- English (UK)

Summary

- Equity Bull Case: The overall bull case of solid earnings, a robust economy, and a looser monetary backdrop remains intact

- Technical Factors: Portfolio 'window dressing' as well as corporate buybacks support the case for further upside

- Risks Remain: However, risks remain, with a busy US data docket this week, and jitters over the AI theme persisting

In an environment where the Fed are saying ‘run it hot’, and the Trump Admin are saying ‘run it hotter’, it’s pretty tough to be structurally bearish on risk assets for any particular length of time. In fact, in many ways, the overall environment remains a bit of a ‘goldilocks’ one, with a ‘Fed put’ and a ‘Trump put’ helping to backstop sentiment, and provide powerful support to an already robust fundamental backdrop.

Zooming in oh the ‘here and now’, there remain numerous drivers of equity upside into year-end, as participants begin to examine whether this year will bring with it the typical ‘Santa rally’.

Fundamental Bull Case Remains Robust

To recap, the four key tenets of the equity bull case, since the hullaballoo around ‘Liberation Day’ died down in mid-May, have been – resilient economic growth; robust earnings growth; a calmer tone prevailing on trade; and, a looser monetary backdrop developing. All four of those factors remain firmly intact.

The US economy continues to expand at a solid clip, with the Atlanta Fed’s GDPNow model pointing to growth of 3.6% on an annualised QoQ basis in the third quarter and, while Q4’s output metrics will be skewed lower by the government shutdown, other indicators point to growth remaining resilient, not least with the ISM services PMI having hit a 9-month high 52.6 last month.

Earnings growth also remains resilient. With the vast majority of Q3 reports now in the rear view mirror, the S&P 500 has recorded earnings growth of around 14% YoY, marking the fourth consecutive quarter of double-digit earnings growth. Looking ahead, while Q4 earnings growth is expected at a more modest 8.1% YoY, there’s every chance those expectations are beaten, as is so often the way, especially with there still being a month or so until reporting season gets underway again.

_spx_v_2025-12-15_11-08-40.jpg)

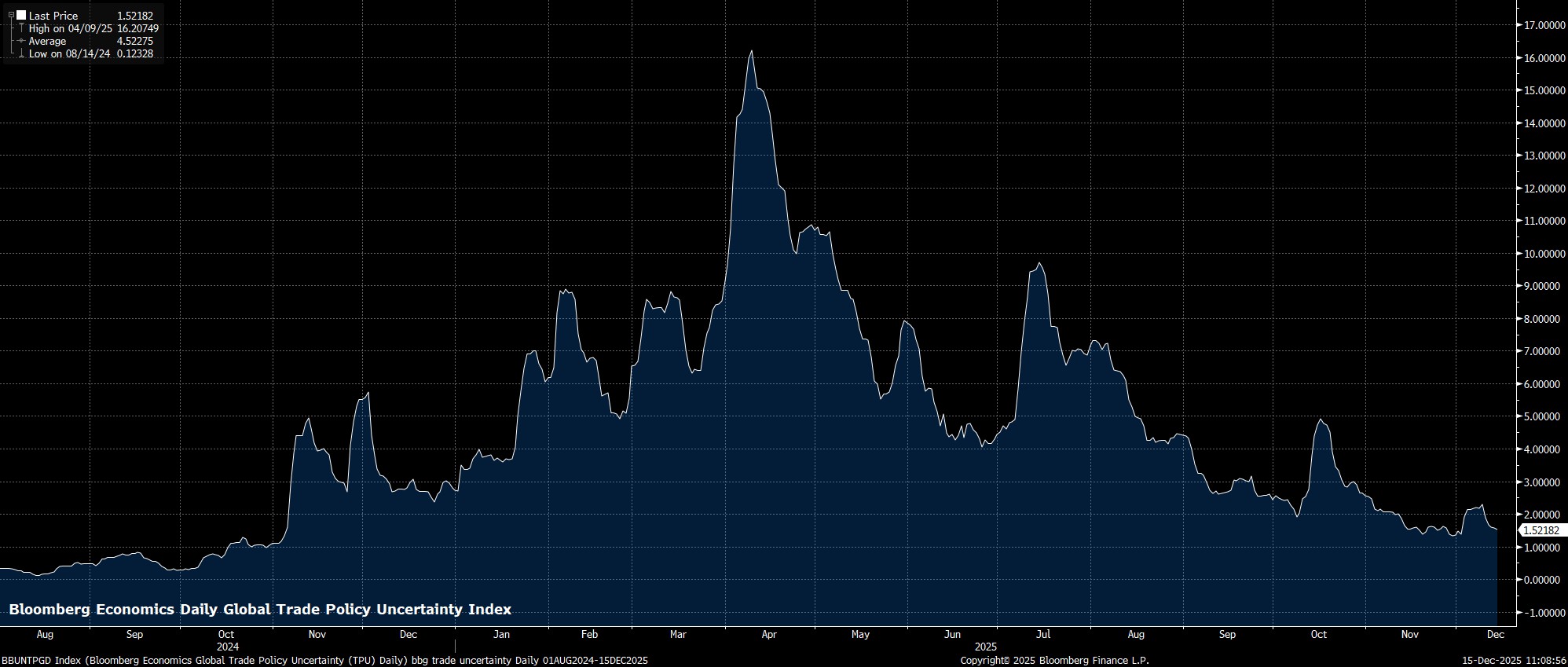

On the trade front, after the US and China agreed a renewed, and longer, trade ‘truce’ at the end of October, uncertainty in terms of tariffs has continued to dissipate, with calmer tones continuing to prevail between the two superpowers, especially as both Trump and Xi see each upholding their own sides of the deal. While a verdict in the IEEPA case is still being awaited, the Supreme Court may not make a ruling on that front until the new year, and in any case the Trump Admin have other tariff powers they could rely on, if the present levies are ruled illegal.

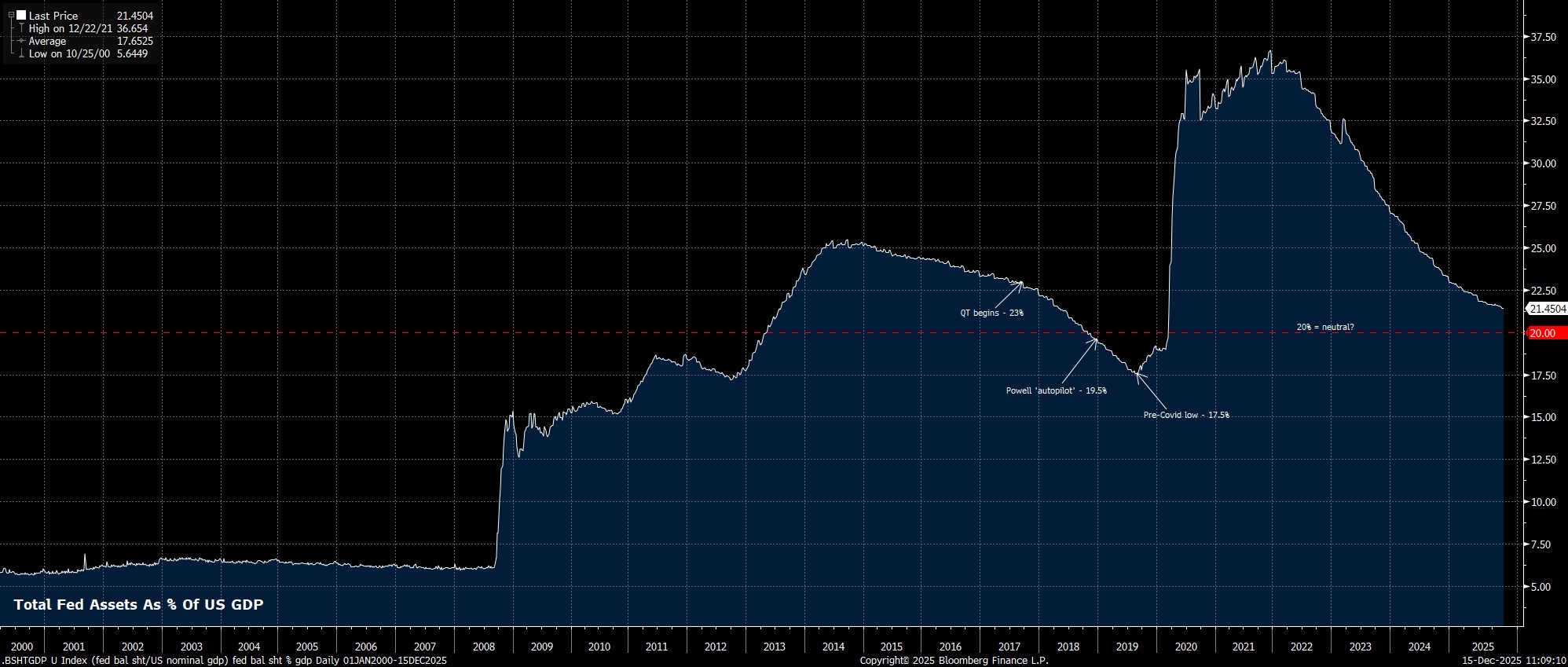

As for monetary policy, the direction of travel remains clear – towards neutral. Having delivered a third straight 25bp cut at the conclusion of the December meeting, the FOMC are set for further rate cuts into the new year, especially with Chair Powell having confirmed that a hike isn’t anyone’s base case in the short-term. Not only is the fed funds rate on its way back towards a 3ish% neutral level, but the balance sheet has also bottomed out at a neutral level around 20% of GDP, with the Fed having now resumed purchases of Treasury bills, purely for reserve management purposes.

Technical Factors Also Provide Support

In addition to those four fundamental factors, plenty of technical factors support the bull case, into the last couple of weeks of the year:

- Seasonals: As alluded to, equity upside is typically seen into year-end, with the S&P having ended December in the green in six of the last ten years, and with the index on average advancing around 1% in the last couple of weeks of the month over the same period

- FOMO/FOMU: Portfolio managers will now be seeking to close up their books for the year, though those who have underperformed their benchmarks this year will likely be suffering from a bout of ‘FOMU’ (Fear Of Materially Underperforming). In an effort to catch-up, those managers will likely be buyers on any dips, however shallow, to try and squeeze out any last possible drops of alpha before the year does indeed wrap up. There’s also an element of ‘window dressing’ that will be going on here, with managers buying YTD winners in the final throes of the year to make writing those year-end letters just a little easier

- Buybacks: Corporate buyback flows continue to support the market too, with estimates pointing to as much as $5bln of daily demand, and corporates needing to complete purchase mandates before year-end. At the very least, these flows should act as a floor under price in the event of any downside, while also acting as a supportive helping hand if the market begins to rally

Risks Remain

Despite these positive factors, a handful of risks remain.

Most notably, in the short-term at least, there are the November US labour market (Tues) and inflation (Thurs) reports that must be navigated. Though the data is somewhat stale at this stage, and some quality concerns linger owing to the US government shutdown, those reports do present some modest risk of a hawkish repricing of Fed policy expectations, particularly if labour data firms more than expected, with the USD OIS curve currently discounting around a 1-in-4 chance of another 25bp cut at the January meeting.

Beyond that, jitters over the AI theme have resurfaced in recent sessions, not helped by Broadcom’s failure to provide concrete guidance for the quarter ahead, nor by reports that Oracle’s data centre construction may be delayed. Concern also lingers over the increase in debt-financed capex, especially from the likes of ORCL, though those concerns seem more likely to linger in the background into next year, as opposed to sparking significant fear in the now.

One must also consider geopolitical risk, not only in terms of the Russia-Ukraine conflict, where a durable peace deal remains a distant hope, but also risk in Latin America, with the US continuing to increase the build-up of combat resources in the region, amid deteriorating relations with Venezuela.

Conclusion

All that said, geopolitical events continue to provide more by way of ‘noise’ than ‘signal’, AI jitters seem set to become a perennial block in the ‘wall of worry’ that markets have climbed so ably this year, and it seems hard to imagine any of this week’s US data materially altering the Fed’s policy trajectory. Hence, the path of least resistance for equities should continue to lead to the upside as the year draws to a close.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.