Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

With investors seeking clarity on a number of pressing domestic and offshore macro and cyclical issues, the insights shared from CEOs will help investors price futures earnings and sales growth – factors such as:

- The ongoing demand for credit, with CBA’s net interest margins, asset quality and earnings growth under close review.

- The underlying health of the consumer and expectations for future consumption trends given elevated expectations for further RBA interest rate cuts

- Quantifying the impact that the US tariff regime may have on company sales and margins – either directly or indirectly through reduced demand from offshore buyers.

Earnings Expectations: A Fragile Balance Amid Overvaluation

The market currently stands at a delicate equilibrium. On one hand, concentrated bullish momentum continues to push the ASX 200 index above 8,800 points, repeatedly setting new record highs - reflecting traders’ strong confidence in corporate earnings prospects.

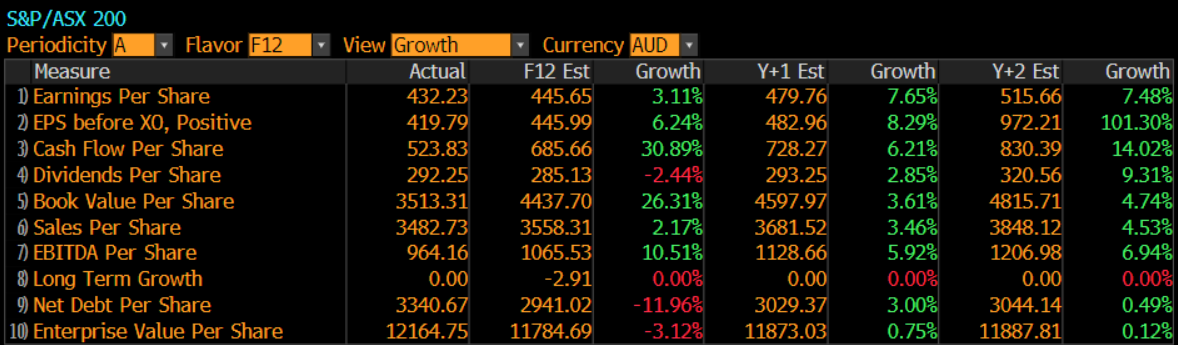

The market anticipates a 3.11% growth in the ASX 200’s earnings per share (EPS) over the next 12 months, with similarly high expectations for cash flow per share and EBITDA. Hedging activity remains restrained, indicating an overall optimistic sentiment and sustained risk appetite.

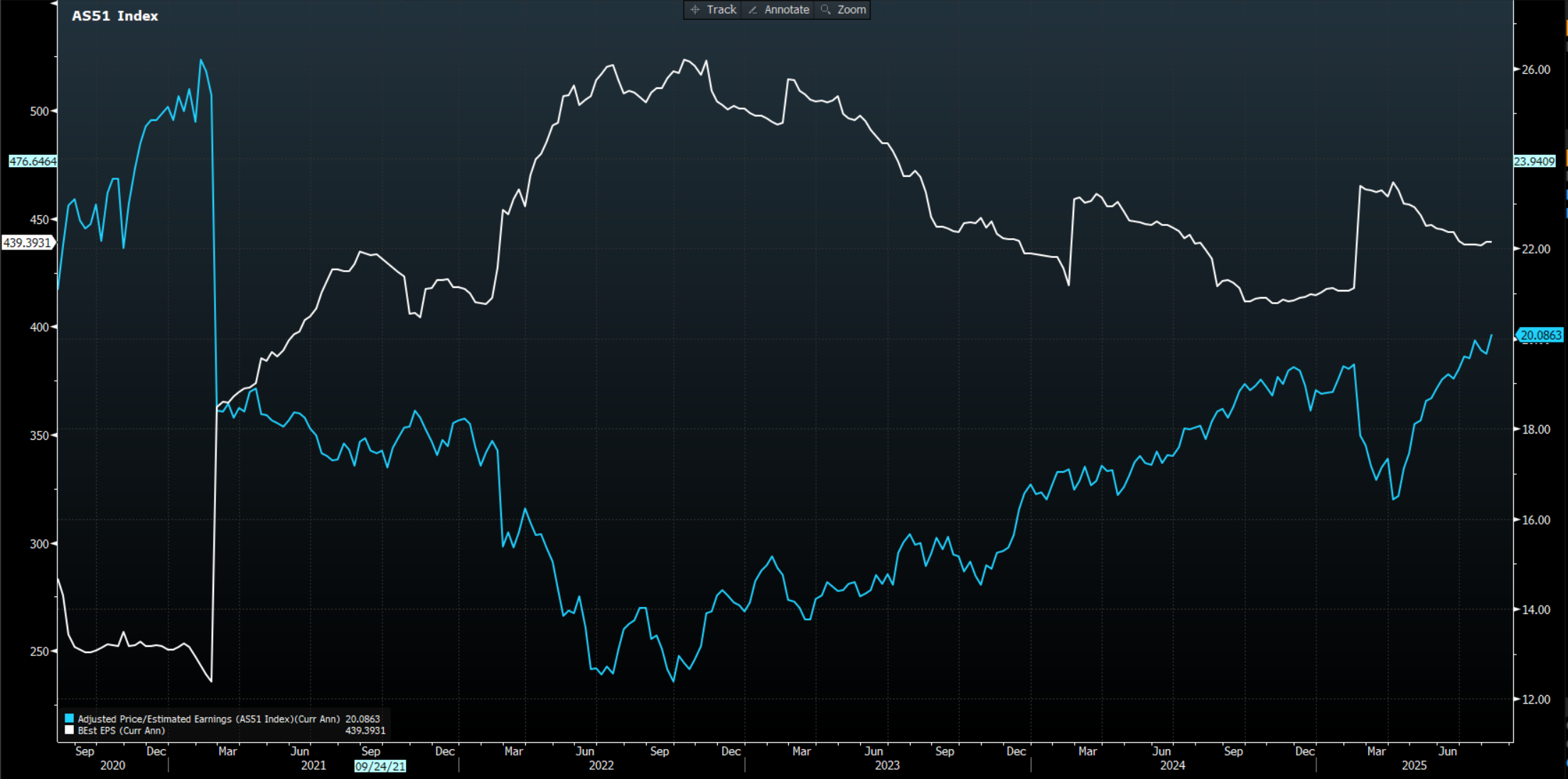

On the other hand, underlying market fundamentals reveal growing disconnects. The 12-month forward price-to-earnings (P/E) ratio of the index’s constituents has reached 20 times—two standard deviations above its historical average. Meanwhile, earnings outlooks appear less encouraging: since the start of the year, the median ASX 200 consensus EPS (Bloomberg BEST EPS) has steadily declined, moving counter to the elevated valuations. The FY25 consensus earnings growth forecast stands at -1.7%, representing an 18.3% cumulative drop from its peak.

Also noteworthy is the marked deterioration in the “freshness” of earnings forecasts—currently, about 75 companies have not updated their earnings estimates for over 100 days, primarily in technology, real estate, and utilities sectors. This raises the risk that the market is overestimating earnings potential based on outdated data.

This divergence—strong price momentum and lofty valuations contrasting with weakening earnings outlooks—may be pushing the market toward a precarious edge, where any earnings shortfall could trigger a chain reaction.

Overall, although the June quarter did not see a cliff-like economic downturn, warning signals at the corporate level are accumulating. In this environment of elevated valuations, rising earnings uncertainty, and lagging data exacerbating volatility, companies that update their forecasts promptly and upwardly revised may present more compelling trading opportunities.

CBA Earnings: A Bellwether for the Australian Market

The banking sector, particularly Commonwealth Bank of Australia (CBA), has long been a focal point for the ASX. The Australian market is known for its high dividend yield, and banks, as major dividend payers, play a critical role in the attractiveness of income returns. Yet, an even bigger factor is institutional holdings.

For example, BlackRock’s IOZ ETF allocates approximately 11.2% of its portfolio to CBA. This means that if CBA’s share price performs well, index funds will be compelled to increase their holdings, further reinforcing the upward momentum. Conversely, if CBA’s earnings fail to justify its current valuation, it could lead to simultaneous declines in both the share price and the ETF’s net asset value, intensifying pressure from fund outflows.

One key market focus is credit demand. As of the end of July 2025, RBA data showed annual growth in business credit at 6.9%, appearing robust on the surface, but a series of micro signals warrant close attention.

Although an RBA rate cut in August is largely anticipated, wholesale funding costs remain elevated and deposit competition is intensifying, squeezing net interest margins more than expected. Risks in the real estate sector are emerging: commercial property loan delinquency rates jumped 12 basis points in June, and Westpac has begun proactively provisioning more against commercial real estate loans—signaling banks’ early efforts to manage potential risks.

When credit expansion depends on elevated risk appetite while net interest margins continue to contract, the sustainability of bank earnings growth faces a critical challenge.

Rate Cuts ≠ Consumer Revival: Beware of Sector Divergence

Market expectations that rate cuts would boost consumption are waning amid recent corporate data. June retail sales rose a mere 0.1% month-on-month—below the 0.3% forecast—with annual growth slowing to 3.2%, reflecting cautious consumer behavior amid uncertainty.

Furthermore, some industrial firms have already issued revenue warnings. Should more companies signal “delayed improvements” in upcoming earnings, concerns over inflated valuations may resurface.

Labor market shifts may also constrain consumption rebounds. With rising part-time employment and unemployment nearing 4.3%, household income predictability declines, putting pressure on consumer confidence. In this earnings season, discretionary spending companies may face tougher scrutiny, while those with cost control and brand pricing power are likely more defensible.

Trade Policy Effects Flowing Through to Corporates

There have long been calls for sector rotation to diversify risks. However, current market conditions paint a less optimistic picture.

Although the 10% tariffs imposed by the U.S. on Australian goods are milder than the 15%-50% levies faced by some other economies, this policy shift has already triggered ripples within supply chains, affecting operational plans and capital expenditure decisions of Australian companies.

As Australia’s largest trading partner, China’s economic recovery is encouraging, yet the mining and materials sectors may still face considerable headwinds amid global growth pressures amplified by tariffs.

If corporate earnings calls continue to convey cautious sentiments, the market may revisit growth expectations for fiscal 2026. But given current low exposure to materials, any positive signals could act as catalysts, reigniting capital inflows and investor interest.

A Tactical Playbook for Traders

In this highly expectation-sensitive season, traders might consider the following strategies:

- Earnings Surprise Analysis:Certain sectors like banking, resources, and domestic demand may carry risks of overly optimistic expectations; focus on discrepancies between actual guidance and consensus forecasts.

- Cost Structure Differentiation:Amid rising labor costs, companies with pricing power or operational efficiency—especially in healthcare and consumer staples—could outperform.

- Event-Driven Opportunities:Mergers, acquisitions, and asset restructurings may create localized trading chances; keep an eye on financials and industrials.

As the August reporting season unfolds, with valuation pressures and growth deceleration in tension, the market is increasingly pricing in “stability.” In the coming weeks, traders should watch closely for management’s views on H2 operating trends, capital expenditure adjustments, and how firms use pricing, product mix, or channel optimization to mitigate external headwinds.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)