- English (UK)

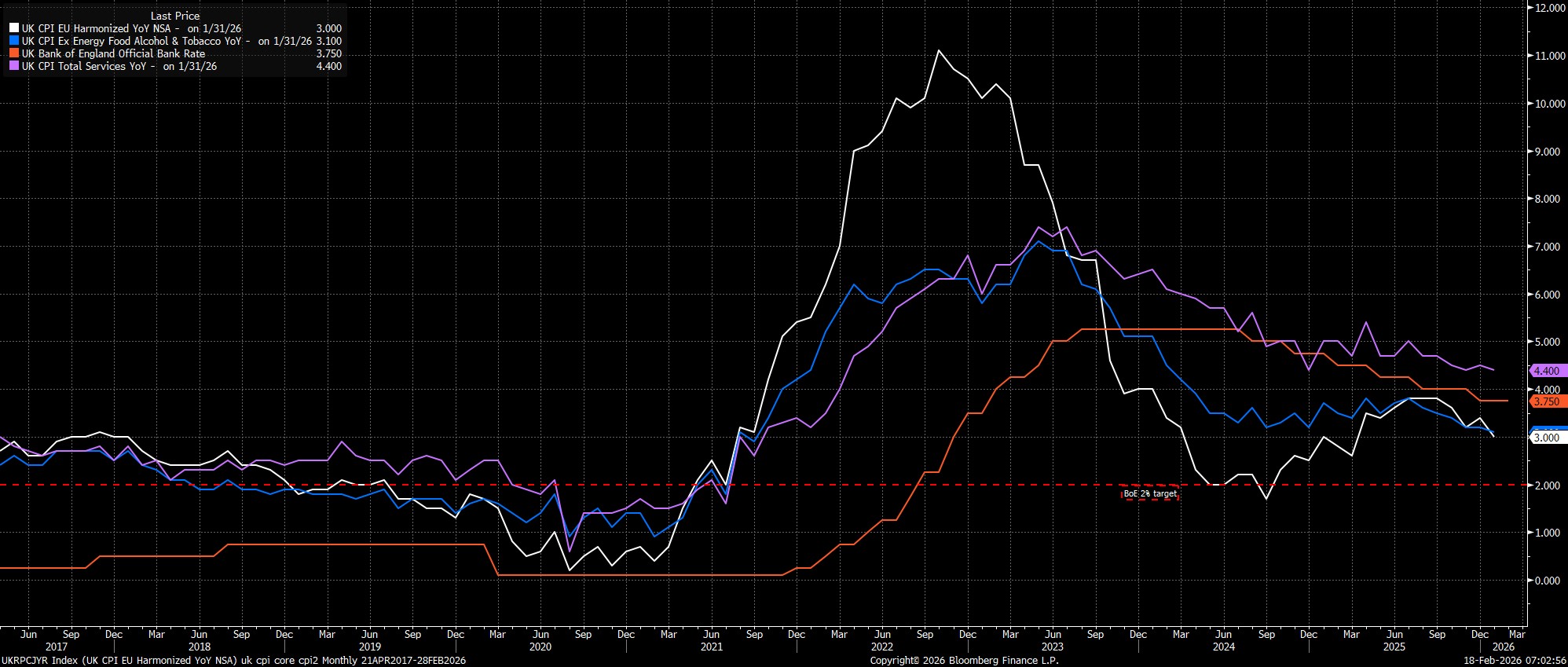

Headline CPI rose 3.0% YoY in January, down from 3.4% YoY in December, and the slowest annual pace of inflation since March last year, while also printing in line with market expectations. Meanwhile, measures of underlying price pressures also cooled, with core CPI falling to 3.1% YoY, the lowest level since September 2021, and services CPI sliding to 4.4% YoY, equalling cycle lows.

A handful of different disinflationary factors drove the notable cooling in price pressures at the turn of the year. Firstly, one must think back to December, where the inflation figures were boosted by several one-off factors, including the tobacco duty hike delivered in last year's Budget, and higher air fares over the festive period, with both of these effects then unwinding last month. Secondly, January itself brought a notable favourable base effect in the education sector, after the imposition of VAT on school fees in 2025, as well as a when it comes to utilities.

For the Bank of England, the January inflation data nods strongly towards the MPC delivering another 25bp cut at the next meeting, in March, especially after yesterday's employment data pointed to a further margin of labour market slack having emerged, further reducing the (already low) risks of price pressures proving persistent.

Of course, the MPC have already laid the foundations for a move next month, after February's confab saw not only a hold by the narrowest possible vote split, and explicit guidance towards further easing, but also a dovish round of forecasts which pointed to CPI achieving the 2% target this spring, and remaining there. Today's data does little to threaten those expectations, with the real risk now being that of an inflation undershoot as the year progresses.

Consequently, my base case remains that the 'Old Lady' will not only deliver a 25bp cut next month, but that further cuts will follow beyond then, with a series of reductions reducing Bank Rate to a neutral level, around 3%, by the end of summer.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.