- English (UK)

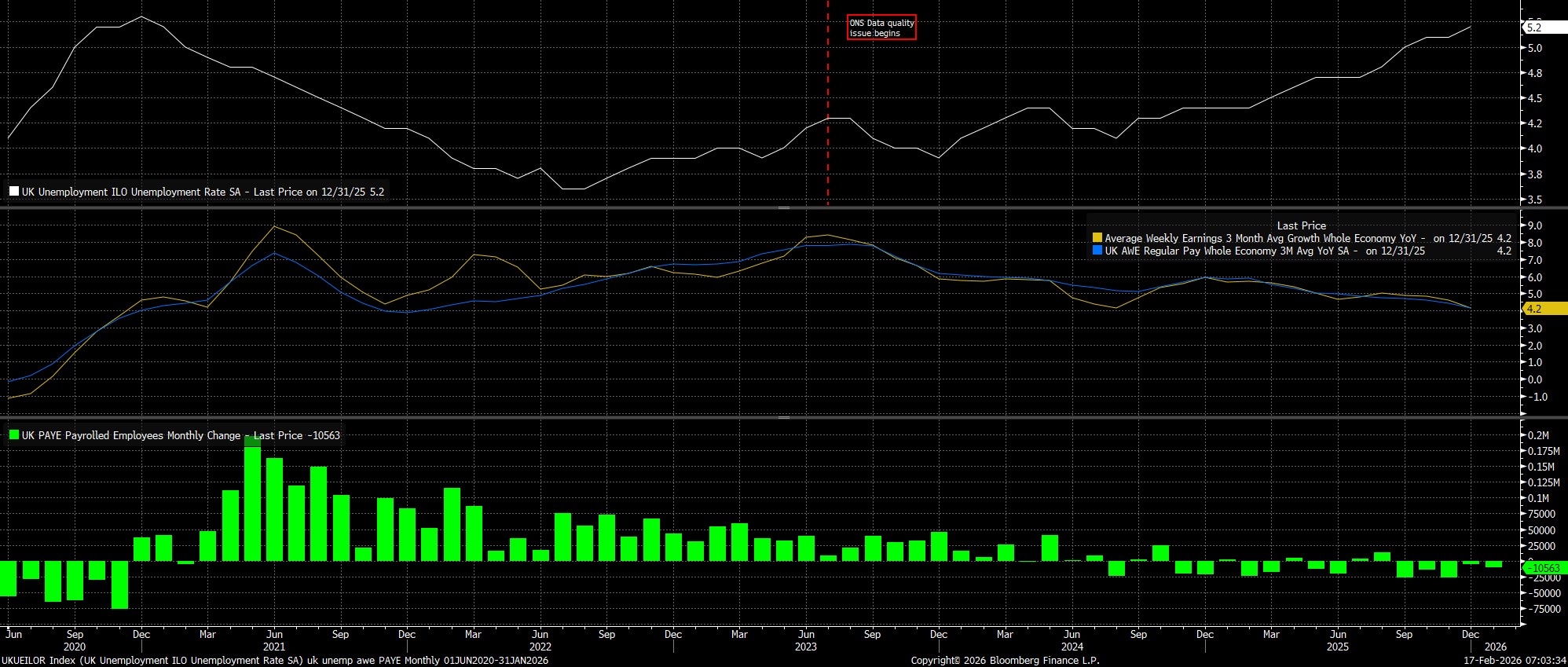

Headline unemployment, in the three months to December, rose to a fresh cycle high at 5.2%, 0.1pp above consensus expectations.

Meanwhile, earnings pressures moderated further, with both regular and overall pay growth rising by 4.2% YoY in the final three months of the year, the former being the slowest pace since Q1 22, though headline pay measures remain at rates inconsistent with the 2% inflation target. Once again, however, there remains a significant divergence between public sector earnings growth, at 7.2% YoY, and private sector pay growth, at 3.4% YoY, with the latter becoming increasingly compatible with a sustainable return to the 2% inflation aim over the medium-term.

Turning to more timely metrics, the report also pointed to PAYE payrolled employment having fallen for the fifth month in a row, with payrolls having declined by a further -11k in January, with 2025's anaemic labour market momentum seemingly continuing into the new year.

Taking a step back, today's data does little to shift expectations that the Bank of England's Monetary Policy Committee will be delivering further easing in the near-term, not least considering the dovish 'triple whammy' delivered at the February confab, where the tightest possible vote split, and explicit guidance nodding towards future cuts, were combined with economic forecasts that see a return to the 2% inflation target this spring, with CPI then remaining at or around that level for the foreseeable future.

While tomorrow's January CPI report will, naturally, be of some degree more importance to the near-term policy outlook, the latest jobs data nonetheless points to further labour market slack emerging, in turn further reducing the risks of inflation persistence. Hence, my base case remains not only that the MPC will deliver a 25bp cut cut at the next meeting in March, but that such a move will be followed by further cuts as the year progresses, taking Bank Rate to a neutral level, around 3%, by the end of summer.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.