- English (UK)

Headline CPI rose 2.9% YoY last month, in line with consensus expectations. Meanwhile, underlying price metrics pointed to price pressures remaining stubborn, as core CPI rose 3.1% YoY, while the ‘supercore’ metric (aka core services less housing) rose 3.2% YoY, both unchanged from last time out.

Meanwhile, on an MoM basis, headline prices rose a hotter-than-expected 0.4%, while core prices rose 0.3% MoM. That latter figure, unrounded, was 0.346%, however, thus being very close to also rounding up to 0.4%.

As has now been the case for some time, annualising those MoM metrics helps to provide a clearer picture of the underlying inflationary trends within the US economy:

- 3-month annualised CPI: 3.5% (prior 2.3%)

- 6-month annualised CPI: 2.3% (prior 1.9%)

- 3-month annualised core CPI: 3.6% (prior 2.8%)

- 6-month annualised core CPI: 2.7% (prior 2.4%)

In addition to that, especially given that in the current macro environment the vast majority of upside inflation risk stems from the Trump Admin’s tariff policies, the composition of price pressures commands even more attention than usual, especially as the degree of tariff pass-through remains uncertain.

On that note, core goods prices rose 1.5% YoY, the fastest pace since May 2023, likely a further sign of tariffs being passed on in the form of higher consumer prices. Core services prices, meanwhile, remained steady at 3.6% YoY, likely leading to further concern over the risk of price pressures becoming embedded within the economy.

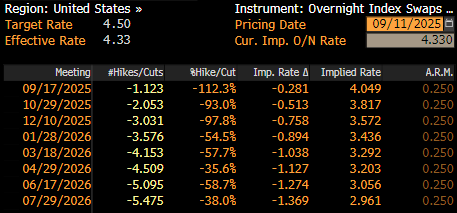

As the data was digested, money markets continued to fully discount a 25bp cut at the September FOMC meeting next Wednesday, but have become increasingly confident that the FOMC will deliver three cuts this year, with the USD OIS curve now discounting 76bp of easing by year-end.

Taking a step back, the August CPI report is unlikely to change much in terms of the FOMC policy outlook, with a 25bp cut next Wednesday remaining the base case. Chair Powell, at the Jackson Hole Symposium, was clear not only in his view that tariffs are likely to represent little more than a ‘one-time shift in the price level’, but also that labour market developments now take precedence when it comes to the Committee’s reaction function.

Consequently, while the base case remains that the FOMC will deliver a 25bp cut next week, followed by another such move at the December meeting, risks to this path tilt in a dovish direction, towards consecutive 25bp cuts through year-end, were the labour market backdrop to soften further.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.