- English (UK)

Summary

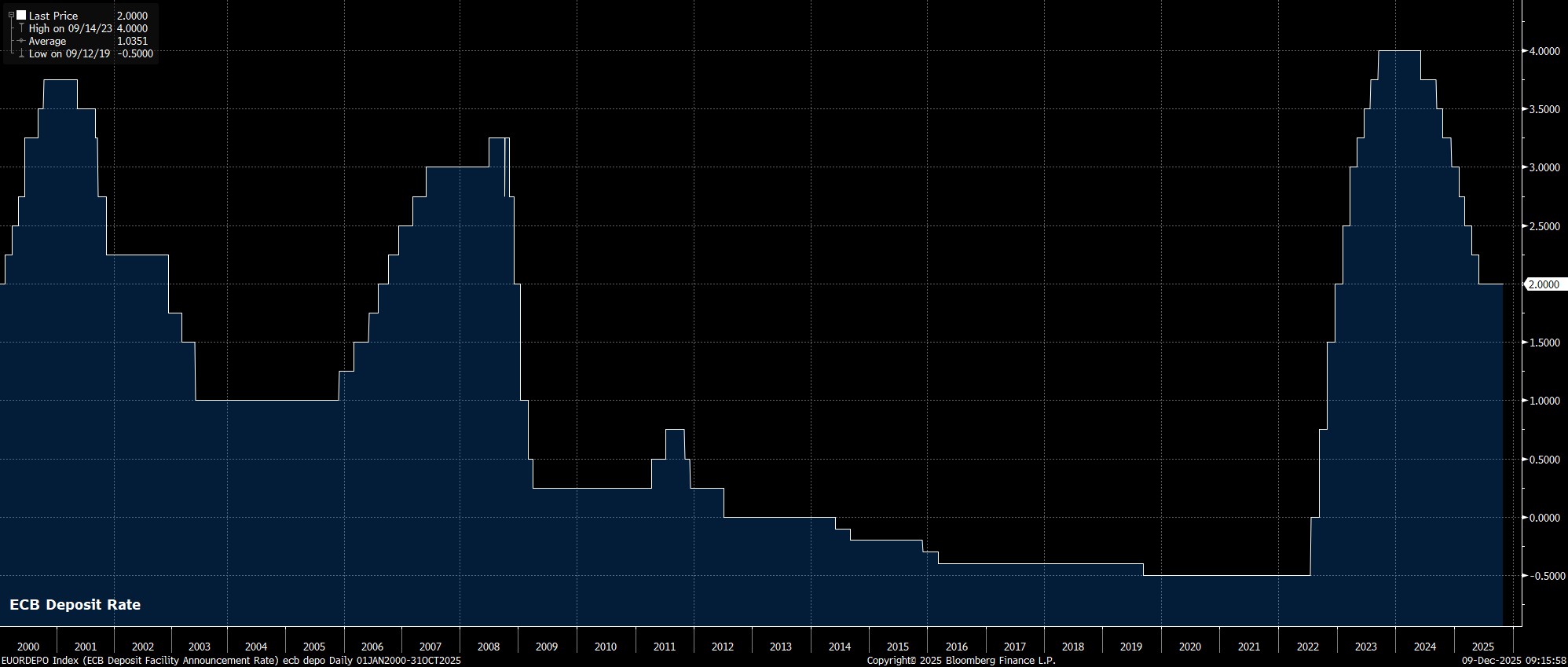

- Rates On Hold: The ECB should maintain all policy settings at the December meeting, holding the deposit rate steady at 2.00%

- Forecasts In Focus: December's staff macroeconomic projections will be they key area of focus, particularly whether an inflation undershoot is foreseen for 2028

- Easing Cycle Over: The upcoming meet should do nothing to dispel the idea that the easing cycle is done & dusted, though policy tightening remains some considerable way off

After what most market participants would describe as an incredibly dull October confab, the ECB’s Governing Council aren’t especially likely to deliver much more by way of excitement this time around, with policymakers still in a ‘good place’, and being set to round out the year by standing pat on all policy instruments.

Done & Dusted On Rates

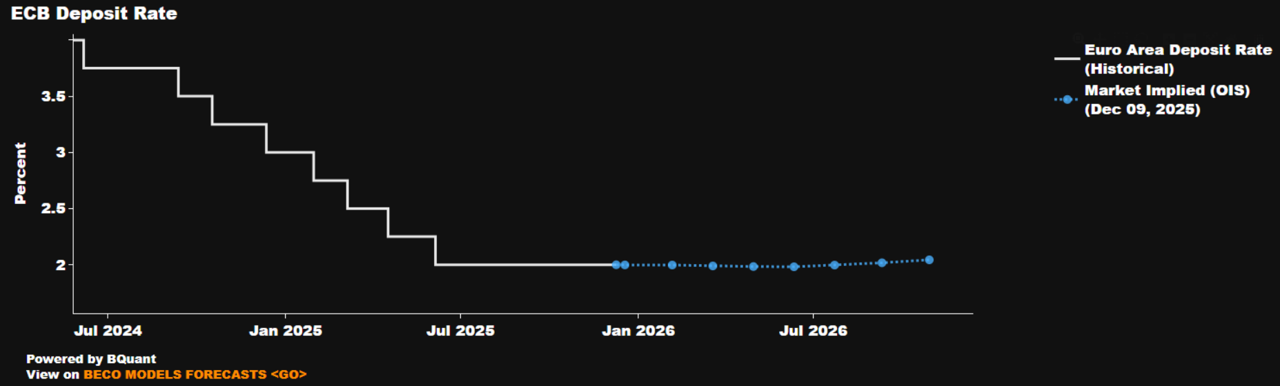

As alluded to above, the ECB’s Governing Council are set to stand pat at the conclusion of the December policy meeting, maintaining the deposit rate at 2.00%. Such a decision to stand pat comes not only as the EUR OIS curve discounts next-to-no chance of any further easing, but also amid little indication from any GC members that they presently see a desire to reduce rates further. All signs point to the easing cycle having now come to an end, and 2.00% being this cycle’s terminal rate.

That said, the swaps curve has got rather excitable of late, now discounting around a 1-in-5 chance that the ECB will deliver a 25bp hike by the end of next year, spurred on by hawkish comments from Exec. Board member Schnabel in recent days. That pricing does appear rather over-ambitious at this juncture, given the likelihood of a relatively sustained inflation undershoot, hence participants will be watching for any explicit pushback on the idea that policy will be tightened within the next 12 months.

Guidance To Remain Unchanged

With the GC set to hold all policy settings steady, focus will naturally fall on whether policymakers decide to make any guidance tweaks.

The chances of said tweaks, however, range between ‘incredibly slim’ and ‘none at all’, with the accompanying policy statement set to simply reiterate the commentary that has been used for many months, and is now incredibly familiar to all participants. Consequently, the statement will repeat that policymakers will continue to adopt a ‘data-dependent’ and ‘meeting-by-meeting’ approach to upcoming decisions, while also making no ‘pre-commitment’ to a particular policy path.

Updated Projections To Drive Policy Path

Perhaps the most interesting area of the December confab will be the updated round of staff macroeconomic projections, particularly the first read on how the projections see the eurozone economy evolving into 2028.

On inflation, the projections are again likely to point to headline CPI undershooting the 2% target both next year, and in 2027. While services inflation has started to bubble away once more in recent months, the beginning of 2026 will see a significant energy-induced base effect impact the data, dragging headline price metrics (much) lower in the first half of the year.

The two key areas of focus for the upcoming inflation projections will be, firstly, whether headline inflation is set to have risen back to 2% by the end of the horizon, in 2028. Secondly, if another undershoot is pencilled in for that year, the question becomes one of whether the Governing Council’s doves view that as reason enough to begin pushing for further policy easing, in the early months of next year.

Meanwhile, on growth, there are likely to be relatively little by way of significant changes to the forecast GDP growth path, not least considering that many of the headwinds which have buffeted the eurozone economy in 2025 will increasingly turn to tailwinds as we move into the new year. Said tailwinds are relatively numerous, including increased certainty in terms of global trading relationships (especially with the US), as well as the lagged effects of ECB policy easing, plus a broadly looser fiscal stance next year.

Of course, said fiscal stance will not be entirely equal across the bloc. The vast majority of any fiscal boost next year will come from Germany, where not only is a significant increase on defence and infrastructure spending on the cards, but also a considerable number of tax changes which should provide a boost to personal consumption. That, in turn, at an aggregate level, is likely to offset the impact of further fiscal consolidation in both France, and Italy, which should result in the overall GDP growth forecast remaining broadly unchanged, seeing the eurozone work its way back towards potential growth in 2027 and 2028.

Lagarde’s Press Conference Shan’t Rock The Boat

Turning to the post-meeting press conference, it seems highly unlikely that President Lagarde will seek to ‘rock the boat’ to any significant degree, thus raising the prospect of another turgid and dull affair, in keeping with the remarks delivered last time out, in October.

As a result, it is highly likely that Lagarde will simply reiterate the remarks that she made last time out, namely that policy is still in a ‘good place’, and that the ECB will ensure policy remains in such a place, while likely also confirming that the December decision to stand pat was a unanimous one.

As always, in addition to the presser, any post-meeting ‘sources’ stories will also be closely watched, particularly in determining how much weight, if any, policymakers are placing on the 2028 inflation forecasts.

Conclusion

On the whole, the December ECB confab is unlikely to be one that goes down as a game-changer in terms of the broader policy outlook.

While the GC’s doves may seek to argue for another rate reduction early next-year, it remains likely that an overwhelming majority of policymakers see little-to-no need to shift to a more accommodative policy stance. Barring a material deterioration in economic growth, policymakers are likely to be relatively comfortable tolerating a modest inflation under-shoot, continuing to place more weight on ‘hard’ data, as opposed to staff projections.

As such, the base case remains that the ECB’s easing cycle has now come to an end, and that the next rate move will indeed be a hike. Such a hike, however, is near-certain not to come next year, with the deposit rate set to remain at 2.00% through the end of 2026, and the matter of policy tightening one that will, eventually, be addressed in 2027.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.