Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

A Traders’ Week Ahead Playbook: September Risks, Nonfarm Payrolls Fed Policy, and Market Set-Ups

Since the GFC, many have become hard-wired to perpetually search out the next big bear thematic and the trigger point that could cause the next 20%+ drawdown in risk assets. Yet the fact is that 90%+ of these “emerging bear market themes” blow over quickly, and having an optimistic stance on market developments has served many well over the years. Still, in the fine art of risk management, it remains prudent to identify and monitor emerging risks and react dynamically if the concerns truly build towards a consensus and the trading environment changes.

With a large percentage of the daily traded volume coming from systematic players and passive entities, the flows and price action speak more to the underlying environment and trend than to macro views. Still, while trading conditions can change quickly, let’s consider the reality of the big-picture set-up as we roll into September.

The set-up going into September

The MSCI World Equity Index is just 0.7% off its ATH. US high-yield and investment-grade corporate credit spreads are near multi-year tights. The US Treasury yield curve continues to steepen (the UST 2s vs 30s yield spread is now the highest since December 2021), and levels of implied cross-asset volatility remain below the 10th percentile of their respective 12-month ranges.

From that standpoint, life for risk bulls is sweet and really since the April lows, risk markets have been exceptionally kind to those who stayed the course and added risk even on shallow pullbacks.

Goldilocks still underpins risk markets

This bullish trend is well explained by the “goldilocks” macro environment: the metaphorical safety blanket of the “Fed Put,” falling US real rates, US broad money supply growth at its fastest YoY pace since July 2022, deficit spending, and record corporate buybacks. Add in reasonable economic growth, consistently stronger-than-forecast US economic data, and solid Q2 earnings growth, and the bullish case for risk appreciation has been clear.

That said, scratch beneath the surface and there are reasons to think that the trading environment (i.e. volatility, daily ranges, liquidity, price action) could soon evolve and challenge what many see as frothy sentiment and one-sided, concentrated positioning. As we roll into September, Monday’s trading session will likely be a write-off due to the US Labor Day holiday. From Tuesday, the cogs of the market move into higher gear, with many of the big hitters returning from their summer break in the Hamptons. Volumes and order-book liquidity should therefore build, and those returning with revitalised minds and fresh perspectives may rotate positioning, add cheap portfolio hedges, or trim core holdings.

September seasonals in focus

It seems unlikely that, simply because we’ve moved into September, we’ll suddenly see a radical shift in conditions — especially as the macro environment hasn’t meaningfully changed. What will dictate the trading landscape are the economic data outcomes and this week’s event risks. For short-term traders, though, frothy markets, a build-up of leverage and short-vol positioning can quickly lead to sharp changes in sentiment and the technicals.

September’s record remains on many minds: historically the weakest month for US equities, Treasuries, and even gold. But few managers will liquidate core holdings on seasonality alone. Late last week, US semiconductors lost momentum and traded poorly. Nvidia, for instance, tried to break above the $184 ceiling it has held since late July, but was quickly knocked back to $174 and now possibly eyes a test of the 50-day MA to $170.52. Lower-quality stocks failed to attract buyers, cyclical equities underperformed defensives/low-volatility plays, and high-growth/high-beta names rolled over a touch.

The VIX looks to have found a floor below 15%, while we have seen a modest rise in the relative demand for out-of-the-money S&P 500 1-month vol relative to 1-month ATM vol.

Gold and silver have both been stealth performers, with gold notably closing Friday at an all-time closing high. While some of this can be attributed to systematic players building longs as they chase the upside momentum, we also see falling US real rates offering tailwinds to the gold price... however, multi-asset money managers are also seeing gold as a hedge against the ongoing risk of Fed independence being compromised, or that incoming data could show the Fed falling behind the curve.

Emerging risks outside of the US for traders to consider:

China: The A50 Index has closed higher in 10 of the past 11 weeks, while the CSI 300 has gained in 9 of the past 10 weeks, with August trading activity setting new records. Liquidity, corporate earnings, and AI enthusiasm have driven animal spirits — but regulators are paying close attention. Margin-financed transactions are up 20% YTD, with outstanding margin debt at its highest since 2015. Many will recall the 2015 crash, when the CSRC forced brokers to cut leverage, and backed by the surprise 4% CNY devaluation, the CSI 300 collapsed 45% in just two months. Europe: UK and German long-end yields are consolidating at recent highs, and renewed selling could drive yields higher still. French equities underperformed last week on political developments, with traders closely watching the spread between French OATs and German Bunds.

Event Risks to Navigate in the Week Ahead

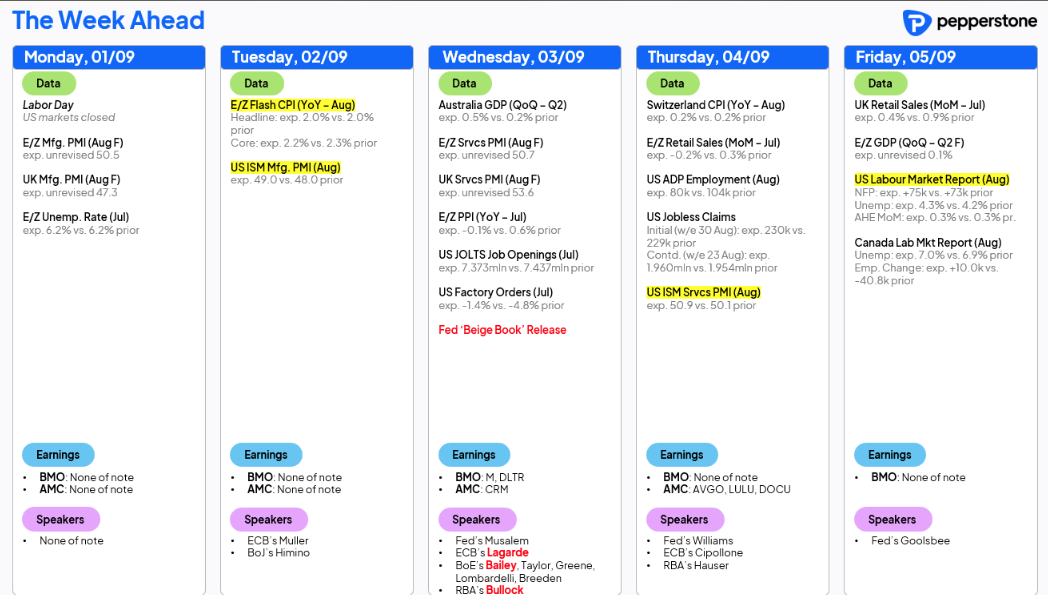

US: Labour market in focus with JOLTS (job openings, layoffs, quits rate), weekly jobless claims, and nonfarm payrolls (NFP). Also, ISM manufacturing and services surveys (both expected to improve). Fed speakers include Musalem, Williams, and Goolsbee — the latter two speak after the payrolls report, so markets will be watching closely for any shifts in their guidance.

Outside the US: Canadian employment data, EU & Swiss CPI, Australian Q2 GDP, and UK PMIs. The US NFP report on Friday is the pivotal release. At Jackson Hole, Jay Powell made clear his concern about a cooling labour market. If payrolls are the Fed’s focus, options dealers should price higher implied volatility across S&P 500 and cross-asset options going into the event.

The markets current base case: The median estimate from economists is +75k jobs, and the U/E rate eyed to tick up to 4.3%. If this outcome is realised, the Fed should cut 25bp in September — an outcome already implied with 88% probability by interest rate swaps.

Stronger than expected: >150k payrolls, U/E steady at 4.2%. Fed cut odds priced into swaps should fall to an implied 60–70%, USD rallies, gold trades lower, equities rally modestly as good data is good news for risk.

The sweet spot for risk: 80k–120k payrolls, U/E at 4.2–4.3%. This would be cool enough to still justify an insurance rate cut in September, but not weak enough to stoke fears the Fed is behind the curve.

Weaker than expected: <50k payrolls, downward revisions, U/E at 4.4%. Swaps may price some chance of a 50bp cut, but equity markets would likely treat this as “bad news is bad news,” with labour concerns sparking broader risk-off moves.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.