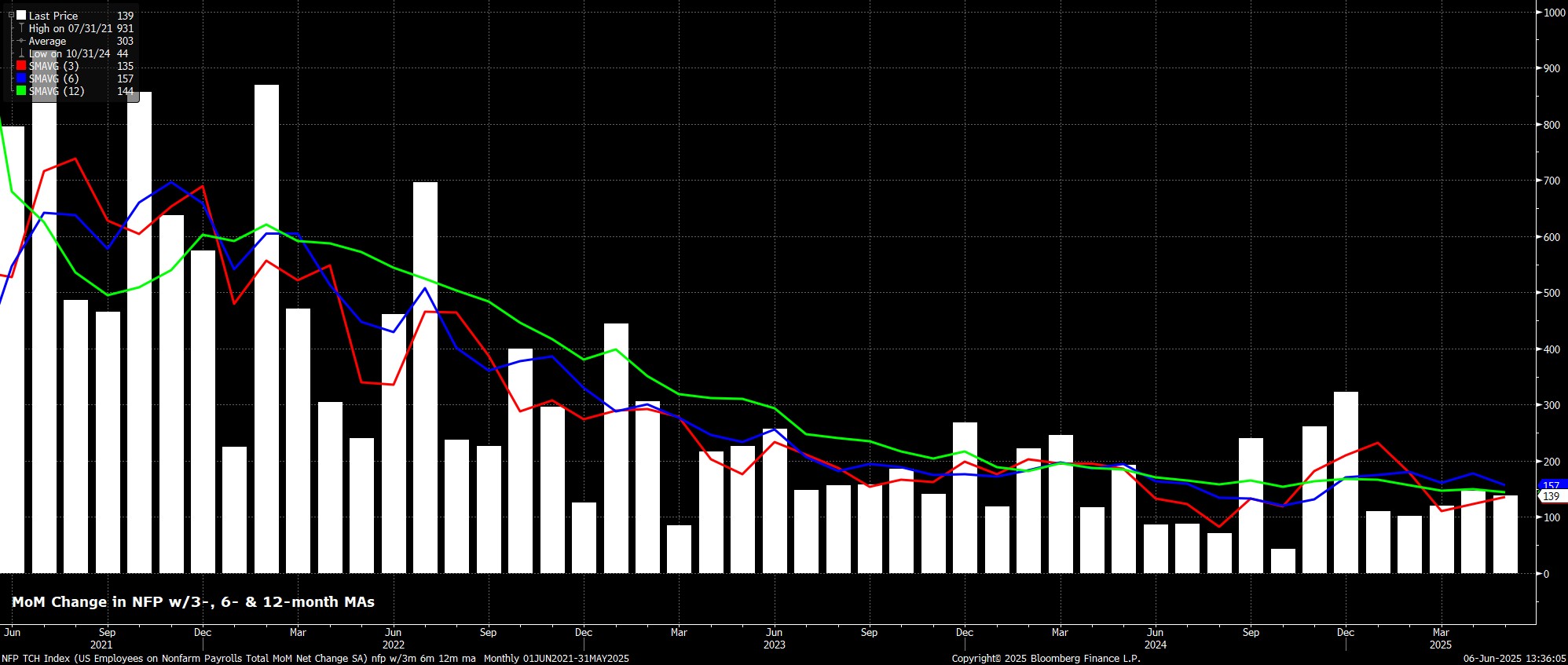

Headline nonfarm payrolls rose by +139k last month, modestly aboveh consensus estimates for a +125k increase, but well within the tighter than usual forecast range of +75k to 190k. Simultaneously, the prior two payrolls prints were revised by a sizeable net -95k, in turn taking the 3-month average of job gains to +135k, still considerably above the breakeven pace

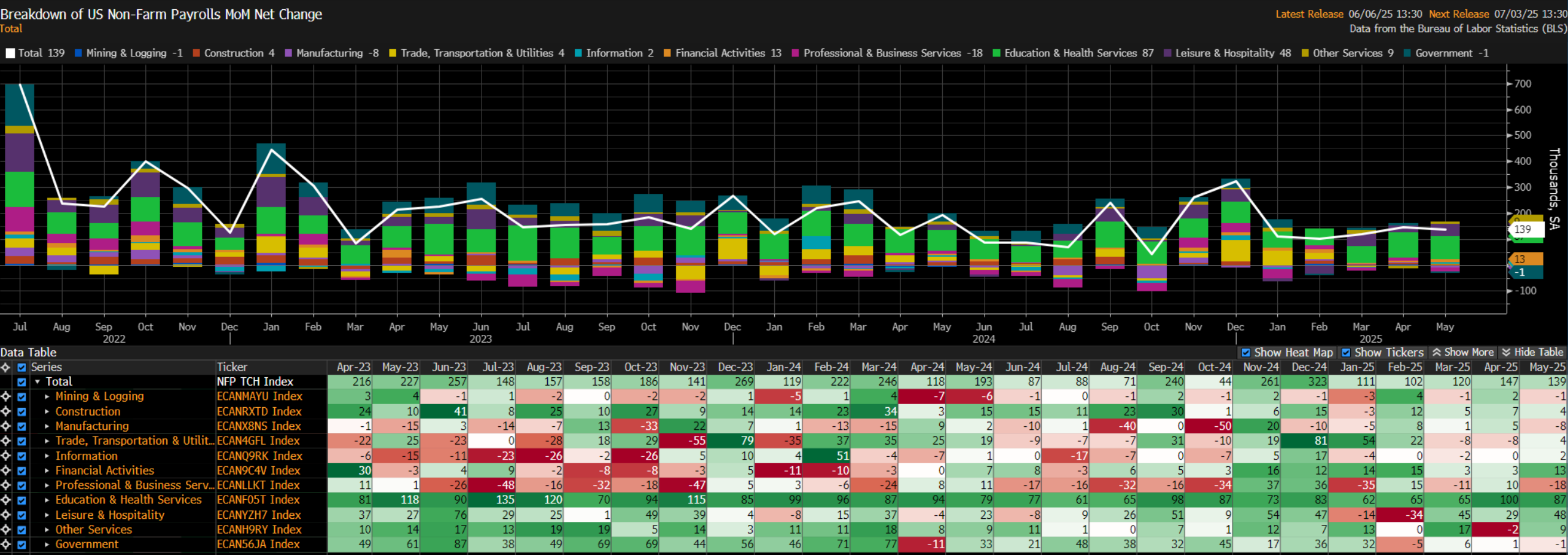

Digging a little deeper into the payrolls print, job gains were relatively broad-based, though for the second month running Education led the way, closely followed by Leisure & Hospitality, while on the flip side Professional & Business Services, Manufacturing, and Mining & Logging were the only sectors seeing MoM declines in employment.

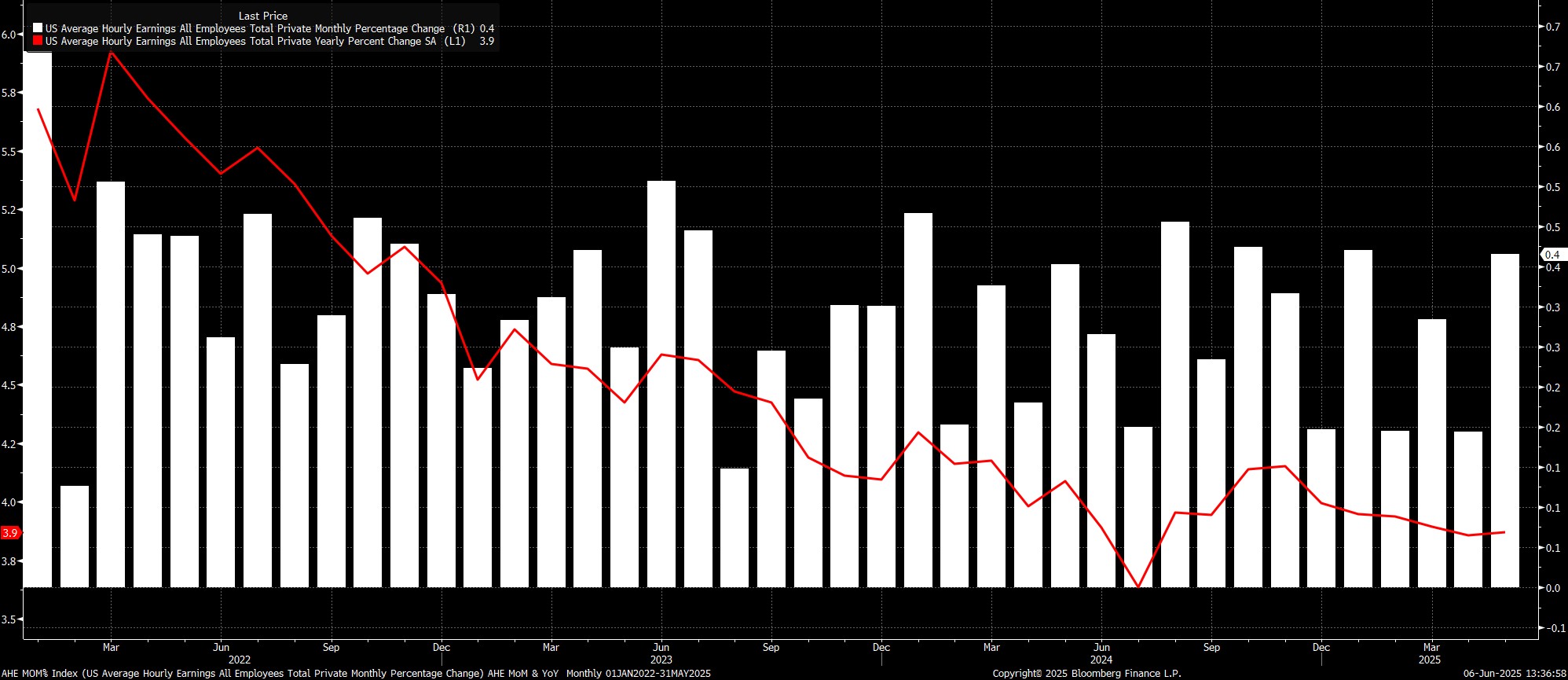

Sticking with the establishment survey, the jobs report once again pointed to earnings pressures remaining contained. Average hourly earnings rose 0.4% MoM, a touch hotter than expected, which in turn saw the annual rate also tick higher, to 3.9% YoY.

Data of this ilk continues to reinforce the FOMC’s now-familiar view that the labour market is not a source of significant upside inflation risks at the current juncture. Those risks, though, are obviously still present, stemming primarily from President Trump’s tariff policies, even if said price pressures are likely to prove temporary in nature.

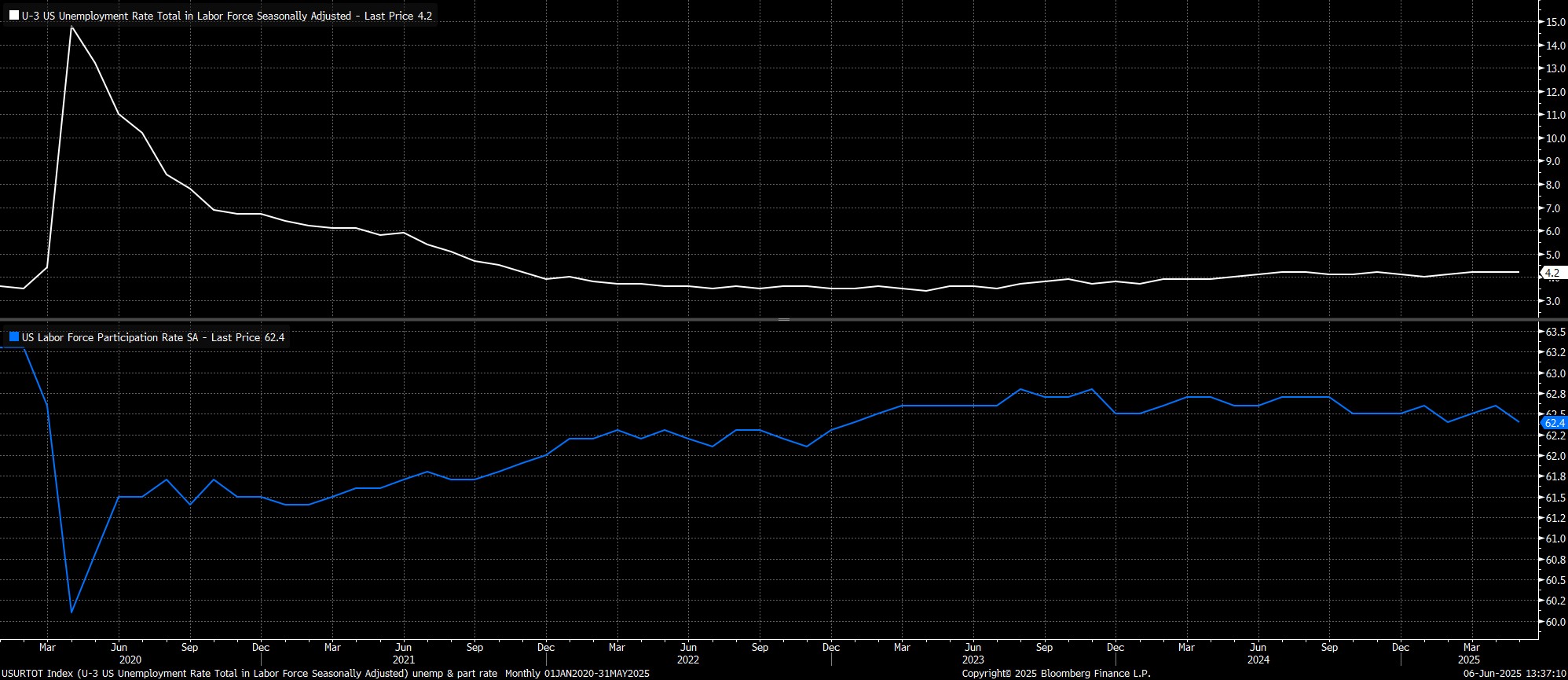

Turning to the household survey, unemployment held steady at 4.2%, in line with expectations, though labour force participation surprisingly dipped to 62.4%, below the bottom of the forecast range.

As has been the case for some time, however, some degree of caution is required in interpreting this data, which has been unusually volatile this cycle, as the BLS continue to grapple with falling survey response rates, and the rapidly changing composition of the labour force.

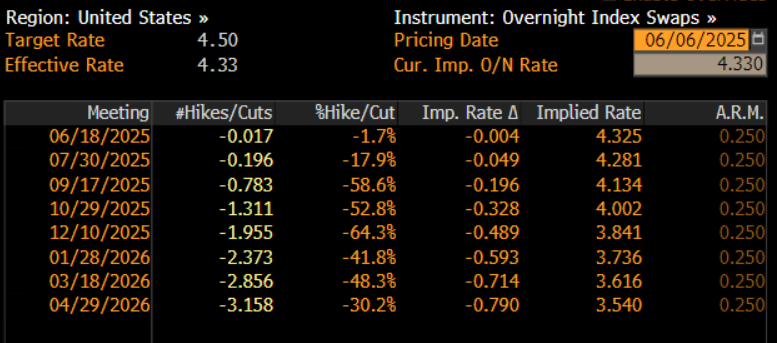

As the jobs report was digested, money markets, per the USD OIS curve, underwent a very marginal dovish repricing, continuing to fully discount the next 25bp cut for October, but now pricing around 48bp of easing by year-end, compared to 53bp pre-release.

Zooming out, it’s difficult to imagine the May jobs report significantly shifting the outlook from a monetary policy perspective. For the time being, the FOMC remain firmly in ‘wait and see’ mode, buying time to assess the impact of tariffs, plus the associated policy uncertainty, and how this shifts the balance of risks to either side of the dual mandate. Furthermore, policymakers are also seeking to ensure that inflation expectations remain well-anchored, in spite of any transitory tariff-related price pressures.

Consequently, Powell & Co, who enter the pre-meeting ‘blackout’ period at close of play today, are likely to remain on the sidelines for the time being. Though the direction of travel for rates clearly is still lower, the prospect of a rate cut before Q4 remains a long shot.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.