Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Gold Outlook: Rate Cut Bets Rise, Tariff Uncertainty Reignite - Safe-Haven Demand Returns!

.jpg)

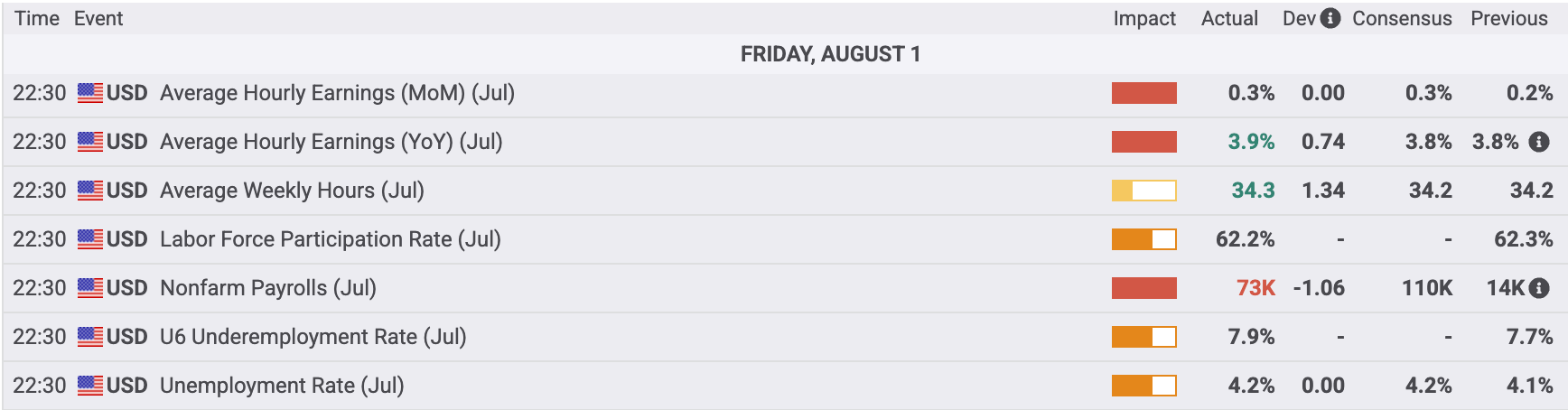

Over the past week, gold reversed earlier losses and encountered resistance near $3,370. July’s U.S. nonfarm payrolls came in far below expectations, raising the likelihood of a Fed rate cut in September. Meanwhile, a fresh wave of tariff-related rhetoric from former President Trump, coupled with potential personnel changes within the Fed, has driven a surge in safe-haven demand. These two factors have provided strong upward momentum for gold.

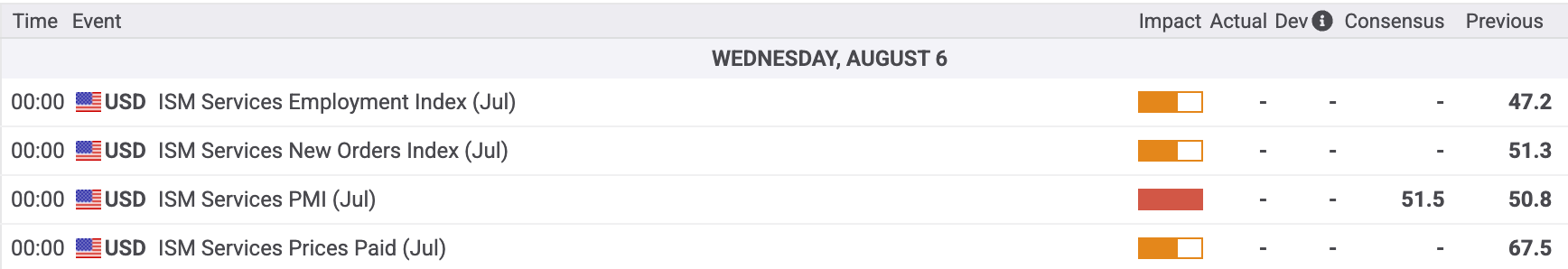

Looking ahead, both the U.S. ISM Services PMI and upcoming Fed speeches may trigger short-term fluctuations in gold prices.

Rebound Faces Resistance: $3,370 as the Key Pivot

On the XAUUSD daily chart, gold briefly dipped below the $3,300 mark midweek, weakening the technical setup. However, Friday’s strong rebound - a 2.2% surge - restored bullish sentiment, erasing the week’s losses and reclaiming ground above the 50-day moving average. Still, the $3,370 level proved to be tough resistance.

As of early Monday trading, sellers have returned, pushing the price back down toward the 50-day moving average. A break below this level could open the door for a test of the $3,300 support zone, followed by the late May and June lows around $3,250. On the flip side, a close above $3,370 - and potentially $3,400 - would likely mark the beginning of a more sustained upward trend.

Two Risks + One Update: Gold’s Safe-Haven Status Regains Traction

At the end of July, gold faced pressure from two key factors: easing trade tensions, which reduced safe-haven demand, and a wait-and-see Fed, which raised the opportunity cost of holding gold. However, both narratives shifted noticeably late last week.

On tariffs, markets had expected another round of the “TACO” strategy on August 1st - Trump Appears Cooperative Occasionally - given his previously softened tone toward Europe, Japan, and Mexico. Instead, the White House doubled down, announcing steep tariffs on countries without finalized agreements: 39% on Switzerland, 35% on Canada, 25% on India, and 50% on Brazil - reigniting trade uncertainty.

Even among nations that have reached preliminary deals with the U.S., there is little clarity on how promised investment pledges will be implemented. With the August 12 tariff suspension deadline fast approaching, the temporary trade truce between the U.S. and China remains fragile, weighing further on market sentiment.

Also concerning was the July U.S. jobs report. Only 73,000 new jobs were added - far below estimates and even below the "maintenance level" for employment. Worse, previous months were revised down by a total of 258,000 - the largest downward revision since the pandemic. The unemployment rate rose slightly to 4.2%, in line with expectations. Traders are now increasingly pricing in recession risks and questioning whether the Fed might move too slowly on rate cuts.

Making matters worse, Trump publicly claimed the jobs data was “manipulated” and announced plans to fire the head of the Bureau of Labor Statistics (BLS), further undermining market trust in official U.S. data. Together with tariff-related uncertainty, this institutional credibility issue has added fuel to gold’s safe-haven appeal.

Despite growing inflation expectations for Q4, deteriorating labor market conditions have pushed market odds for a 25-basis-point rate cut in September to nearly 90%. Combined with a sharp drop in Treasury yields and a weaker dollar, gold - as a yield-free asset - stands to benefit significantly. Meanwhile, a pullback in U.S. equities has freed up liquidity, much of which is finding its way back into gold.

In addition to trade and economic risks, Fed Governor Kugler announced her resignation this week. This gives Trump the opportunity to nominate a new member, potentially tipping the current hawk-dove balance - or even empowering a so-called “shadow chair.” Such moves could further compromise Fed independence, reinforcing gold’s appeal as a hedge and prompting more central bank gold buying.

Multiple Drivers Converging: Gold Poised for a Breakout

Overall, gold’s bullish momentum has strengthened, but it has yet to break out of its broader consolidation pattern. Trade uncertainty, labor market weakness, mounting expectations of Fed rate cuts, and leadership changes are collectively providing a solid foundation for further upside. Monday’s early pullback looks more like a technically driven correction than a shift in fundamentals. As long as the broader macro backdrop holds, a close above $3,370 would likely open the door for renewed upside momentum.

Looking ahead, markets should closely monitor the White House’s next steps on tariffs, along with any potential retaliatory measures from impacted economies. Any further deterioration could intensify safe-haven flows into gold.

While top-tier data releases are relatively light this week compared to last, the July ISM Services PMI still warrants attention. Markets expect a rise to 51.5 from June’s 50.8. Given heightened sensitivity to signs of economic slowdown, a surprise drop - especially into contraction territory - could further boost gold’s appeal.

Finally, multiple Fed officials are slated to speak this week. Following weak job data and easing inflation, markets have largely priced in a September rate cut. But questions remain around the size of the cut - 25 or 50 basis points - and whether it marks the beginning of a cutting cycle. Powell is likely to stay flexible ahead of the early-September jobs report, but broadly dovish language from Fed speakers could offer gold more upside fuel.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.