- English (UK)

2022 will offer new challenges when navigating markets, while some familiar ones, such as inflation and central bank divergence, will continue to drive FX trends.

I've refrained from making predictions for 2022 – they can be useful for investors to know where to position portfolios, but I see little value or edge for traders. What's important is identifying the core themes that may be prevalent and reconciling how the market is reacting and responding to them.

Ultimately, I want to assess the probability of trending conditions in which we can hold exposures through or take the timeframe in and scalp in and out of. It will also have huge ramifications for volatility and range expansion/contraction, which affects all of us who are active.

With some scope for movement until the turn of the year, it’s been the Chinese Yuan which has been the strongest currency in 2021. However, taking the focus to G10 FX, it’s been the USD that has rallied vs all currencies this year – recall, the broad consensus at the end of 2020 was for a weaker USD – the view was EURUSD would rally to 1.2400 by Q421, with calls ranging from 1.3000 to 1.1500 - So at 1.1280, no FX strategist really came that close. The consensus for the USD index was 88 and we now see 96.50 in our sights.

Somewhat ironically, in late 2019 forecasters were widely bullish on the USD going into 2020, and ultimately in 2020 we saw the USD fall vs all major currencies except the ZAR and MXN.

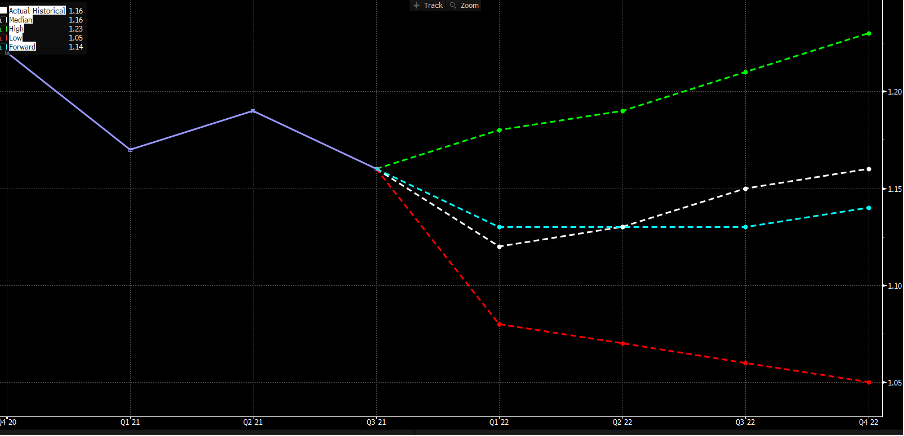

EURUSD forecasts with high, median, and low calls

(Source: Bloomberg - Past performance is not indicative of future performance.)

Looking ahead and the median call from strategists (who supplied forecasts to Bloomberg) for Q4 2022 and we see EURUSD at 1.16, AUDUSD at 0.75, GBPUSD at 1.38 and USDJPY at 115. So calls on the USD are quite nuanced and there is not the one-sided view we may have had in years gone by. The spread in calls for EURUSD (by Q4) ranging from 1.23 to 1.05.

Positioning must play a part here and recall the market is long of USDs and very short of AUD and EUR.

The consensus call for crude is $66.96 and $1800 in XAUUSD and 5200 in S&P 500.

I think these can be widely dismissed and are not helpful for short-term traders, as given the evolving dynamics markets could really go anywhere – our job as traders is to have an open mind, not fall in love with a view and trade the tape as per the strategy.

So what is key for 2022?

FX volatility to make a genuine comeback. Central banks, bar the PBoC, seem to have shifted from ultra-predictable policy settings, which has radically suppressed FX volatility. Perhaps led by the BoE, the Fed and others have joined the party injecting surprise and uncertainty into policy settings, which seems unlikely to go away unless we see a shock to the system. In theory, this change in central bank stance should lead to a year of higher volatility and movement in FX markets.

Central bank policy normalisation is the core theme – the Fed actions will dominate and while we’ve seen short-term pockets of volatility in Q3/Q4, the visibility to too uncertain to really make a call on markets – especially if the Fed are not only going to start hiking, but potentially actively talk up reducing its $8.76t balance sheet. This is what's priced, but the big surprise would be if the Fed were forced to radically pivot – the markets can be brutal when they want to be.

Geopolitics and politics will again play a greater role – we have a raft of major political events in LATAM, France and of course the US Mid-Terms. Traders typically tend to be woeful at pricing risk around major political events and hence we tend to get great volatility as a result.

Hopefully, Covid becomes less of a concern from humanity, subsequently realising greater animal spirits into global economics – hope is not a strategy though and of course the optimist in me questions if an aggressive spread with low severe cases proves ultimately to be a positive event for humanity and markets. May it be so. Ready to trade the potential opportunity? Trade it with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.