Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Trading Nvidia: Key AI Risks, Earnings Dates & Market Strategy

Fed independence aside, investors were blindsided last week by the licensing ruling for Nvidia, which resulted in them writing off $5.5b of its H20 chips. Investors had felt an increasing comfort that the Trump admin would hold off from this course of action, so this was a surprise, and we saw that expressed in Nvidia’s share price.

Looking Ahead…The Key Risks to Navigate

A debate hanging over Nvidia’s share price and the other US AI plays falls on the level of committed capex on AI data centres spend for CY2026 from the hyperscalers: Microsoft, Google, Meta and Amazon.

Microsoft (report on 30 April) is expected to retain its capex plans for CY2025, but it would not surprise to see them lower its planned capex spend below $90b for CY2026. The big issue then is whether a lower CY2026 capex intention is idiosyncratic to Microsoft or more broad-based across the other hyperscaler businesses – hence, earnings from Google (24 April) and Amazon (1 May) are key… most analysts expect them to retain its committed spend on data centres for 2026, but any signs they are reducing spending won’t be taken well at all by Nvidia shareholders.

We then have the US AI Diffusion ruling on 15 May…. this ruling puts individual countries in a tiering system, with different degrees of export restrictions depending on the tier they are deemed to fall under. China, for example, will fall into ‘Tier 3’and will be barred from accessing any of the US’s AI compute capabilities. This has already been announced but is due to kick in on 15 May and there is the possibility of tweaks given the submissions and lobbying from the major AI plays. Either way, it is a big deal for Nvidia, and the market wants absolute certainty to fully discount this headwind into earnings assumptions.

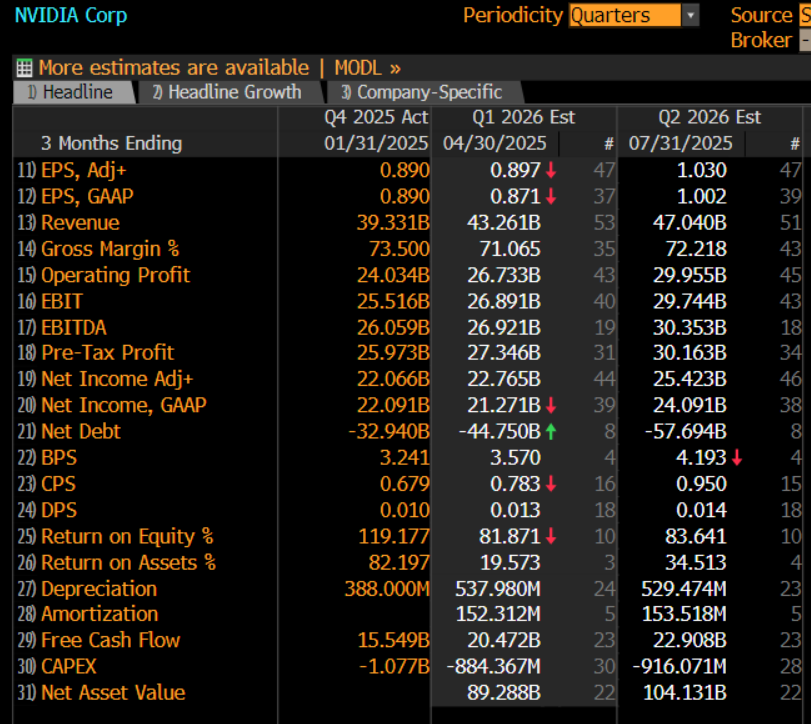

On 28 May Nvidia report Q126 earnings – it’s typically revenue and gross margins that matter most, and it’s these lines where we see the instance reaction in the share price, with the market looking at the extent of any beat (to the reporting quarter sales) and subsequent raise (for the following quarter). The market expects Q126 revenue to come in at $43.26b, which would be in line with prior company guidance seen at the Q425 earnings report, and for management to guide Q226 sales to $47.11b.

Gross margins are expected to pull down to 71% on the reporting quarter - again, in line with prior guidance - but they are expected to guide margins to 72.2% in the next reporting quarter. A factor which could be taken well by shareholders, especially if this cemented a view of trough margins.

The Trade?

As we navigate a highly challenging period for Nvidia, with several key risk events to work through - for those investors who still love the investment case, the sidelines seem like a good place for now, with the view that when all of these factors are known and, in the price, it could be the time to get set for a new run higher - that is, if earnings expectations haven't been cut up too badly.

For traders, let’s not forget that Nvidia is a high volatility, high beta momentum play - so for me, the best expression when trading Nvidia on the long side (and with leverage) is when there is evidence that investors are coming back in and accumulating - volume is greater on the up days, the stock is making higher highs and higher lows, and we start to see evidence of funds chasing returns… momentum is the play, where the rate of change is the best guide and where strength begets strength.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.