- English (UK)

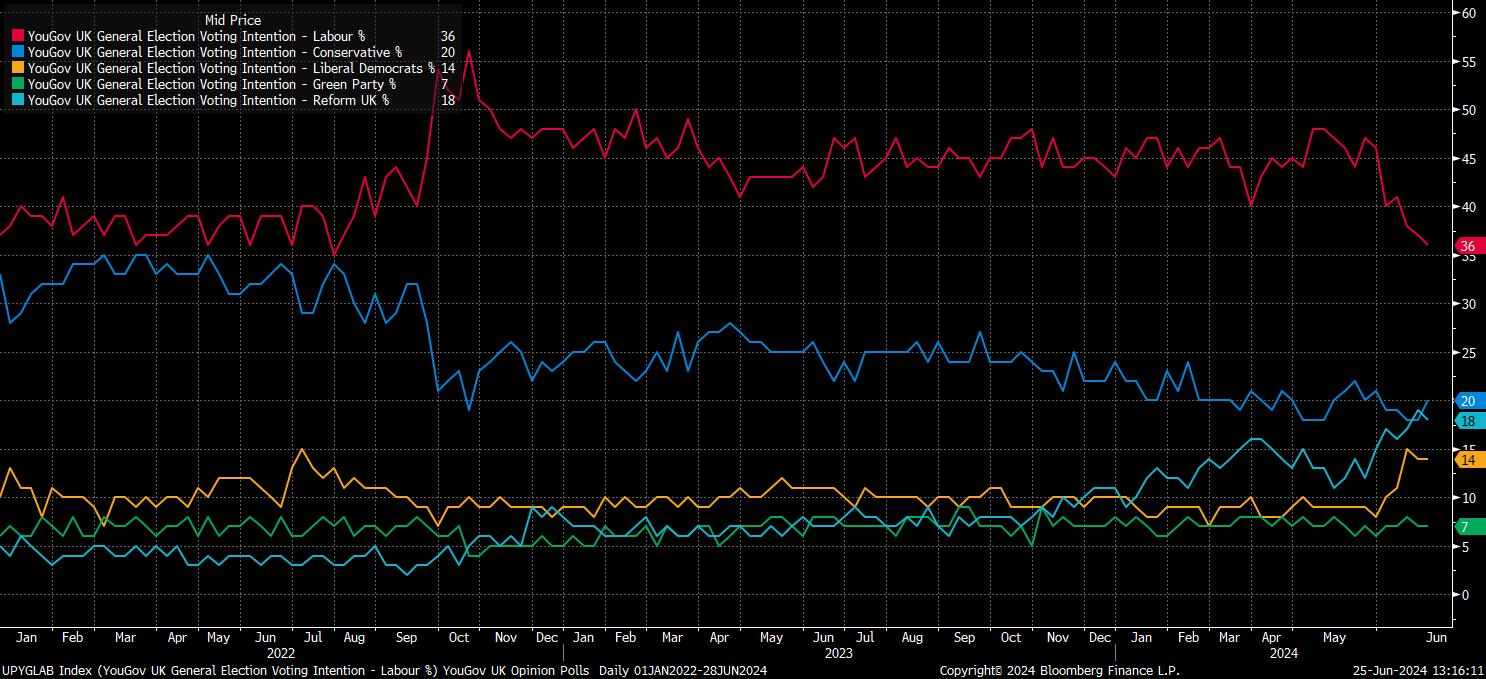

Polling day here in the UK is a little over a week away. After what has been, to be frank, a relatively dull campaign, littered with self-imposed missteps, PM Sunak’s Conservatives have seen their support barely budge in the polls, if anything seeing some voters peel away to Nigel Farage’s Reform party, leaving Labour with a vast double-digit poll lead.

While, of course, anything can happen when voters come to mark their ballot papers – though many will have already been cast by post – a sizeable Labour majority remains, by far, the most likely outcome come the morning of 5th July.

Markets, to be blunt, don’t appear to care especially much about either the campaign, or the result.

Cable, for instance, has remained well-contained within the broad 1.25 – 1.28 range that has – give or take – held since last December. In fact, a much more significant driver of the quid than politics, is monetary policy, with downside risks facing cable having intensified of late, despite price having managed to hold above both the 50- and 100-day moving averages on a couple of downside tests.

_2024-06-25_13-16-17.jpg)

Of course, the derivatives space is – as always – the best place to gauge risks that markets price, or not, over a key event, such as the upcoming election.

In terms of hedging activity, there appears to be relatively little at this stage, with few sizeable option expiries, neither puts nor calls, relative to recent activity, having been reported either shortly before, or shortly after, election day. The largest notional position is a £430mln 1.28 put, though this expires at the NY cut on 4th July, hours before the election result will be known, or even the exit poll released.

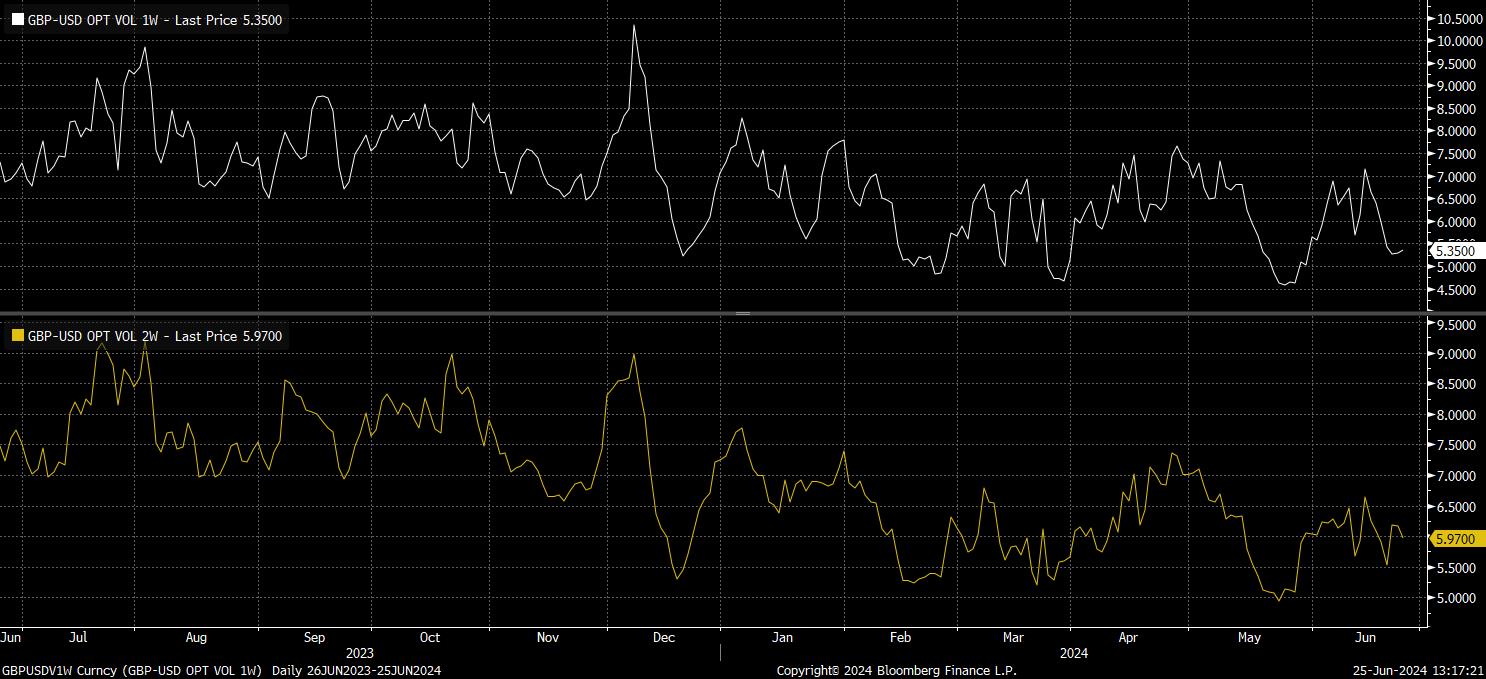

Sticking with the options space, contracts price little by way of either pre- or post-election volatility.

1-week implied vols, which don’t yet capture polling day itself, trade at a subdued 5.38%, below the 20th %ile of the 52-week range, and less than 1 vol above the recent 4.62% lows. 2-week implieds, which cover polling day, and its aftermath, are also subdued, sitting just shy of 6%, with this tenor also encompassing risk associated with the release of the June US labour market report on 5th July.

In terms of implied moves, these tenors price ranges of +/- 80 pips, and +/- 125 pips, both within 1 standard deviation (68.2%) of confidence, respectively.

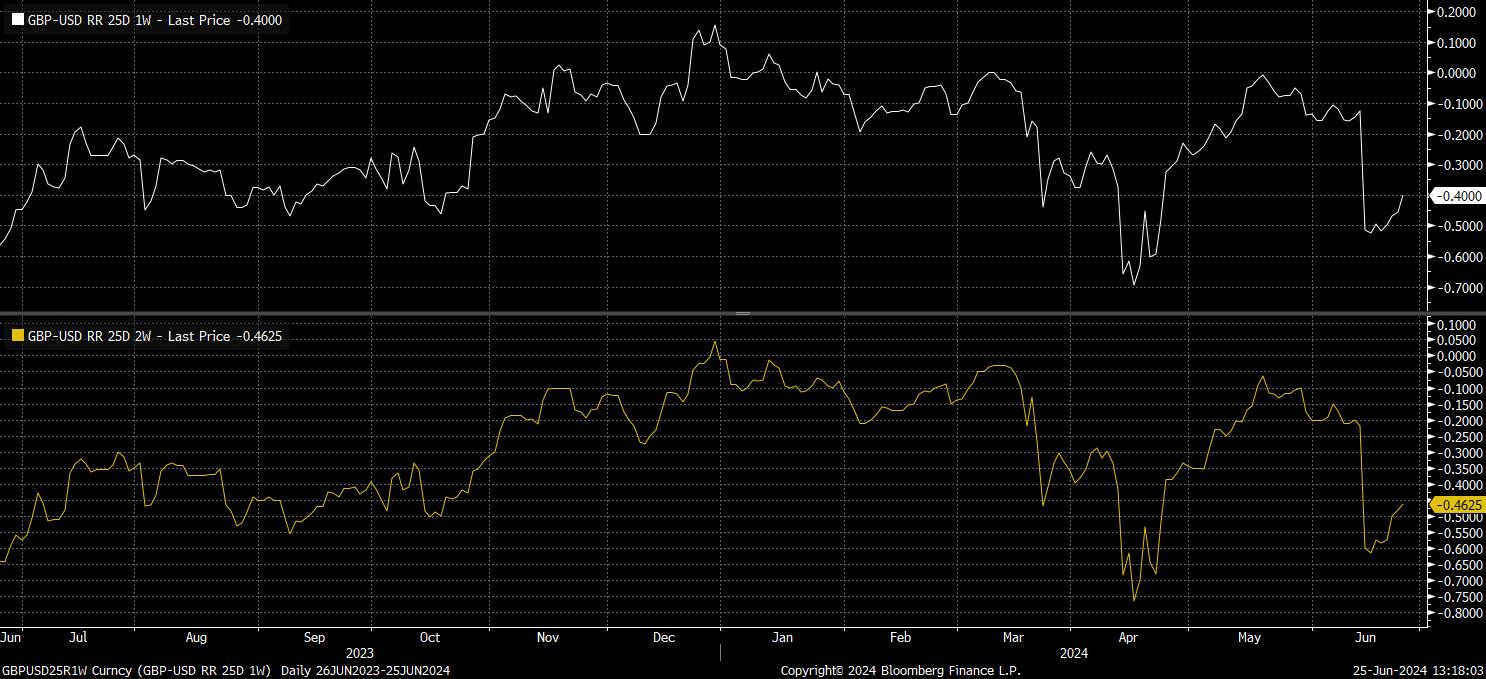

Risk reversals, meanwhile, show puts trading at their lowest premium over calls – over both 1- and 2-week tenors – in around a fortnight. This implies a relative decline in demand from market participants for downside GBP/USD protection, and thus a lack of concern over the likely Labour majority, or any sort of surprise, come polling day.

Some context, here, is key however. Riskies across G10 have moved notably in favour of USD upside over the last fortnight, with some of that move only modestly beginning to pare back, since French President Macron surprised almost everyone by calling ‘snap’ legislative elections in the aftermath of a mauling for his ‘Renew’ party in the European elections.

This raises an interesting point, in that short EUR/GBP could represent a relative political stability trade over the medium-term.

In contrast to almost the entirety of the last decade, the political environment in the UK appears set to become a significantly more stable one, with a sizeable Labour majority likely to see the party, and Sir Keir Starmer, in power for a full five year parliamentary term, if not two terms, depending on the scale of the likely victory.

Across the channel, the environment in the eurozone seems to be becoming increasingly unstable, and volatile. While legislative elections have been called in France, the aforementioned EU elections also saw a significant rightwards shift across the bloc, including in Italy, Germany, the Netherlands, and others. This, of course, comes on top of a fragile fiscal backdrop, ever-increasing government spending, and ballooning deficits – including France and Italy, the second and third largest economies respectively within the bloc, having received a ‘slap on the wrist’ from the European Commission under the ‘Excessive Deficit Procedure’.

Against this backdrop, and with spot EUR/GBP having broken decisively below the 0.8500 figure which had stood as support since last July, though a closing break beneath the next key support – at the 0.8400 handle – has yet to occur.

Perhaps the biggest risk to the bearish EUR/GBP view is that the market’s reaction to eurozone political instability turns out to be a ‘sell the rumour, buy the fact’ one. Yield spreads would also point to the cross trading around 3 big figures higher than spot, though the cross hasn’t paid particularly much attention to the FI space since the turn of the year.

_e_2024-06-25_13-18-13.jpg)

On a broader level, however, it is of interest that the UK’s seemingly inevitable leftwards governmental shift comes at a time when (almost) all other DM democracies are moving towards the political right. While not necessarily a short-term concern or tradeable theme, the evolution of the UK’s diplomatic relations, and perhaps waning influence on the global political stage as the landscape shifts, will be important themes to keep on the radar for some time to come.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).png?height=420)