Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Traders’ Week Ahead: Jackson Hole, Implied Fed Cuts, and Rising Market Volatility

Focus now turns to the Trump/Zelenskyy meeting in the Oval Office, where scenes from the prior meeting on 28 February – and Zelenskyy’s roasting by JD Vance – won’t have been forgotten. One suspects there will be some heat on Zelenskyy this time around to take whatever is put on the table. Talk of the US offering Ukraine security guarantees may form the centrepiece of discussions, with Zelenskyy required to cede control of up to five territories to move closer to a lasting peace agreement – a factor he has consistently said is not possible. Hence, market expectations for anything tangible that would constitute a positive surprise remain low. Long EU equity, RUB, and short Brent would be the cleanest expressions.

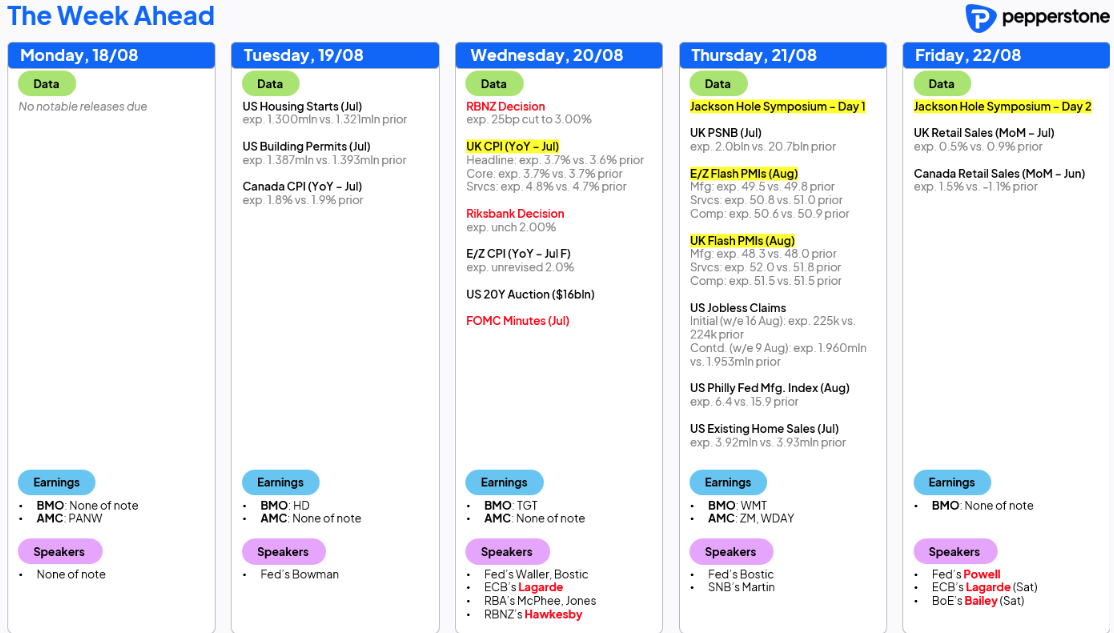

The key events to navigate in the week ahead

Outside of the geopolitical developments, at a topline level, the main events for traders to navigate will be the Jackson Hole Symposium, inflation readings from the UK, Japan, Mexico and Canada, while the RBNZ looks set to cut rates to 3% on Wednesday.

On the earnings side, in the US we get results from the retailers – Home Depot, Lowe’s, TJX and Walmart. In Australia, BHP, Woodside, CSL, Santos and Goodman Group are the big names to report FY numbers, in what is the key week for company earnings. Earnings also ramp up in the HK50/H-share space, with Alibaba, Xiaomi, Baidu, AIA, and retail favourite Pop Mart all set to get attention.

Watching developments in DM bond markets - notably in the long-end of the curve

In markets, close focus for many falls on moves in bond markets, and notably on the slope of the yield curves – and not just in US Treasuries, but also in the long end of the German and UK curves, and possibly in Japan too. Notably, German 30-year bond yields have broken out to their highest levels since 2011. UK 30-year yields are pushing YTD highs, with 5.60% having been the level where buyers have previously stepped in – as such, a closing break of 5.60%/5.65% could draw significant attention.

The slope of the US Treasury curve will also be closely watched ahead of the week’s most anticipated event, the Jackson Hole Symposium, culminating with Fed Chair Jay Powell’s speech on Friday. Powell’s guidance on policy will be seen as a key steer for markets, which currently price a 77% probability that the Fed cut in September, with the Fed expected to pull the rates trigger again in December.

The US 2s vs 30s yield curve sits at 116bp, pressing the top of its YTD range of 120bp, while the 5s vs 30s curve is at 108bp, the steepest since October 2015. The message from the US Treasury market is a complex one – within the Fed there are concerns that core PCE inflation, having lost its disinflationary momentum since April 2024, is progressively pulling even further from its 2% target. In fact, the upcoming core PCE print is expected to come in at least 90bp above target, close to its widest divergence from the Fed’s goal since January 2024.

The rates/swaps market has priced in over 100bp of cuts from the Fed by Q2 2026. While there are concerns shared by rates traders that inflation may rise in the short term, this is expected to be temporary, with slowing growth and labour market dynamics the primary influence for rates traders that will force the Fed’s hand even if inflation stays ahead of target.

The long end of the US Treasury curve (10s and 30s) and the bear steepening underway sees that argument through a different lens and therefore offers a disconnect to rates pricing, and a message the Fed should not be too hasty in cutting rates. Powell’s guidance at Jackson Hole will therefore be important in showing how he balances the focus on inflation versus growth and labour markets.

A flatter Treasury curve will see USD upside and bring out equity sellers

In essence, if the outcome from Powell’s speech results in some of the implied rate cuts being priced out, and the curve flattening, then the USD will likely push higher, and equity sold. There is a clear relationship between EURUSD and the US 2s vs 30s curve – the steeper the curve, the more buying support for EURUSD has been observed.

The disconnect between what rates traders are focused on, and what the long end of bond markets is signalling, is complex – but it suggests frothy markets may soon make a move. The US Labour Day holiday (1 September) looks like a key marker, with September historically a weak period for bond returns and could be stage for an increasingly probable pickup in cross-asset volatility.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.