- English (UK)

A Traders' Week Ahead Playbook: Markets Navigate Geopolitical Tensions and Central Bank Decisions

The market environment for traders evolves

The trading environment is morphing from a low volatility, tight trading range, upwards sloping grind, with minimal hedges in place, to one of increased dispersion from market participants on their respective short-term outlooks - this typically results in increased two-way trading opportunities, changes in top-of-book liquidity and range expansion. Traders need to recognize and adapt to these changes, and considering the risk they take in a trade, and their position sizing.

There’s certainly been demand from market players to get set in volatility (vol) exposures, where on Friday, the VIX index closed back above 20% and a level that typically leads to a more active approach to trading. S&P500 1-month 5-delta put implied volatility (IVOL) has risen to a 15.6 volatilities premium to S&P500 1-month at-the-money IVOL – essentially, highlighting an increasing demand for tail hedges and the risk of a 5-10% drawdown in the SPX500.

We see the demand to hedge out the risk of drawdown in ‘skew’, with S&P500 1-month put IVOL closing at a 6.5 vol premium to call IVOL, which lifts S&P500 skew back above the YTD average of 6 vols. This highlights an increased relative demand from market players to pay up for downside protection, over the risk of an upside move in risk.

On the daily chart, S&P500 futures closed below the prior 4-day consolidation lows, and while the intraday tape (on Friday) showed that there are still buyers present in the market, the sell-off into the close was clearly indicative of traders reducing risk going into the weekend. We see the risk picture developing in S&P500 equity factors and styles, with US cyclical, high beta, growth and small cap stocks sold down heavily through the back end of last week and I suspect that will be a theme we see early this week too.

Energy markets are front and centre

Naturally, any legacy shorts in the energy sector have been and will continue to be managed dynamically – although initiating long positioning in energy equity or directly in crude is geared towards those with a higher tolerance for risk and the fast money crowd, as putting a theoretical fair value on crude and where supply could end up in such a rapidly evolving conflict is not for everyone – most importantly we need to cut through heightened noise, emotions and misinformation, and specifically around the probability that Iran will influence logistical flows through the Straits of Hormuz – an outcome that would seemingly only occur in the most extreme circumstances. As the Iran-Israel conflict intensifies, oil facilities (non-export) impacted, and Iran making it known they are not open to negotiate, we've seen a lively open in crude and NG futures, with the buyers dominating and we look to see if the opening moves can build through Asia and into EU/UK trade.

EU equity markets are the weak link

The weak link across the equity index space falls squarely on the EU Stoxx 50 and German Dax, with both indices falling far heavier than any of the major bourses, and both closing lower for five consecutive days – scanning the universe of our tradeable markets there aren’t many that can match that run of poor form. A classic case of what outperformed on the way up, getting most impacted on the way down.

Gold is also working well with 'the market' seeing the near-term investment case for gold as relatively clear-cut. Spot gold settled out the week at a record closing high and will look to build on this platform today for a test of the ATH of $3500.10 (printed on 22 April), with gold futures not far off closing highs and trading a punchy 264k contracts on Friday. Staying in the precious metals space, and while gold finds form, traders have cut back on profitable longs in silver, platinum and palladium – potentially to raise cash in the portfolio or even flipping the exposure into gold.

In FX markets, it was interesting to see the USD finding a small bid on Friday – perhaps driven by the rise in UST yields and a modest covering of extensive short positions ahead of the new trading week and the known event risks in store. The strong moves in crude have offered a modest tailwind to the Petro-currencies (NOK in particular), but the fact that there was no obvious flight to the safe-havens currencies in G10 FX (JPY, CHF and USD), has been another reason why the gold market trades long and strong.

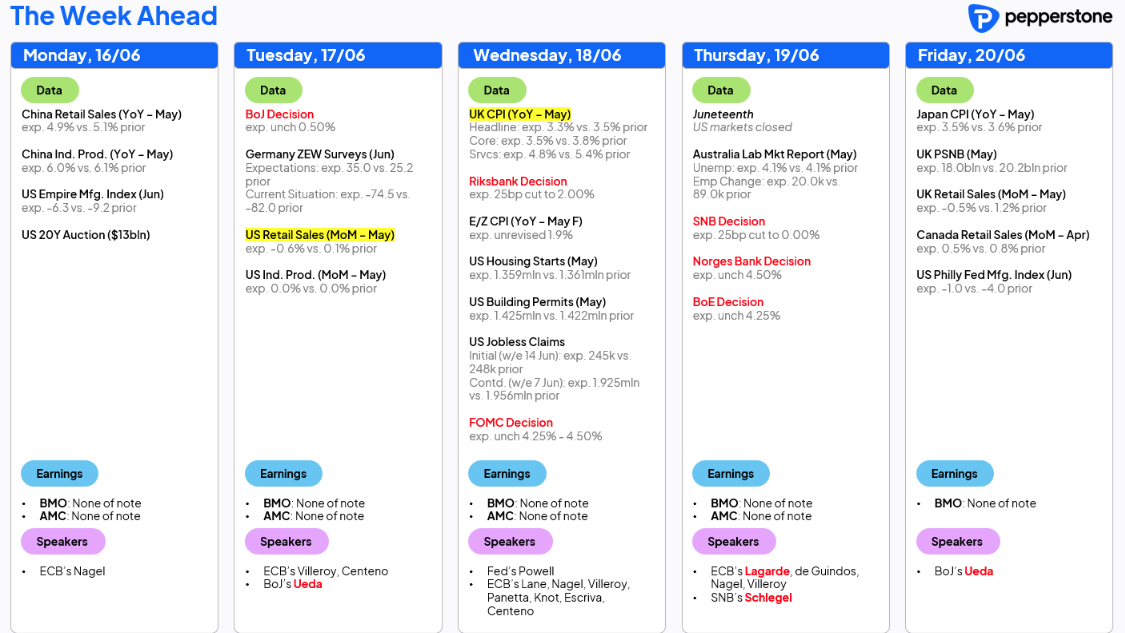

The marquee risk events for the week ahead

A deluge of central bank meetings ahead

Away from the geopolitical and fiscal debates taking place in the US Senate, the event risk through the week ahead is heavy on central bank meetings. Traders navigate policy outlooks from the FOMC (no change expected), BoE (no change expected), BoJ (no change expected), Swiss National Bank (SNB – 25bp cut eyed), Norges Bank (Norway), Riksbank (Sweden), Brazilian Central Bank (BCB) and Banco Central de Chile (BBCh).

Of these, the SNB and Riksbank are expected to move on policy, with a 25bp cut from SNB seen as a slam dunk in market pricing, with swaps pricing even implying a 23% chance of a 50bp cut, which if realised would take the SNB’s policy rate into negative territory – with the CHF looking attractive as a hedge against the geopolitical risk, and a healthy 25bp vs 50bp cut debate in play, expect a lively week for the ‘Swissy’.

A 25bp cut from the Riksbank is implied in market pricing at 80%, which suggests we could see a bout of vol in the SEK over the meeting. The BCB meeting will get attention, notably from the macro funds, given the BRL has been a huge carry play, and while the base case is that the Selic rate is left unchanged at 14.75%, it wouldn’t surprise to greatly if we saw a 25bp hike. Rallies in USDBRL should be well contained and an opportunity to layer into short exposures.

The FOMC meeting will naturally get the greatest degree of market focus, and while the market sees no chance of a rate cut at this meeting, we do get a new set of economic and fed funds projections (a.k.a ‘the dots’), and a chance to quantitively understand where collectively within the Fed's ranks see the ongoing developments impacting their respective forecasts. The Fed should remain sufficiently constrained by the many uncertainties to offer anything truly market-moving and the statement should stress that policy is in a sound place for now.

The risk of a punchy downgrade to the Fed's median 2025 GDP forecast is certainly there, with the current 2025 GDP forecast of 1.7% (put out in the March SEP’s) likely taken down by 30-50bp. The 2025 median Core PCE inflation estimate may well be revised higher (currently 2.8%), with the 2025 fed fund projection expected to stay at 3.9% (implying two 25bp cuts this year), although the distribution of estimates (from economists) ranges from 4.375% (implying no cuts in 2025) to 3.625% (implying almost four 25bp cuts).

Aside from the FOMC meeting, we also navigate US retail sales, import prices and weekly jobless/continuing claims. In China, we receive home prices, retail sales, IP, and property investment data. Ahead of the BoE meeting, we get UK inflation data and while inflation is expected to slow it shouldn’t affect the BoE’s call to leave the bank rate at 4.25%, although an outlier print could influence pricing for the August meeting, where swaps currently imply a 76% chance of a 25bp cut.

In Australia, the monthly employment lottery would need to be significantly above consensus to throw real doubts about a 25bp rate cut in the RBA’s July meeting – an outcome which is implied at 79%.

Good luck to all

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.