- English (UK)

Amazon Surges 10% After Earnings: AWS Rebound & AI Bets Drive Big Growth

.jpg)

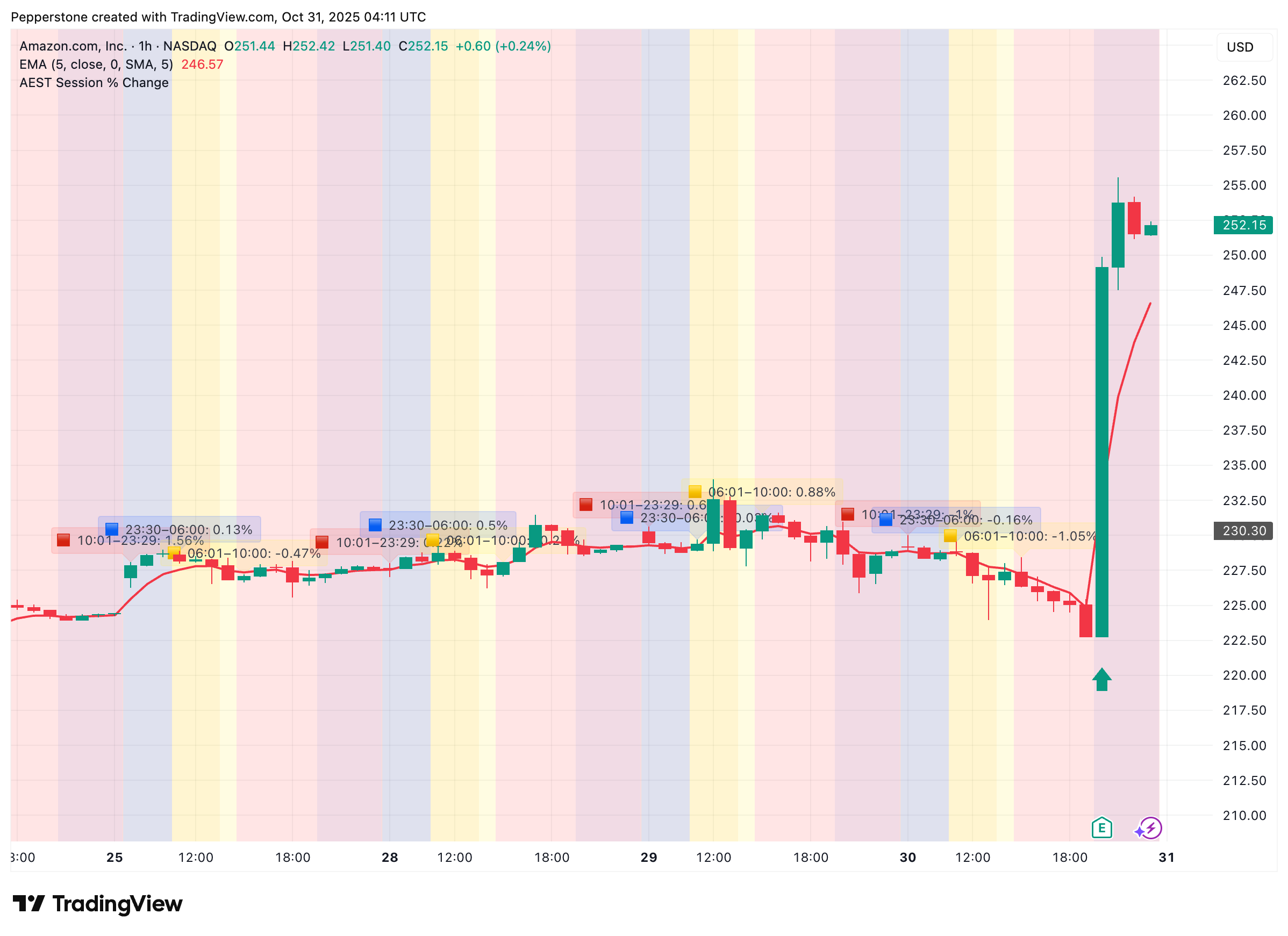

After the U.S. market close on October 30 (early morning in Australia), Amazon delivered a strong Q3 report. Revenue and earnings per share (EPS) comfortably beat expectations, AWS growth rebounded, and profits improved. Retail and advertising remained steady, and the company raised its Q4 guidance. Beyond the “perfect scorecard,” the most exciting takeaway for investors is Amazon’s growing commitment to AI, with plans to invest over $100 billion in AI infrastructure.

The market reaction was immediate: the combination of better-than-expected results and aggressive AI capital spending fueled a surge in trading, with shares rising over 10% within an hour of the report. Traders clearly raised their expectations for Amazon’s future growth potential.

Yet, the report also carried some caution. While ramping up AI investments, Amazon simultaneously announced large-scale layoffs and recorded roughly $1.8 billion in severance costs, highlighting the cost and organizational pressures behind its expansion.

Overall, the earnings convey two main signals: first, Amazon has made cloud and AI its core growth engines for the next phase; second, the company is aligning aggressive capital spending with organizational restructuring to support these goals.

While the strategy is clear and logically sound, translating massive investments into sustainable long-term returns will depend on execution pace, customer retention, and successful deployment of in-house technology.

AWS Recovery: Amazon’s Growth Engine

AWS’s rebound is a standout of this quarter’s report. Its year-on-year growth returned to roughly 20%, with quarterly revenue surpassing $33 billion, significantly supporting Amazon’s overall profitability. Although cloud revenue doesn’t represent the largest share of total sales, it contributes most of the company’s operating profit, and growth recovery clearly boosts overall earnings quality.

Management emphasized that most new capacity was quickly absorbed by the market, reflecting ongoing demand for enterprise cloud services. Improved supply-demand balance reduces concerns over overinvestment or idle capacity, providing clear support for the stock.

In the near term, AWS’s steady growth gives Amazon time and flexibility to pursue its AI ambitions. In coming quarters, sustained AWS growth will depend on how quickly new capacity is absorbed, customer diversification, and maintaining margins amid rising competition—factors that will directly influence whether AWS continues to fuel Amazon’s long-term growth.

AI and Chip Investments: Supporting Shares Now, Driving Profits Later

Amazon is pursuing a dual-track strategy in chips and compute: large-scale GPU purchases ensure short-term delivery capacity, while accelerating deployment of in-house chips like Trainium2 to gain cost and performance advantages. In other words, the company is balancing short-term revenue stability with building long-term differentiation.

If in-house chips outperform standard GPUs on cost and efficiency, Amazon’s future margins and pricing power could increase significantly; if progress slows, the company may face greater pressure in competition with Nvidia, Microsoft, and others.

The report also shows Amazon expects capital expenditures of $125 billion in 2025, mainly for data centers, power, and chips. Large AI model training requires extensive compute and stable power, so securing resources early helps prevent competitors from gaining ground through pricing or delivery speed.

However, such heavy spending also pressures short-term cash flow and returns. Traders will focus on the unit return on new capital and the convertibility of backlog orders, which directly affects market confidence in Amazon’s future growth and stock performance.

Retail and Advertising: AI Delivering Value

Beyond cloud and infrastructure, Amazon is integrating AI into retail and advertising. Growth in users and conversion rates for shopping assistants like Rufus, along with double-digit advertising growth, shows AI is not just “selling compute”—it’s enhancing front-end efficiency and conversions, expanding profit potential.

This front- and back-end monetization model is a unique advantage, amplifying the impact of technology investments on both cost and revenue.

Strong Foundations and Future Bets: Opportunities and Risks

Amazon shows a combination of “clear strategic direction” and “uncertain return timing.” With clear demand signals, the company is investing heavily in infrastructure—a logical strategy, yet one with notable risks.

First, high customer concentration may create pricing pressure—if major clients shift to other cloud providers for better deals, Amazon’s utilization and pricing power could be affected. Second, competition is intensifying, with Microsoft and Google also ramping AI infrastructure investments, making pricing and service innovation an ongoing battleground. Finally, regulatory and compliance costs, including one-off settlements, could affect short-term profits.

In the short term, AWS growth and AI applications in retail and advertising will continue to support results. For long-term sustainable returns, success depends on whether in-house chips and external procurement strategies complement each other, are accepted by customers, and whether organizational adjustments maintain efficient delivery and continuous innovation.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.