Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Beyond Meat stock soars 1,300% as meme mania returns

.jpeg)

Summary

- Explosive rally: Beyond Meat (BYND) has surged over 1,300% in four days, driven by renewed meme stock enthusiasm and extreme short covering.

- Catalysts: Gains followed a new Walmart distribution deal and inclusion in Roundhill’s Meme Stock ETF, triggering heavy inflows and speculative buying.

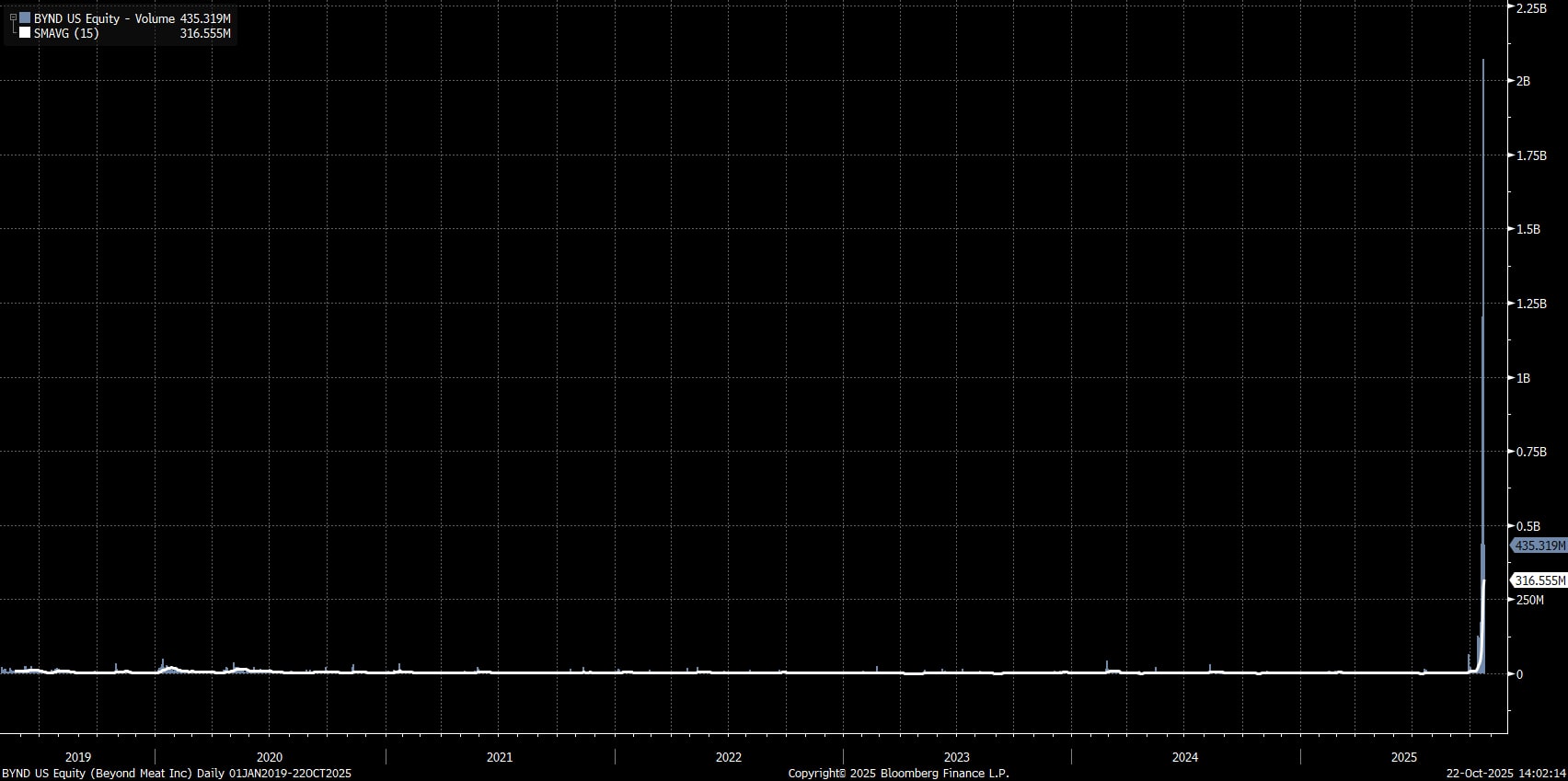

- Record volumes: Over 2 billion shares traded on Tuesday, the stock’s highest volume since its IPO, though price action now appears detached from fundamentals.

Beyond Meat’s explosive rally reignites meme stock momentum

Beyond Meat (BYND) surged on Tuesday, with the stock adding a whopping 146% during the session, and trading another 100% higher in Wednesday’s pre-market session at the time of writing, amid signs that the meme stock mania may be returning. If these gains are maintained into cash trade, the rally will run to a whopping 1,300% in just four days.

Walmart deal and ETF inclusion spark investor frenzy

Two principal factors are driving upside in the name. Chiefly, this remarkable upside stems from BYND having announced a distribution deal with Walmart (WMT), expanding access to products across the states, and leading to hopes that a more prolonged turnaround for the beleaguered company – which concluded a debt deal just last week – could well be on the cards.

Passive flows are also helping here too, after Roundhill added BYND to its ‘Meme Stock ETF’ (MEME) at the start of the week, sparking a wave of investor buying as participants sought to front-run the stock’s inclusion, and inflows that will stem from such a move.

Combined, these factors drove significant upside in the stock, in a move that was then compounded by a sizeable short squeeze, with over 60% of the float having been sold short, driving participants to cover positions, and exacerbating the upside move.

Record trading volumes signal short squeeze pressure

This squeeze is evident by just a mere glance at BYND volumes. 2bln shares traded during Tuesday’s session, following over 1bln shares having changed hands on Monday. This volume not only dwarfs the 300mln average daily volume, but per Bloomberg records marks by far the biggest volume days for the stock since its IPO.

Can the rally continue, or is a pullback imminent?

Despite the face-ripping rally in recent sessions, the stock still trades at an incredibly depressed level, ending Tuesday still trading in the red YTD, though Wednesday’s pre-market gains are likely to erase these declines.

Moving forwards, it must be said that the stock has come an incredibly long way, in an incredibly short space of time, and likely having become detached from its usual fundamental drivers, as often happens with these meme-induced short squeezes. Some froth will likely come out of the market at some stage, though in the face of incredibly high volumes, and a huge number of underwater shorts, timing such a pullback is difficult.

That said, to the downside support will lie first at the 200-day moving average, at $3.05, which also coincides with the highs that the stock printed in September. Should the rally continue, however, and considering pre-market gains, the September 2024 highs at $7.60 are likely the first upside target.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.