- English (UK)

A Trader's Weekly Playbook: Key Market Risks, Nvidia Earnings & US Nonfarm Payrolls

While the nonfarm payrolls (NFP) report is always a headline act, market sensitivity to this print should feasibly be set lower, with traders instead placing far greater weight on the November NFP release (5 Dec) and also the Nov CPI report (10 Dec) — with both key data points landing just before the December FOMC meeting, in what will be a period littered with major event risk and possibly reduced liquidity in the order books. Christmas, it seems, may have to be put on ice this year, as the data deluge seen through December suggests trading will be pushed right until the New Year.....

Options pricing implies a -/+6.5% move in Nvidia on the day of reporting

Nvidia’s Q3 2026 earnings and its Q4 guidance are viewed as this week’s main volatility event - justifying that call we see that the options pricing implies a ±6.5% move on the day of reporting and setting the platform for an implied ±1.1% move in the S&P 500.

With the bar to please set a lofty level once more, Nvidia will likely need to post Q3 revenue around $56 billion and guide toward $61.5–$62 billion for Q4, with gross margins near 74% (Q3) and 74.7% (Q4) to satisfy high buy-side expectations. CEO Jensen Huang is expected to deliver a strong outlook, which is what we've become conditioned to see. Investors will look for updates on Nvidia’s target of an additional 14 million GPUs (as outlined at GTC for CY25/26) and progress on its $100 billion investment in OpenAI.

The reaction to Nvidia’s results could ripple through the broader AI and semiconductor space - however, traders are also keeping a close eye on the credit markets — particularly firms with comparatively elevated net debt-to-cash flow and net debt-to-EBITDA ratios that continue issuing debt (and are expected to accelerate this in 2026) to fund capacity buildouts.

Labour's budget U-turn is becoming a DM bond issue

The UK gilt market remains a major focus. UK 10-year yields rose 14 bps week-on-week, and 30-year yields gained 15 bps. Although still about 35 bps below recent highs, it's the rate of change in yield that matters more than the absolute level. The Labour government’s budget U-turn last week has further undermined Chancellor Reeves’ credibility, as markets perceive yet another developed-market (DM) government refraining from heading down that pot-holed road of deficit-reduction when growth would be squarely be put at risk.

GBP interest-rate swaps have modestly reduced the implied probability of a BoE rate cut on 18 December, now pricing a 79% chance of a 25 bp reduction. Importantly, given cross-market linkages, the sell-off in UK gilts should not be viewed as a UK-specific issue — higher gilt yields tend to drive higher US Treasury and other developed-market bond yields, with rising bond volatility spilling into equities and other risk assets.

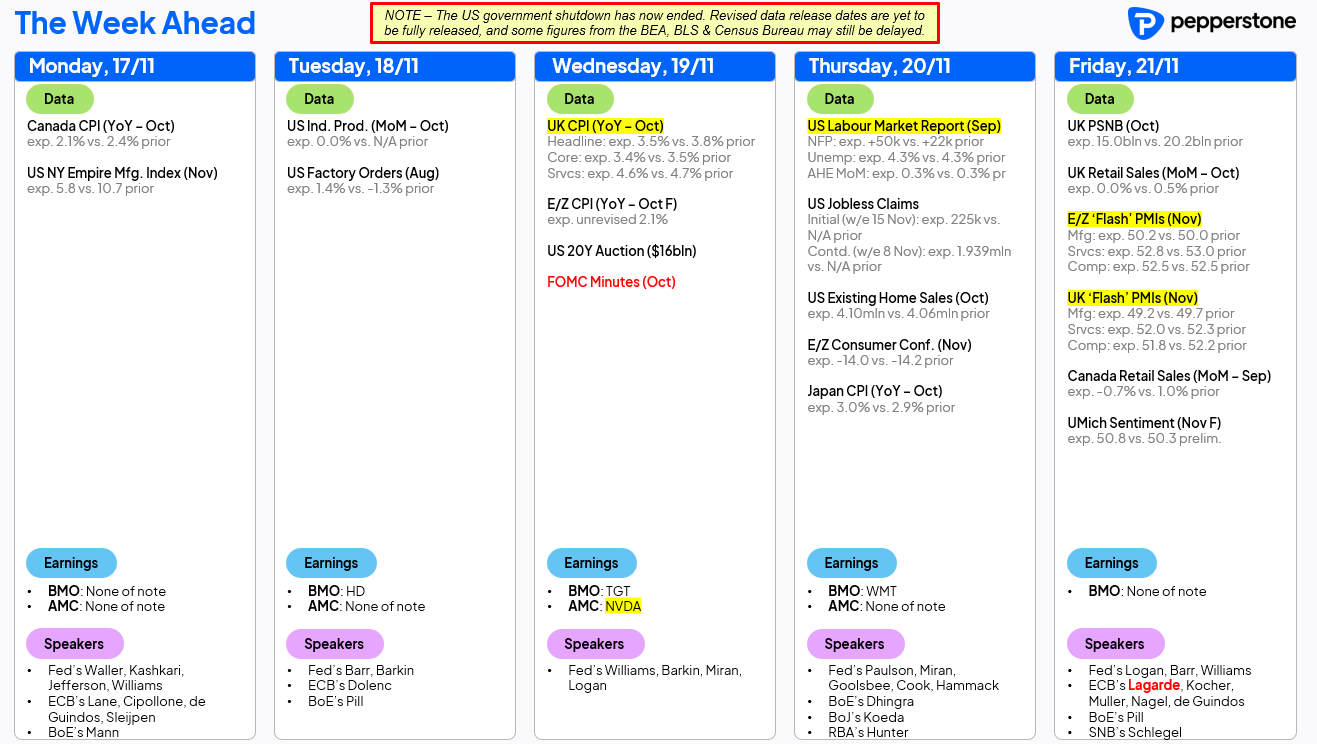

Key Risk Events for the Week Ahead

- US Earnings Reports: Results due from Home Depot (Tuesday), Target (Wednesday), Nvidia (Wednesday after-market), and Walmart (Thursday).

- September US Nonfarm Payrolls (Thursday): The economists' consensus estimate models 50k jobs added, a 4.3% unemployment rate, and 0.3% m/m growth in average hourly earnings.

- US Import Price Index (Tuesday): Offers insights into tariff effects on goods through October. Economists expect a 0.1% m/m increase, suggesting tariff-related price pressures remain contained.

- Fed Speakers: Nineteen Fed officials are scheduled to speak this week. However, it’s unlikely their comments will significantly shift US interest-rate swaps pricing, which now implies a 47% chance of a rate cut in December. Until November CPI data is released, the Fed lacks clarity on core PCE trends and inflation dynamics within its dual mandate.

- October FOMC Minutes (Wednesday): With most Fed voters and non-voters already sharing views since the October meeting, the minutes may consolidate perspectives but are unlikely to reveal new information.

- UK Data Watch: With UK bond markets and swaps in focus, GBP and FTSE 100 traders will monitor CPI, public finances, and retail sales.

- Australian Wage Price Index (Wednesday): Q3 wages expected to rise 0.8% q/q, keeping the annual rate steady at 3.4%. AUD reaction will depend on any surprise versus consensus.

- Japan GDP (Monday) & National CPI (Friday): The December BoJ meeting is considered live, with swaps implying a 32% chance of a 25 bp hike. PM Takaichi’s preliminary budget could also influence JPY and the Nikkei 225.

- EU PMIs (Friday): Economists expect stable preliminary November readings, with modest expansion in both services and manufacturing. Unless results deviate significantly, the impact on EUR should be limited. EUR swaps indicate the ECB’s cutting cycle is largely complete.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.