Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Weekly Trader Playbook: China AI Equities Surge, USD Trends & RBA Rate Decision

Can Meta make it to 21?

Meta is the absolute epitome of consistency, with its share price gaining for an incredible 20 consecutive days – as Meta are reportedly set to start taking orders of silicon chips from Arm, the market clearly loves Meta's story, but one questions who is now left to buy the stock?

The HK50 Index on a Tear - Alibaba and China Tech/AI are Ripping

Intel closing +23% on the week did not go unnoticed, helped along by JD Vance's "ensuring the most powerful AI systems are to be built in the US" comments at the AI Action Summit in France, with a JV with TSMC also in the works. Alibaba also finds the buyers only too readily, with shares +20% on the week, taking the rally from 13 Jan to 55%. Traders built on longs post the news of its partnership with Apple, with increasing optimism ahead of today's symposium (in China), with President Xi leading the proceedings with the aim of lifting sentiment towards China’s private sector.

Alibaba report earnings on Thursday with options pricing implying a -/+7.5% move on the day of earnings - it promises to be another lively week for BABA and China AI/tech more broadly.

The HK50 and CHINAH have been by far the standout equity indices on the week, rallying 7%. Both have been the beneficiaries of the moves in Alibaba and the evolving view that the China tech/AI players can compete on a global stage and deserve an increased percentage of the global capital concentrated in the US equity markets.

Will Last Week’s USD Sell-off build?

In FX markets, after a period of choppy price action, the USD has emerged as the weak link closing lower last week vs all G10 currencies, bar the JPY. We now observe the DXY at the weakest levels of the year and closing below the 27 Jan low on Friday - we question if the move can kick, with price action then evolving into more of a trend, although for that we would need to see EURUSD break the 27 Jan swing highs of 1.0533.

The market now digests JD Vance's speech at the Munich Security Conference, in which Trump's deputy didn't hold back and relations between the US and European nations appear evidently fractured - one suspects this will have a minimal effect on near-term FX rates, and we look towards the data, where this coming Friday we receive the EU PMI data, and we could also see traders managing EUR and EU equity exposures into the latter part of the week, given the potential for gapping risk from Sunday’s German election.

US economic data last week certainly catalysed the USD selling flows. Granted, we saw US CPI and PPI inflation come in far hotter than expected, but the inputs that feed into the US core PCE inflation (due 28 Feb) are less concerning, with tracking estimates running around 2.5% to 2.6% y/y. Friday’s weak retail sales release has put US growth and consumption trends concerns back on the map, with the Atlanta Fed Q125 GDP tracking estimate pulled lower from 2.94% to 2.34%.

With consumption increasingly front of mind, Walmart’s earnings on Thursday (in the pre-market) could therefore get greater attention from both equity traders and macro heads.

Of the US economic releases this coming week I’d argue it would be the S&P manufacturing & services PMI data (due Friday) that has the greatest potential to move the USD and risk dial. I’d also argue that the USD will be more sensitive to a miss in the PMI data and the other growth data points, relative to the USD upside on a beat.

A Focus Down Under – The RBA Set to Cut for the First Time Since 2020

The AUD gets increased focus this week, partly due to AUDUSD breaking out top side of its 0.6330 to 0.6150 range it has held all year - but also due to the deluge of macro event risks out this week. Tuesday’s RBA meeting / Statement on Monetary Policy and Gov Bullock's presser are set to dominate the local news flow. However, we also get the Q4 Wage Price Index, and January employment report, with the RBA then testifying to Parliament on Friday.

Given the event risk this coming week it’s somewhat surprising to see AUDUSD 1-week (options) implied volatility at 8.59%, levels set at a discount to 1-week realised vol (at 9.77%). With Aussie interest rate swaps pricing the 25bp cut at an 85% probability, the message we’re hearing from the options pricing is that the RBA meeting will likely be a low-volatility affair and that a cut is a done deal.

Given the rates implied pricing and the volatility structure, one would like to believe that the RBA should be highly cognizant of an impending volatility spike should they leave rates unchanged at 4.35%. They would also risk injecting a high degree of policy uncertainty ongoing in the rates market as the market has essentially priced a 70%+ chance of the RBA easing all year and the bank hasn’t guided market expectations away from this view. So, either the cut is a done deal, or the RBA would be seen as injecting vol into rates pricing, which would seem somewhat illogical at this point in the cycle.

ASX200 Earnings Increase in Frequency

With the ASX200 hitting a new ATH on Friday, ASX2001H25 earnings increase in frequency this week, and naturally this could play a big role in the volatility and dispersions seen at a single stock level. BHP, RIO, Fortescue, Wesfarmers, Block, Newmont and QBE will likely be front of mind for equity and AUS200 index traders.

UK Wages and CPI a Big Risk Event for GBP Traders

UK data will also come in heavy this week, with traders having to navigate key wages and employment data, as well as Jan CPI, retail sales and PMIs – and just to really pad it out, BoE Gov Bailey speaks on Wednesday. UK swaps imply the next 25bp cut by May, with another 25bp cut implied by August. Expectations for the UK CPI release already highlight why the inflation print needs to be on the radar for GBP traders, with the consensus eyeing core CPI to 3.7% y/y (from 3.2%), with services inflation underpinning that lift and expected to push to 5.2% y/y (from 4.4% y/y).

GBPUSD closed out the week at the best level of the year, and while the weaker USD has been a key factor, we see the spot rate working higher in a channel, suggesting some skew towards higher levels with pullbacks likely to be supported. That said, weaker UK jobs and growth data, married to a lift in the wages and the year-on-year inflation rate would not sit well with UK markets.

Gold Set to Test $2850?

Gold continues to be well traded by clients, many of whom weighed into shorts on Thursday and Friday and were subsequently well rewarded. The gold bulls will say a pullback into $2860/50 and a solid flush out of extended longs after such a strong run is a good thing - with a cleaner position offering a more compelling entry point. We shall see if Friday’s selloff increases in momentum, as gold remains above the short-term moving averages, which can be effective for holding a position in a strong trend and remaining unemotional.

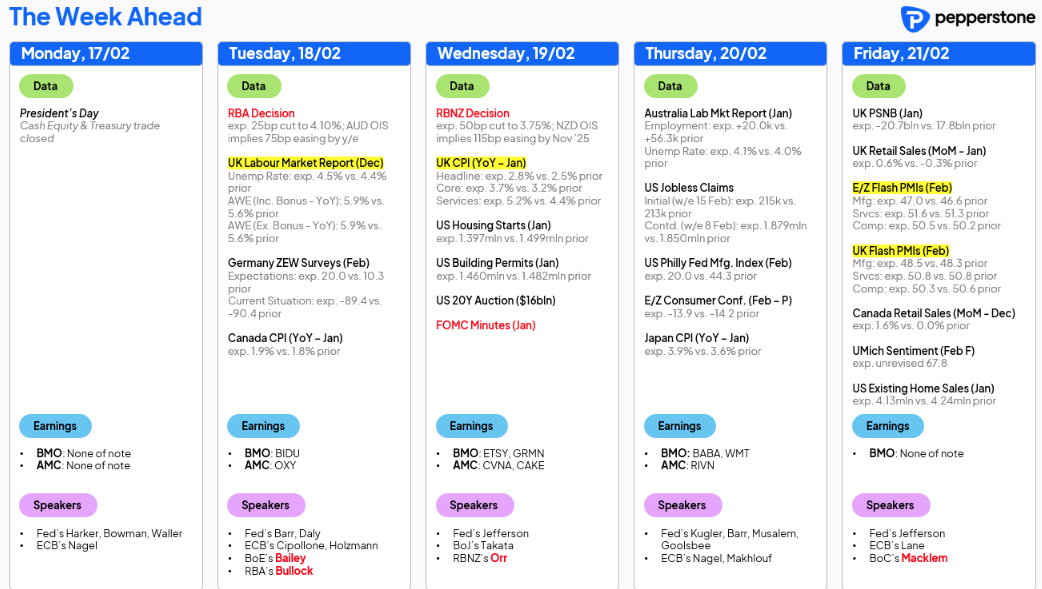

US equity and bond markets will be closed on Monday for Presidents Day but ramps up from there and given the landmines stated above and with evolving and in some cases mature trends in markets the new trading week is shaping to be yet another lively week.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.