- English (UK)

February 2026 BoE Review: The ‘Old Lady’ Sets Up A March Cut

Bank Rate Unchanged

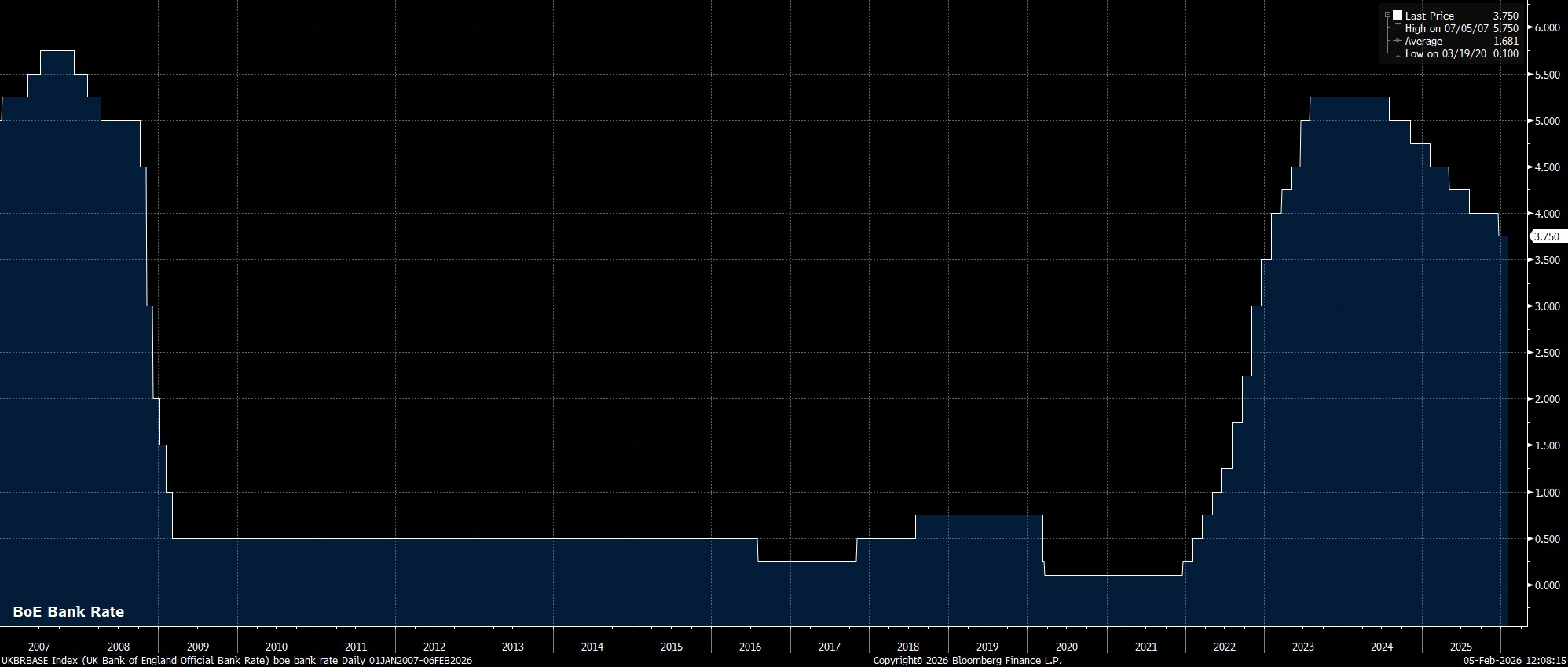

In line with consensus expectations, my own base case, and the outcome that money markets had fully discounted in advance, the Bank of England’s Monetary Policy Committee stood pat at the conclusion of the first policy meeting of the year.

Consequently, Bank Rate was maintained at 3.75%, with policymakers sitting on their hands once more, seeking additional evidence of disinflationary progress, while also digesting the impact of easing already delivered this cycle, including the 25bp cut that came at the prior meeting, last December.

Committee Divisions Persist

While the MPC standing pat was in line with market expectations, the decision to do so again came by virtue of a split decision. This, though, was also of little surprise, not only given public comments that MPC members have made of late, but also bearing in mind that the MPC’s last unanimous decision came all the way back in September 2021.

In any case, this time around, the MPC voted 5-4 in favour of holding Bank Rate steady, with only Governor Bailey switching his vote from the December meeting. Such a vote split was considerably more dovish than markets had anticipated, with consensus having foreseen just two dovish dissenters. Importantly, the 5-4 vote means that it remains the case that the Governor will be able to enact a rate cut whenever he wishes, simply by changing his own vote.

Forward Guidance Tweaked Dovishly

In addition to the unexpectedly dovish vote split, the MPC also strengthened their guidance around future easing, noting explicitly that Bank Rate is ‘likely to be reduced further’, while continuing to caveat that said cuts are contingent on the inflation outlook remains favourable.

Forecasts Lay The Foundations For Further Cuts

With today being a ‘super Thursday’, accompanying the policy statement, and minutes, was the quarterly Monetary Policy Report, including the Bank’s updated economic forecasts.

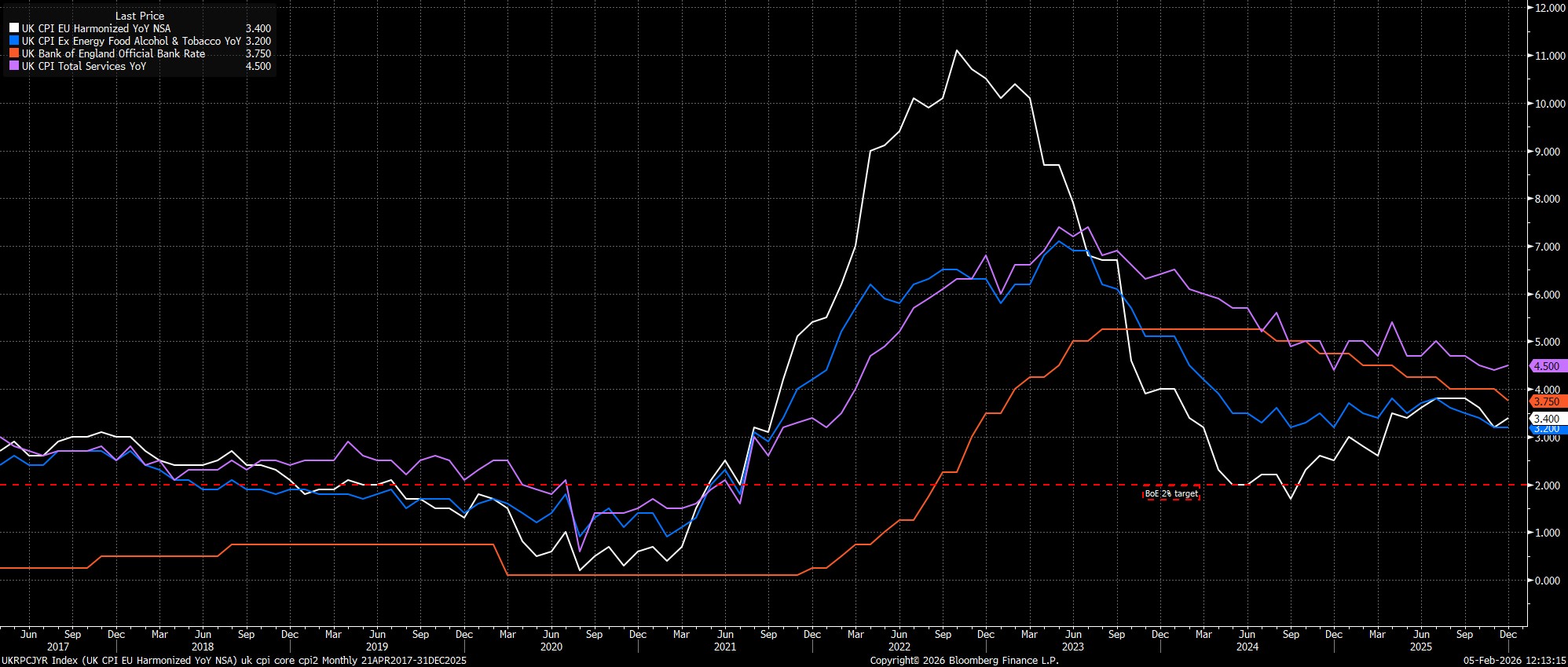

On inflation, the Bank now foresee headline CPI falling back to the 2% target this spring, before projecting that CPI will remain at, or below, target for the remainder of the horizon. The implication, here, is that if Bank Rate were to remain unchanged for the next three years, policy would be too tight, and inflation would fall below target, in turn signalling that further rate reductions are likely to be necessary.

Meanwhile, the projections now pencil in unemployment peaking at 5.3% in the middle of this year, before gradually falling over the remainder of the forecast horizon, compared to the prior peak of 5.1%. As for economic growth more broadly, annual growth is seen at 0.9% this year (an 0.3pp downgrade on the November forecast), and at 1.5% next year, also a modest downgrade on the prior forecast round.

Governor Bailey Strikes A Dovish Tone

Reflecting on all of the above, at the post-meeting press conference, Governor Bailey struck a similarly dovish note. Not only did the Governor note that a return to the 2% inflation target is now expected about a year earlier than had previously been foreseen, but also explicitly flagged that there should be scope for ‘some further easing’ in the months ahead.

Despite that relatively dovish rhetoric, Bailey did flag some degree of caution as to the extent of easing that may be delivered, noting that how much further to go becomes a ‘closer call’ with every cut that is delivered.

Conclusion

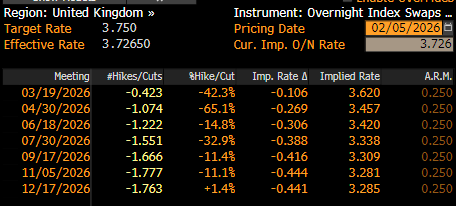

Taking a step back, it is clear that further cuts remain on the cards; the February meeting should be seen as the 'Old Lady' laying the groundwork for further policy easing as the year progresses, amid fading concerns over the potential for price pressures to prove persistent. My base case remains that the next cut will come at the March meeting, by which stage the MPC will have not only another CPI report likely pointing to embedded disinflationary pressures, but also two further employment reports likely signalling a further margin of slack emerging.

Beyond March, further rate reductions are likely, taking Bank Rate back to a neutral level around the 3% mark by the end of summer, with risks to this view likely tilting in a more dovish direction, given the relatively rapid pace at which the employment backdrop continues to weaken, and inflationary risks diminish.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.