- English (UK)

WHERE WE STAND – We enjoyed the ‘last hurrah’ of summer here in London on Friday and, in many ways, price action across the board felt a bit like the ‘last hurrah’ for summer markets, given the lack of anything particularly interesting or fresh going on.

As has so often been the case of late, though, GBP-denominated assets bucked that broader trend, as fiscal fears resurfaced once more. Participants rather rapidly shrugged off the better than expected August retail sales figures (+0.5% MoM vs. +0.4% exp.), instead focusing squarely on a government that continues to spend like a drunken sailor.

The deficit ballooned to £18bln in August, not only £3.5bln above last year’s figure, but also the highest August borrowing figure since the pandemic. Speaking of which, government borrowing in the April to August period now amounts to a whopping £83.8bln, the second-highest figure on record, after 2020, for the first five months of a financial year. Hardly surprising, then, that Gilts came under pressure, as benchmark 30-year yields rose 5bp to the highest level in a fortnight, nor is it surprising that the quid sold-off across the board, with cable sliding back beneath the $1.35 figure.

I shan’t repeat what are now very well-worn arguments on this front, but it remains the case that unless and until the Government get a grip of the situation and embark on significant spending cuts, ‘Mr Market’ will continue to take a very dim view indeed of UK assets, ultimately forcing the Treasury’s hand as the bond vigilantes always do. Given that all indications currently point to Chancellor Reeves focusing on counter-productive tax hikes in November, this whole circus could well carry on for some time. Staying short the GBP, and the long-end of the Gilt curve, remain the obvious plays here.

Elsewhere, as mentioned, Friday wasn’t exactly an exhilarating day for financial markets, though it did very much bring ‘more of the same’ as fallout from Wednesday’s FOMC decision continued. As such, Treasuries sold-off again across a steeper curve, while the dollar found a modest bid, and stocks rallied to yet more record highs.

Fresh catalysts, amid all that, were relatively thin on the ground, setting aside a Trump-Xi call which lasted hours, but yielded little more than some positive, if woolly, murmurings about a future leader-level meeting. We also had new Fed Governor Miran popping up on TV a couple of times, which did little to disprove my, and every other sane market participant’s view that he is little more than President Trump’s puppet on the FOMC.

A quick glance at the week ahead docket, on which more below, suggests that a ‘lack of fresh fundamental developments’ might well become a theme of the next few days, probably allowing markets to continue to take the path of least resistance, unless EoM/Q flows start to make a bit of a mess of things.

That path, in my mind, continues to lead towards equity upside, as a front-loading of Fed cuts and an FOMC seeking to lean in and support growth combines with an economy that remains resilient, and earnings which remain solid, creating something close to a perfect cocktail for risk assets to rally. Elsewhere, that path points to a continued steepening of the Treasury curve as participants fret over whether a more dovish Fed risks un-anchoring long-run inflation expectations, which in turn seems set to allow the dollar to continue its recent rebound, especially if the DXY manages to clamber its way back above the 50-day moving average. This bounce, if it were to happen, is one that I’d see more as an interruption of the longer-run downtrend, as opposed to an end to it.

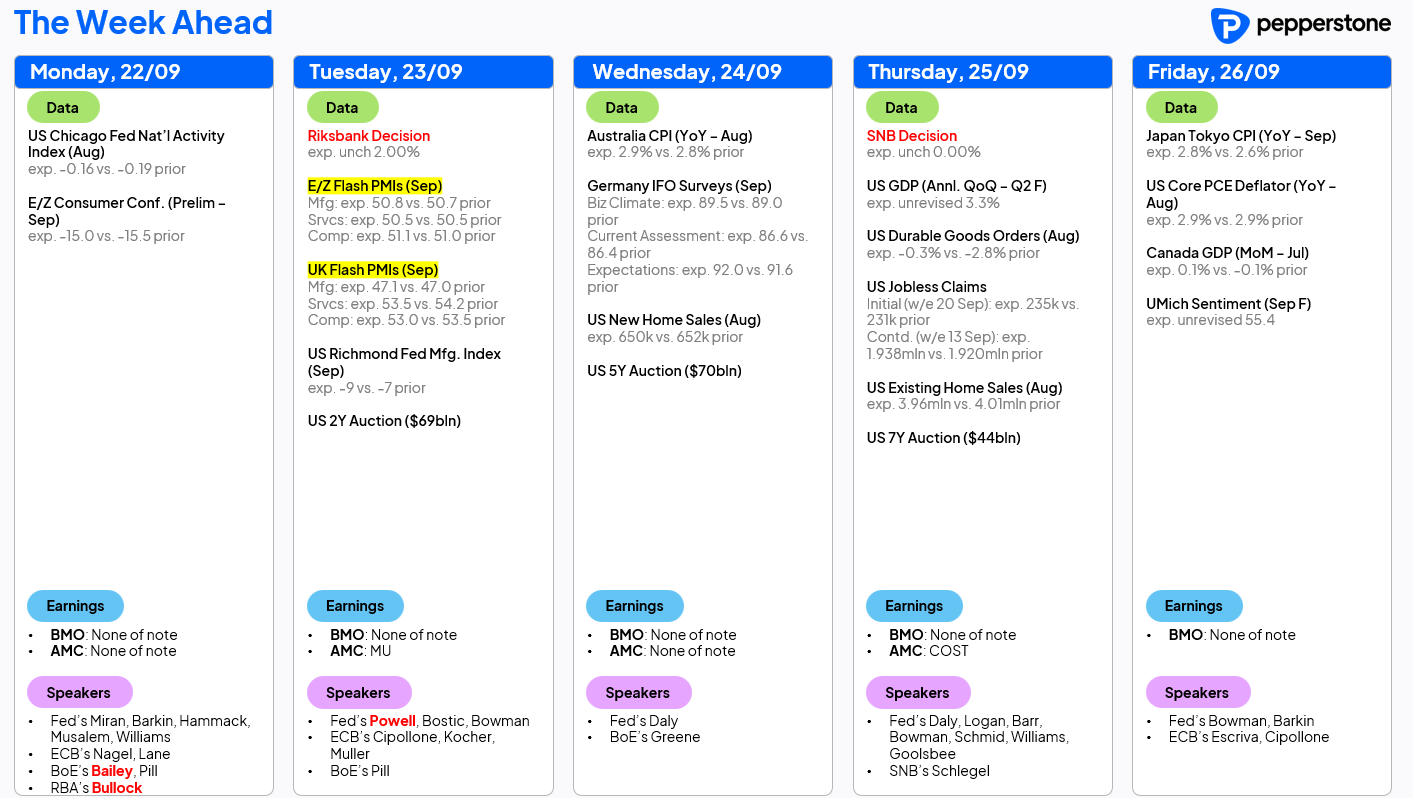

LOOK AHEAD – As mentioned, this week’s calendar is considerably quieter than the chaos that greeted us over the last few days.

On the data front, the latest round of ‘flash’ PMIs are probably the highlight, though it’s worth remembering that survey data has bared relatively little resemblance to comparable ‘hard’ data for much of the cycle. That said, this week doesn’t bring much by way of impactful ‘hard’ data, with Thursday’s US GDP print a final read for Q2, hence being rather stale, and Friday’s PCE report likely to be ignored as the Fed’s reaction function shifts almost entirely to supporting the labour market.

On the subject of the Fed, a frankly ridiculous amount of Fedspeak is due over the next five days, with Chair Powell’s Tuesday remarks stealing the limelight. While nothing new on the policy front is likely, at least the speech will give Powell a chance to clear up the somewhat clumsy ‘risk management’ framing from last week’s presser.

Elsewhere, the Riksbank and Swiss National Bank should both stand pat on rates, though the latter is nonetheless likely to leave the door open to a potential return to sub-zero rates in the future. A chunky slate of Treasury supply also awaits, though supply at the front-end and in the belly has recently been well-received, and should be again this week. Besides that, participants will continue to focus on any trade and geopolitical headlines that may crop up through the next few trading days.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.