- English (UK)

Intervention Risk Remains Limited Despite Further JPY Slide

The best analogy with which to frame the overall debate, here, is one where the MoF appear to be trying to ‘have their cake and eat it’. In other words, not only do fiscal policymakers want to stem the tide of JPY weakness and ensure a more stable currency, but at the same time Takaichi’s new administration are also seeking to lean against the BoJ when it comes to the deliver of further monetary policy tightening. Quite obviously, those two factors don’t entirely mesh together in perfect harmony, and actually make for a rather unsustainable combination.

In any case, with USD/JPY trading to 9-month highs, and spot knocking on the door of the 155 figure for the first time since late-January, speculation is naturally mounting that the MoF may soon step in to stem this weakness.

_D_2025-11-12_10-25-14.jpg)

Currently, though, the MoF seem to have conducted some very gentle jawboning against the recent bout of JPY weakness, but little else. The language used recently, by Finance Minister Katayama, is hardly out of the ordinary in terms of the rhetoric that her predecessors have reached for, namely that recent moves are ‘rapid’ and ‘one-sided’, with market volatility being watched with a ‘high sense of urgency’.

To put this into some sort of context, this is still two or three levels below the stage where we would typically view monetary intervention as being imminent. Other rhetoric that is typically heard before such intervention, in ascending order of closeness to the MoF pulling the trigger, includes a recognition that recent market moves are ‘not reflecting fundamentals’, a commitment to take ‘bold action’ were it required, as well as a reference to ‘close communication’ with other counterparties.

Something else that is often, but not always, seen, is the BoJ conducting a ‘rate-checking’ exercise – essentially, asking banks for their spot USD/JPY quotes, in a not-so-subtle nod to the market that the authorities are getting antsy around where the market currently trades.

To be clear, it is at the sole discretion of the MoF as to if, and when, intervention takes place. The role of the BoJ is to simply facilitate the required operation, in this case selling USD to purchase JPY, submitting the requisite orders to a number of commercial banks, where they are then executed. In contrast to the jawboning that we’ve seen thus far, which typically acts as little more than a ‘speed bump’ in the grand scheme of things, outright monetary intervention, even if unilateral, tends to have a considerably longer-lasting impact. In the couple of sessions following the last two bouts of intervention, in April and July 2024, USD/JPY fell around 2.5%.

Gauging how close we may be to intervention taking place is very much an imperfect science, given that the MoF keep the precise variables that they monitor a closely guarded secret.

One thing we do know policymakers watch, though, is the nominal effective JPY exchange rate (or JPY NEER). In simple terms, this is a trade-weighted index allowing the overall performance of the JPY to be measured against a basket of other currencies. As it currently stands, the BoJ’s JPY NEER index sits, as near as makes no difference, at its lowest level since last July, when the most recent round of ‘yentervention’ took place.

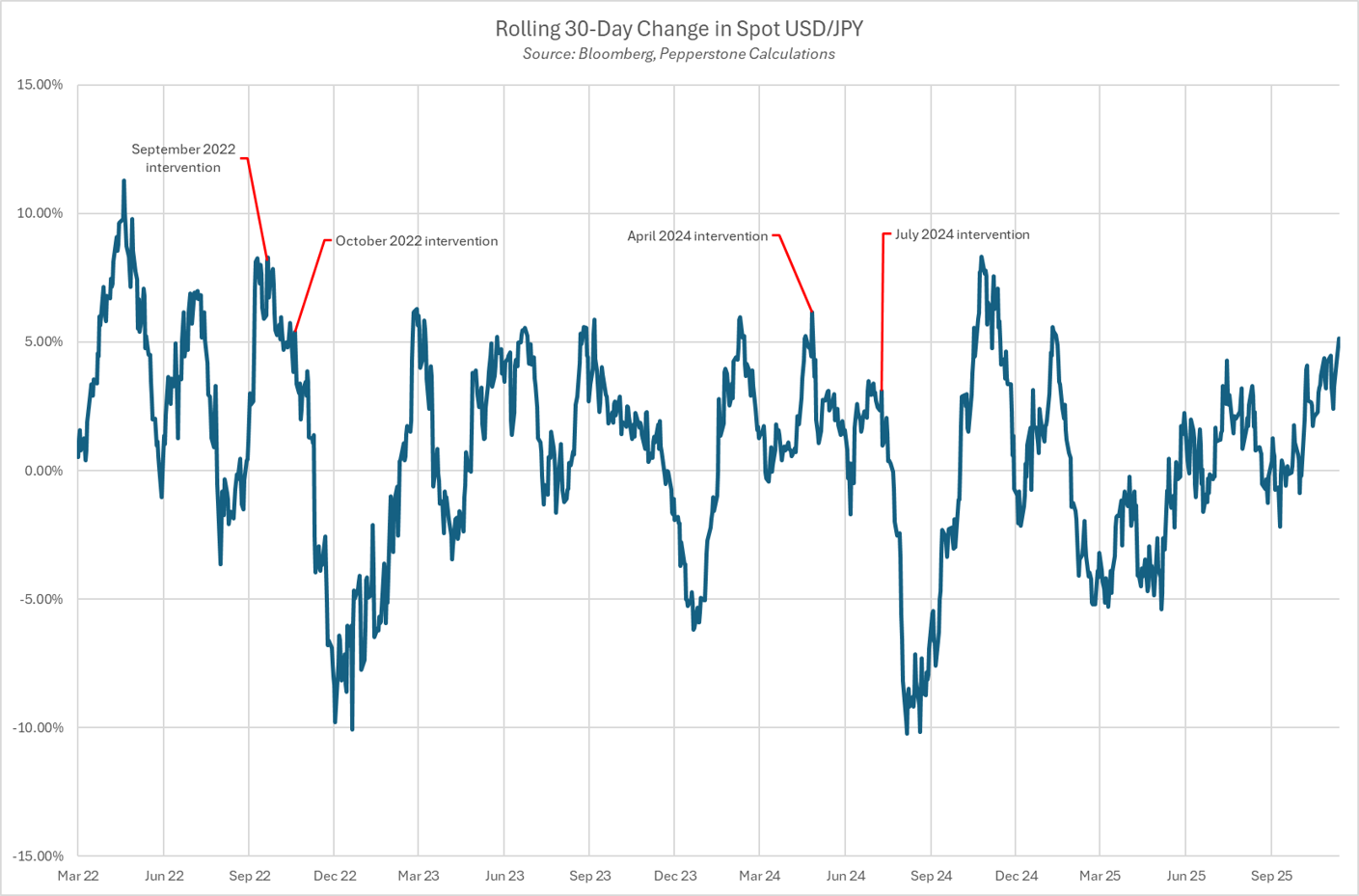

That said, it is also well-known that the MoF’s principal concern tends not to be with the actual level at which the JPY trades, but the speed of any market move that may be taking place. The speed of the most recent move does flash something of an amber warning light, with USD/JPY having rallied around 5.2% in the last 30-days, topping the 30-day move seen in the run up to three of the last four intervention rounds.

Measures of implied volatility, however, remain very subdued indeed, broadly in keeping with the G10 FX complex at large, and don’t especially argue in favour of intervention being imminent. In fact, one-month USDJPY implieds trade at their lowest level since last summer, while one-week vols trade well within the bottom 10th percentile of the 12-month range.

_J_2025-11-12_10-26-54.jpg)

Taking a step back, despite the JPY having softened by a significant degree in a very short space of time, this is a move that, by and large, has been in line with fundamental drivers, as the BoJ are nudged in an increasingly dovish direction, and as markets brace for a potential fiscal ‘bazooka’ from new PM Takaichi. These two factors, coupled with an apparent hawkish shift from Powell & Co at the Fed, combine to create a relatively strong bear case for the JPY, with further downside likely on the cards.

While said downside will, more than likely, raise intervention risks further, it would likely remain difficult for the MoF to argue that such a move is out of line with the typical fundamental drivers of the currency. That said, the Takaichi Admin do appear to be much more worried about softness in the JPY than those who have come before them, potentially lessening the utility of some of the indicators mentioned earlier in the note.

Durably changing the trend in the JPY, however, is likely to require more significant changes in the Administration’s overall stance, either demonstrating less reluctance towards the idea of BoJ tightening, or demonstrating a greater degree of fiscal restraint. With neither of those seeming especially likely for the time being, the direction of travel for the JPY likely points towards further downside, regardless of whether the MoF seek to step in the way of that trend.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.