Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Gold Outlook: Market on Edge as US CPI and Tariffs Take Focus

.jpg)

Over the past week, gold has continued to trade in a narrow range, struggling to establish a clear directional trend. Strong economic data and the Federal Reserve’s watchful approach have weakened gold’s short-term appeal. However, tariff uncertainties, rising debt pressures, and escalating geopolitical tensions continue to drive demand for gold as a risk hedge.

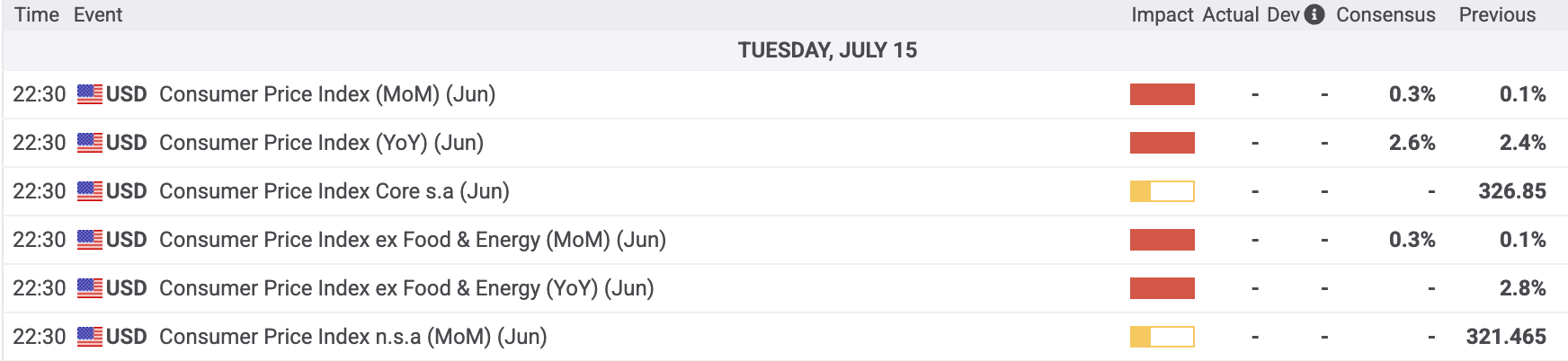

Beyond further tariff updates, this week’s market focus will shift to US CPI and retail sales figures, where stronger-than-expected results could cause price swings.

Looking at the XAUUSD daily chart, gold fluctuated mostly between $3,300 and $3,360 last week. Bulls found solid support near the lower end of this range, with prices rebounding above the 50-day moving average and currently actively testing the $3,360 level.

If this support breaks, gold may revisit the 50-day moving average and $3,300. Conversely, a renewed bullish dominance could push prices toward the $3,400 area, which merits close attention.

Three Key Drivers Support the Bulls’ Stance

Gold’s mixed price action reflects significant trader divergence. Bulls have gained some ground recently, driven largely by new tariff policy announcements and rising geopolitical risks, which heighten market uncertainty.

The White House has unveiled a series of new tariffs targeting multiple countries, ranging from 25% to 50%. When combined with the delayed implementation dates, this is widely seen as another classic “TACO” (escalate to de-escalate) strategy aimed at pressuring trading partners during negotiations. Notably, the 50% tariff on copper imports is regarded as more than symbolic, attracting heightened trader scrutiny.

Given that most economies have yet to reach trade agreements with the US (only the UK and Vietnam have done so), and with no substantive progress after recent US-China talks in London, trade outlook remains murky. This uncertainty supports demand for safe-haven assets like gold.

On the geopolitical front, the conflict between Ukraine and Russia persists, while ceasefire talks in Gaza show limited progress. With tensions ongoing on multiple fronts, gold’s non-sovereign, risk-off characteristics continue to attract capital, underpinning price support.

Meanwhile, central banks remain steady buyers of gold reserves. The People’s Bank of China has increased holdings for eight consecutive months, and many emerging markets regard gold as a core asset in their “de-dollarization” strategies. This structural demand lends strong fundamental backing to gold prices. To some extent, even if real interest rates rise short-term, any wavering confidence in US dollar assets will likely boost gold’s appeal.

Delayed Rate Cuts, Soaring Debt, and Robust Stocks Limit Gold’s Rally

Despite these supportive factors, gold’s upside momentum is limited by three converging forces: resilient US economic data, the Fed’s reluctance to cut rates imminently, and strong US equities attracting some risk-off funds away from gold.

Data-wise, the US nonfarm payrolls report confirmed a robust labor market, while the ISM services index and other soft data surveys neither indicate a recession risk nor a surge in inflation fears. Markets currently price in about two rate cuts by the Fed this year, with a July cut now largely off the table.

This shift in policy expectations has a dual impact on gold. On one hand, delayed rate cuts reduce the near-term appeal of gold as a non-yielding asset. On the other, Fed internal disagreements and uncertainties around future monetary policy add a layer of unpredictability, which helps support gold.

While former President Trump calls for a 300 basis-point Fed rate cut, Chair Powell remains steady. At the same time, US fiscal policy is accelerating. The “One Big Beautiful Bill” has narrowly passed Congress, extending 2017 tax cuts and raising the debt ceiling to $50 trillion, pushing the fiscal deficit above 7% of GDP - a historic level of stimulus.

This legislation eases Treasury funding pressures in the short term and bolsters market confidence. Some market participants believe aggressive fiscal expansion could boost US economic growth and fuel equity gains, siphoning liquidity from safe-haven assets like gold.

However, risks lurk: ballooning US debt issuance could strain supply, tighten liquidity across assets, and raise sustainability concerns. This reinforces gold’s value as a hedge against fiscal risks.

Gold Awaits Breakout; Key Data Could Shift the Balance

In summary, gold remains rangebound near $3,360 resistance amid ongoing tariff announcements, geopolitical developments, US debt challenges, and steady central bank buying. Yet, strong US economic data and the Fed’s cautious stance limit breakout potential. For now, gold is likely to trade sideways.

Looking ahead, one focus this week will be progress in trade talks between the US and other major economies. Besides President Trump’s irregular updates on Truth Social, the EU and Japan’s responses will be closely watched. Any concessions may ease safe-haven demand and temper gold buying.

Tariffs’ impact on inflation is also critical. US annualized tariff revenue for June has reached $327 billion, about 1.1% of GDP. Should companies fully pass these costs onto consumers, inflationary pressures could intensify, potentially signaling a recession risk. The upcoming June CPI report will be a key Fed reference for assessing a September rate cut.

Markets expect headline inflation to rise from 2.4% to 2.6% year-over-year, with core inflation nudging from 2.8% to 2.9%. A softer-than-expected CPI print would likely boost bets on September rate cuts, pushing US yields lower and the dollar weaker, thus supporting gold. Conversely, stronger data could trigger a reassessment of Fed easing expectations and weigh on gold prices.

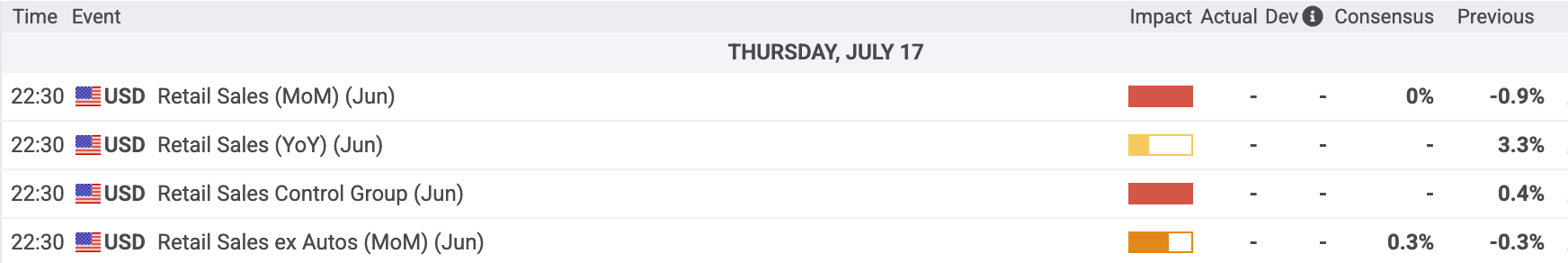

Additionally, the July 17 release of June retail sales growth is now expected to turn positive from prior negative forecasts. If consumption data, especially core spending excluding food and energy, continue to show delayed tariff effects, it may reduce expectations for rate cuts this year, posing a headwind for gold’s upside.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.