- English (UK)

December 2025 BoE Review: The Old Lady Delivers A Christmas Cut

Time To Cut Again

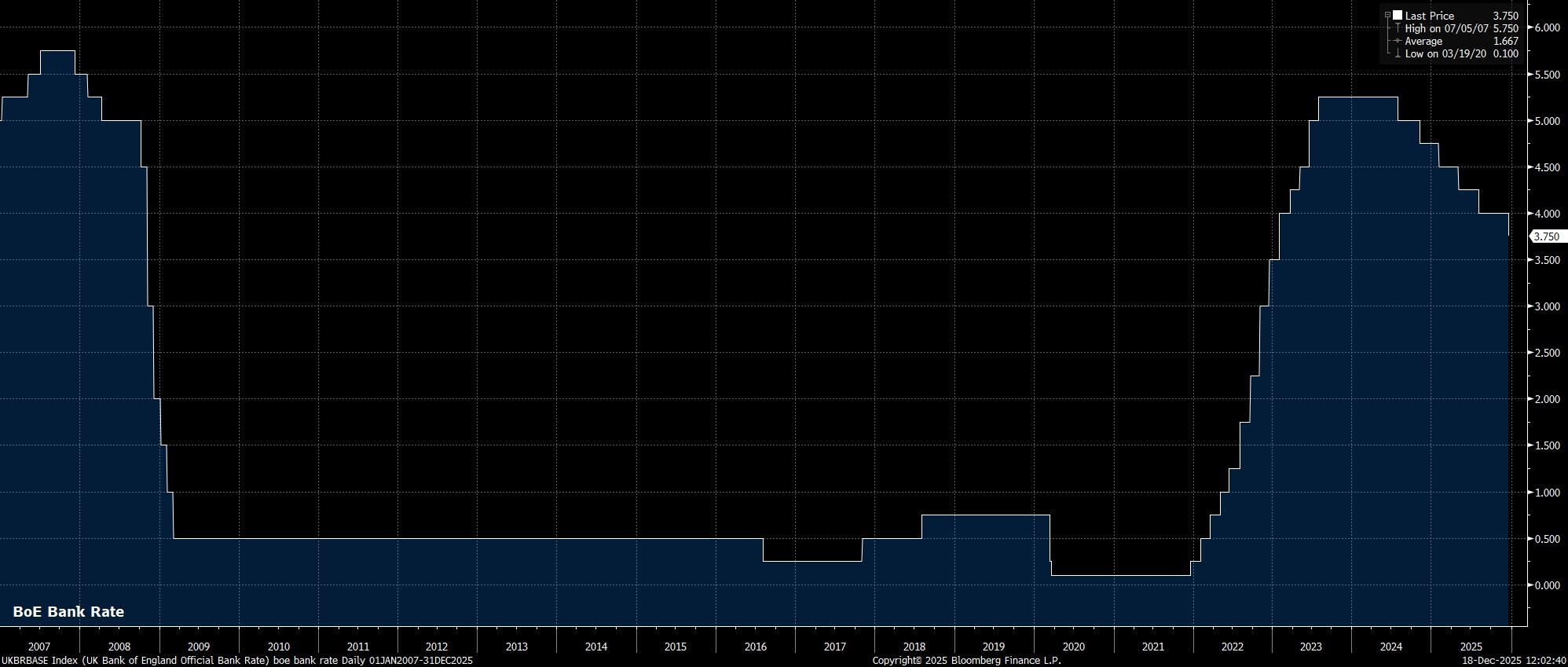

As expected, and as had been fully discounted in advance by the GBP OIS curve, the ‘Old Lady’ delivered a 25bp cut at the conclusion of the December confab, in turn lowering Bank Rate to 3.75%, in what marks the first rate reduction since the summer, and brings Bank Rate to its lowest level since Q1 23.

Committee Remain Divided

Despite delivering on market expectations in terms of the decision to lower Bank Rate, the Monetary Policy Committee remain divided when it comes to the appropriate policy path, with dissenting votes having been a notable theme this cycle.

The December meeting was no different, with the aforementioned Bank Rate cut coming courtesy of a 5-4 vote, with Governor Bailey swinging in favour of a 25bp cut, having preferred to stand pat last time out. Despite this week’s dismal jobs, and softer than expected inflation figures, the four hawks (Greene, Lombardelli, Mann and Pill) clearly still see there being little need to reduce policy restriction at this stage.

Familiar Guidance Repeated

While the vote split provided some degree of intrigue, it’s safe to say that the MPC’s policy guidance did not.

In fact, said guidance was almost entirely a repeat of that issued after the November meeting, with policymakers reiterating that Bank Rate is set to remain on a ‘gradual downwards path’, providing that disinflationary progress continues to be made, with the extent of any further cuts depending on the evolution of the inflation outlook. In something resembling plain English, this is the MPC sticking resolutely to a ‘data-dependent’ approach, while maintaining a clear bias to ease policy further over time.

Conclusion

Stepping back, the BoE largely lived up to expectations at the final meeting of the year, with Bailey & Co delivering the rate reduction that every man and his dog had expected. Clearly, policymakers – on the whole – retain their bias to continue removing policy restriction over time, taking account of both the economy continuing to make disinflationary progress, and a significant margin of slack emerging in the labour market.

Hence, further rate reductions remain on the cards, potentially as soon as the February meeting, especially if the employment backdrop were to sour further. That said, with the Bank estimating that the neutral rate could be as high as 3.50%, there may be limited room for significant rate reductions over the next year or so, especially with every cut likely to be a closer call as Bank Rate nears policymakers’ own estimate of where neutral may lie.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.