- English (UK)

As mentioned, both headline and core CPI printed cooler than expected in October, on both a YoY, and MoM, basis. Headline inflation rose 3.2% from a year prior, while remaining flat on a monthly basis. Removing the volatile food and energy components, core CPI slowed to an annual pace of 4.0% last month, rising just 0.2% from a month prior.

While a significant degree of the decline in headline inflation owes to energy prices – gasoline fell around 7% MoM – the fall in core inflation does provide cause for optimism. Core goods inflation, for instance, has now all-but-disappeared, while the decline in core prices came despite a change to the calculation of the healthcare component of the index, which should provide an upside impetus to the measure for around the next 6 months.

Though the FOMC tend to focus more on PCE than CPI, which will be released in a couple of weeks, the CPI report did include a measure that many on the Committee, including Chair Powell, watch closely. The so-called ‘supercore’ measure, which provides a read on services inflation excluding energy and housing costs, rose just 0.2% MoM, a sharp deceleration from the 0.6% rise seen in September, and the slowest monthly increase since July.

This was, then, indisputably, a dovish inflation report. Unsurprisingly, markets reacted in an aggressive fashion to reprice the data, pricing out all but the slightest change of the FOMC raising rates further, with the data making it almost certain that the Fed’s final hike of the cycle came at the July meeting.

Money markets also brought forward their expectations of when policy may begin to be loosened, with OIS now seeing the first rate cut taking place in June 2024, from July prior to the data, while also pricing around 100bp of further easing by the end of next year.

Such a pace, however, appears out of step with what the FOMC have signalled, not only via the September ‘dot plot’, but also in recent speeches, which have re-emphasised the ‘higher for longer’ policy stance in an attempt to keep financial conditions relatively tight. Though the December statement will presumably be revised to nod towards the tightening cycle having been concluded, it still seems rather too premature for policymakers to be making any noises about cuts.

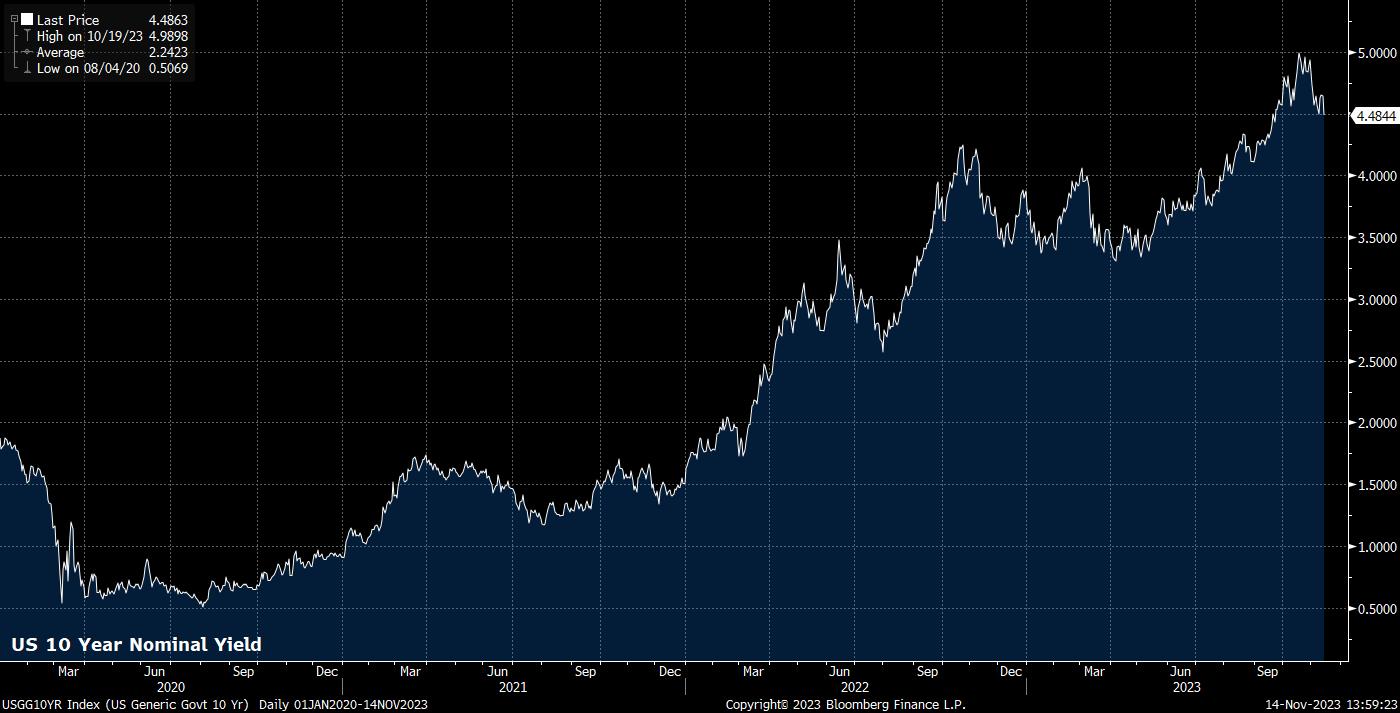

Nevertheless, financial markets aren’t waiting for confirmation that the Fed are done before pricing such a scenario, as the reaction to October’s CPI print showed. Treasuries rallied significantly in the aftermath of the data, with the curve bull steepening, as yields from 2-10 year tenors fell at least 15bp on the day, taking the benchmark 10-year yield back below the 4.50% handle, over 50bp below the cycle highs seen towards the middle of last month. Bond bulls look to be back in control, with any signs of softness in upcoming activity data – with retail sales and industrial production due later this week – likely to further embolden buyers.

This significant bid into Treasuries sparked an almost as significant softening in the USD, with the greenback dropping like a stone as the data crossed, taking the DXY below the 105.00 handle, which had marked the bottom of the recent range, and back under the 50-day moving average. In the process, upside was seen in all G10 peers, with USDJPY dipping back under 151 (likely much to the MoF’s relief!), cable rising to its highest in a week, and EURUSD touching 1.08 for the first time since early-September.

_D_2023-11-14_13-59-43.jpg)

With the hiking cycle having now almost been confirmed as over by the inflation print, USD bears may now decide to flex their muscles a little, while longs who had been betting on the possibility of a further Fed hike may decide to bail. Nevertheless, on a broader level, the ‘US exceptionalism’ theme remains intact from a growth point of view, especially with a rather anaemic pace of expansion continuing to be seen in Europe, while haven demand continues to linger amid ongoing geopolitical tensions. Hence, it may be too early to bet against the buck just yet.

Finally, in the equity space, the reaction to the CPI report further emboldened the bulls, with the S&P 500 future slicing above its 100-day moving average akin to a hot knife through butter, further helping to set the stage for a rally into the end of the year. 4,500 remains the key upside target here.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.