- English (UK)

February 2026 ECB Review: Starting The Year As They Ended The Last

Rates Unchanged

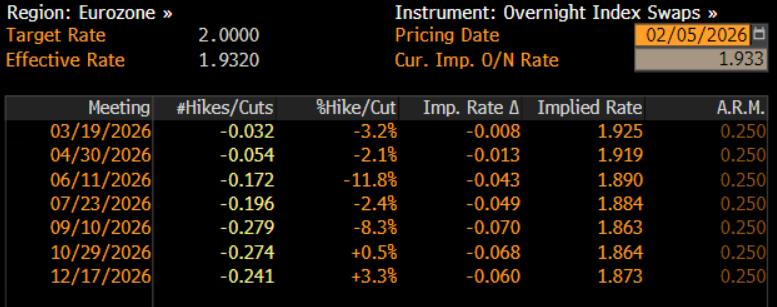

As expected, and as money markets had fully discounted in advance, the ECB’s Governing Council maintained all policy settings at the conclusion of the first confab of the year.

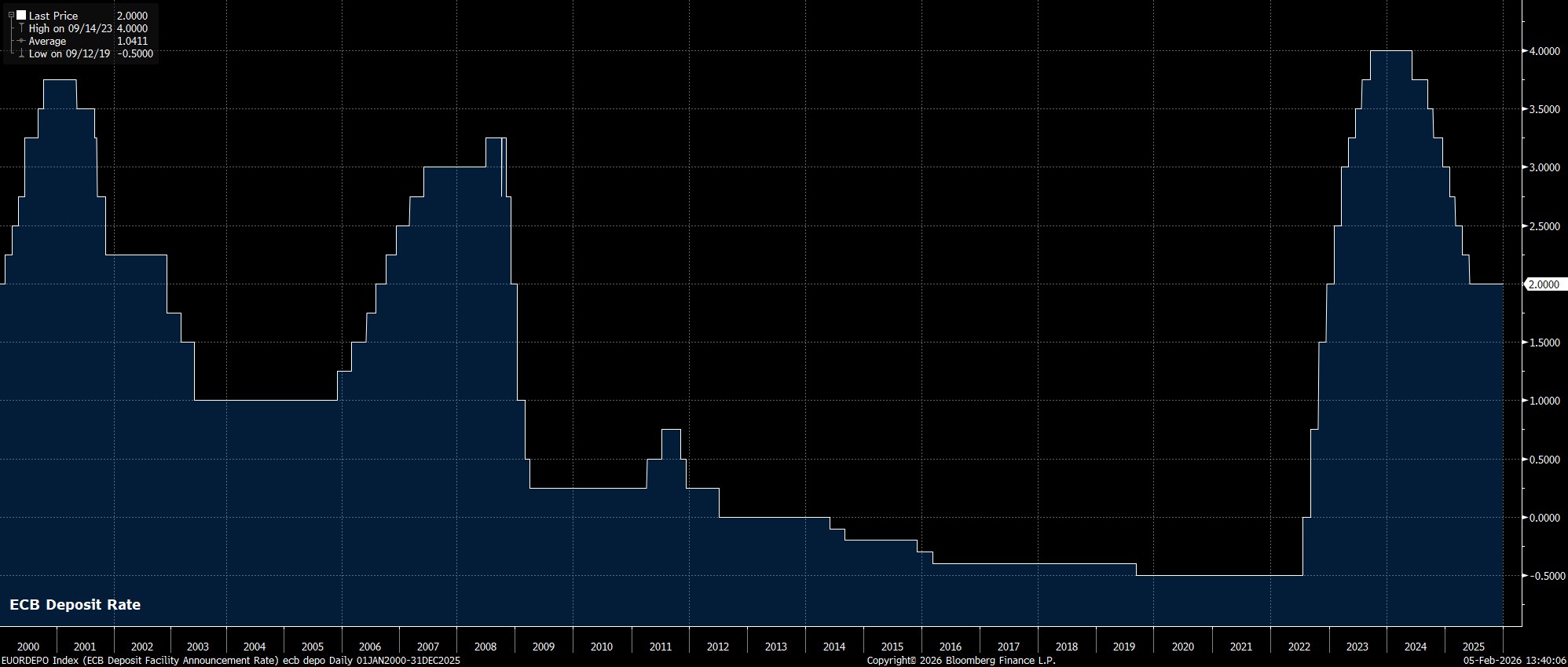

Consequently, the deposit rate was held steady at 2.00%, having now been held at such a level since last June, with the easing cycle effectively now at an end, and the deposit rate likely having reached its terminal level.

Familiar Guidance Repeated

Along with the unchanged rate decision, the Governing Council also reiterated forward guidance with which all market participants should now be incredibly familiar.

As such, the accompanying policy statement reiterated that policymakers will continue to adopt a ‘data-dependent’ and ‘meeting-by-meeting’ approach in determining a suitable policy stance. Furthermore, the statement reiterated that the GC are making no ‘pre-commitment’ to a particular rate path going forwards.

Lagarde Toes The Line

In keeping with the familiar policy guidance, President Lagarde struck a familiar note at the post-meeting press conference.

Here, Lagarde, reiterated that the ECB are not pre-committing to a particular rate path, while also seeming rather unconcerned with recent FX moves, flagging that the EUR rally seen since last March is already incorporated into the Governing Council’s baseline scenario. Lagarde also reiterated that the ECB are ‘still in a good place’.

Conclusion

Zooming out, the February Governing Council meeting is highly unlikely to be one that goes down in the ‘history books’, nor is it likely to be one that materially alters the longer-run policy outlook.

The base case, hence, remains that the ECB’s easing cycle has now concluded, with the deposit rate set to be maintained at 2.00% for the foreseeable future, likely until at least the second half of 2027, at which stage policy tightening may well start to be discussed.

While some of the GC’s dovish contingent may seek to deliver further easing in the meantime, those members are likely to remain in the minority, with most members set to tolerate a modest undershoot of the inflation target over the medium-run, resisting a temptation to over-react to the staff macroeconomic projections, and in turn preferring to focus on incoming ‘hard’ data releases.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.