- English (UK)

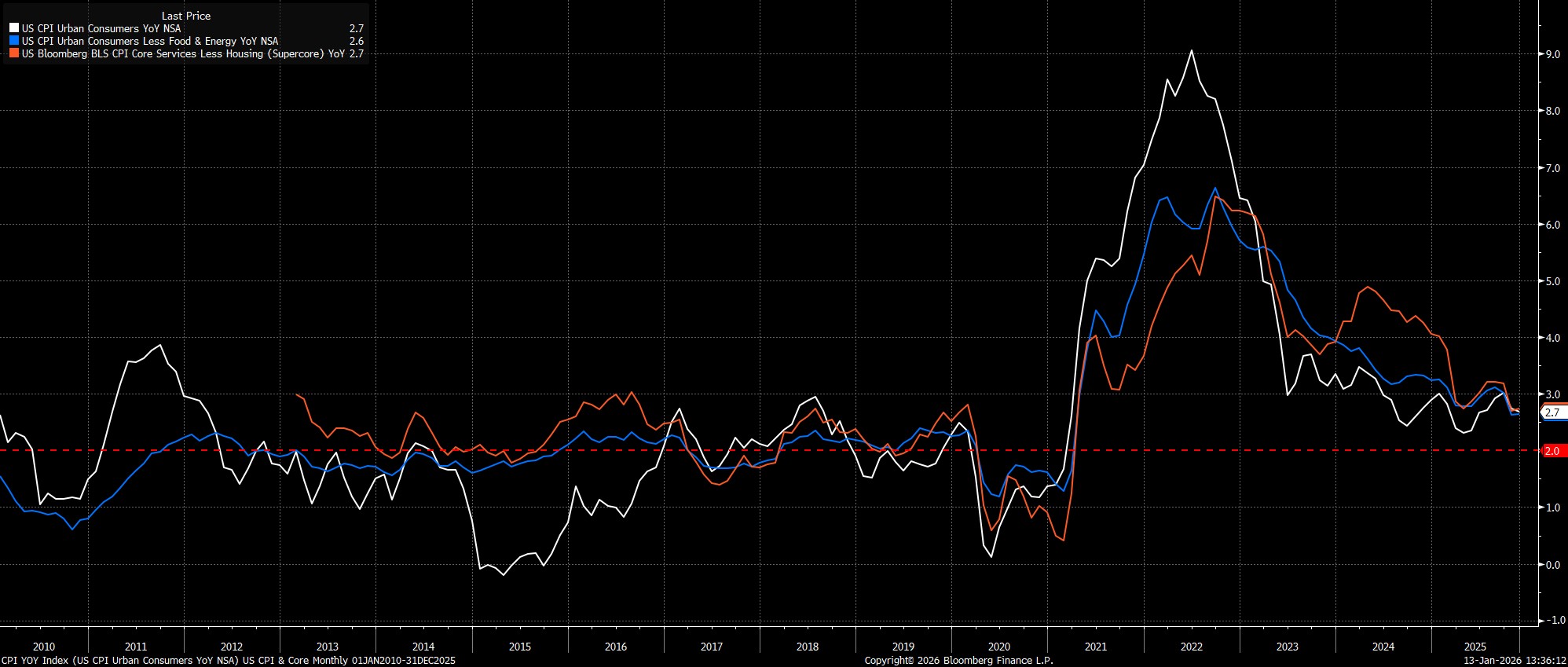

Inflation Remains Contained

Headline CPI rose 2.7% YoY in the final month of 2025, in line with consensus expectations, while staying below the 3% mark for the second month running. Metrics of underlying price pressures, meanwhile, also remained relatively contained, with core CPI rising 2.6% YoY, unchanged from the pace seen in November, while ‘supercore’ inflation (aka core services ex-housing) rose 2.7% YoY, also unchanged from the prior month.

On a monthly basis, headline prices rose by 0.3% MoM in December, while core prices rose a cooler-than-expected 0.2% MoM. There are, however, no priors to which we can compare these prints, given that the October CPI report was skipped due to the government shutdown, while statistical quirks stemming form assumptions that the BLS made as a result of the shutdown also continue to have the effect of skewing the overall data cooler than it otherwise would be.

In any case, annualising the December MoM prints can help us to discern a clearer picture of the underlying inflationary trend:

- 3-month annualised CPI: 2.1% (Sep 3.6%)

- 6-month annualised CPI: 2.8% (Sep 3.0%)

- 3-month annualised core CPI: 1.6% (Sep 3.6%)

- 6-month annualised core CPI: 2.6% (Sep 3.0%)

Details Remain Key

As has now been the case for some time, the devil is in the detail when it comes to incoming inflation figures, not least as participants and policymakers alike seek to gauge the impact of price pressures stemming from the Trump Admin’s tariff policies.

On that note, core goods inflation slowed in December, to 1.4% YoY, in what many will interpret as a sign of tariff-related inflation now being in the rear view mirror. Core services prices, meanwhile, rose 3.0% YoY, as disinflation continued in the sector, providing further reassurance that headline inflation is likely to continue on its way back towards the 2% target throughout 2026.

Limited Policy Implications

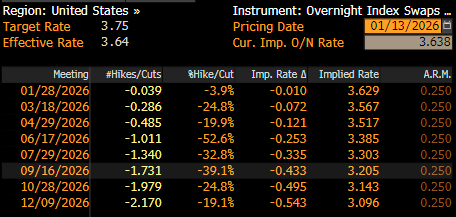

Overall, the policy implications of the December inflation report, at least in the market’s mind, are relatively limited. Per the USD OIS curve, markets continue to imply just a 3% chance of a 25bp cut this month, though the next 25bp cut is now fully discounted by June, vs. July pre-release, though this is of course after the next Fed Chair will have taken office.

Looking Ahead

By and large, the market’s read on the inflation data feels like the correct one, not only as inflation remains north of the FOMC’s 2% target, but more importantly considering that policymakers’ reaction function hinges considerably more on labour market developments, than it does on price pressures, at the present time.

While the direction of travel for the fed funds rate, clearly, remains lower, the timing of further rate cuts is likely to hinge on incoming employment data. Though the December jobs report was a bit of a ‘mixed bag’, a fall in the unemployment rate is likely to keep the Fed on the sidelines for the time being, with the FOMC set to stand pat at the end of the month. While a 25bp cut in March remains a possibility, delivery of such a move will likely require further evidence of labour market fragility, as well as additional signs of price pressures remaining contained, before that confab.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.