- English (UK)

FX Volatility Seems Mispriced As Year-End Risks Mount

Summary

- Vol Looks Cheap: While equity vol has ticked higher along with the recent sell-off, other asset classes remain somewhat moribund

- Choppy Run Into Year-End: A string of potential catalysts could cause choppiness into year-end, including a coinflip December FOMC meeting, and fiscal jitters in the UK

- FX In Focus: Compared to long-run averages, FX vol looks like the cheapest expression of a potential rough ride to Christmas

Year-End Looms With Vol Still Subdued

As Thanksgiving approaches, most market participants will be starting to look very eagerly towards year-end. There are just four ‘proper’ trading weeks of the year left to run before Christmas, which we can effectively reduce to three and a half given how thin conditions are likely to be at the back end of this week, with US desks away.

It is, hence, worth pondering whether we are likely to see a slow and steady cruise into year-end, as is so often the case, or whether something choppier could well lie in wait.

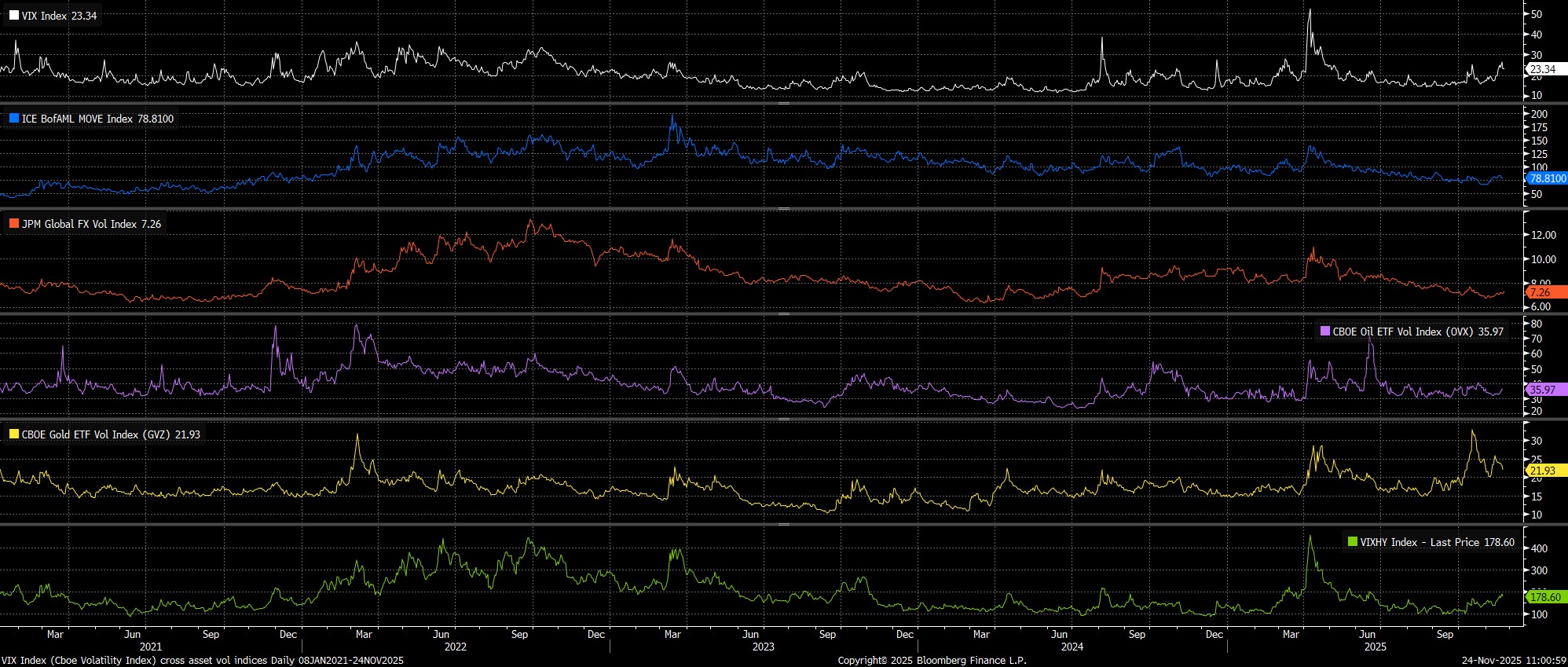

In terms of where we stand at present, equity vol has seen a notable uptick over the last week or so, with the VIX briefly notching its highest daily close since the ‘Liberation Day’ episode in April, amid the chunky stock sell-off on Wall Street. Though this sell-off had no obvious catalyst behind it, the VIX was driven higher not only by increased realised vol, but also by a surge in hedging activity in the options space, primarily as participants sought to protect what, for many, are very healthy YTD gains.

What was perhaps most interesting, though, was not only did we not really see significant spot moves in other asset classes, but we didn’t see them in the options space either. By and large, the events of last week were confined to the equity complex suggesting, in terms of catalysts at least, that the sell-off was driven more by idiosyncratic factors than anything broader.

That said, relatively subdued levels of implied vol elsewhere naturally prompts two, related, questions. Firstly, is vol too cheap? Secondly, are markets too complacent heading into year-end?

A Long List Of Potential Catalysts Awaits

A decent place to start when trying to answer both of those questions is to have a glance at the potential market drivers that are ‘in play’ between now and year-end.

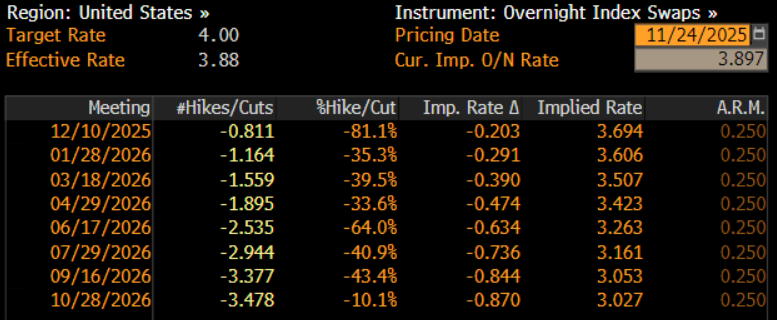

Probably the most important of all is the monetary policy outlook stateside, particularly with there being little-to-no consensus as to how the December FOMC meeting will likely pan out. While the USD OIS curve currently discounts around an 80% chance of a 25bp cut at the final confab of the year, such a move seems far from a ‘done deal’, with recent remarks from policymakers indicating that the Committee is split almost 50/50 between another cut, and standing pat. There are also plenty oof question marks over the policy path into 2026, with those Committee divisions, based on the outlook at present, likely to make every cut a tighter call than the one that precedes it.

Sticking with the US, there is also the matter of the upcoming Supreme Court ruling on the legality of tariffs imposed by President Trump under the IEEPA, which should come before year-end. Were those tariffs to be ruled illegal, as appears increasingly plausible, the Trump Admin will likely seek to re-impose as many of the levies as possible using other sections of the Trade Act (e.g. Sec 122, Sec 232, ect.), though this will clearly bring with it plenty of uncertainty as that process takes place. There are also likely to be questions as to whether the US will be liable to pay refunds to those who paid tariffs which are now illegal – the total refund bill could run to in excess of $200bln, blowing a huge hole in US borrowing projections.

On this side of the pond, focus will fall primarily on fiscal developments, with the Budget set to be delivered on 26th November. Though the exact policy announcements are still subject to change, the contours of Chancellor Reeves’s Budget are clear – approx. £30-£35bln in tax increases to build a greater degree of fiscal headroom than was present in the spring, and to fund an extra £10bln of spending commitments. In truth, the major Budget-related risk is not fiscal, but political, given that the Budget could go down so terribly with both the electorate, and Labour MPs, that rebels within the party ‘up the ante’ in their efforts to force a change in leadership. Given that such a contest would bring not only a huge degree of uncertainty but, in all likelihood, a much more left-wing PM/Chancellor duo, this tilts risks to UK assets firmly to the downside.

Elsewhere, the JPY continues to catch the eye, especially with the Takaichi Admin seemingly considerably more sensitive to currency weakness than those who came before. When coupled with the Admin’s expansionary fiscal plans, as well as continued urging against the BoJ tightening policy further, or too significantly, this creates a macro mix that could reasonably be described as ‘having one’s cake and eating it’. That, clearly, is unsustainable, however with the trade-weighted JPY at its weakest since last summer, and spot USD/JPY trading at 9-month highs, we could well be getting close to a ‘line in the sand’ that the MoF may seek to defend.

Finally, in this non-exhaustive list, is geopolitics. Peace talks between Ukraine, Russia, and the US are continuing and, while they may well be inching towards a conclusion, there remain questions not only as to whether a positive conclusion can be reached in the first place, but also as to whether any agreement is durable. There are also other geopolitical concerns in the mix too, including simmering tensions in the Middle East, plus the ever-lingering risk of a flare-up in China-Taiwan relations.

FX Vol Looks Like The Best Way To Express Potential Choppiness

With such a long list of potential catalysts that could impact markets before year-end, the question then becomes what the best expression of all this could be.

A bet on higher FX vol would be my preferred option, principally as a glance cross-asset suggests that it is currently the cheapest of the lot.

We can, of course, quantify that a bit better, using the 1-month tenor in order to cover the period up to the end of the last ‘proper’ trading week of the year. Across G10, most one-month vols, with the exception of the GBP, trade well below the 20th percentile of the 52-week range, suggesting a fair degree of scope to correct higher. Meanwhile, JPMorgan’s proprietary index of G7 FX vol trades at a meagre 7.25, close to the lows printed last summer, and well below the 12-month average of 8.30.

Were participants to increasingly start to brace for a choppy end to the year, one would logically expect levels of implied vol to climb in tandem.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.