- English

- Italiano

- Español

- Français

Learn to trade

The birth of the DAX

Frank Mella, an Editor of the Borsen-Zeitung in the 1980’s, is regarded to be the brains behind the DAX. His publisher at the time asked him if he could come up with an index to highlight Germany as a financial centre. The DAX was born, as a result of his work.

Figure 1 frank-mella.de

It was founded in July 1988 with a base value of 1,000. The highest that the Dax has ever traded is 16290 on the 18th of November 2021.

The DAX, also known as the Deutscher Aktienindex (German Stock Index), initially recorded the share performance of the largest 30 blue chip companies by Market Capitalization listed on the Frankfurt Stock Exchange (DAX 30).

The rebirth (DAX 30 to DAX 40)

In September 2021 the Deutsche Boerse tightened the rules on membership to the index while expanding the number of companies from 30 to 40. This was in response to the Wirecard accounting scandal* and to offer a broader reflection of the German economy.

*Wirecard accounting scandal involved a huge commercial fraud involving Wirecards former Chief Executive Markus Braun and two colleagues. Reports suggest that 1.9 billion went missing.

Figure 2 DAX Pepperstone

New rules for listing on the DAX

New rules were implemented to boost the quality of the companies listed on the index.

These rules included:

- Companies must be profitable. Insolvent companies are removed for the DAX within two days.

- Companies must publish quarterly statements and audited annual financial reports promptly.

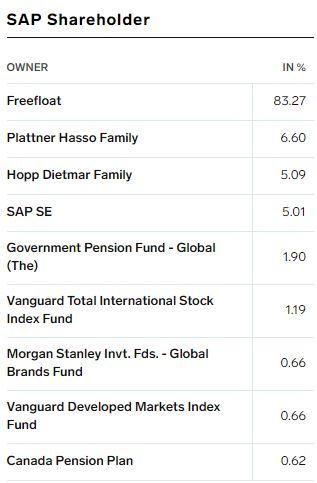

- They must have a free float of at least 10%. This is the portion of the company's shares that can be traded on the open markets.

Any breaches of these conditions result in the removal of the company from the DAX after a 30-day grace period.

Figure 3 market business insider SAP Shareholding free float 83.27% 05/10/2022

DAX Trading Hours

The DAX40 trading hours are 09:00 to 17:40 CET Monday to Friday. Pepperstone calculatesout of hours pricing, allowing trading on the underlying asset 24-hours a day from Sunday night to Friday night.

Similar Indices

Similar indices include the United Kingdom’s FTSE 100, the French CAC 40, and the United States Dow Jones 30.

There are some fundamental differences between different indices that you should be aware of.

For instance, in the United States, there are three main indices. They are the Dow 30, the NASDAQ 100 and the S&P 500. All three are a measure of market performance. However, the Dow 30 measures 30 blue-chip companies while the S&P 500 and NASDAQ 100 use market capitalization.

The S&P 500 and NASDAQ 100 are more sector focused. The NASDAQ 100 contains predominantly technology companies.

When we look at the DAX 40 and the FTSE 100, a great percentage of FTSE 100 companies generate their income from overseas, while in the DAX 40 only a limited amount relies on revenue from abroad.

These are important factors to consider, with currency fluctuations affecting the FTSE 100 far more than the DAX 40.

It should be noted that there are two calculations for the DAX. The DAX TR is a performance index. The index is relatively unique in the fact that it takes dividend yields into account. The DAX PR does not take dividends into account. The DAX TR is the most traded one out there.

What companies make up the index?

The companies that make up the DAX 40 are globally recognised. As of the 5th of October 2022, the 40 listed companies are:

Adidas |

Airbus |

Allianz |

BASF |

Bayer |

Beiersdorf |

BMW |

Brenntag |

Continental |

Covestro |

Daimler Truck Holding |

Deutsche Bank |

Deutsche Boerse |

Deutsche Post |

Deutsche Telekom |

E.ON |

Fresenius |

Fresenius Medical Care |

Hannover Rück |

HeidelbergCement |

Henkel |

Infineon Technologies |

Linde |

Mercedes Benz Group |

Merck |

MTU Aero Engines |

Münchener Rück |

Porsche Automobil Holding |

Puma |

Qiagen |

RWE |

SAP |

Sartorius |

Siemens |

Siemens Energy |

Siemens Healthineers |

Symrise |

Volkswagen |

Vonovia |

Zalando |

What is market capitalization?

Market capitalization is the value of a company that is traded on the stock market, calculated by multiplying the total number of shares by the present share price.

For example, a company with 10 million shares valued at £5 per share would have a market cap of £50 million.

Who are the heavy weights?

The Dax does not allow a single company to have a weighting over 10% of the index.

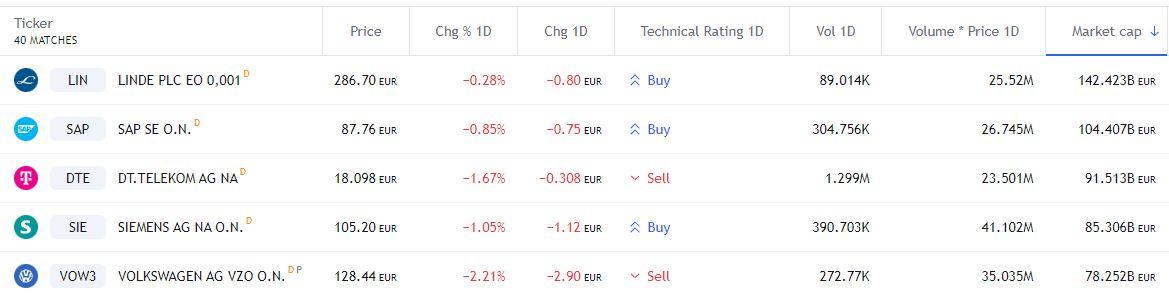

The 5 largest companies by market capitalization are:

- LINDE PLC – Headquarters in Guildford, the United Kingdom. The company specialises in the production and distribution of industrial gases. They have a global presence.

- SAP SE - Headquarters in Walldorf, Germany. The company is the world's leading enterprise resource planning software vendor.

- DT. TELELKOM AG - Headquarters in Bonn, Germany. A leading telecommunications and technology company.

- SIEMENS AG - - Headquarters in Munich, Germany. A technology company focused on industry, infrastructure, transport, and healthcare.

- VOLKSWAGEN AG - Headquarters in Wolfsburg, Germany. A vehicle manufacturing company.

Figure 4 TradingView Top 5 DAX40 Market Cap 05/10/2022

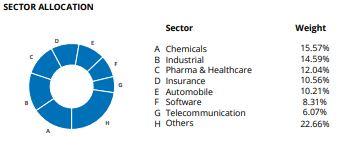

DAX by sectors

The sector allocation is broad and covers between 75-80% of companies listed on the FWB (Frankfuter Wertpapierborse – Frankfurt Stock Exchange).

Figure 5 DAX-indices sector allocations

What drives the performance of the DAX?

Global sentiment

War, global inflation concerns, the UK leaving the EU and the coronavirus. These occurrences have all had a knock-on effect on the price of DAX. Covid, inflation, and Brexit are more recent sentiment changers but still create a significant effect on the index.

Although not perfectly correlated, global stock indices tend to track each other. Sometimes when this correlation is over extended traders look to benefit by trading a system known as a spread trade, selling one index and buying the other. A typical example is the FTSE/DAX spread trade.

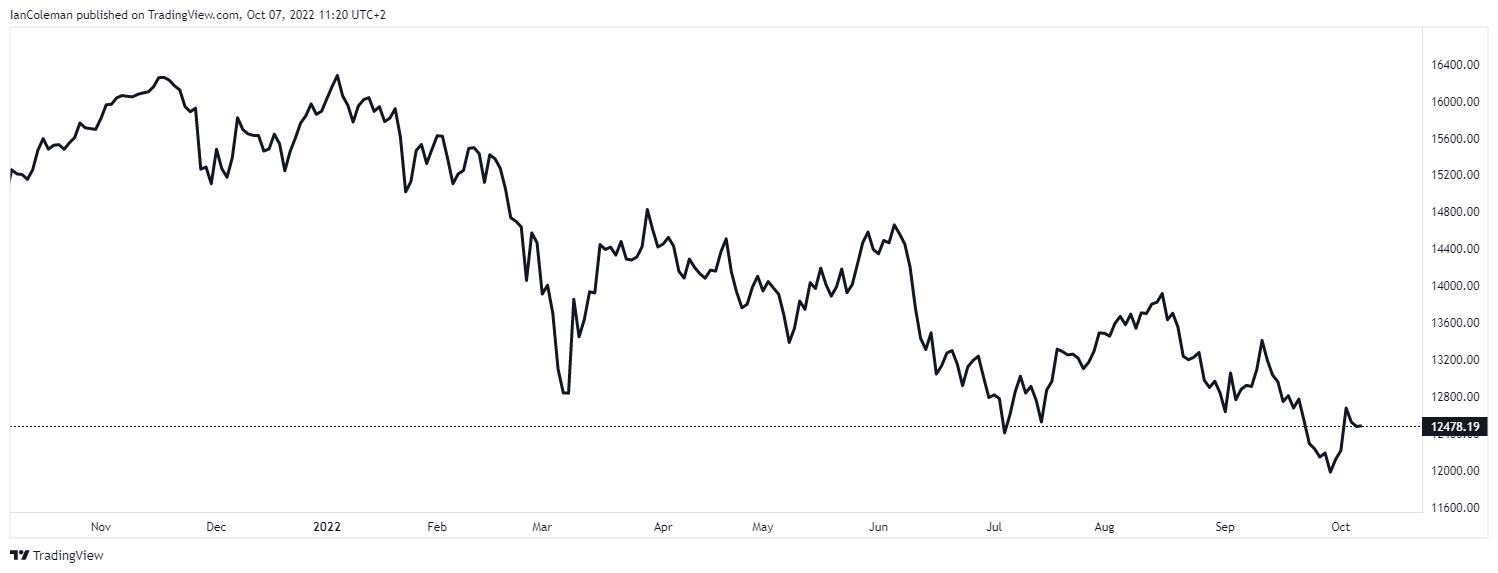

Figure 6 Global indices 06/10/2022

Currency fluctuations – key exporters

The strength or weakness of the Euro against its counterparts can influence the profitability of German companies who export to countries around the globe. If the Euro is falling, it makes German goods more affordable and can lead to a boost in sales and profits. Conversely, a rising Euro can have a dampening effect on exports.

Company performance

A heavily weighted share price can have a direct impact on the index. In October 2008 VW’s share price more than quadrupled in just two days, at one point making them the most valuable company in the world. The short squeeze only lasted a few days with the shares then falling 58% over the next four days. Volkswagen was down 70% from its peak a month later.

Futures and Options

What are the differences between futures and options?

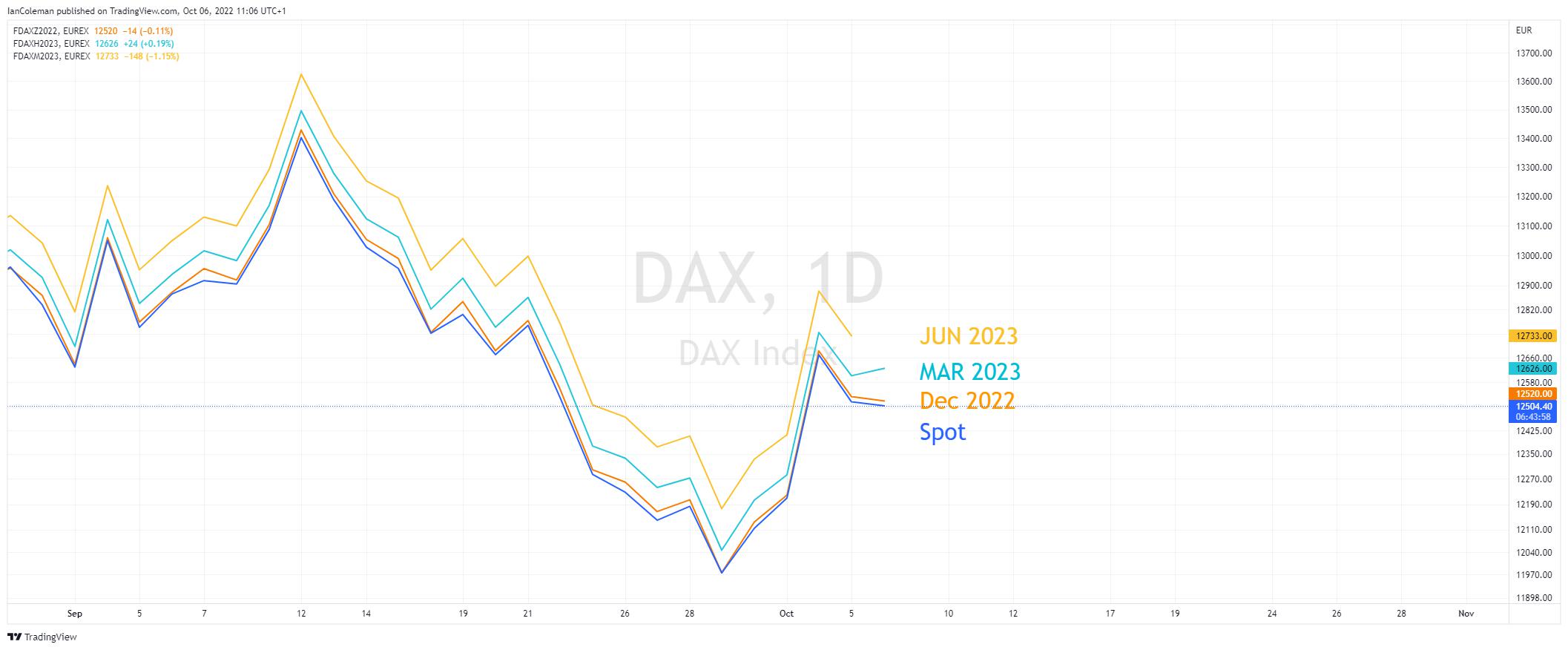

Futures

A DAX futures contract is an obligation to trade the DAX as a specified price on a specified date. The settlement dates for DAX futures are the third Friday in the contract month. The contract months are March, June, September, and December.

A DAX future will be priced at a premium to spot. As a rule, the further the settlement date, the greater the difference will be. On the settlement date the DAX cash and DAX futures will be the same.

One futures contract has a value of EUR25 per point. This is fairly big especially when we account for the daily fluctuations of the index. It is known to be fairly volatile.

The code for Dax Futures is FDAX. The monthly codes are Z for December, H for March, M for June, and U for September. The March 2023 contract is: FDAXH2023.

Figure 7 DAX futures 06/10/2022

Options

The holder of an option has the right, but not the obligation, to buy or sell an asset at an agreed price and date.

There are two basic types of options. A PUT option gives the holder the right to sell an asset at an agreed price and date. A CALL option gives the holder the right to buy an asset at an agreed price and date.

DAX options are actively traded due to their high liquidity and the ability to get exposure to the German economy.

EUREX offer mini-DAX futures with a tick size of EUR5 and micro-DAX with size of EUR1.

An explanation of financial derivatives

A financial derivative, such as a Contract for Difference (CFD), Exchange Traded Fund (ETF) or Futures and Options, are a product whose value is dependent on the underlying asset.

The GER40 CFD tracks the price of the underlying asset, which is the DAX cash price.

How can I get exposure to the DAX or the German economy

Trading through Pepperstone offers two ways to get exposure. The first, and most popular, is trading the GER40 Contract for Difference (CFD). Secondly, you might consider trading a German Exchange Traded Fund, the iShares MSCI Germany ETF.

INDEX CFD

Some advantages of trading CFDs with Pepperstone:

- You can go long as well as short (buy or sell).

- The ability to use leverage, offering you higher exposure to the market.

- Out of hours trading from Sunday night to Friday night.

- No Capital Gains Tax on profits.

- Pepperstone is regulated by the FCA, BAFIN, CySEC, DFSA, CMA and others.

Figure 8 DAX CFD 06/10/2022

ETF

An Exchange Traded Fund is an investment vehicle that is traded like a share. An ETF is a pooled investment vehicle. ETFs track an index, a single or basket of commodities or a defined sector.

Pepperstone offer trading on the iShares MSCI Germany ETF CFD, short code EWG.P.

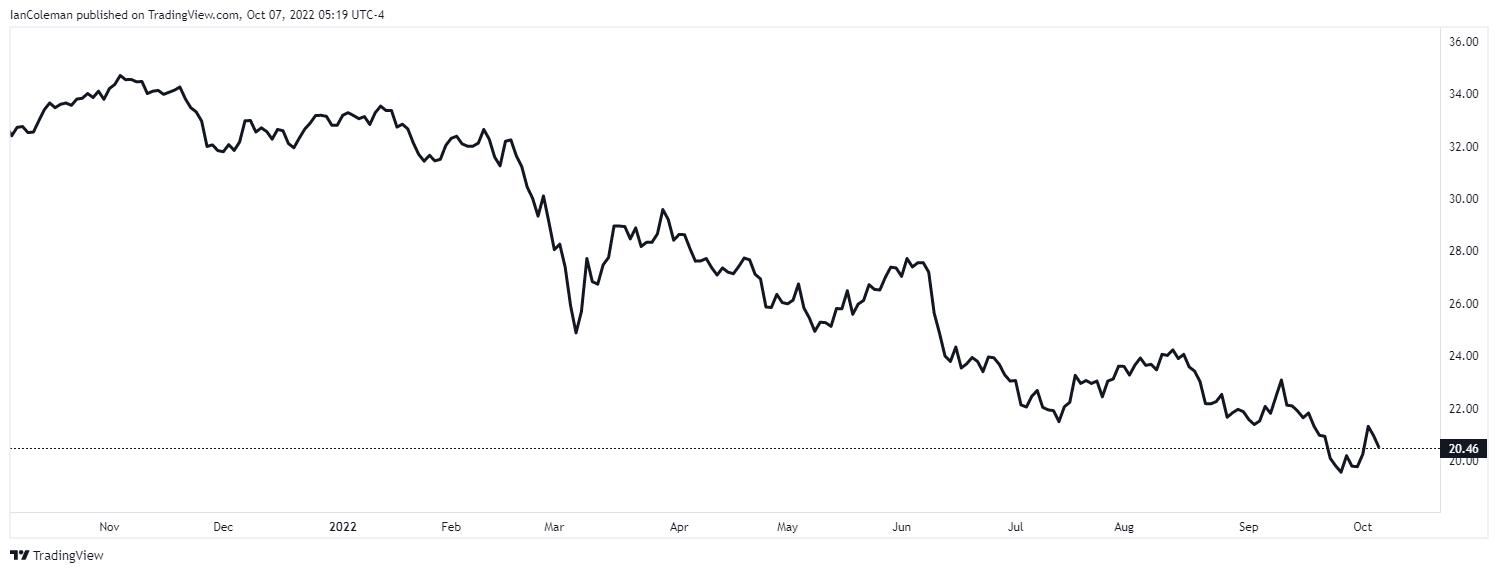

Figure 9 MSCI Germany ETF 06/10/2022

Why trade the DAX?

The GER40 is a liquid product making it suitable for investors and day-traders alike.

- It is a good barometer of the economic health of Europe, Germany being the largest economy within the Eurozone.

- The GER40 also offers ample price swings throughout the day making it a favourite product for day-traders.

- The ability to go long and short.

- Leverage, allowing for higher exposure.

- Possible hedging against your stock portfolio.

- The ability to choose a trade size that suits your exposure and risk tolerance.

- Extended trading hours.

- Tight spreads, reducing your cost to trade.

Holding overnight trades on the GER40 may require funding. This will vary depending on the currency the trade is executed in, the position size, and if the trader is net long or short. This is a fee that you pay on leveraged trades.

Interesting facts about the DAX

- The worst yearly performance in the DAX was in 2002 with a decline of -44%. An aggressive selloff was also seen in 2008 with a decline of -40%.

Figure 10 DAX worst yearly selloff 06/10/2022

- The Deutsche Telecom IPO (initial public offering) was the largest in the history of the DAX. The demand for the 713 million share was fivefold resulting in a valuation of EUR13 billion.

- On the 20th of March 1998 the DAX closed above 5000 for the first time.

- From June 1999 DAX was calculated exclusively on electronic Xetra pricing.

- Fifteen companies have stayed with the DAX index since its launch.

- The 13th of October 2008 resulted in the biggest daily gain of 11.4%.

Technical analysis

Technical analysis is a common technique used by traders to calculate future expected price movements. This may be chart formations like trend channels or candlestick patterns, like a reversal Evening Doji Star. Perhaps a study of the Elliott Wave theory or symmetrical cypher formations. Let us break down the GER40 using time frame analysis:

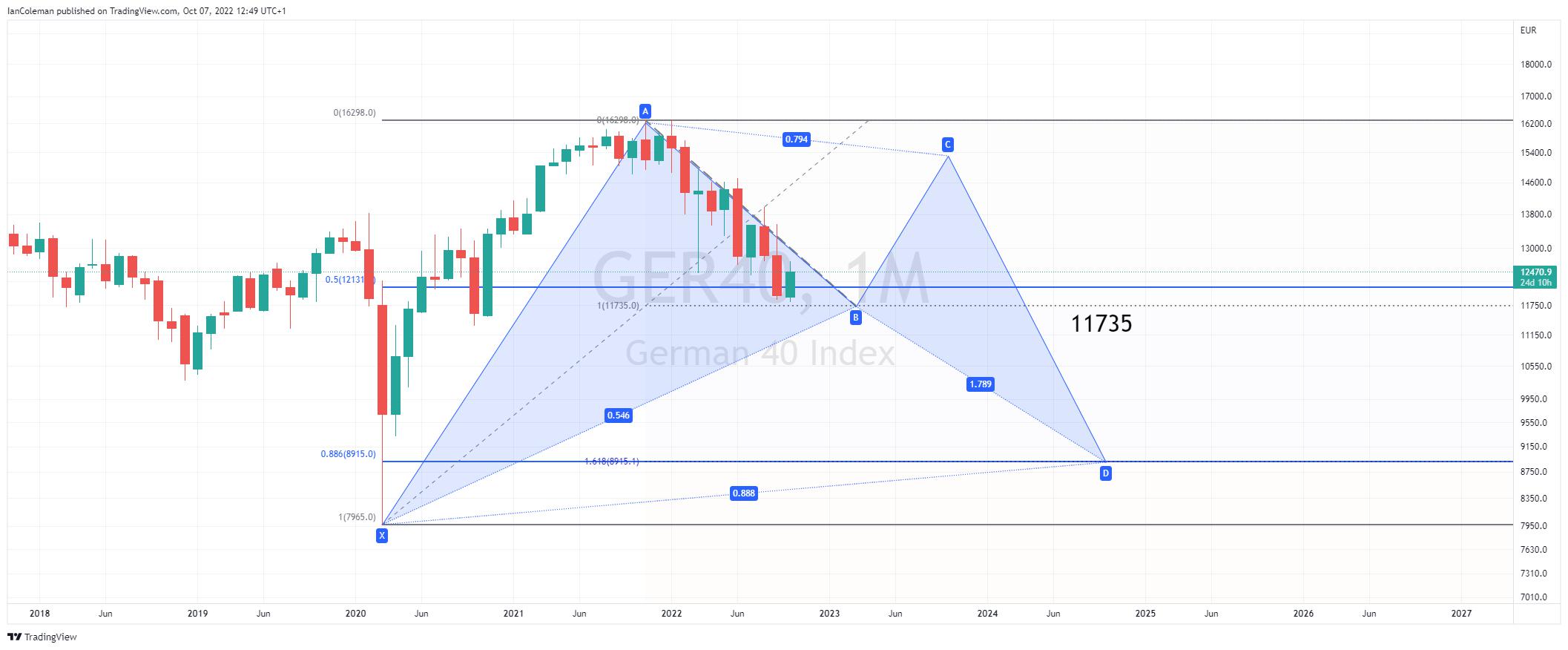

GER40 Monthly Chart

Cypher price level support is calculated at 11735. A push to the upside from this zone could eventually form a pattern known as a symmetrical BAT.

Figure 11 DAX monthly 06/10/2022

GER40 Weekly Chart

The weekly chart is highlighting a bullish Outside Candle. This pattern is often seen at the base of a trend and the start of a new upside bias. Price action from the start of 2022 could be seen as a falling wedge pattern. This has an eventual bias to break to the upside. Current trend line resistance is seen at 13544.

Figure 12 DAX weekly 06/10/2022

Day Trading the DAX

Scalping technique

Day trading the DAX (GER40) is a common pastime for traders due to its liquidity, tight spreads, and price fluctuations.

Scalping techniques look to profit from short term price movements. They are normally analysed and traded from short timeframes such as 5-, 3- and 1-minute charts.

Let us start by using a reversal candle formation known as an OUTSIDE BAR. In the chart below we highlight all the bullish and bearish scenarios.

A bearish outside candle (Red arrow) is a candle that has a higher high and a low lower than the previous candle and closes lower than its opens.

A bullish outside candle (Green arrow) is a candle that has a lower low and a higher high and closes higher than its opens.

Figure 13 DAX 1 minute Outside Bars

You can clearly see that some of the ‘signals’ worked while others did not. This is where traders look to add in overlays.

Let us add in the Relative Strength Index with a 14 setting and 14 SMA (simple moving average). The new rules are:

Sell Trade: Bearish Outside Candle + RSI above 50 + RSI/EMA crossover.

Buy Trade: Bullish Outside Candle + RSI below 50 + RSI/EMA crossover.

We delete the arrows that do not conform to this new filter. The added filter results offer more productive signals.

Figure 1 DAX 1 minute Outside Bars plus RSI

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.