- English (UK)

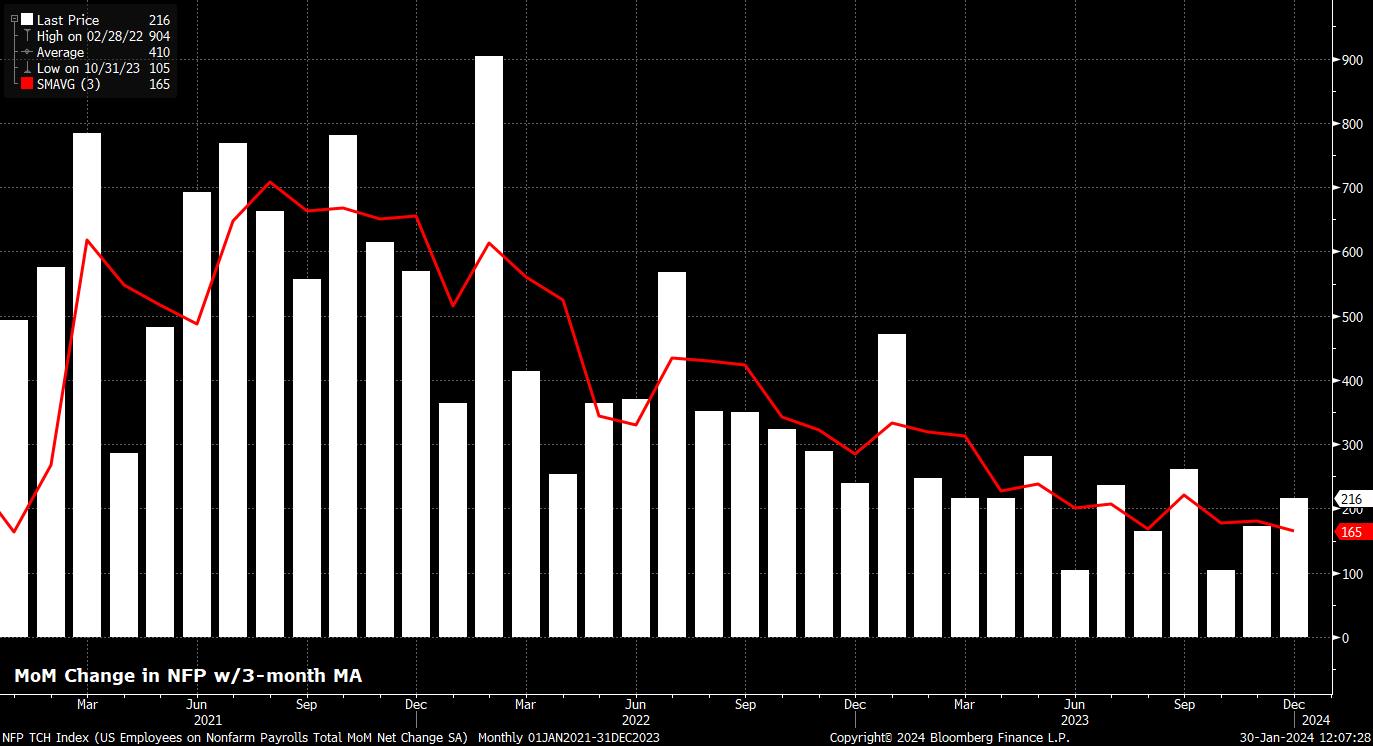

Headline nonfarm payrolls are seen rising +180k in January, a touch below the +216k pace seen in December, but a touch above the 3-month average of job gains, which currently stands at +165k, its lowest level since the beginning of 2021.

The recent form guide suggests risks to that consensus figure are tilted to the upside, with headline payrolls growth having beaten expectations on four of the last five occasions; of course, the usual caveat of past performance not being a reliable indicator of future results must apply.

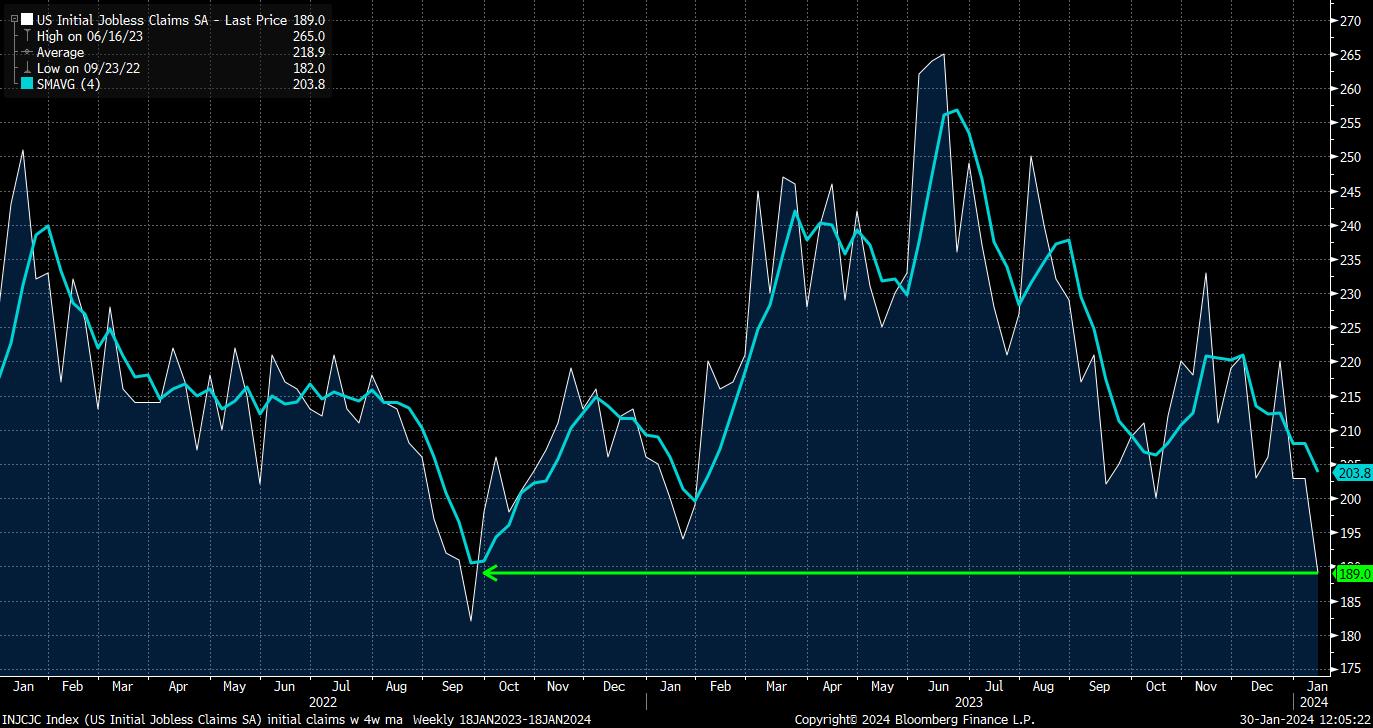

Reassuringly, leading indicators also reinforce the idea that risks are to the upside, with initial jobless claims having fallen to a more than 2-year low in the survey week, while continuing jobless claims remained just north of 1.8mln in the same week, a decline of around 500k from the December survey period.

Due to the timing of this month’s jobs report, other leading indicators are yet to be released. The latest ISM manufacturing survey is due on Thursday, while the comparable services report won’t drop until after the jobs number has been released. As always, the ADP employment figure can be safely ignored, with that dataset continuing to demonstrate a negative correlation with the headline payrolls print.

There are, however, a couple of other things worth bearing in mind with the NFP print. Firstly, during the January survey week, the US endured a record cold snap, with wintry weather and heavy snowfall being experienced across much of the country, and temperatures dropping as low as -45°C. This is likely to have had a detrimental impact, at the margin, on headline payrolls growth, if weather left some unable to work, while also likely further denting already diminishing survey response rates.

The other notable aspect of the January jobs report will be the annual benchmark revisions. This is usual practice for the BLS and, while unlikely to be market-moving, will provide additional clarity on the ‘true’ scale of job creation seen in 2023, though the average annual revision is typically within 0.1% of the previously stated figure. On the subject of revisions, though, the annual CPI revision next Friday is likely of much more importance to markets, and the FOMC.

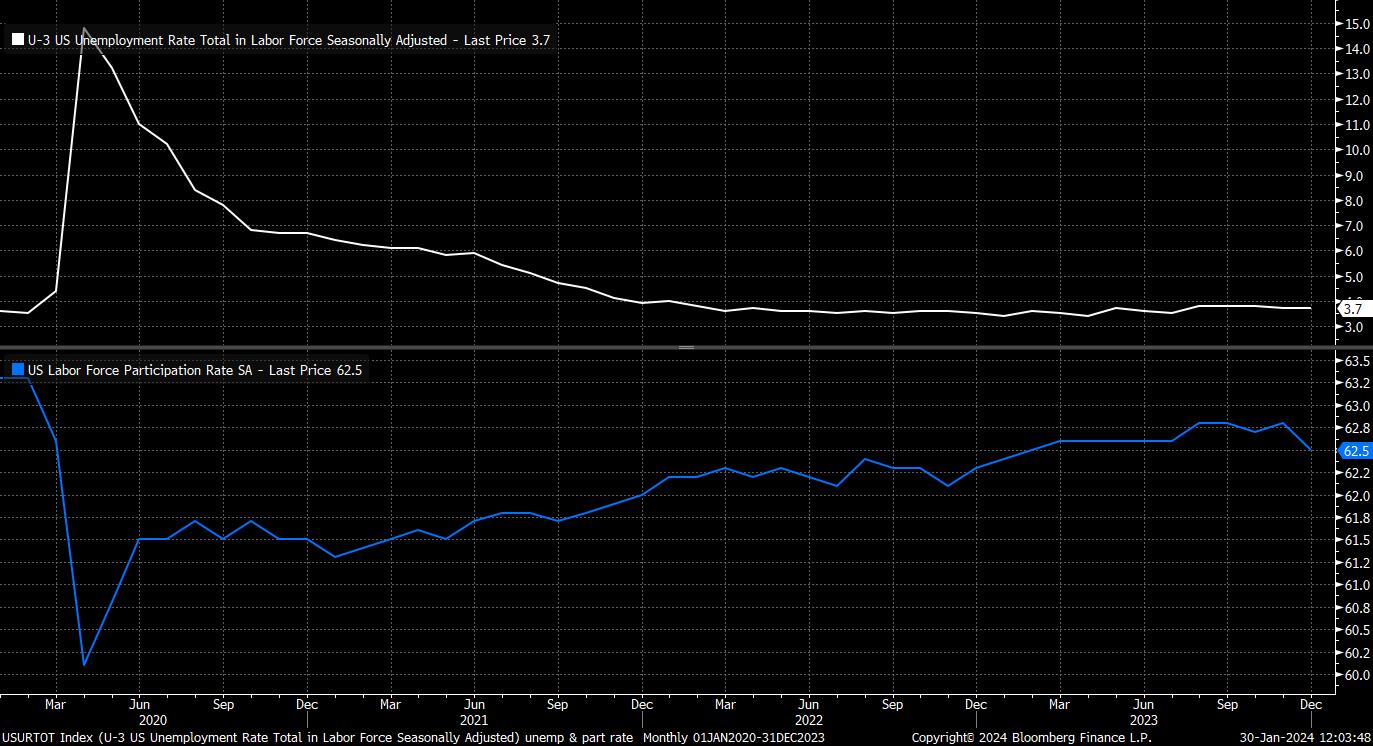

As always, it will not only be the headline payrolls print that markets watch closely, with various gauges of labour market slack of equal importance. Unemployment is set to have risen by 0.1pp to 3.8% in January; while this would represent a 3-month high, such a print would still leave the U-3 rate at levels which, by and large, imply an economy at ‘full employment’.

Such a rise in unemployment should also be of relatively little concern when viewed in conjunction with the participation rate. Consensus sees labour force participation rebounding to 62.6%, recovering a touch from the slump seen over the festive period, which represented the biggest one-month decline since the height of the pandemic. Rising participation would imply that a higher unemployment rate is being driven by people returning to the labour force to seek work, rather than by an increase in workers being laid off – hence, perhaps counter-intuitively, this would likely be viewed as a positive in policymaking circles.

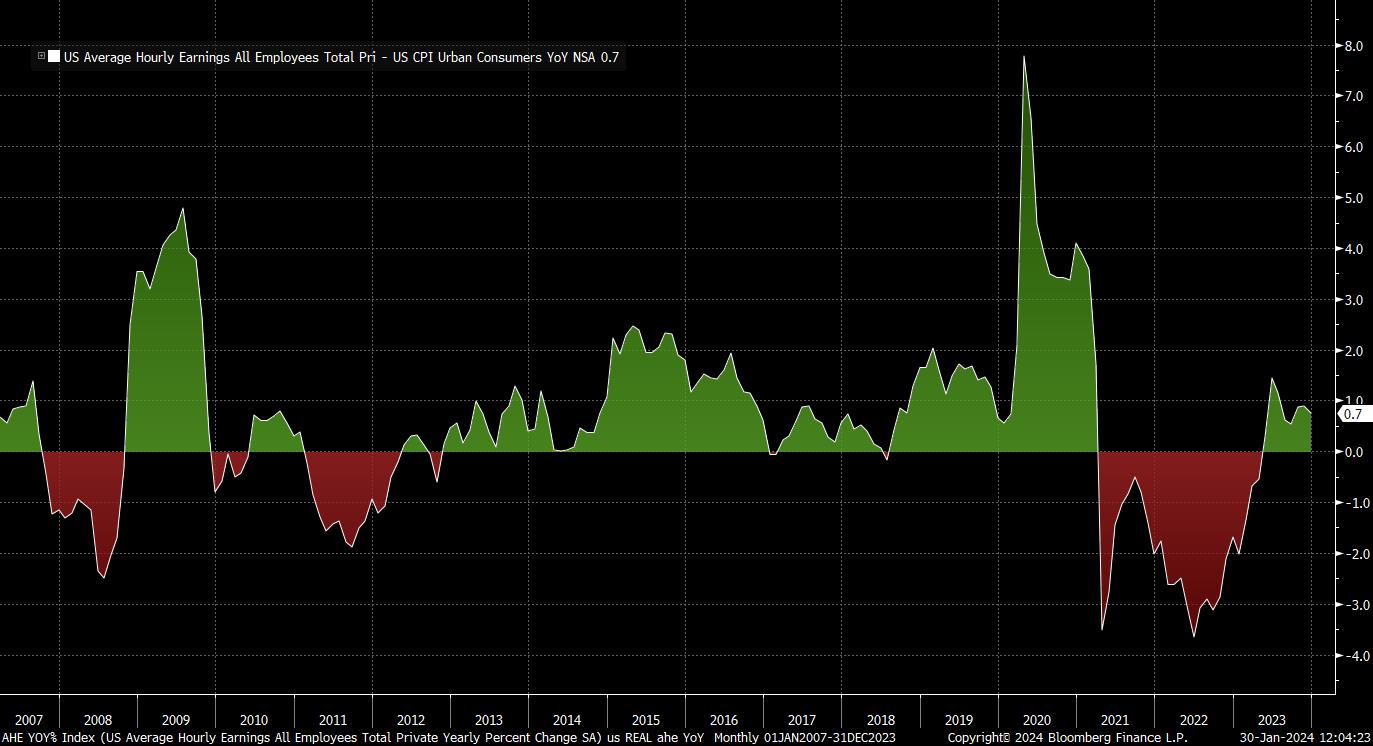

Earnings are also unlikely to concern the FOMC especially much, with average hourly earnings set to have risen 0.3% MoM, as near as makes no difference unchanged from the pace seen over much of the last 12 months. Such a monthly pace would keep the annual rate unchanged at 4.1% YoY, likely representing a marginal quickening in the pace of real earnings growth, with headline CPI set to have cooled a touch in January, upon release in a couple of weeks’ time.

In terms of market reaction, much will – of course – depend on the policy outlook outlined by Fed Chair Powell on Wednesday, after the first FOMC meeting of the year.

Nevertheless, with the market currently positioned in quite an aggressively dovish manner, continuing to price around 140bp of cuts by the end of the year, the bar for a further dovish repricing on a negative payrolls surprise seems a relatively high one.

On the other hand, a hotter than expected payrolls print will likely, in the market’s mind, reinforce the ‘goldilocks’ US exceptionalism narrative that has dominated the start of 2024, with the greenback having already notched four consecutive weekly advances to kick off the year, closely tracking the sell-off seen across the Treasury curve. A further rise in yields is likely needed for the greenback to continue to advance, probably stemming from any more aggressive pushback from the FOMC on the market-implied rate path.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.