- English (UK)

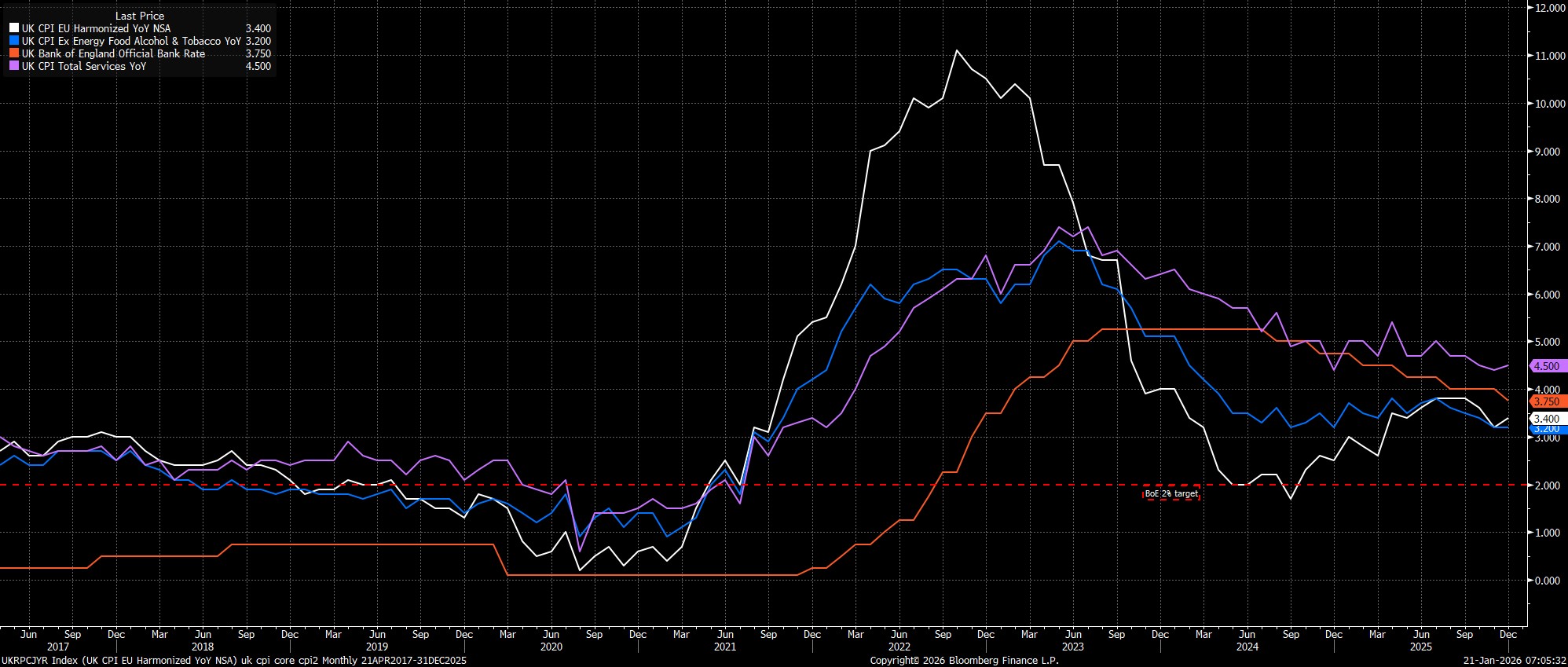

Headline CPI rose 3.4% YoY, marginally above market expectations, though still a touch below the Bank of England's November forecast. Meanwhile, as for metrics of underlying price pressures, core CPI rose 3.2% YoY, while the closely-watched services CPI metric rose 4.5% YoY, also a touch below the Bank's expectations.

Digging into the details of the print, the majority of the upside seen in December's inflation print came from a variety of one-off factors, largely centring around an increase in tobacco prices stemming from the November Budget, as well as a 28.6% MoM rise in airfares, largely owing to the timing of the ONS's survey coinciding with the peak pre-Christmas travel season. It is near-certain that policymakers will look through these one-off factors, not least considering that the bulk of these effects will unwind in the January data anyway.

Turning to the policy outlook, it seems unlikely that the December inflation figures materially change things for the BoE in the short-term, with the MPC set to hold Bank Rate steady at the February meeting in two weeks' time.

That said, the overall disinflationary trend remains broadly intact, and is likely to continue throughout the first half of the year, with the 2% inflation target set to be achieved at some stage in the spring. In turn, such an outlook ensures that the path for Bank Rate remains lower, though policymakers are likely to want a little more data to be sure of such a path - especially the MPC's hawks - before pulling the trigger on another rate cut. In any case, concern over inflation persistence, to my mind, seems misplaced, not least considering the rapid pace at which slack continues to emerge in the labour market, plus with risks to employment, and growth at large, continuing to tilt to the downside.

Hence, my base case continues to pencil in the next 25bp cut for the March meeting, before further cuts as the year goes on, taking Bank Rate back to a neutral level, around the 3% mark, likely by the autumn. However, bearing in mind the narrowly divided nature of the MPC, with the last two meetings having been decided by the narrowest possible 5-4 votes, having a high degree of conviction in the outlook is somewhat difficult, with just one or two policymakers shifting their stance potentially flipping the entire outlook on its head.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.