- English (UK)

Gold Price Outlook: XAUUSD Bulls Regain Control With All-Time Highs In Play

Key technical levels - Supply zone in focus The immediate focus for traders is the $4347–$4353 supply zone, which capped upside on both Friday and Monday. A clean and sustained break above $4353 would likely open the door for a renewed push toward the all-time highs at $4381. Given the persistent buying pressure evident in recent sessions, it feels increasingly plausible that the yellow metal will soon test, and potentially break, this prior resistance level.

Gold futures and institutional order flow

Attention also remains firmly on volume and order flow in front-month gold futures, where institutional and leveraged players typically deploy capital. If XAUUSD is to accelerate higher, it is likely to be driven by gold futures, currently trading around $4356, pushing through $4387 and pulling spot prices higher in the process. A futures-led breakout would add further conviction to the bullish gold narrative.

Event risk to navigate - US CPI on the radar

With US nonfarm payrolls now behind us, traders looking to build positions may show some hesitation ahead of the upcoming US CPI inflation report. CPI remains a key event risk capable of shaping broader market sentiment into year-end, and some restraint in positioning is understandable. That said, gold’s historical performance around US core CPI releases offers comfort to the bulls.

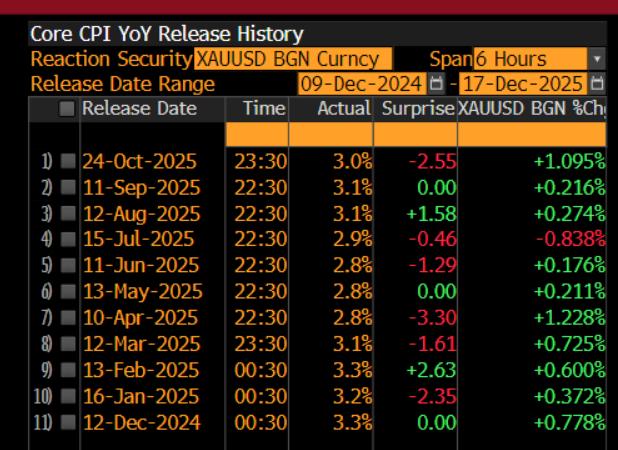

Gold's past performance around US CPI prints

Over the past 12 months, gold has rallied in the six hours following the US CPI release in 90% of instances, regardless of whether inflation surprised to the upside or downside. While past performance is no guarantee of future outcomes, this consistency highlights gold’s strong underlying bid in macro-driven environments.

Summary - The bullish gold case into year-end

While this CPI outcome may prove different, any scenario that keeps Fed rate cuts in play for 2026 is likely to be sufficient to attract buyers back into gold. With technical momentum building, institutional flows supportive, and macro conditions remaining broadly constructive, gold appears well positioned to cap off 2025 as one of the year’s standout performers, with fresh all-time highs firmly in sight.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.