Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Gold Outlook: Tariff Uncertainty and Dovish Fed, Focus on US CPI

.jpg)

Last week, gold saw gains followed by a pullback, overall trading in a tight range. Although the spot market appeared calm, a sharp premium between futures and spot on Friday caught broad trader attention. Coupled with the Fed’s dovish pivot, this became a key driver behind gold’s price rise. This week, markets will closely watch Trump’s clarifications on gold tariffs alongside US CPI and retail sales data to gauge gold’s next moves.

Looking at the XAUUSD daily chart, prices steadily climbed last week, briefly breaking above $3,400 intraday on Friday. Bears then stepped in, with prices retreating Monday morning to test the critical $3,370 support. A break below here could put the 50-day moving average in focus as the next defense line. Conversely, a rebound would likely face resistance near $3,400 and $3,430.

History Rhymes: Gold Tariff Front-Running

The main catalyst driving gold higher is the US’s inclusion of key Swiss-manufactured gold bars under tariff coverage. Swiss refiners account for over 70% of global refining capacity, producing 1-kilo and 100-ounce bars that serve as the recognized physical delivery standard on COMEX. The imposed 39% tariff has tightened the supply of deliverable bars, causing liquidity strains in the London and New York gold markets.

In response, bullion banks urgently reallocated physical gold from London and Swiss refiners to New York for delivery, leading to a sharp drop in London vault inventories. Meanwhile, the London gold market is heavily reliant on “paper gold” certificates, which often depend on repeatedly rehypothecating and borrowing the same batch of bars to back multiple transactions. If tariffs disrupt this rehypothecation chain, liquidity tightens abruptly.

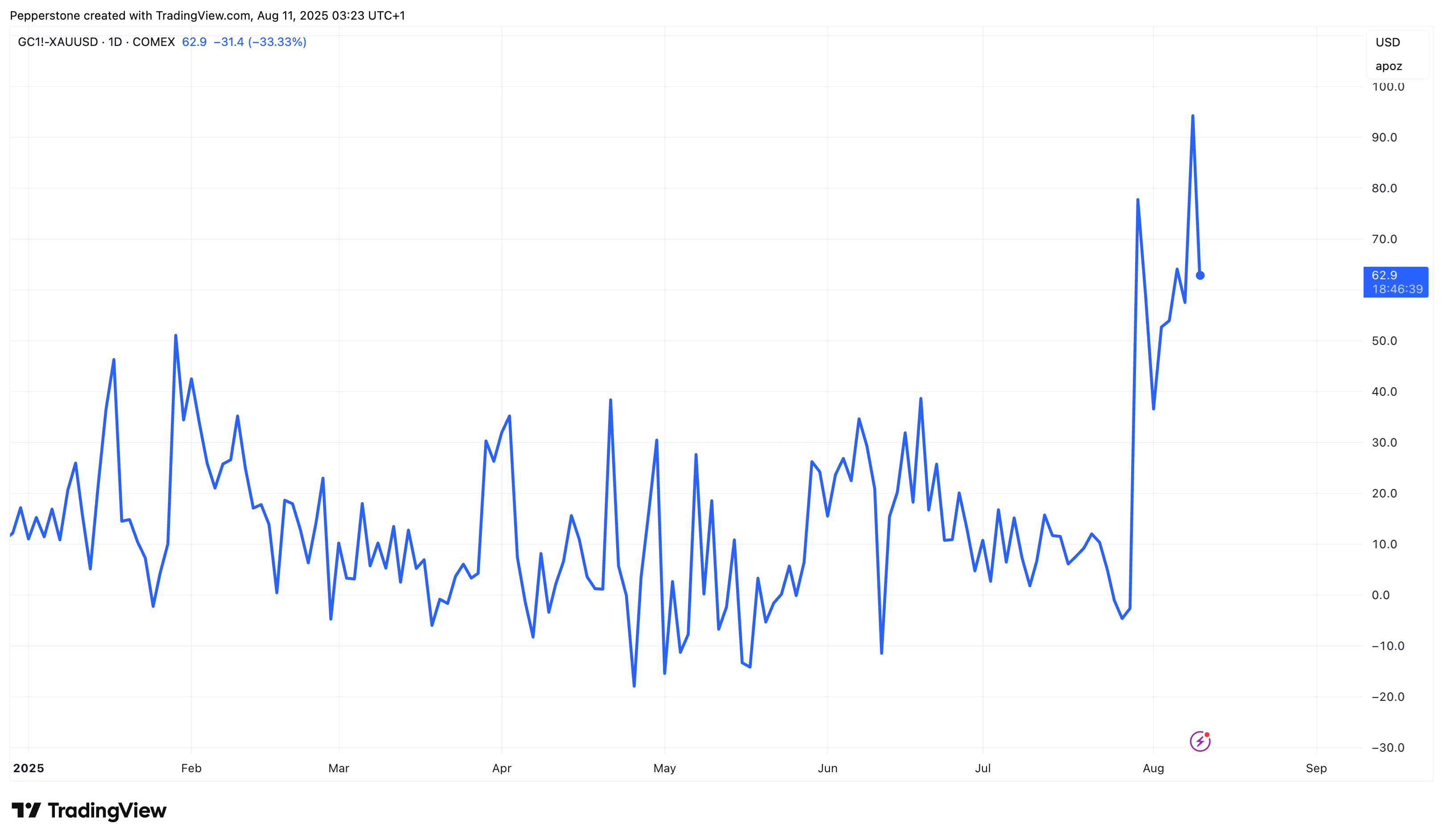

On August 8, the futures premium between COMEX and LBMA surged to as much as $95 per ounce, highlighting the immense delivery pressure.

In the US market, if longs accept delivery, some COMEX shorts will be forced to unwind or roll positions to avoid tariff impacts. The market has gradually priced in the chain reaction from potential Swiss gold tariffs, giving solid support to gold prices.

However, later on Friday, the White House announced that gold imports would not be subject to tariffs for now, easing panic in the market. Nevertheless, geopolitical and trade policy volatility, combined with Trump 2.0’s “reshoring” agenda, keeps gold attractive as a safe haven.

Economic Slowdown + Dovish Fed: Rate Cut Expectations Support Gold

Beyond tariffs, weak US economic data and shifts in the Fed’s internal balance also favor gold bulls.

On one hand, the US ISM services index for July fell to 50.1, down from 50.8 and marking its lowest since December 2024, with employment components continuing to weaken. After a sharp softening in nonfarm payrolls, the latest initial and continuing jobless claims also came in higher than expected, signaling rising labor market risks.

On the other hand, Fed officials’ comments have generally leaned dovish. Following Bowman and Waller, hawkish member Daly unusually admitted that the time for rate cuts is near, expecting more than two cuts this year. The market now prices over a 90% chance of a September cut, benefiting gold as a non-yielding asset.

Furthermore, Trump’s nomination of Miran to the Fed Board nearly guarantees three votes for a cut at the September FOMC meeting, raising concerns about Fed independence. Reports also name Waller as the White House’s favored next Fed chair, whose potential “shadow chair” role could weaken Powell’s influence and accelerate de-dollarization and gold buying.

Watch US Data and Tariff Developments

Overall, buoyed by tariff expectations and dovish Fed tones, gold bulls showed strong momentum last week. While Trump’s tariff clarifications eased market fears, policy uncertainty continues to sustain safe-haven demand. Assuming the Fed cuts 25 basis points in September and tariff tensions ease, I expect gold to remain range-bound in the near term.

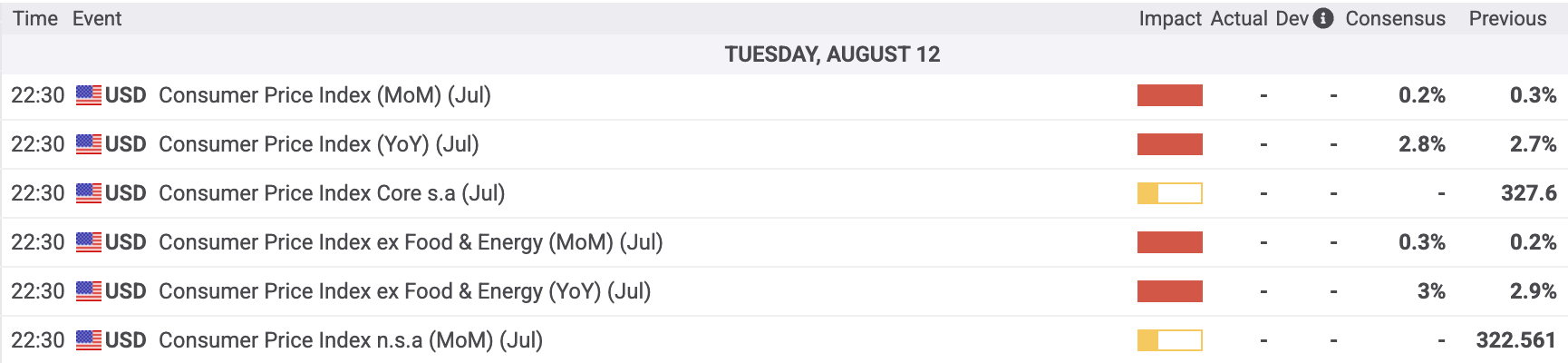

To validate these key assumptions, several critical events await this week. Gold traders will focus on Tuesday’s US July CPI release and Friday’s retail sales. Inflation forecasts call for headline and core CPI to rise slightly YoY to 2.8% and 3%, respectively. Retail sales are expected to decline 0.1% to 0.5% MoM.

Higher-than-expected inflation or retail data could pressure gold, but given the rate cut path hinges more heavily on the September 5 nonfarm payrolls, these reports’ sustained impact on gold may be limited.

Second, tariff developments remain in focus. The market strongly anticipates Trump’s clarification of Swiss tariff scope and likely extension of the US-China tariff truce by 90 days. If the White House follows this script, gold prices may face downward pressure; however, uncertainty over policy shifts could provide price support as a floor.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.