- English (UK)

DIGEST – Friday’s ‘goldilocks’ US labour market report elicited a solid risk-on reaction, clearing the way for fresh equity highs. This week, the May US CPI figures, and latest round of US-China trade talks, are in focus.

WHERE WE STAND – A goldilocks jobs report, spoos trading back above 6k, and the sun shining in the Square Mile. As Fridays go, last Friday was a pretty good one!

In terms of that jobs report, headline nonfarm payrolls rose +139k in May, a smidgen above expectations, but well above the breakeven rate required for growth in employment to keep pace with the increasing size of the labour force. This, in turn, took the 3-month average of job gains to +135k, also a pretty solid pace, even if the prior two prints were revised down by a chunky 95k.

Meanwhile, average hourly earnings rose 0.4% MoM, and 3.9% YoY, again a little above expectations, but certainly not hot enough to cause any concern about upside inflation risks stemming from the labour market among FOMC policymakers, who have now entered their pre-meeting ‘blackout’ period. Hallelujah!

The household survey was, perhaps, a little less optimistic, though has been very volatile of late amid falling response rates, so should be taken with a pinch of salt. Labour force participation unexpectedly slipped 0.2pp to 62.4%, though unemployment did hold steady at 4.2%. This was, though, a ‘high’ unemployment print, at 4.2443% to be precise, perhaps raising the chances of the figure rounding up to 4.3% next month.

Anyway, all in all it was a very solid report indeed – not too hot, not too cold, just about goldilocks-esque. In fact, that continues to sum up the state of the US economy, amid immaculate disinflation, solid underlying growth, and a tight labour market. That theme, though, is of course continuing to be over-shadowed by ongoing tariff-related uncertainty, even if ‘peak chaos’ on that front does now seem to be well behind us.

Still, that uncertainty, and the continued upside inflation risks posed by tariffs, will keep the Fed on the sidelines for the foreseeable, especially with there being nothing in incoming data to suggest an urgent need for action. Any cuts before the fourth quarter seem a very long shot indeed, to my mind. The “full point” rate cut that President Trump was screaming for on Friday just isn’t going to happen, as if that even needed to be said.

Equity markets, though, simply don’t need cuts to rally. A cocktail of solid incoming data, solid corporate earnings, plus continued movement towards trade deals, and calmer rhetoric, is enough to keep the bulls in charge. With the S&P future back above 6,000, new highs now look to be on the cards, particularly with there being a bit of a dearth of major risk events up ahead until the FOMC next Wednesday, which should allow the market to happily take the path of least resistance to the upside.

Elsewhere, the solid jobs report saw Treasuries sell-off across a flatter curve, with weakness most pronounced at the front-end and in the belly, amid a hawkish repricing of Fed policy expectations. The USD OIS curve now discounts around 44bp of easing by year-end, compared to about 52bp pre-NFP.

In any case, the selling pressure in the Treasury complex saw benchmark 2-year yields close above 4%, 10s above 4.5%, and 30s testing 5.0% to the upside once more. While all three of these have been levels that proved attractive to dip buyers in recent weeks, I wonder whether we might see conviction on that front lacking a little, at least until we’ve seen this week’s supply (more on which below) absorbed comfortably.

Predictably, the dollar also firmed against most peers after the jobs report, also piggy-backing on that hawkish repricing. Still, the FX market remains a rangebound and choppy mess when one zooms out, with the DXY still content to plod along in a 98-102 range, the EUR capped by 1.15, and anything north of 1.36 still too tough of an ask for cable. Unless and until we see a convincing break of these ranges, mean reversion will remain the preferred play.

LOOK AHEAD – A somewhat light data docket up ahead this week, though focus will first fall on the next round of US-China trade talks, due to be held today in London.

Given recent rhetoric between the two sides, it seems that the balance of risks tilts more in favour of a market-positive outcome, if one lacking concrete developments, with the broader direction of travel still one which is towards deals being struck, and trade tensions on the whole continuing to cool.

Besides that, this week’s data highlight comes in the form of the May US CPI figures due on Wednesday. Both headline and core CPI are seen ticking higher, to 2.5% YoY and 2.9% YoY respectively, with particular attention likely to be paid to goods prices, as participants attempt to gauge the degree to which tariffs are beginning to push prices higher. These upside price pressures are likely to persist through the end of Q3, keeping the FOMC firmly on the sidelines for the time being.

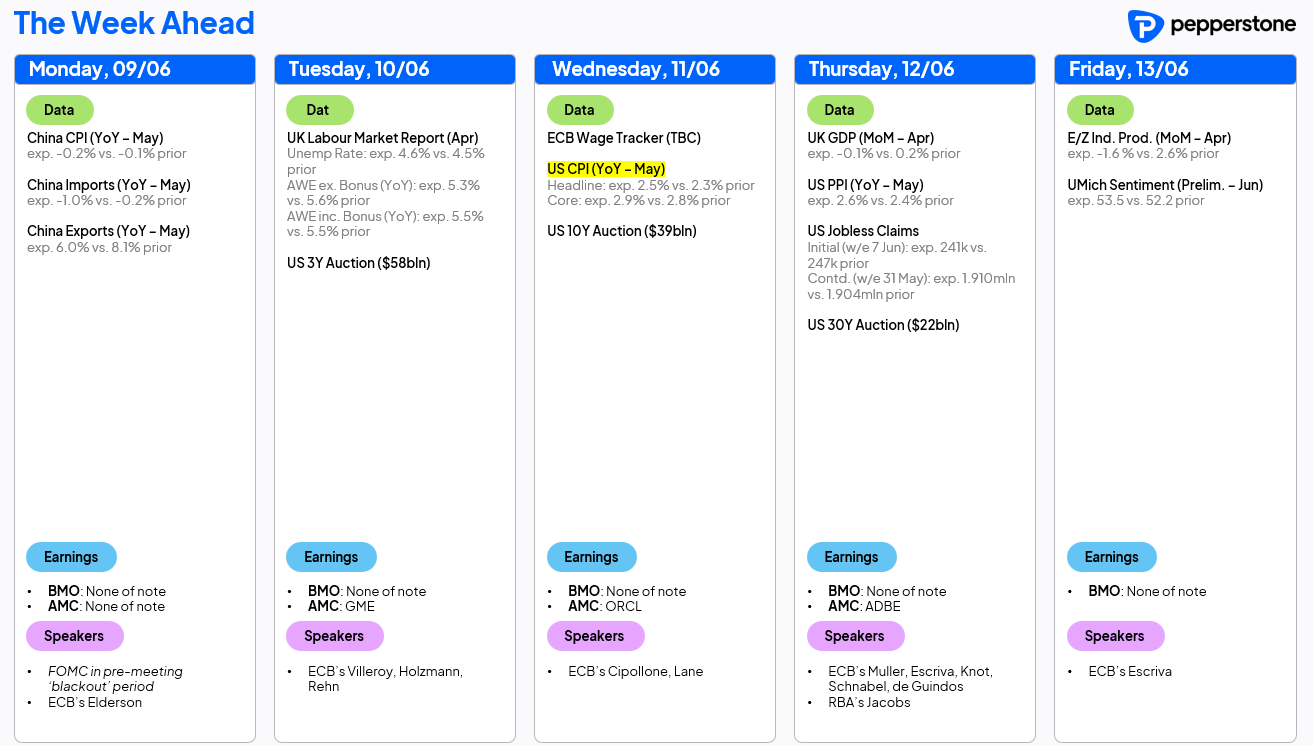

Elsewhere, the latest UK jobs and GDP figures are due, though given recent well-documented issues with the ONS, both of these datapoints should be taken with a pinch of salt, and neither are especially likely to materially alter the BoE policy outlook. Other notable releases this week include the latest eurozone wage figures, and preliminary UMich consumer sentiment data on Friday.

Besides data, the FOMC are now in the pre-meeting ‘blackout’ period, though the deluge of ECB speakers will more than make up for any respite on that front. A busy week of Treasury supply also awaits, with 3-, 10- and 30-year sales scheduled, and with particular attention likely to fall on the latter, given ongoing market jitters over the unsustainable fiscal trajectory on which the US remains.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.