Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

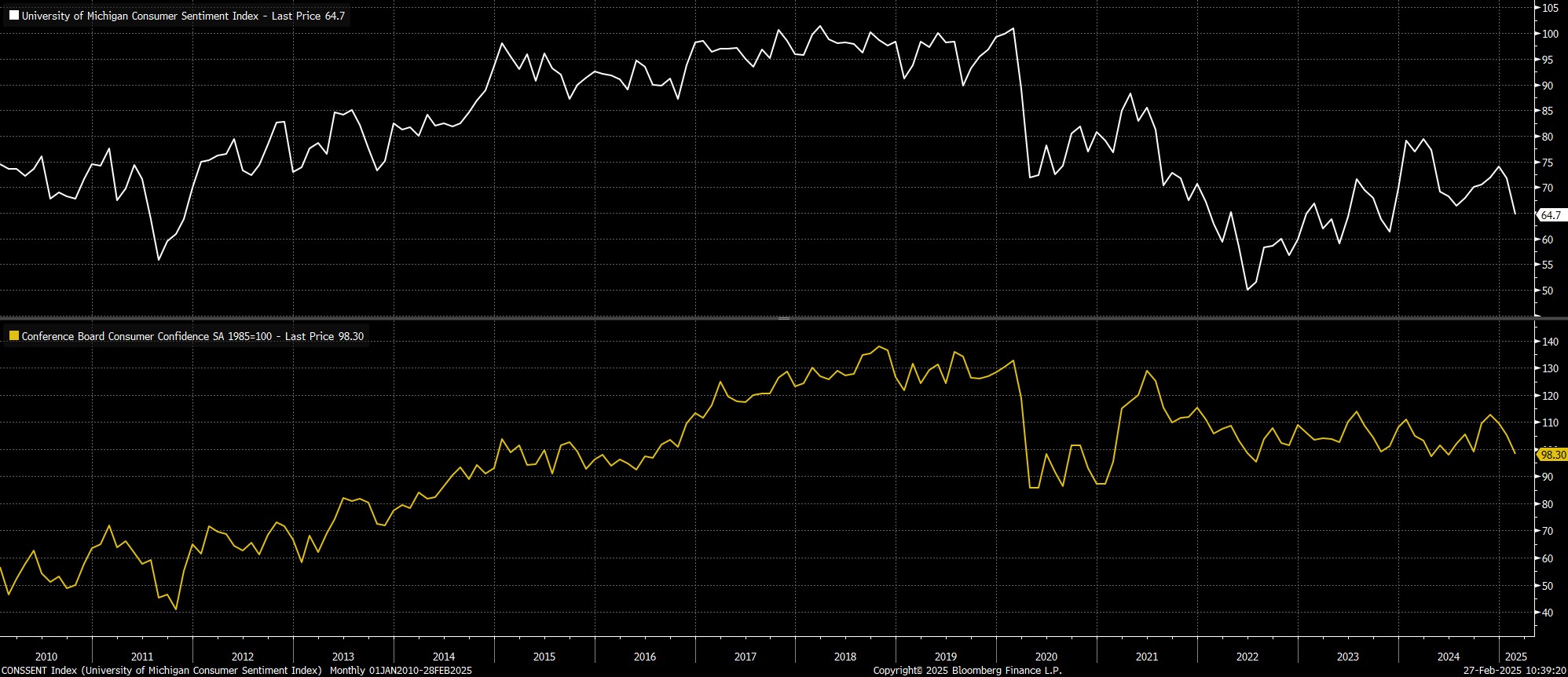

Over the last couple of weeks, markets have undergone a bit of a ‘growth scare’ – Treasuries rallying across the curve, as stocks swooned – though a decent degree of these moves probably owe to a broad unwind of momentum trades as well. In any case, recent data has been soft – January’s retail sales figures disappointed; February’s S&P Global services PMI slumped to a 25-month low; while consumers have become increasingly downbeat, per gauges from both UMich, and the Conference Board, with the latter metric having notched its biggest MoM decline in over three years.

That said, it’s important to acknowledge that all of these downside surprises have been in ‘soft’ data; i.e., survey metrics that are likely to be significantly skewed by the elevated uncertainty in the current environment, and which probably overstate any negative impact on that front, compared to the ‘hard’ figures that will be released in a few weeks’ time.

In any case, this data is not the only thing that has challenged assumptions about the US economy in recent weeks.

At the start of his term, most believed that a ‘Trump Put’ was present. This being the assumption that, given how Trump loves to gauge his success based on how equities are trading, and how rapidly the broader economy is growing, the Administration would pivot its policies were either of those unofficial aims to come under threat. In essence, if stocks sell-off enough, Trump will change course. It is not opinion polls that are the yardstick, but how Wall Street is feeling.

That assumption, while logical, looks like it may no longer hold water to the degree that it did a couple of weeks ago, with risks beginning to emerge. Furthermore, the strike price of that put, if it indeed exists, is still unknown – though it’s, obviously, a drawdown of greater than the 3% we’ve seen since the S&P traded at record highs.

The first of those risks stems from the Administration’s efficiency drive, led by Elon Musk’s DOGE, which is aiming to reduce government spending, and stamp out perceived waste within federal agencies. Thus far, it seems that the narrative around DOGE trumps (pardon the pun) the actual impact that the agency has had, though that could change as time goes on, and the magnitude of spending cuts grows.

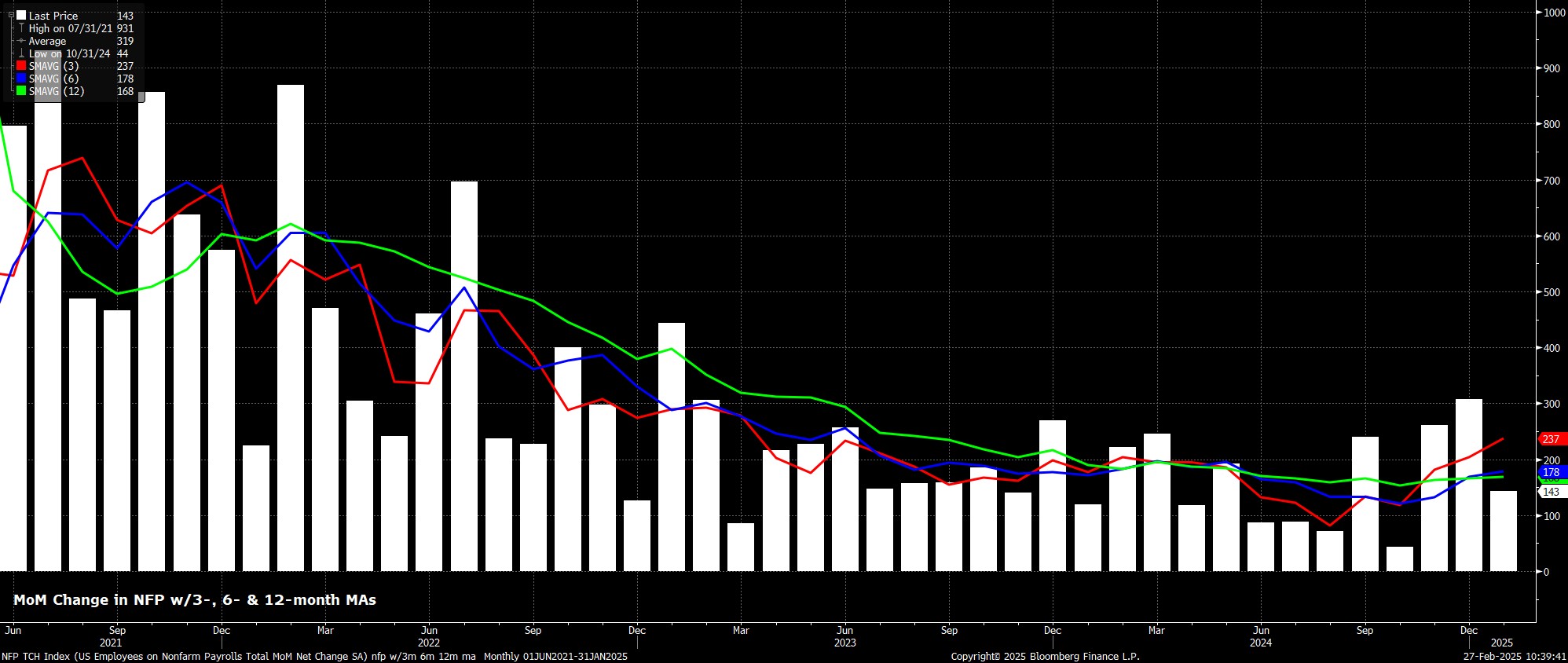

Most obviously, the issue of the federal workforce springs to mind here. By terminating the approx. 200k workers on probationary contracts, as well as 75k having signed up for voluntary redundancy packages, these layoffs could sum to the biggest ever round of job losses in US history. Naturally, this raises the risks of a horrifically large rise in jobless claims, and potentially even a negative NFP print, at some stage.

Meanwhile, there is also continued uncertainty on the tariff front. Thus far, the general vibe of trade policy has been one where Trump’s ‘bark’ has proved worse than his ‘bite’. Essentially, tariffs have been used as a threat to get other nations to the negotiating table, and to extract concessions, without actually having to be imposed. China, obviously, is the exception here.

That said, the narrative on this front could well be shifting soon, particularly with the much-touted idea of reciprocal tariffs seemingly much more focused on equalising trade deficits, as opposed to furthering certain political aims. Though we remain a month away from said tariffs potentially being imposed, the inclusion of VAT and other non-tariff barriers in calculating the levies that the US, by virtue of Commerce Secretary Lutnick, will apply, means that the levies in question could well prove much larger than markets have discounted thus far, in turn posing a significant upside risk to inflation, and downside risk to economic growth.

Looking closely at recent remarks from Admin. officials, the pitch is already being rolled for potential headwinds facing the economy to intensify. Treasury Secretary Bessent noted recently that the US economy is “brittle underneath” and heading for an “unstable equilibrium”, ostensibly as a result of how the Biden Admin. left things. Nevertheless, a Treasury Secretary talking down their own economy is a rare occurrence, akin to waving a big old red flag in the air!

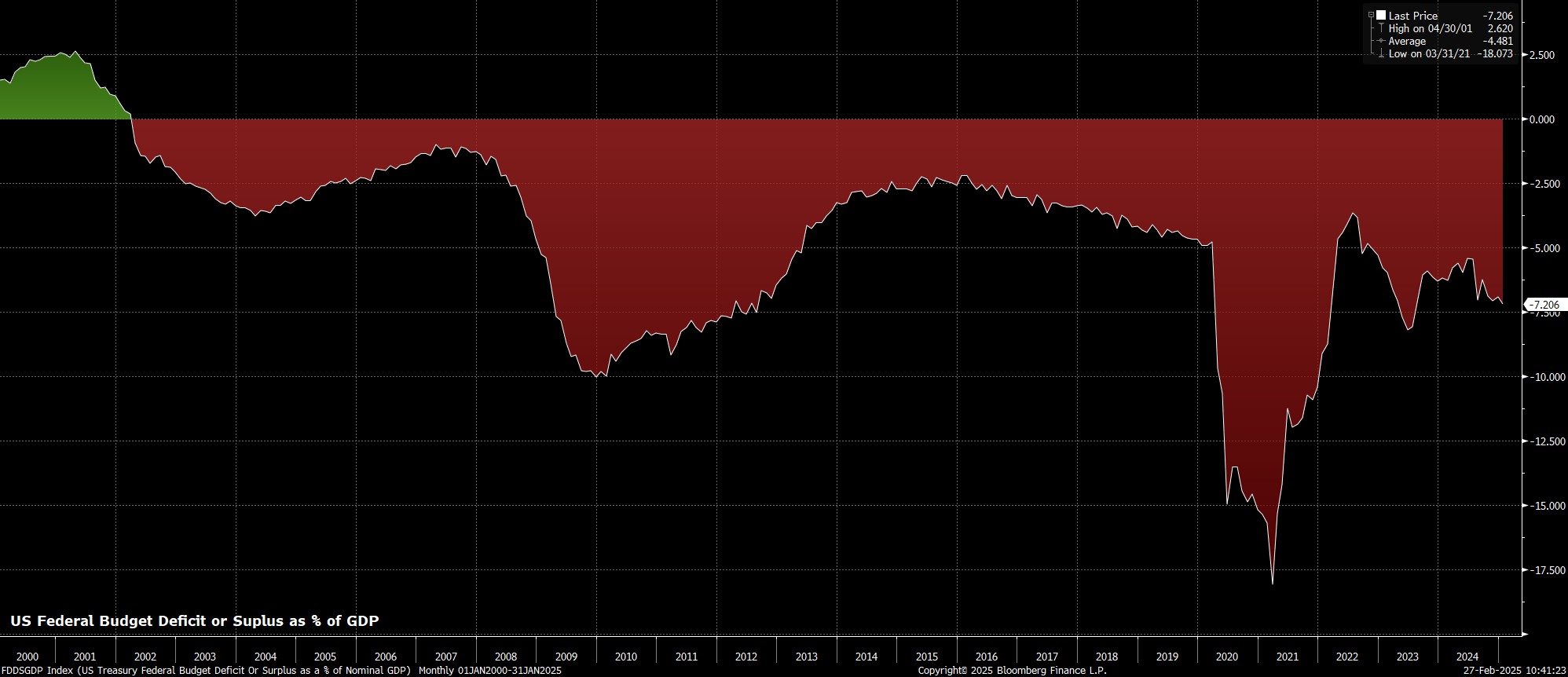

Furthermore, all of these potential growth-harming policies come before one considers efforts to cut the budget deficit to 3% of GDP, from the current 7%, potentially by the end of 2026. While a noble aim, cutting the deficit by that much (400bp!!), in such a short space of time, will require a degree of spending cuts and broader economic damage that would make prior recessions look like a ‘walk in the park’.

I guess the big question among all of this is what degree of short-term pain will the Admin tolerate, for potential long-term gain?

The assumption that the short-term pain threshold is a low one is now starting to be challenged, even if current economic fundamentals still look solid. If, or when, these fundamentals weaken is the ‘acid test’ – does that prompt a pivot, or does that see Trump & Co. ‘double down’?

For the time being, I remain bullish equities, albeit with the path to the upside likely continuing to prove a bumpy one, as markets grapple with the elevated degree of policy uncertainty in the present environment. If a ‘Trump Put’ isn’t present, though, the floodgates could well open, as Treasuries surge in relative attractiveness to equities. The market’s assumption will likely be tested soon enough, though the Administration’s degree of stubbornness is a tail risk that seems underpriced for the time being.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.