- English (UK)

Headline CPI rose 2.4% YoY last month, a modest uptick from April, but in line with expectations, while core prices rose 2.8% YoY over the same period, 0.1pp cooler than consensus, and unchanged from last time out. In addition, the so-called ‘supercore’ inflation metric, aka core services less housing, rose 2.9% YoY, a notable rise from the 2.7% YoY prior, bucking the trend of coolness elsewhere.

Meanwhile, on an MoM basis, both headline and core prices rose just 0.1% MoM, both also considerably cooler than had been expected, with the expected price pressures from tariff pass-through thus far elusive.

As is usually the case, annualising this data helps to provide a clearer picture of underlying inflationary trends, and the broader backdrop:

• 3-month annualised CPI: 1.0% (prior 1.6%)

• 6-month annualised CPI: 2.6% (prior 3.0%)

• 3-month annualised core CPI: 1.7% (prior 2.1%)

• 6-month annualised core CPI: 2.6% (prior 3.0%)

The details of the CPI report, though, are of considerably more importance this time around than the headline metrics, as participants and policymakers alike continue to try and gauge the degree to which tariffs are being passed on to consumers in the form of higher prices. On that note, and again contrary to expectations, the pace of core goods inflation remained subdued, at just 0.3% YoY, while core services prices rose 3.6% YoY, unchanged from last time out.

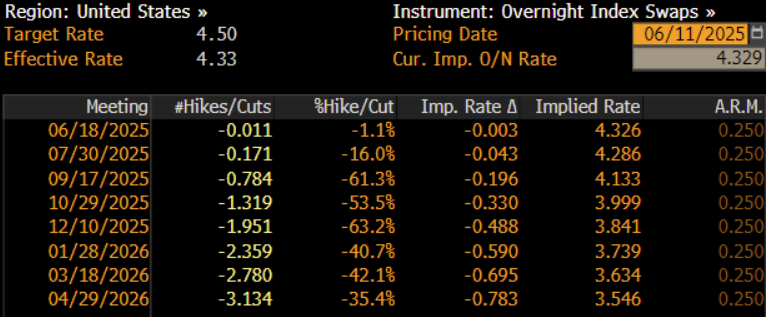

As the data was digested, money markets repriced marginally in a dovish direction, once again fully discounting two 25bp cuts by year-end, up from around 44bp pre-release.

Taking a step back, the May CPI figures reinforce the FOMC’s ongoing ‘wait and see’ approach, and shan’t significantly alter the monetary policy outlook. Despite being cooler than consensus, upside inflation risks from tariffs clearly remain.

Policymakers, hence, will remain on the sidelines for the time being, seeking to ‘buy time’ in order to assess the impacts of the tariffs which have been imposed, and how this alters the balance of risks to each side of the dual mandate. Concurrently, the Committee are also attempting to ensure that inflation expectations remain well-anchored, despite the trade-induced ‘hump’ in inflation that we are now likely to see through to the end of summer.

Overall, Powell & Co. seem highly unlikely to deliver any rate cuts before the fourth quarter, with just one 25bp cut in December my base case, even if the direction of travel for rates clearly remains to the downside. Next week’s FOMC is unlikely to ‘rock the boat’ especially much, merely being a ‘placeholder’ as policymakers continue to stand pat for the time being.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.