- English (UK)

Gold Outlook: Prices Hit New Record Highs, Rate Cuts Remain the Main Driver

.jpg)

Over the past week, gold briefly pulled back before resuming its upward momentum, surpassing Wednesday’s intraday high of $3,707 to reach fresh all-time highs. The market’s expectation of two additional rate cuts this year remains the core driver for gold’s rally, while ongoing central bank purchases provide strong support. Although recent US-China talks temporarily eased trade concerns, the US short-term budget standoff and ongoing geopolitical developments continue to maintain a risk premium for gold.

This week, a series of Fed officials’ speeches, along with Friday’s US core PCE data release, may trigger short-term volatility for gold.

Technical Snapshot: Buying on Dips Remains the Preferred Strategy

On the XAUUSD daily chart, gold briefly broke above the critical psychological level of $3,700 last week before entering a high-level consolidation phase. Early-week gains were offset by a midweek short-squeeze, with prices retreating fully from Wednesday to Thursday. However, the pullback did not extend, bottoming near $3,630. Bulls subsequently stepped in to cover positions, and gold has now reclaimed $3,700, testing new highs.

Technically, two key points stand out: First, the previous breakout failed to hold primarily due to news flow dynamics and short-term arbitrage (profit-taking and options hedging). Second, given the current liquidity and policy expectations, pullbacks are generally seen as buying opportunities rather than trend reversals - i.e., the market favors “buying the dip.”

Currently, $3,700 is a critical short-term level. A stable close above this point would likely turn it into strong support, opening the door for a further move toward $3,750. Conversely, if selling pressure intensifies, the consolidation low since September 9 around $3,630 would become the key defensive level.

Rate-Cut Expectations Remain the Main Driver, Central Banks Fuel Demand

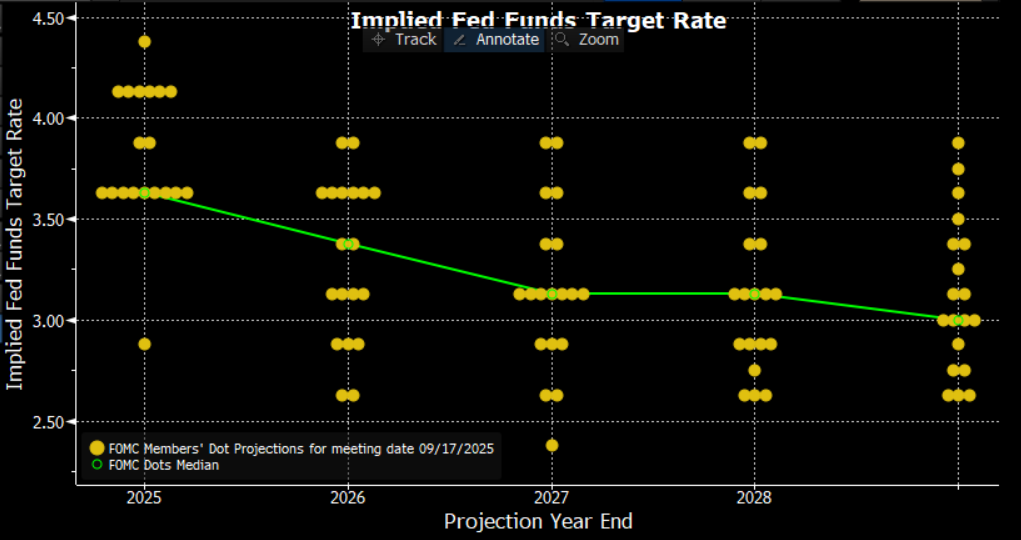

Gold’s upside remains primarily driven by expectations around Fed monetary policy. According to the CME FedWatch Tool, the market currently prices in a roughly 90% probability of a 25bp rate cut in October, and nearly an 80% probability of another cut in December. This aligns with the Fed’s updated dot plot, which signals roughly 50bp of additional easing priced in for the remainder of the year, supporting non-yielding assets such as gold.

Meanwhile, the extremely dovish stance of new Fed governor Miran, combined with concerns about the Fed’s independence, adds to market uncertainty regarding policy credibility, providing additional support for gold.

Gold’s buying momentum, however, is not solely reliant on Fed rate cut expectations. Physical demand and continued official purchases also provide strong long-term support. In China, for example, the central bank reported purchases of just 20.8 tons from January to July 2025, while UK customs data shows imports of roughly 137 tons during the same period, highlighting a significant gap between official statistics and actual flows. This indicates robust demand through London and other channels, with quotas posing no material constraint.

At the same time, India’s gold premiums have risen to nearly a 10-month high, reflecting strong retail and seasonal demand.

On the investment side, SPDR Gold ETF added approximately 18.9 tons in a single day on September 19, pushing total holdings to 994.56 tons, the highest level this year. This reflects not only direct capital demand but also strong market confidence in gold’s safe-haven appeal.

Geopolitics and Short-Term Volatility

Geopolitical factors are more mixed. On one hand, last week’s US-China leadership call eased short-term trade-related buying pressure. On the other hand, the US Senate’s rejection of a short-term spending bill, rising government shutdown risks, and tensions in Ukraine, Gaza, Eastern Europe, and the Caribbean continue to inject uncertainty premiums into gold.

Overall, Fed rate-cut expectations remain the primary driver of gold, while sustained global central bank purchases establish a strong longer-term floor. Together, these factors reinforce the bullish advantage in the current environment.

In the short term, while gold may face some profit-taking or temporary USD rebounds, the overall trend remains upward. Buying on dips remains the prevailing strategy, with traders advised to consider longer-term capital flows and physical demand as underlying support while monitoring short-term volatility for entry opportunities.

Focus on Fed Speeches and Core PCE Data

This week, 18 Fed officials are scheduled to speak. Chair Powell will appear on Tuesday, September 23, with markets expecting clearer policy signals. New governor Miran may reiterate an extremely dovish stance, emphasizing “150bp of cuts this year with limited recession risk,” potentially signaling future aspirations for the chairmanship. Any dovish indications could further support gold bulls.

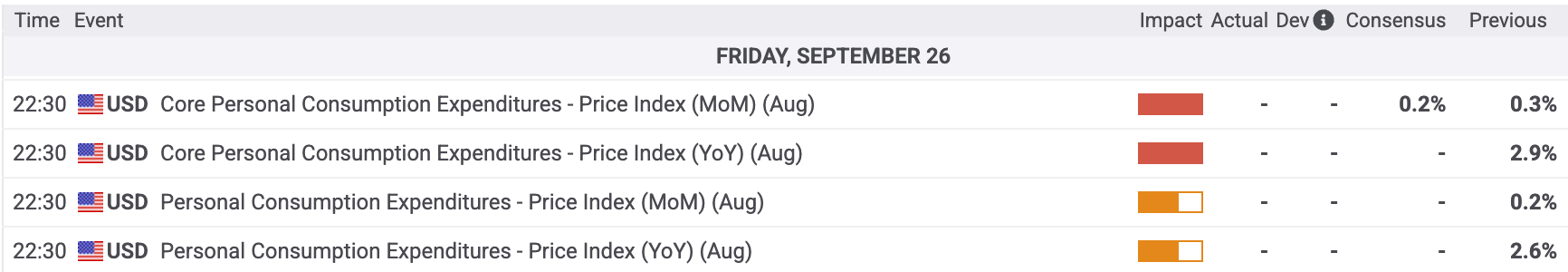

Friday, September 26, will bring the release of core PCE inflation, with market expectations at 0.3% MoM and 2.7% YoY, both slightly above prior readings.

With policy focus currently skewed toward employment, weakening labor data is likely to influence market expectations for rate cuts more than minor inflation fluctuations. Therefore, unless inflation surprises significantly, Fed decisions are unlikely to be materially affected, and gold may only see short-term volatility as a result.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.