- English (UK)

2026 Eurozone Macro Outlook: Headwinds Turn To Tailwinds

Summary

- ECB Stand Pat: The ECB are set to stand pat, holding the deposit rate at 2.00% through 2026, despite inflation undershooting target

- Fiscal Tailwinds: Looser fiscal policy, primarily in Germany, supports the growth backdrop, along with easing trade tensions

- Risks Remain: Ongoing geopolitical tensions pose a notable risk, as does the fragile domestic political backdrop in a number of eurozone countries

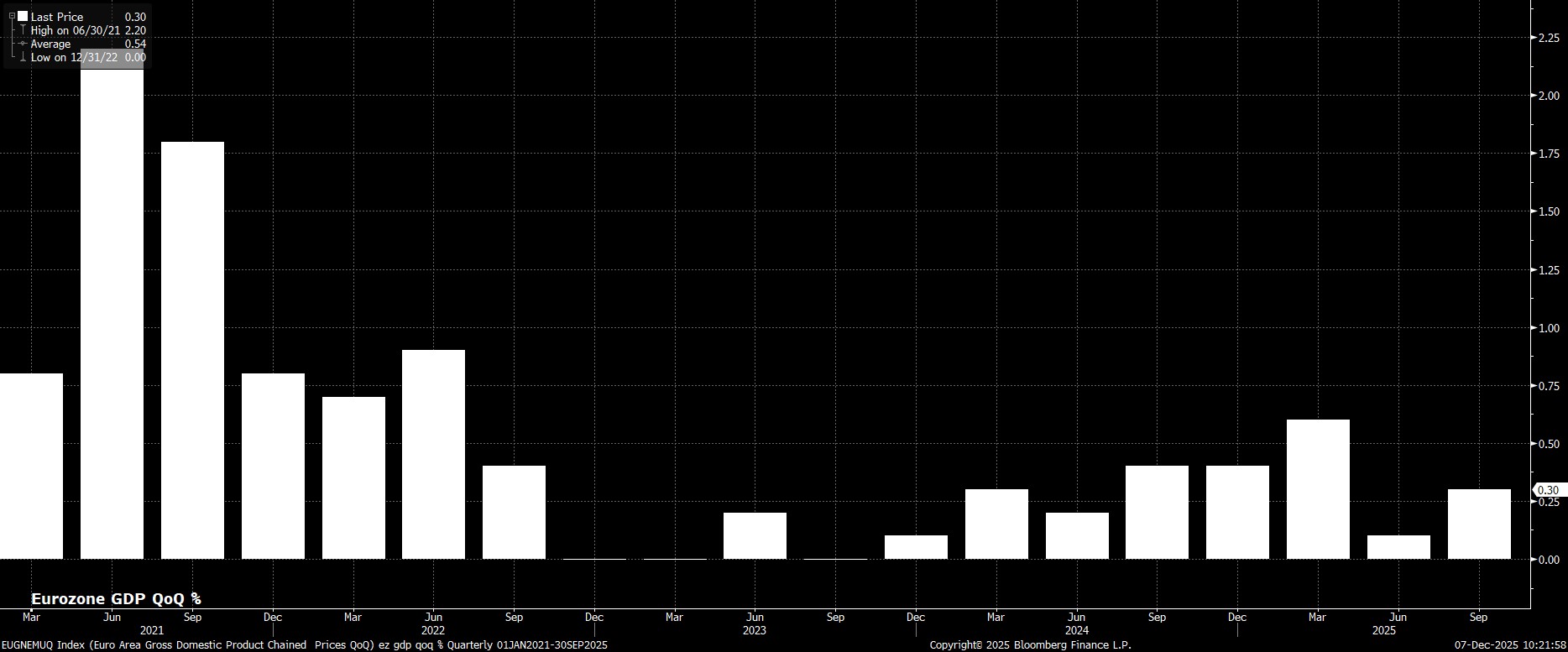

The last year has been a tumultuous one for the eurozone economy where, despite the ECB having continued to ease policy in H1, overall activity has remained somewhat sluggish, largely a result of continued trade and geopolitical uncertainty. However, 2026 should see the alleviation of trade uncertainty see the matter become a macro tailwind, while long-overdue looser fiscal policy, and a relatively easy ECB stance also support a rosier outlook for the year ahead.

ECB – Done & Dusted

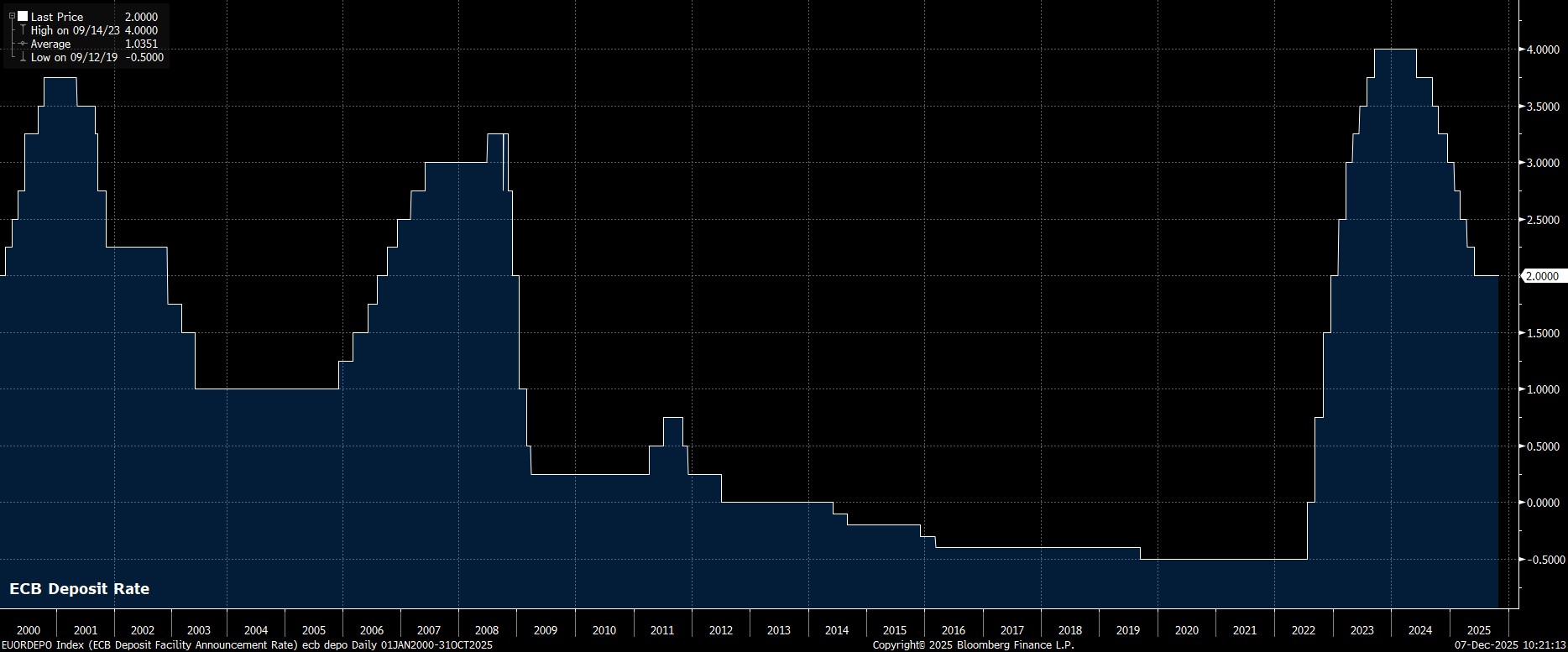

Having been on pause since this cycle’s most recent 25bp cut in June 2025, and with the deposit rate now bang in the middle of the ECB’s range of estimates for the neutral rate, at 2.00%, policymakers are likely to see little reason to shift from the present ‘wait and see’ approach, with numerous members of the Governing Council, including President Lagarde, having described policy as being in a ‘good place’.

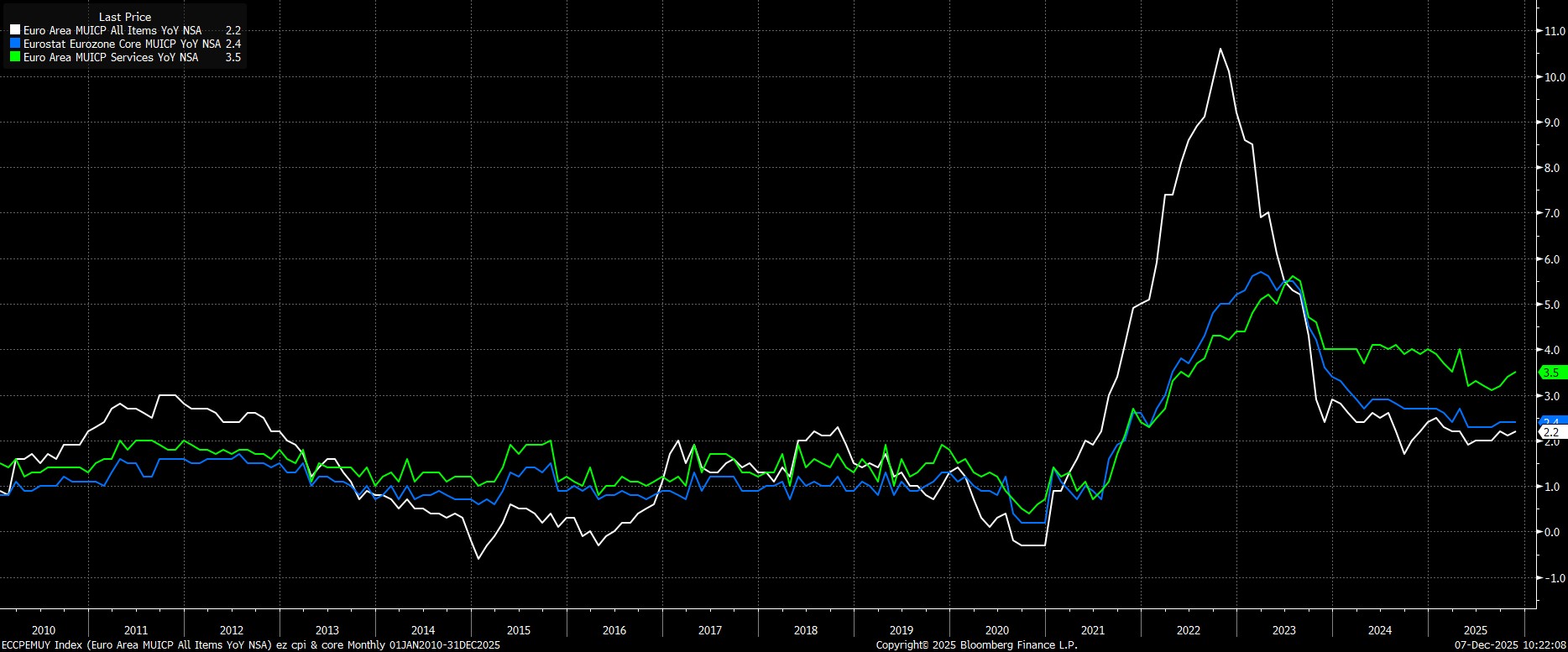

Interestingly, that ‘good place’ is one that, per the most recent staff macroeconomic projections, leads to an undershoot of the 2% inflation target in both 2026 and 2027, suggesting that a majority of policymakers either place relatively little weight on the staff forecasts or, more likely, that such an undershoot can be tolerated as the ‘price’ to pay in order to provide continued support to the economy at large.

Either way, the implication here is that it is likely to take a much more significant, and sustained, undershoot of the inflation target to see the ECB deliver another rate reduction, with the base case being that 2.00% stands as the deposit rate’s terminal level, before the narrative turns to when modest rate hikes could begin in 2027. Naturally, a significantly weaker than expected growth outturn, or resurgence of downside trade risks, could force the ECB’s hand into a further cut, though neither of these are the base case for the year ahead.

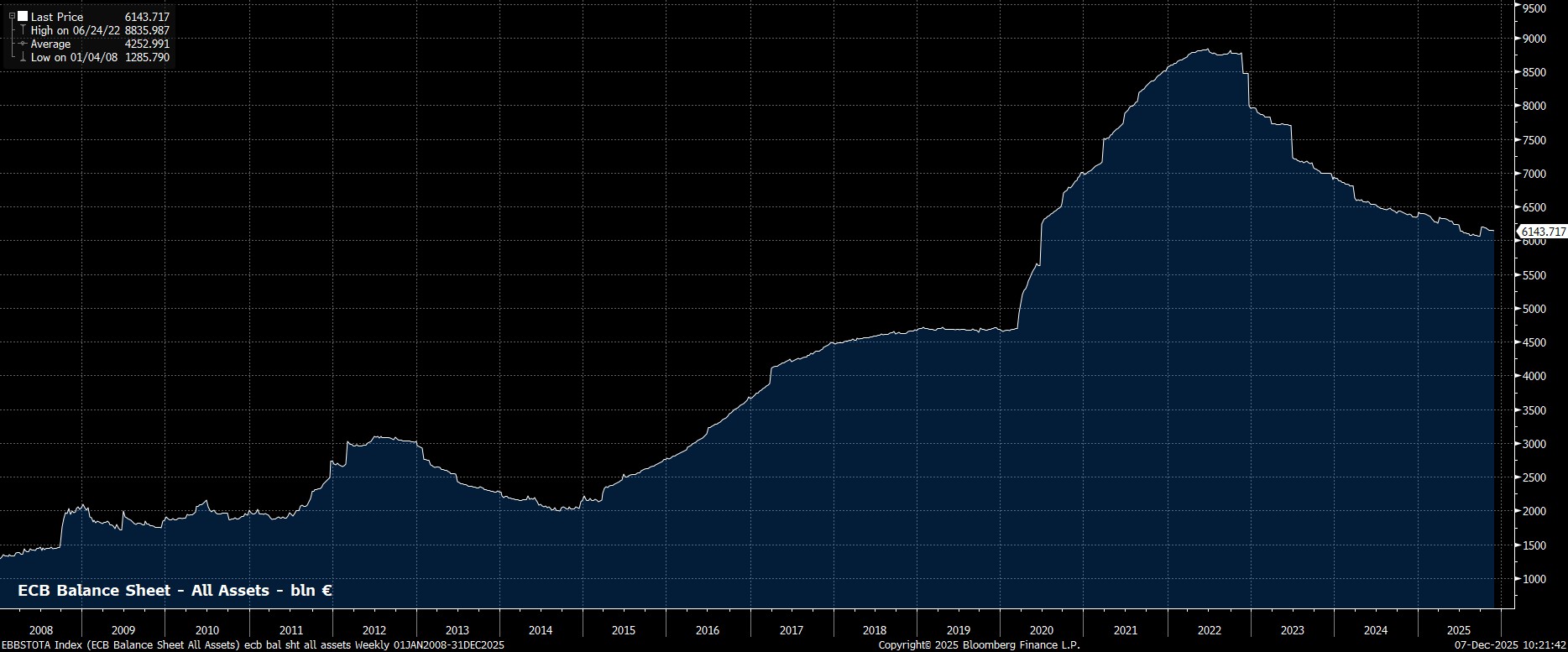

While policymakers stand pat on rates, the ‘autopilot’ nature of the ECB’s quantitative tightening programme should continue, with passive run-off of APP and PEPP holdings to continue throughout the year ahead, in the relatively uneventful fashion that they have done so thus far.

Finally A Fiscal Boost (In Part)

Given the ‘status quo’ nature of the monetary outlook, it is again fiscal policy that is likely to dominate the narrative in the year ahead, with the deficit likely to balloon significantly over the coming twelve months, bringing with it a sizeable eurozone-wide economic tailwind.

Said increase in government spending will come, in large part, from Germany, and principally from a significant uplift in defence and infrastructure spending. That said, there will also be a significant tailwind stemming from numerous changes to German taxes, including greater tax relief for higher earners, an increased basic income tax allowance, and higher child tax allowances. All this, combined, should ensure that consumption growth in Europe’s economic engine room is relatively robust over the coming twelve months, in turn providing a boost to E/Z-wide growth metrics.

That said, such a fiscal easing will not be seen across the bloc. France, for instance, will continue to focus on fiscal consolidation and deficit reduction over the coming year, despite PM Bayrou’s well-documented difficulties in passing such policies, in the face of stiff opposition from the Socialists. Deficit reduction is likely to continue to be the focus in Italy too, where said policies have been bearing fruit, though by virtue of these tighter fiscal stances, and considerably less ‘room to manoeuvre’ than peer economies, any considerable uplift in government spending is likely to come by virtue of higher tax revenues, in turn lessening the stimulative effect that such policies could have.

Broader Economic Backdrop Turns Constructive

As alluded to in this note, the broader eurozone macro backdrop is likely to turn increasingly constructive over the course of the year ahead, as the headwinds that dominated through the course of 2025, increasingly turn to tailwinds through the course of 2026.

Trade is the most obvious of these catalysts, where uncertainty continues to lift in the aftermath of the US-EU trade deal agreed during the summer, and where cross-border relationships are increasingly returning to ‘normal’, or at least adapting to what one could characterise as a ‘new normal’. While the recent strengthening in the EUR could pose a hurdle on this front, ECB policymakers have thus far displayed little by way of concern over either the downside risks to growth, or inflation, that this could pose.

On the subject of inflation, headline prices are set to undershoot the ECB’s 2% target for a period, beginning in the first quarter of next year, when a significant base effect from energy prices will exert substantial downwards pressure on headline price metrics. Despite that, services inflation is once again beginning to bubble away under the surface, having risen for the last three months in a row. Thus, earnings growth will remain a key focus, with the risks of inflation persistence having not entirely disappeared just yet.

Labour market momentum, thus far, at least, has held up relatively well, with headline unemployment having been below 6.5% for the last 18 months in a row. Taking into account the aforementioned economic tailwinds, particularly on the fiscal front, and with a lower level of trade uncertainty likely giving businesses across the bloc increased confidence to ramp up hiring, there seems little prospect of a material labour market loosening taking place which, in turn, should support consumer spending over the year to come.

Risks Remain

Although, on the whole, the outlook for 2026 is a considerably more constructive one than the year that has been and gone, there are numerous risks still on the horizon.

Trade remains an obvious theme on this front where, despite agreement of a US-EU trade deal, implementation of the agreement could prove to be a potential stumbling block, especially where tensions are already beginning to emerge when it comes to steel and aluminium levies. That said, as discussed in the 2026 US outlook, President Trump likely has some degree of incentive to ensure that relations remain relatively cordial in the run-up to next year’s US midterm elections.

Political risks also remain plentiful across the eurozone, most notably in France where, despite the political backdrop having steadied of late, PM Lecornu – and by extension President Macron – remain in very fragile positions, not least amid the need to deliver significant fiscal consolidation measures in order to drastically reduce the budget deficit. Meanwhile, as the year wears on, focus is likely to increasingly turn towards a busy year of elections in 2027, including national polls in France, Italy, and Spain, respectively the 2nd, 3rd, and 4th larges economies in the bloc.

Other potential risks that remain important to bear in mind stem from the geopolitical realm, where as yet a durable Russia-Ukraine peace agreement has yet to be reached, and still seems far away, while AI and new technologies may also cloud the outlook, especially considering the eurozone’s relative lack of advantage on this front compared to peers such as the US and China.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.