- English (UK)

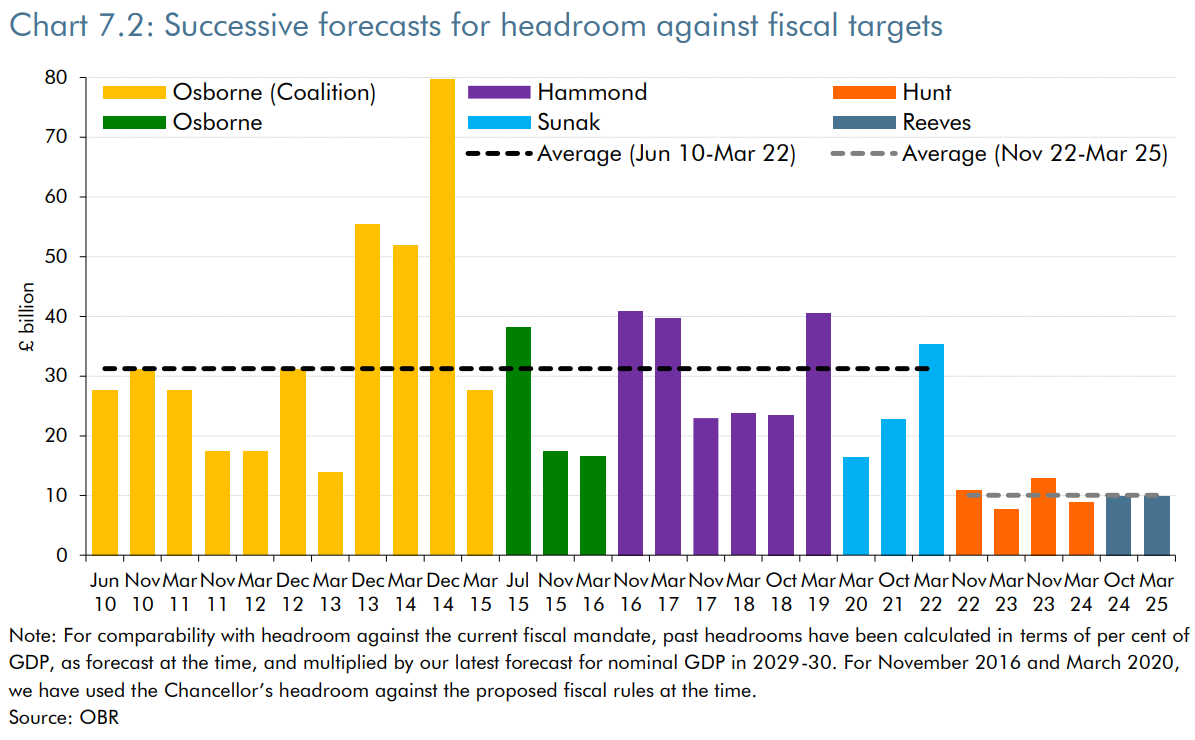

To recap, at the Spring Statement in March, the OBR forecast that the Chancellor had £9.9bln headroom with which the ‘fiscal rules’ were being met. Those rules being that, by 2029/30, public sector net financial liabilities (PSNFL) should be falling relative to GDP, and that the government would meet its day-to-day funding needs with revenues, borrowing only for investment purposes.

Now, as the Budget approaches on 26th November, the Chancellor yet again finds herself in a position where the fiscal headroom that was present six months ago has been eroded, with yet another fiscal ‘black hole’ having emerged. While we await the first pre-measures forecast from the OBR, on 3rd October, it is likely that the Budget will result in at least £30bln needing to be found, either via revenue raising measures, or spending cuts, in order to restore headroom to its March 2025 level.

That £9.9bln, incidentally, is about the bare minimum that the Chancellor would be able to ‘sell’ to financial market participants, even if the figure itself still represents a perilous fiscal position, and around a third of the headroom by which fiscal rules were typically met pre-covid.

In any case, the £30bln that now needs to be found stems primarily from three sources. Firstly, there is a widely-expected downgrade to the OBR’s productivity growth assumptions, which have long been fanciful, by as much as 0.2pp. As a rule of thumb, each 0.1pp downgrade adds around £10bln to the deficit, by the end of the forecast horizon. On top of that, we must add around £5bln stemming from the Government’s failure to cut welfare spending over the summer, and another £5bln as a result of the rise seen in market-based interest rates (Gilts) since the last OBR forecast round. Overall, pencilling in a £30bln shortfall is a conservative estimate.

_10_2025-09-30_10-51-51.jpg)

Of course, there are two ways in which – theoretically, at least – that fiscal hole can be plugged, either via higher revenue (aka taxes), or by lower spending. Any further rise in borrowing, or a relaxation of the fiscal rules, can be ruled out at this time, given the febrile market backdrop in which the Chancellor is operating.

Spending cuts, however, seem highly unlikely, at least at this stage. Not only did the welfare debacle over the summer prove that the Chancellor is unable to deliver said cuts, given deep splits within the Labour Party, despite the Government having a working majority of 161 in the House of Commons. In fact, it’s plausible to envisage a scenario where the upcoming Budget actually results in higher government spending, particularly if a backbench campaign to scrap the two-child benefit cap proves successful.

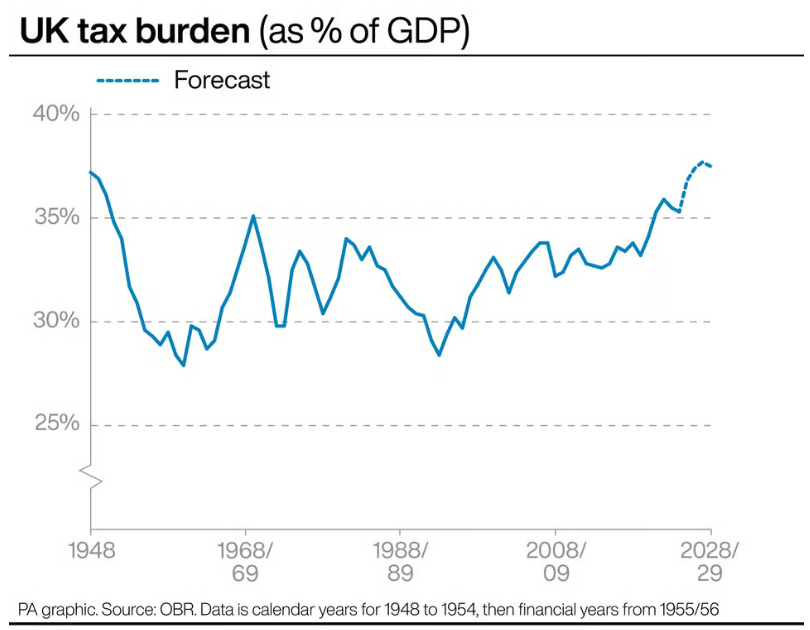

As a result, it seems somewhat inevitable that the Chancellor will turn to tax hikes in order to plug the gap, despite the overall tax burden being at an 80-year high.

Where those tax hikes may fall, however, is rather more difficult to figure out. At the Labour Party conference, Reeves reiterated her commitment to promises made in the 2024 election manifesto, namely that there would be no increases to income tax, national insurance, or VAT. A promise which, since, has led to the snappier line that there will be no tax hikes on ‘working people’, even if Labour politicians have been unable to define that term. Furthermore, at conference, Reeves reiterated her pledge not to hike corporation tax at the upcoming Budget, while also appearing to (mercifully) rule out a standalone wealth tax.

All of that means that the Chancellor appears to have boxed herself in rather considerably when it comes to finding a way of raising the requisite revenue, particularly with pulling any of the aforementioned ‘big four’ revenue raising levers having been ruled out. Hence, it seems likely, by process of deduction if nothing else, that property owners could be left picking up a substantial amount of the tab, either by changes to stamp duty, capital gains tax, and/or the replacement of council tax with an alternative levy.

Other possible areas that the Chancellor may end up looking at include changes to the tax relief offered on pensions, possible alterations to inheritance tax, and/or potential increases in sector-specific taxes such as the banking levy, or gambling duties. A planned unfreezing of income tax thresholds is also likely to be scrapped, given that this technically wouldn’t count as a manifesto breach, while some degree of ‘creative’ accounting is also likely to be employed, like a pledge to remove the ‘temporary’ 5p per litre fuel duty cut at some stage in the future, despite it having been in place since way back in 2011.

Those measures, though, largely represent tinkering round the edges, thus leading to the potential that Reeves will indeed be forced to break one, or more, of the aforementioned manifesto pledges. The probability of such action will become clearer as Budget Day nears, and the typical media ‘trial balloons’ increase in frequency.

Quite obviously, a further round of tax hikes at the upcoming Budget are highly unlikely to change the overall arithmetic when it comes to the UK economy. As the common adage goes, ‘the definition of insanity is doing the same thing over and over again, and expecting different results’.

This will now mark the second time that Reeves has raised taxes by somewhere near £40bln, and will almost certainly end up being the second time that those tax hikes have prompted a significant hit to economic growth, the second time that the ‘black hole’ has deepened further, and overall mark the second time that we’ve done a complete lap of the fiscal doom loop within which we appear to be stuck.

Unsurprisingly, market participants grew wise to this some time ago, realising that spending cuts are the only way to restore UK Plc to a proper fiscal footing, in a sustainable manner, over the long-run, hence the continued premium on Gilt yields over G7 peers.

_10_2025-09-30_10-55-53.jpg)

Given the Chancellor’s apparent inability, or unwillingness, to even contemplate such cuts, a fiscal reckoning quite clearly remains on the cards, with another round of counter-productive tax hikes likely to do little-to-nothing when it comes to restoring investor confidence, even if they ensure that the OBR’s proverbial spreadsheet adds up this time around.

A move towards 6% on the benchmark 30-year Gilt yield, and to 5% on the benchmark 10-year, still looks to be on the cards before the year is out, either pre-Budget as participants attempt to test the Chancellor’s mettle, or post-Budget as reality dawns that the UK economic outlook remains an incredibly dour one. In fact, there’s some chance that Reeves may end up having to deliver two Budgets, potentially being forced to tear up the one delivered in late-November, if it is poorly received.

Given that the Chancellor seems to want to go round in circles, I may as well do the same.

After the Budget last year, I wrote “fiscal headroom is still tiny in historical terms, leaving open the significant risk that Reeves will have to come back for more tax hikes”. After the Spring Statement, I wrote, “the Chancellor’s days appear to be numbered, with it being a question of whether a complete loss of market confidence, or manifesto-breaking tax hikes, eventually bring about Reeves’s demise”.

As things stand right now, both of those statements continue to hold water; certainly, holding more water than the idea that tax hikes are the way out of the fiscal mess that the UK finds itself in.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.