- English (UK)

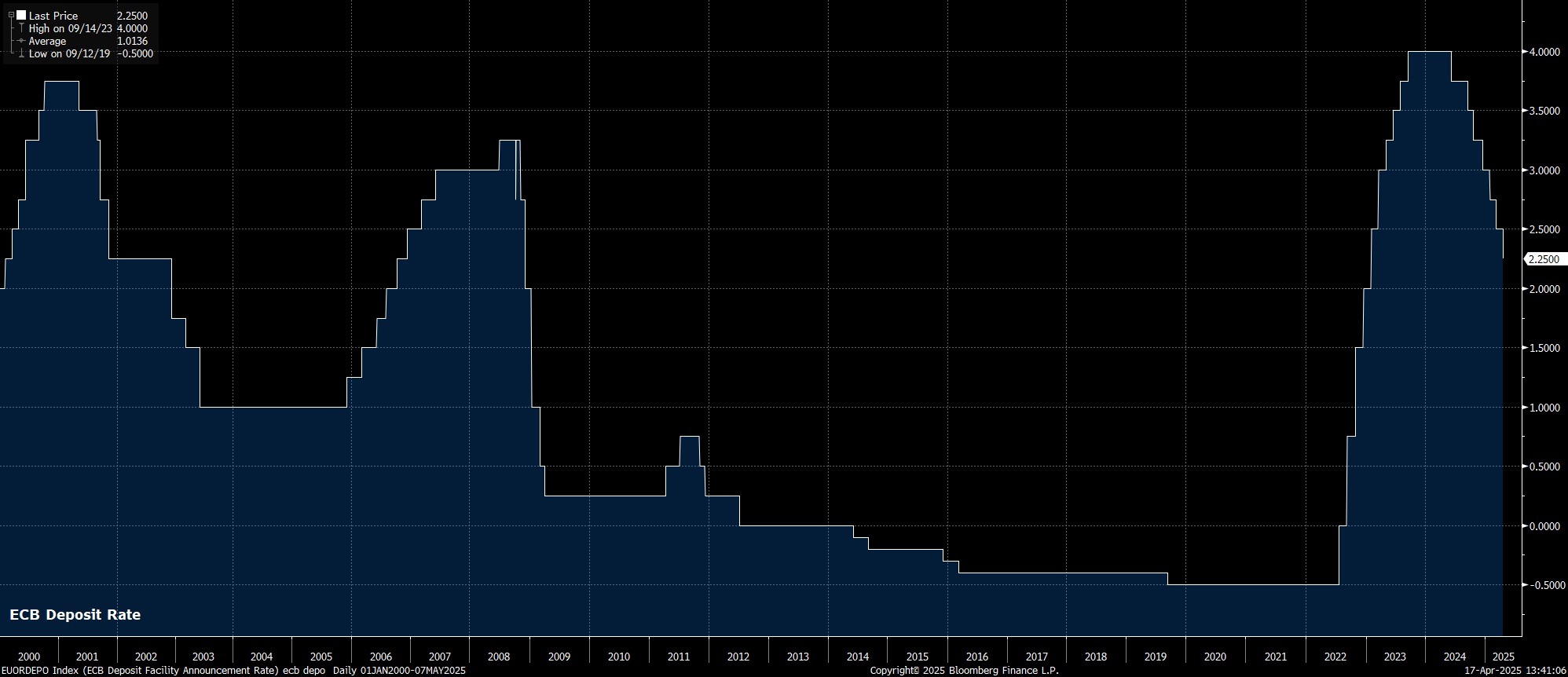

That 25bp cut, which had not only been widely expected, but also fully discounted by money markets, now sees the deposit rate stand at 2.25%, its lowest level in two years.

Accompanying the unanimous decision to deliver another rate cut, was the Governing Council’s updated policy statement. By and large, this statement was a ‘copy and paste’ of that issued after the prior decision, last month, and as such reiterated that policymakers will continue to follow a ‘data-dependent’ path, deciding policy on a ‘meeting-by-meeting’ basis, while also noting that no ‘pre-commitment’ is being made to a particular course of monetary policy.

Meanwhile, with the deposit rate now roughly in the middle of the range of estimates for the neutral rate, the statement dropped a long-standing reference to the policy stance being “restrictive”. This amendment, however, shouldn’t be particularly surprising, as such a moniker is no longer justified at this stage.

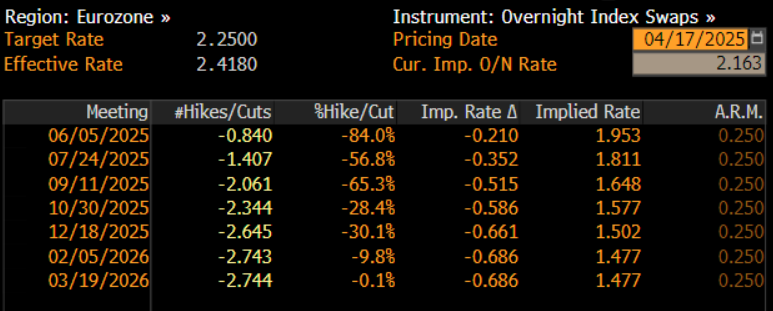

While the rate reductions delivered so far this cycle have taken the overall policy stance to a neutral level, further such rate cuts remain on the cards as risks to the eurozone economy, most notably stemming from the ongoing global trade war, continue to mount.

There were, of course, no updated staff macroeconomic projections released this time around, with the next forecasts due to be published at the June meeting. However, even just six weeks after they were published, the March expectations of 0.9% GDP growth, and 2.3% YoY inflation, in 2025, both seem overly ambitious, with risks skewed to the downside in both cases. It goes without saying, however, that the outlook remains highly uncertain at this moment in time.

At the post-meeting press conference, President Lagarde noted that while the economy is likely to have grown in Q1, the outlook is clouded by “exceptional uncertainty”, and downside risks to growth have “increased”. Furthermore, Lagarde noted that an adverse market reaction to trade developments could lead to tighter financial conditions – my read, is that in turn, this could necessitate a greater, and more rapid, degree of easing from the ECB.

On the whole, the April ECB meeting brought little by way of surprise, either in terms of the decision to deliver another 25bp cut, or the guidance which nodded firmly towards further such cuts being delivered at coming meetings. Frankly, there is little else that the Governing Council can do at this juncture, given not only the extremely uncertain nature of the global economic outlook, but also the substantial downside risks that the bloc’s economy continues to face.

Consequently, it seems likely, at this stage, that the easing cycle will continue for some time to come, with 25bp cuts likely now to be delivered at every meeting until the autumn, and a move below the 1.75% lower bound neutral rate estimate, into outright ‘easy’ territory, seemingly nailed on, as policymakers attempt to cushion the eurozone economy from a host of external shocks.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.