CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

We navigate corporate earnings from several global titans. We get several marquee economic data releases, central bank meetings from three of the world’s price makers, and we’re likely to hear of stimulus to be announced from China’s Politburo meeting. We also get month-end flows.

In equity land, we see the Dow Jones index up for 10 straight days, a fate that hasn’t played out since 2017, when we saw 13 consecutive up days. While many of the big names are considered to be ‘priced for perfection’, the pain trade remains to the upside in the major equity bourses, and we will need to see a deterioration in the economic data or a reversal higher in inflation to give the bears their 5-10% drawdown. Until then, traders will be buyers of equity weakness.

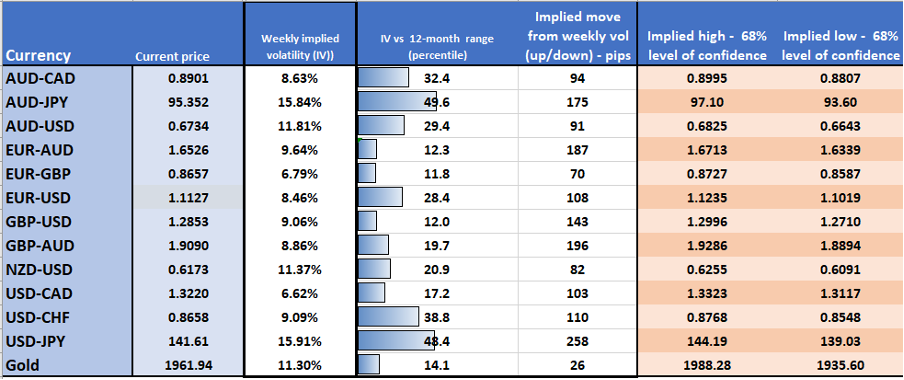

The USD found a better tone last week, notably vs the NZD and JPY, and it feels like there is more USD upside to come. It is obviously prudent to keep a close eye on JPY exposures, where we see 1-week implied volatility higher in the JPY crosses than elsewhere in G10 FX. CHFJPY is the horse I’m backing, and last week’s breakout may have legs.

CHFJPY - daily chart

This is a week where we recognise the event timeline and make sure we’re either in front of the screens over the news or have sufficiently managed the exposure. This week we manage risk – it's how we stay in the game. We take in new news; we are humble to the aggregation of behaviours and the collective wisdom in the price action. We observe, we react, and, as always, nimble in our approach. Good luck.

(G10 FX options implied volatility matrix)

The marquee event risks for the week ahead:

China Politburo meeting (28-31 July) – the key policy decision-makers in China meet and should announce a range of fiscal stimulus measures to support targeted areas of the Chinese economy. The market is high on expectations (for stimulus) but has so far refrained from expressing a strong view in financial assets, and the CN50, CHINAH and yuan have yet to see any trend. I hold a slight skew to be long Chinese assets into the meeting, with proxies (AUD, NZD, and copper) likely following closely.

US Q2 corporate earnings – it’s the marquee week of earnings with 48% of the S&P500 market cap due to the report (60% of the tech sectors market cap). Trader favourites include Alphabet (Tuesday – the implied move on the day of earnings is 2.7%), Microsoft (Tuesday - 5.3%), Meta (Wed - 4.4%), Intel (Thurs - 6.4%) and Exxon (Friday – 1.4%).

ASX200 earnings – ASX200 earnings get going with CBA due to report on 9 Aug. In the lead-up this week, we get 1H23 numbers from RIO (Wed 16:15 AEST), with the street expecting 1H23 EBITDA of $12.32b, on sales of $26.4b. The AUS200 will become highly sensitive to bottom-up factors, with price now trading towards its range high of 7400.

UK100 earnings – This week, we get numbers from Rio, Lloyds (Wed), and Barclays (Thurs). The UK100 was the best performing major equity index last week, and I see the skew of risk for a move into 7800.

Bank of Japan (BoJ) meeting (Friday – sometime in the Asia afternoon) – Headlines (Source: Reuters) on Friday detailed that the BoJ was not seeing any urgent need to make changes to its Yield Curve Control (YCC) program. Market expectations of policy tightening have therefore been lowered, with Japan 10yr swaps closing 11bp lower on the week at 59bp (or 0.59%) - the JPY has found renewed selling interest, with USDJPY eyeing a push into 142.

Several market participants have talked up the BoJ’s form of being unpredictable, however, consider that Governor Ueda is changing tactics and is looking to regain market credibility around its forward guidance - so it would surprise to see YCC tweaked, an outcome which could cause a sizeable JPY rally. We also look to new inflation forecasts from the BoJ, and these forecasts may be influential for the JPY. Recall the BoJ forecast core CPI at 2.5% for 2023, and this should be revised above 3.3%. Any changes to its 2024 core CPI forecast above 1.8% could be a JPY positive. I like buying pullbacks in JPY pairs, notably CHFJPY and USDJPY.

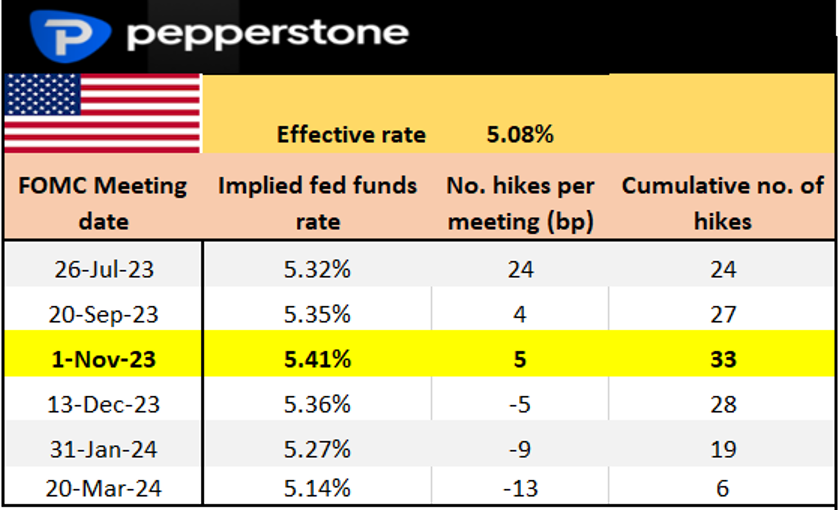

FOMC meeting – (Thurs 04:00 AEST, with Fed chair Jay Powell speaking at 04:30 AEST) – the Federal Reserve should almost certainly hike by 25bp this week, although this is fully priced into markets. This is not the time for the bank to declare victory on its fight against inflation, and Jay Powell should make that clear, striking a modestly hawkish tone in his press conference.

From August, the Fed’s reaction function will be entirely driven by the incoming data, and specifically the outcome of the month-over-month (MoM) core PCE deflator and core CPI prints. Once the Fed hike this week, we see a 30% chance of another hike priced for the November FOMC meeting. This feels a touch too low, but on balance, the market sees this as the last hike in the cycle.

(US swaps pricing – what’s ‘priced in’)

ECB meeting (Thurs 22:15 AEST) – the ECB will hike 25bp this week and offer vague guidance that they may look to hike again if the data starts to heat up again. With the market pricing the ECB peak/terminal rate at 3.87% by December, these expectations feel fairly priced, and one could argue the ECB meeting will be undramatic.

Aus Q2 CPI (Wed 11:30 AEST) – Aussie interest rate futures price 15bp of hikes for the 1 Aug RBA meeting; a 60% implied probability of a hike. The Q2 CPI data should move that pricing, so the outcome should matter for the AUD. The market eyes headline Q2 CPI at 1% QoQ / 6.2% YoY (from 7%). We eye the trimmed mean CPI measure, which is expected at 6% (from 6.6% last quarter). A 5-handle on Q2 Inflation should see the implied probability of a hike come down to around 30% and see AUDUSD into 0.6650 through the week. An inflation print above 6.5% will make a hike in August the strong consensus position – in this scenario look for AUDNZD and AUDJPY to continue finding good buyers.

US Core PCE deflator (Friday 22:30 AEST) – I think it makes sense to remove base effects and look at this US inflation on a month-over-month basis. Here, the market looks for core PCE inflation to come in at 0.2% MoM. Taking this to 2 decimal places – simplistically, a read above 0.25% (which rounds it to 0.3% MoM) would be USD positive and would increase the prospect of a hike in September or November. A reading below 0.15% and the USD likely finds sellers.

UK composite PMI (Mon 18:30 AEST) – the market looks for the composite PMI print to come in at 52.3, a slower pace of growth from the 52.8 recorded in June. While the manufacturing diffusion index is eyed at 46.0, given the market is evenly split on a 25bp or 50bp hike at the 3 Aug BoE meeting, GBP could be especially sensitive to any downside surprise in the services PMI print, which is eyed at 53.0. Any number below 50 shows a decline in activity from the prior month.

French & German CPI (Fri 16:45 & 22:00 AEST) – while many will be focused on the ECB meeting, the country-level CPI prints could impact the EUR. The market median consensus is for French CPI to come in at 4.2% YoY and German CPI at 6.2%.

EU composite PMI (Mon 18:00 AEST) – another data point which could get some attention from EUR traders. The market eyes the composite print to slow down to 49.6 (from 49.9). We know manufacturing will be weak, but any read below 50 in the service PMI print will surprise and cause EUR volatility.

Euro Area Bank Lending Survey – (Tues 18:00 AEST) – the market will expect some tightening in bank lending standards. This is a data point that many won’t have on their radar but holds some significance at a macro level.

US Q2 Employment Cost Index (ECI - Fri 22:30) – the market sees the ECI at 1.1% (from 1.2%) – we know the Fed look at the ECI closely as a gauge of wage pressures. I think the USD reacts to an extreme outcome; above 1.3% or at/below 0.9%.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)