- English (UK)

2025 UK Budget: Pick & Mix Policies That Will Please Nobody

Summary

- Slower Growth, More Headroom: The OBR pencilled in slower GDP growth in every year of the forecast, albeit with the Government now having more than double the previous buffer against meeting the fiscal rules

- Tax & Spend: Taxes rise by almost £30bln, with spending higher by almost £10bln by the end of the forecast horizon, as the Treasury continue to display little sign of restraint

- Markets Unperturbed: Besides some choppiness on the early OBR release, the GBP and Gilts were relatively unfazed by the Budget, with the pitch having been heavily rolled beforehand

OBR Forecasts – Bigger Buffer, Slower Growth

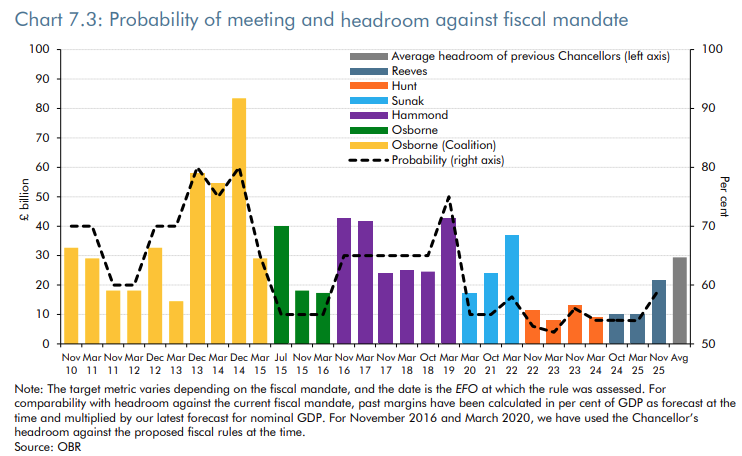

Per the OBR, policies announced in the Budget will lead to the Government meeting its fiscal rules with a buffer of £22bln in 2029-30. This headroom, which had been whittled down to just £4bln in the pre-measures forecast, is not only more than double the margin that Chancellor Reeves left herself in the spring, but is also the widest such margin since March 2022, being not at all far from the pre-covid average of £30bln.

That said, while fiscal headroom is now significantly larger, this has come at the cost of notably weaker real GDP growth in the medium-term. The OBR, as expected, revised down expectations for medium-term productivity growth by 0.3pp, a move that was long overdue. As such, lower growth is now expected in each of the next five years in the forecast horizon, however as a result of revisions causing a higher ‘starting point’ for the forecast, the overall level of UK GDP is likely little changed in 2029 relative to the last forecast round, in the spring.

A Smorgasbord Of Tax Hikes

In order to ‘balance the books’, Chancellor Reeves delivered almost a dozen tax increases, taking a ‘smorgasbord’ approach to proceedings, having U-turned on earlier plans to fill the ‘black hole’ in one fell swoop, by hiking income tax rates.

That smorgasbord, which doesn’t appear especially appetising if I’m being honest, albeit we have no choice but to eat from it, included:

- Extending the freeze on income tax, and National Insurance contributions thresholds for a further three years from 2028/29, raising £8.0bln

- Charging NICs on salary-sacrificed pension contributions, raising £4.7bln

- Increasing tax rates on dividends, property and savings income by 2pp, raising £2.1bln

- Reducing corporation tax write-down allowances, raising £1.5bln

- A ‘pay-per-mile’ scheme for electric vehicles, raising £1.4bln

- Gambling tax changes, raising £1.1bln

- Lower CGT relief, raising £0.9bln

- A ‘mansion tax’ on properties worth over £2mln, raising £0.4bln

- Tax compliance measures to raise £2.3bln

In total, the OBR project the aforementioned measures to raise £26.1bln in additional revenue.

Importantly, the vast majority of these tax increases are back-loaded, not coming into effect for two or three years. Pencilling in said hikes for 2028 is fine, on paper, however there is not only the risk of a new government taking office before then and tearing up said plans. Furthermore, it does somewhat stretch credibility to believe that those tax hikes will be implemented so close to the next general election, making all off the tax plans incredibly questionable once you dig into the details.

Little Sign Of Spending Restraint

Importantly, those tax increases were delivered not only to fill the ‘black hole’ that emerged since the ‘Spring Statement’, but also to fund even more government spending, with Reeves & Co continuing to demonstrate little-to-no restraint on that front.

In fact, overall spending is now set to increase by about £10bln compared to the path that was outlined in the spring, as a result of:

- The failure to reform welfare spending in the summer, costing around £6.9bln

- Today’s decision to scrap the two-child benefit cap, costing a further £3bln

- Various other spending increases which will lead to over £10bln in additional borrowing over the forecast horizon.

In contrast to the aforementioned tax increases, which are largely back-loaded, the above uplifts in government spending are primarily front-loaded (i.e., taking place almost immediately). This, rather obviously, potentially poses a significant issue as, while the ‘fiscal rules’ are indeed being met on paper as things currently stand, were those proposed consolidation measures to be scrapped by a new administration, this spending then becomes un-funded, significantly eating into the expanded buffer that the Chancellor has now built.

Macroeconomic Implications = Slower Growth, Higher Unemployment & Stickier Inflation

A cursory glance at the above policy mix suggests that there will be three major implications from what the Chancellor has announced.

Firstly, slower economic growth. UK GDP growth has been anaemic for some time now, with the economy having expanded by less than 0.3% QoQ in four of the last five quarters. Risks to growth continue to tilt to the downside as we look ahead into 2026, not only as a result of the tax hikes announced today likely posing a stiff headwind to consumption, but also with both business and consumer confidence likely to take a further hit.

Secondly, further labour market slack is almost certainly on the cards, with businesses now facing an even greater cost burden, particularly after the National Living Wage was hiked by 4.1%, and by 8.5% for those aged between 18-20. Such substantial increases are, frankly, folly at this stage, with youth unemployment already running north of 15%, and with these increases likely resulting in especially younger workers being ‘priced out’ of employment.

Thirdly, and following directly from the prior point, is the inflationary implications of those minimum wage increases. Businesses are bound to pass on those costs, or at least a proportion of them, in the form of higher consumer prices, thus putting under threat the disinflationary process that the economy has been making, and raising questions as to whether the Bank of England’s projection of inflation falling below the 2% target in Q2 27 still seems realistic.

Markets Choppy Amid Budget Fallout

In reaction to all of the above, UK markets traded in incredibly choppy fashion, not at all helped by the fact that the OBR released the entirety of their economic outlook around an hour before the Chancellor stood up in the Commons. The drip-feed of information as the news slowly hit wires exacerbated the volatility to a significant degree.

In any case, cable ticking 20 pips softer, and long-end Gilt yields ticking a couple of bp higher, is a relatively subdued reaction all told, and one that the Chancellor will likely be relatively content with, even if she is likely to be far from content with the Budget watchdog!

_10_2025-11-26_12-27-14.jpg)

The Verdict

Overall, the Budget contained little by way of surprises, perhaps expectedly given how much ‘pitch rolling’ had taken place, and how many leaks there had been, prior to the Chancellor standing up at the despatch box.

That said, the lack of surprises does little to distract from the Budget largely being a shambolic smorgasbord of tax hikes that may not only stand as political landmines, but which also appear unlikely, in reality, to raise the revenue that Reeves so desperately needs, given the Treasury’s inability, or unwillingness, to cut public spending. There is little-to-nothing in the Budget that will likely act as a boost to growth, to employment, or to business investment, which subsequently raises the risk that Reeves, or her successor, will be back for another round of tax hikes next autumn, as the economy slides further into the fiscal ‘doom loop’.

On that note, there is probably just enough in the Budget to allow Starmer & Reeves to muddle through until May, and a likely calamitous Labour result in the local elections. Having allowed the PM and Chancellor to ‘own’ both the Budget fallout, and that election result, rebel MPs may then choose to mount a leadership challenge, through the summer, which Starmer would inevitably lose.

Taking a step back, today’s Budget simply represents the latest episode in ‘government by spreadsheet’ from a Treasury that’s lost control of the narrative, and a Chancellor whose credibility is so shot that the OBR must be worshipped as if they are a deity. Until now, market participants have viewed Reeves as the ‘least bad’ option among Labour MPs to occupy Number 11. Based upon today’s announcements, and the apparent lack of desire to escape the present vicious cycle of ever-higher spending, and an ever-higher tax burden, that perception could soon change.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.