Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

How Traders Are Approaching the Rise and Rise in Silver and Platinum

• Initiate new longs – Buy at market and chase the move, or place limit orders to enter on modest pullbacks. Momentum is incredibly strong, with silver up 7% last week (platinum +11% w/w), taking YTD gains to 60%. A body in motion tends to stay in motion, and while technically overbought, pullbacks could remain shallow. The precious metals complex is elevated for a reason—the market clearly loves the story.

• Fade the rally with short positions – Take the view that the rally is overdone. Classic technical indicators flash “overbought,” with silver trading at a 15% premium to the 50-day MA and two standard deviations above the long-term average. Mean reversion traders may see an opportunity for a downside move.

• Stand aside – Sometimes no position is the best position. Risk is skewed both ways. XAGUSD could just as easily fall 20% as rally another 10%. Being short in a strong momentum market can be costly, even if the directional call eventually proves correct.

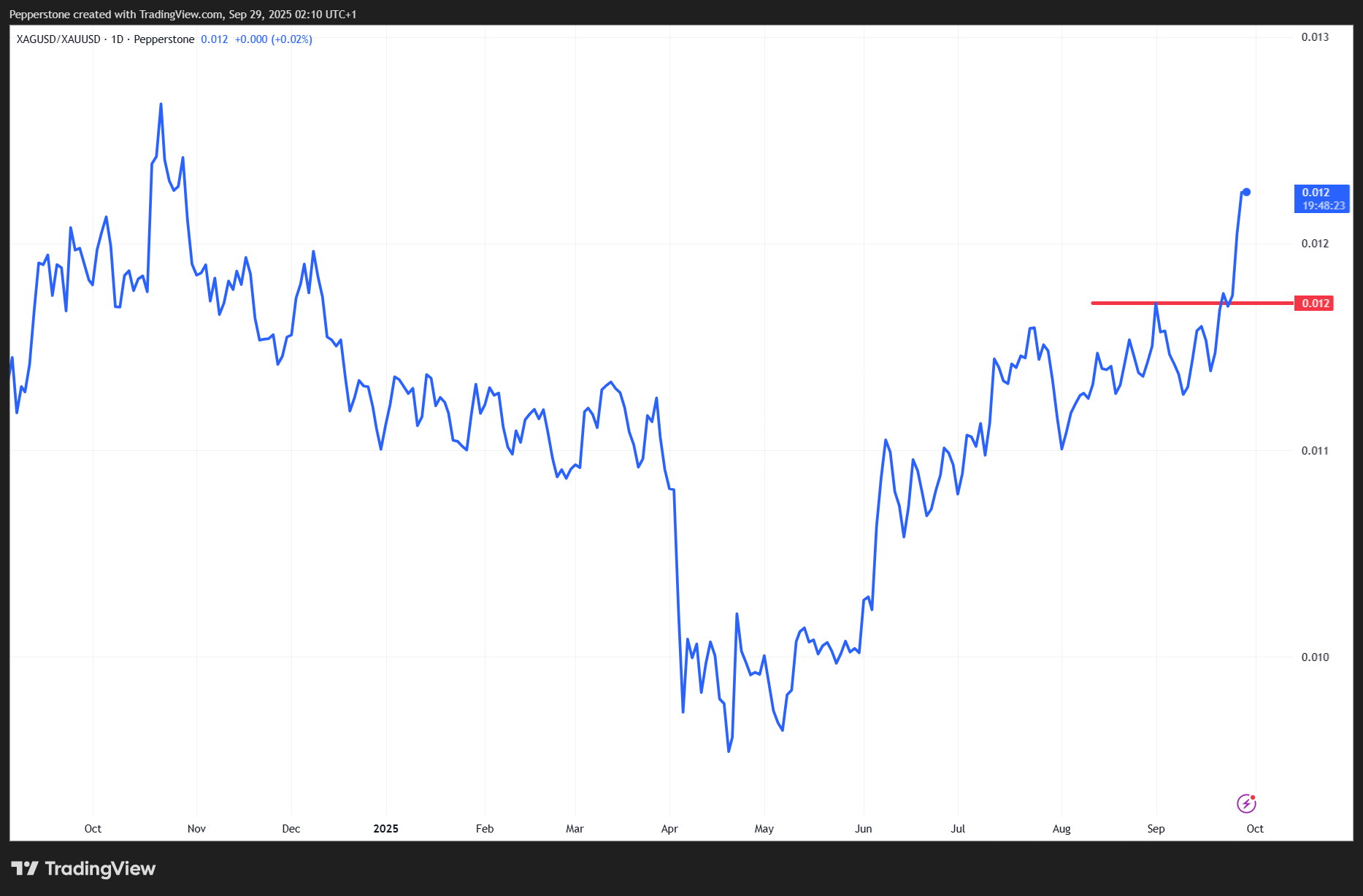

• Trade relative value vs gold – Remove a straight directional bias by using a pairs trade. For example, if you believe gold will outperform silver, go long gold and short silver, netting off performance and focusing on relative moves. The chart below shows the silver/gold ratio, which can be useful when considering a long/short strategy.

There are many other ways traders might approach this set-up, depending on their strategy. But it remains a superb case study in how traders respond to a market rallying with incredible strength, which is now largely driven by momentum and systematic flows.

Naturally, positioning and volume become key to spotting potential fatigue. Technical indicators and divergence signals can help, but ultimately price is the best fundamental. Until sellers take control, shorting a ripping market can feel like swimming against a powerful current.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.