- English (UK)

Summary

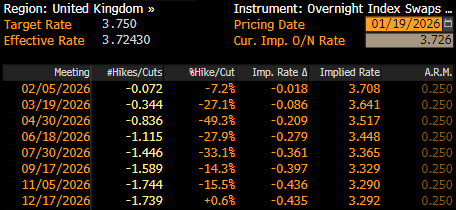

- CPI Lies Ahead: This week's UK CPI figures (exp. 0.4% MoM/3.3% YoY) hold the key for the near-term BoE outlook

- Airfares in Focus: Uncertainties over the timing of data collection could skew airfares, and thus the overall index, considerably higher

- Looking Through Noise: Policymakers should look through such noise, thus meaning any hawkish bets on the BoE rate path, or GBP upside, would likely prove misplaced

Why do airfares matter so much?

Allow me to explain. When collecting inflation figures, the ONS observe return flight prices around the second or third Tuesday of the month, sampling return flights with the second leg of the flight being ‘a pre-specified number of days’ after the outbound one. The precise sampling date tends to change month-to-month, but for the December print will be either the 9th, or the 16th.

This sounds niche, however is incredibly important, as sampling airfares on the 16th would mean taking a reflection of prices as they stood the week before Christmas. Quite obviously, with this being such a busy travel period, this will result in prices being considerably higher than if they were sampled a week prior. Quantifying that impact is a bit of an inexact science, though taking a sample of airfares on the 16th could result in a frankly ridiculous 50-60% MoM rise in airfare prices, in turn adding as much as 20-30bp to the headline, core, and services CPI metrics that market participants keep a close watch on.

What might these quirks mean?

There are a couple of implications here.

Firstly, from a market perspective, risks to consensus expectations for this week’s print – 3.3% YoY at a headline level, and 4.6% YoY for the services metric – tilt pretty clearly to the upside, even if this risk stems from little more than a statistical quirk. Regardless, a hotter-than-consensus print on Wednesday morning could spark knee-jerk gains for the pound, as participants begin to fret once more about the risks of inflation persistence in the UK, and price a more hawkish BoE policy path.

That, though, would be misplaced. The second implication of this is that, with these data quality issues well-known, and easily observable, it seems likely that the MPC would ‘look-through’ any upside data surprises. Furthermore, any upside in airfares in the December print should be unwound in January, thus leaving a zero net impact. As the dust settles on the data, then, and the MPC hopefully exercise a degree of reasoned analysis, one would expect any hawkishness to be unwound relatively rapidly, and any GBP upside to hence dissipate.

How can the issue be solved?

Of course, none of this may happen, and the ONS may make 9th December the reference date, much earlier than usual, thus removing any potential impacts of the aforementioned statistical skew, and making this note ‘null and void’.

Still, the mere fact that that so much hinges on what is, essentially, a random choice of date from a department in the ONS, again speaks to significant concerns over both the accuracy, and quality, of UK economic statistics. Solving this particular issue isn’t rocket science, either, as it would simply require sampling prices over a longer period, as opposed to taking a one-day snapshot – the folk in Newport can have that idea for free, if they want it!

Regardless, the crux of the matter remains that any hawkish bets on the GBP, or Bank Rate path, on the back of CPI this week are likely to be wholly misplaced, and fade in short order.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.