Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

December 2024 US Employment Report: Blowout Headline Print Won’t Be A Gamechanger For The FOMC

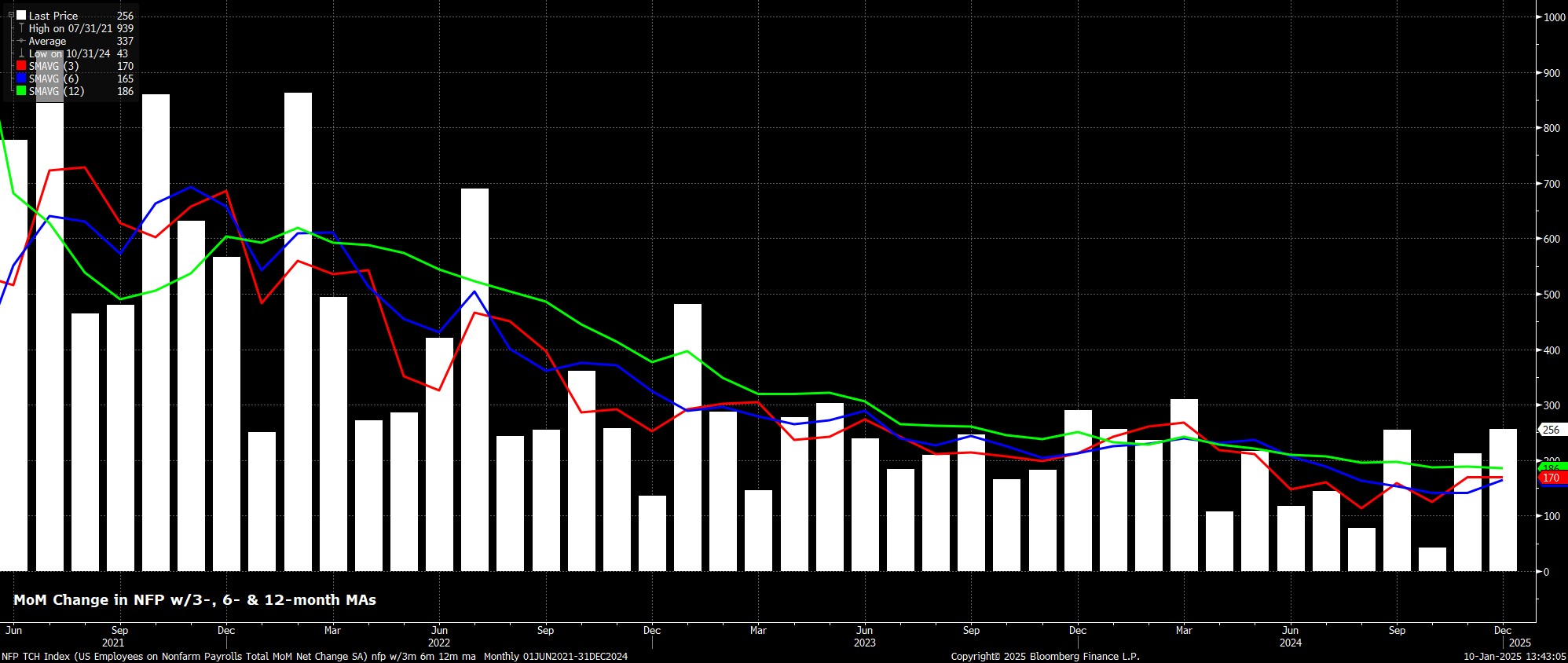

Headline nonfarm payrolls rose by a blowout +256k in December, well above consensus expectations for a +165k increase, while also topping the forecast range, while also representing the biggest 1-month jobs gain since last March. Concurrently, the November and October payrolls prints were revised by a modest -8k, seeing the 3-month average of job gains remain broadly unchanged, at +170k

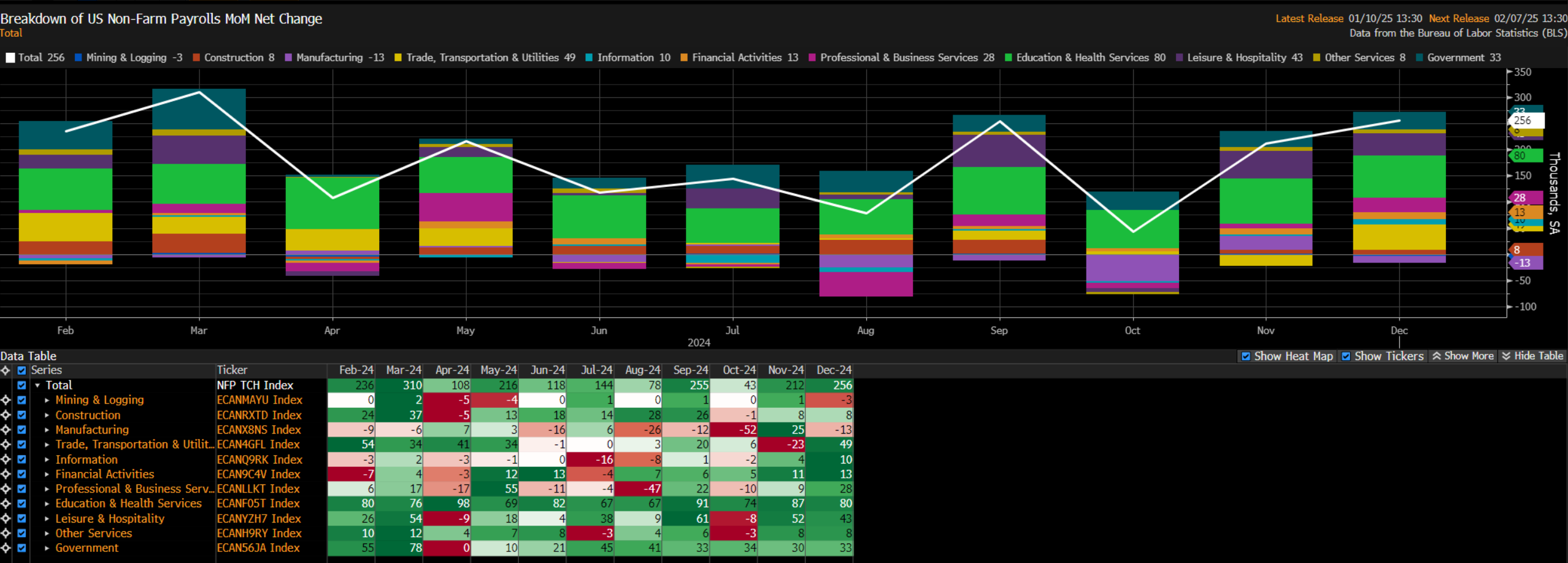

Digging a little deeper into the data, the sectoral split showed relatively broad-based job gains, with Education & Health Services, along with Trade & Transport, the biggest sectoral gainers. Meanwhile, only Manufacturing and Mining & Logging saw a negative MoM employment change.

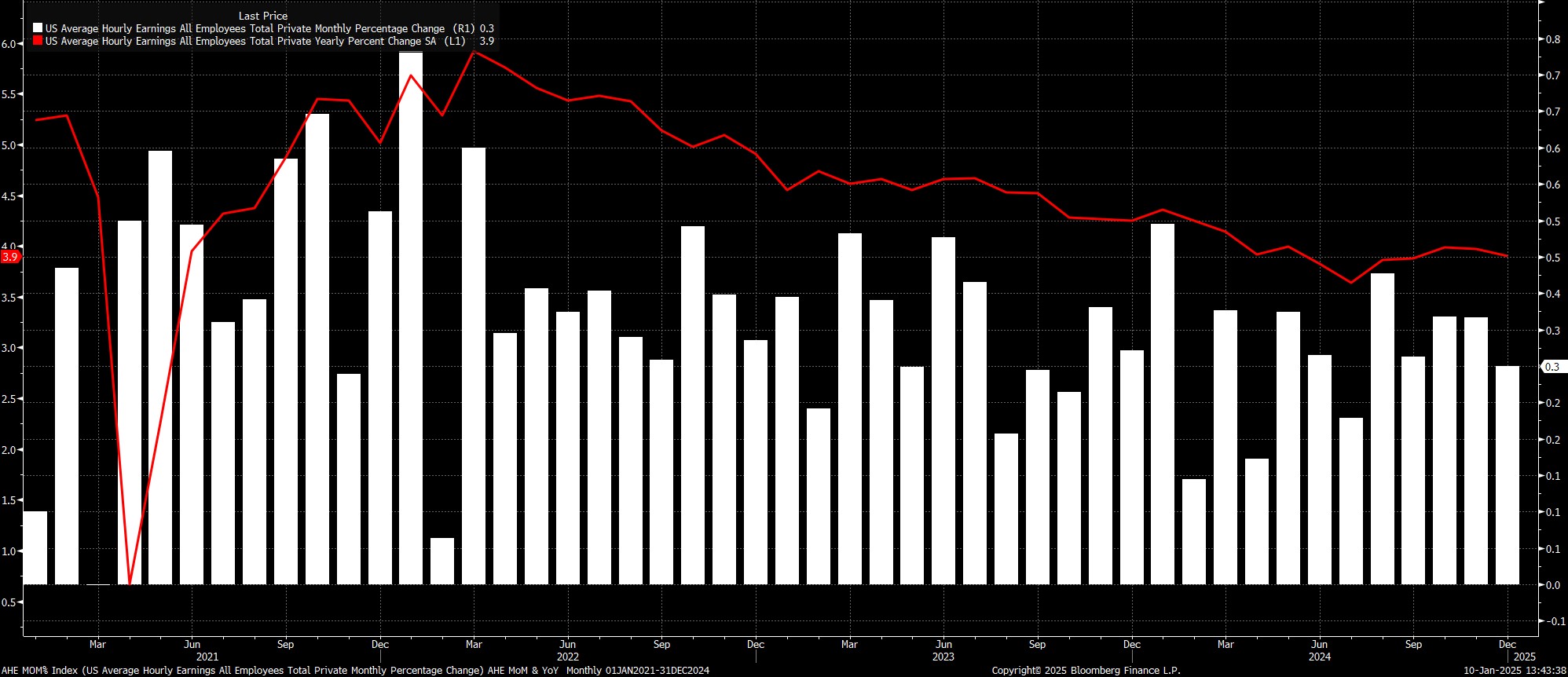

Sticking with the establishment survey, the labour market report also pointed to earnings pressures remaining relatively contained. Average hourly earnings rose by 0.3% MoM, in line with expectations, which in turn saw the annual pace cool just a touch, to 3.9% YoY.

Though still, perhaps, a little hotter than policymakers would like in an ideal world, such a pace of earnings growth is unlikely to be off too much concern, and shan’t threaten the sustainable achievement of the 2% inflation target over the medium-term. Furthermore, policymakers, including Chair Powell, have repeatedly flagged their belief that the labour market is not, at present, a source of price pressures, and does not pose upside inflation risks.

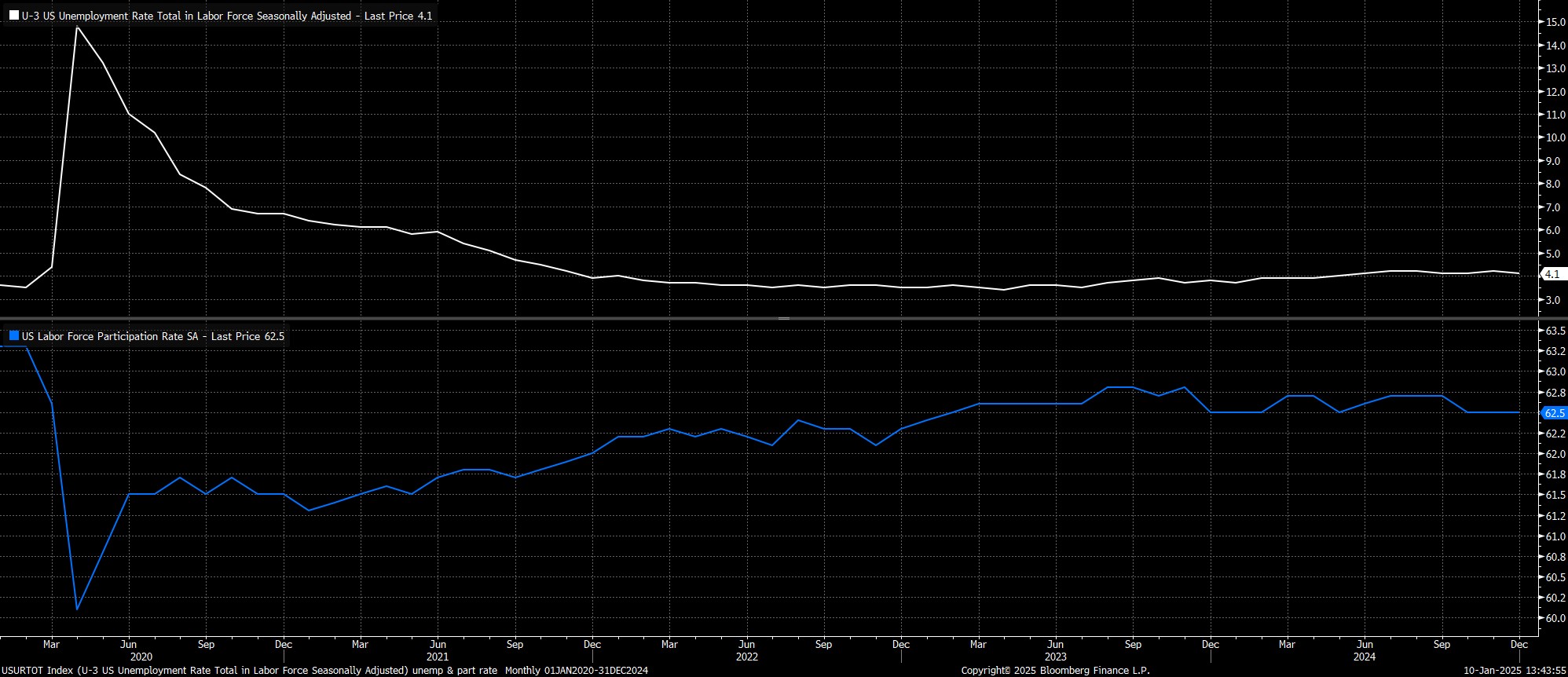

Meanwhile, turning to the household survey, unemployment ticked lower to 4.1% as the year drew to a close, down 0.1pp from the November print, even as labour force participation held steady at 62.5%.

As has been the case for a while now, however, these figures may need to be taken with a ‘pinch of salt’, given the highly volatile nature of the HH survey in recent months, amid falling survey response rates, and a struggle to account for the changing composition of the US labour market, particularly the impacts of higher immigration.

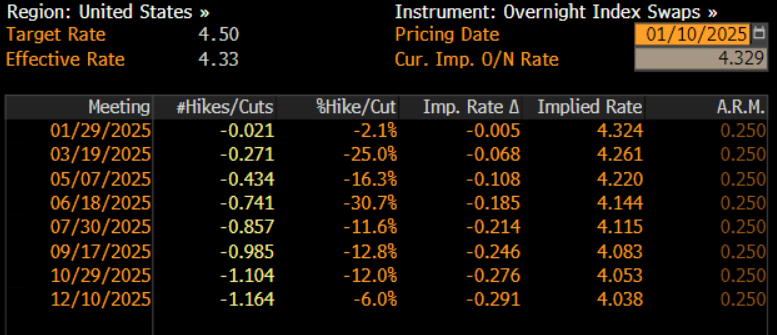

In reaction to the jobs report, and principally the blowout headline figure, the USD OIS curve underwent a significant hawkish repricing. The next 25bp cut, which was foreseen in June pre-release, is now not fully priced until October, while the curve also discounts just 29bp of easing in total this year, compared to the 40bp priced pre-release.

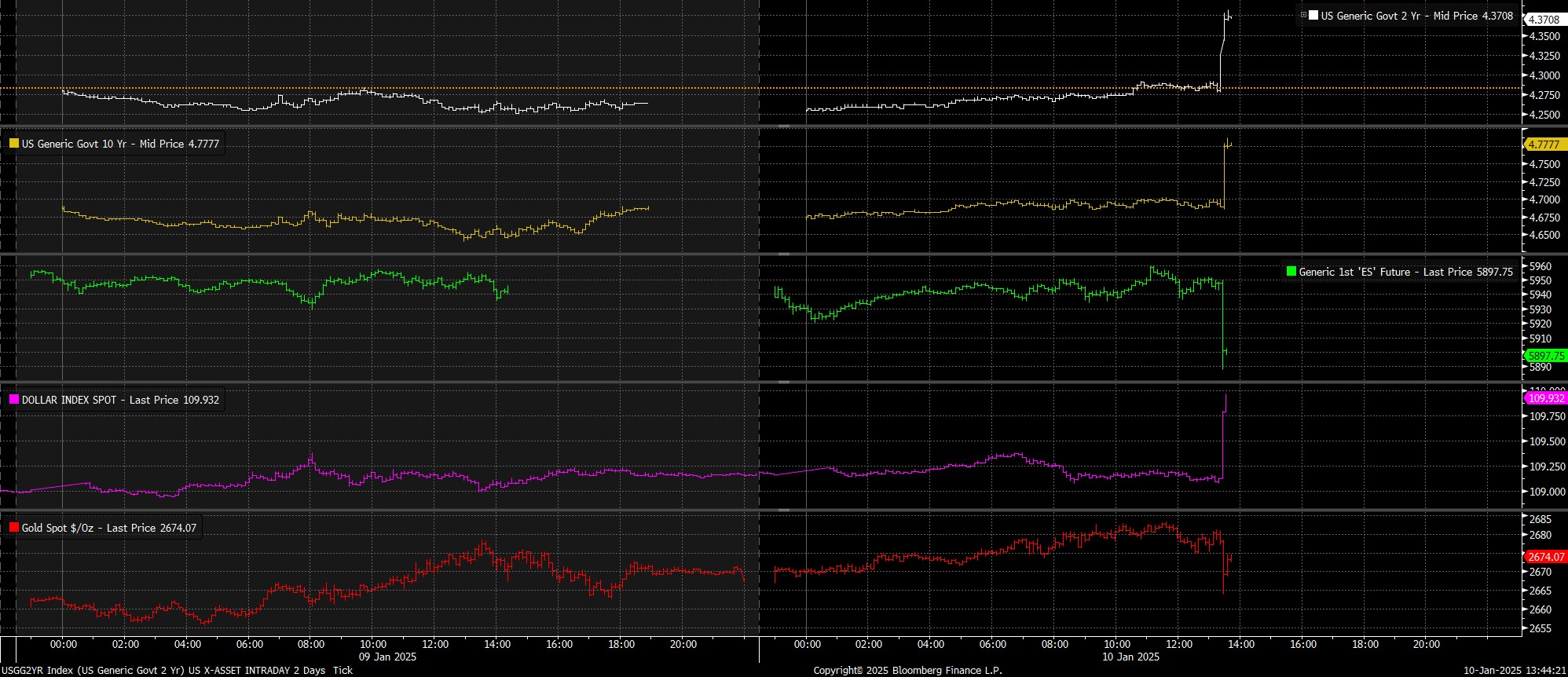

More broadly, markets also underwent a hawkish reaction across the board. Treasuries, firstly, sold-off across the curve, with 2-year yields rising as much as 10bp, while benchmark 10- and 30-year yields popped higher by about 7bp apiece. This, in turn, was a catalyst for substantial weakness in the equity space, with the front S&P and Nasdaq futures diving by around 1%, as both fell to fresh day lows. The dollar, meanwhile, gained against all peers, with the DXY piercing the 1.09 figure, as the EUR tested 1.02 to the downside, and cable probed beneath 1.22.

On the whole, the report pointed to the labour market having remained solid as 2024 drew to a close, and hence seems unlikely to be a game-changing one, from a policy perspective.

The FOMC remain on track to ‘skip’ the January meeting, leaving the fed funds rate unchanged, allowing time to examine the impacts of the 100bp of normalisation delivered last year, while also providing a chance to assess upside inflation risks, and the impacts of the early policies implemented by the incoming Trump Administration.

Looking ahead, 2025 is likely to see further steps back towards a more neutral policy stance, albeit said steps will likely be taken at a much slower pace than last year, with the ‘dot plot’ pointing to just two 25bp cuts as a median expectation for the year ahead.

Consequently, with a renewed hawkish risk having now been introduced to the rate path, the ‘policy put’ that has been in place over the last 18 months is set to become considerably less forceful. Hence, the market’s ‘comfort blanket’ – the prospect of deeper, or faster, rate cuts – likely won’t be present to the same extent next year.

Consequently, while strong earnings and economic growth should continue to paint a positive backdrop for risk, and see the path of least resistance still leading to the upside, said path is likely to be somewhat bumpier, and considerably more volatile, than that seen over the last year or so.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.