CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

July 2024 US Employment Report: Dismal Data Fuels Further Fed Cut Bets

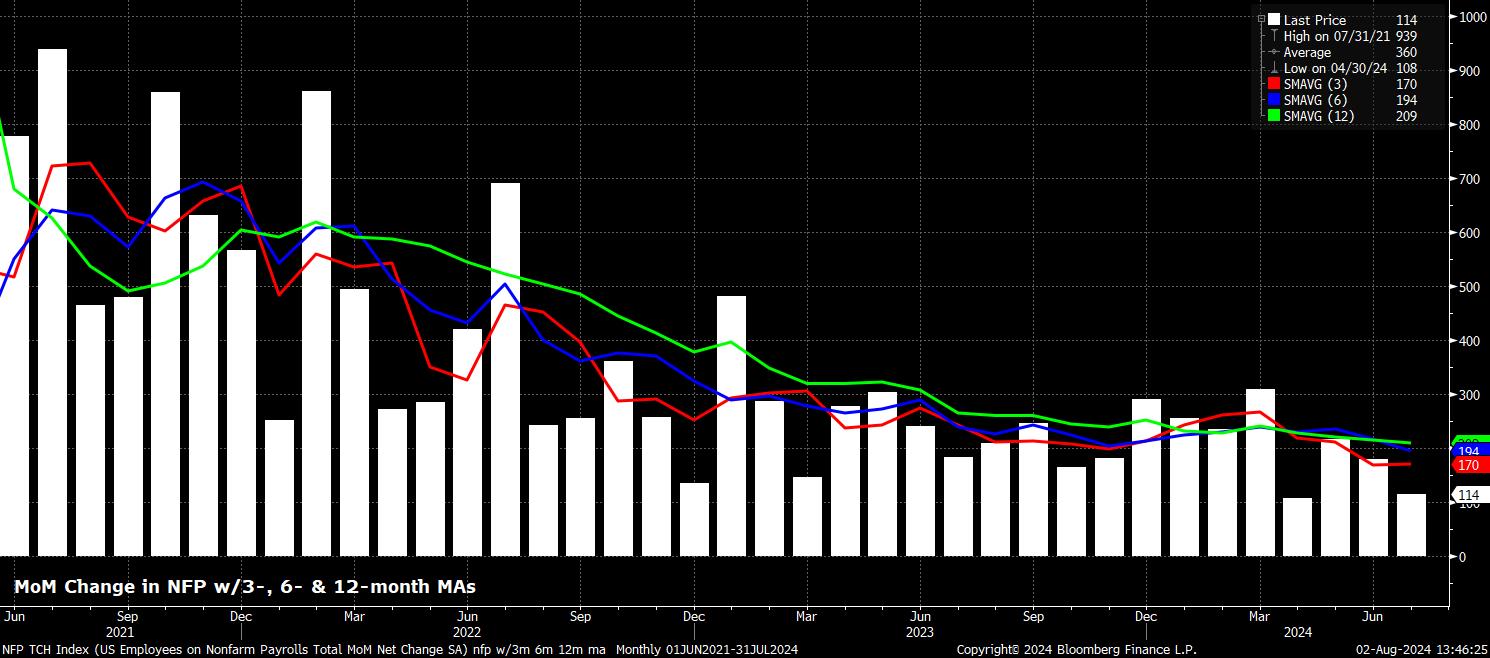

Headline nonfarm payrolls rose by just +114k in July, considerably below consensus expectations for a +175k increase, albeit just within the always-wide forecast range, of +70k to +230k. At the same time, data for May and June was revised by a net -29k, bringing the 3-month average of job gains to +170k, a modest further decline from the prior +177k. At the same time, both the 6- and 12-month averages of job gains, at +194k and +209k respectively, also now sit considerably below the ‘breakeven’ pace of job growth required to keep pace with growth in the size of the labour force.

Diving into the data, and particularly given the scale of the downside surprise, it was interesting that the BLS noted there was no discernible detrimental impact on the NFP print from Hurricane Beryl, which struck during the survey week, perhaps pointing to a greater degree of underlying softness within the labour market than had previously been anticipated.

In any case, the sectoral split of job gains reveals notable drops in employment, on an MoM basis, in the Information, Financial Activities, and Other Services sectors. All other sectors experienced an MoM increase in employment, albeit at a substantially slower pace than in recent months, with government hiring – at just +17k – a considerable drag on the overall headline figure, having been running closer to +50k in recent months.

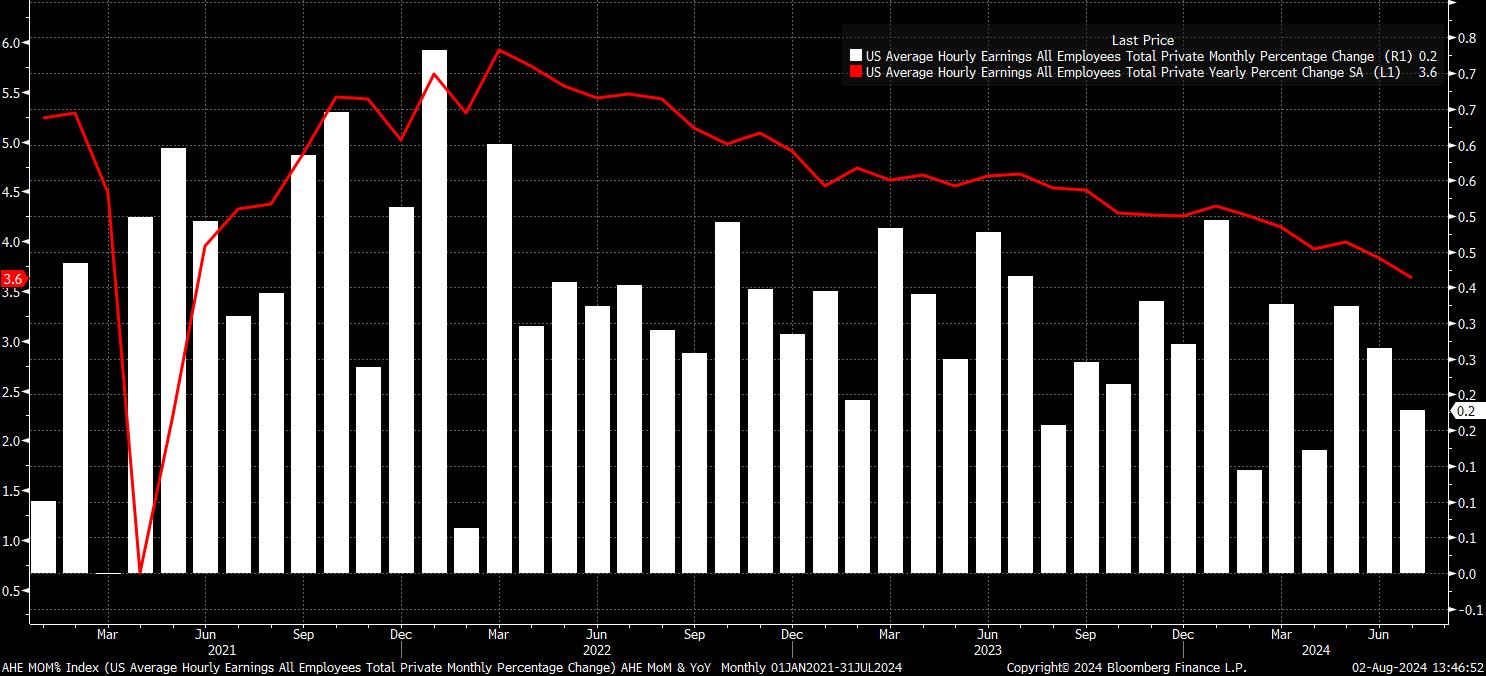

Staying with the establishment survey, the employment report also showed average hourly earnings rose by a cooler than expected 0.2% MoM lats month, below expectations for an unchanged 0.3% MoM print.

Said monthly increase saw the annual pace of earnings growth continue to cool, to 3.6% YoY, down from a prior 3.9% YoY. While some degree of this decline owes to base effects from last year’s data, the continued easing in earnings pressures both provides further evidence of the labour market slowly but surely loosening, as well as likely giving the FOMC increased confidence in inflation moving sustainably towards the 2% target over the medium-term.

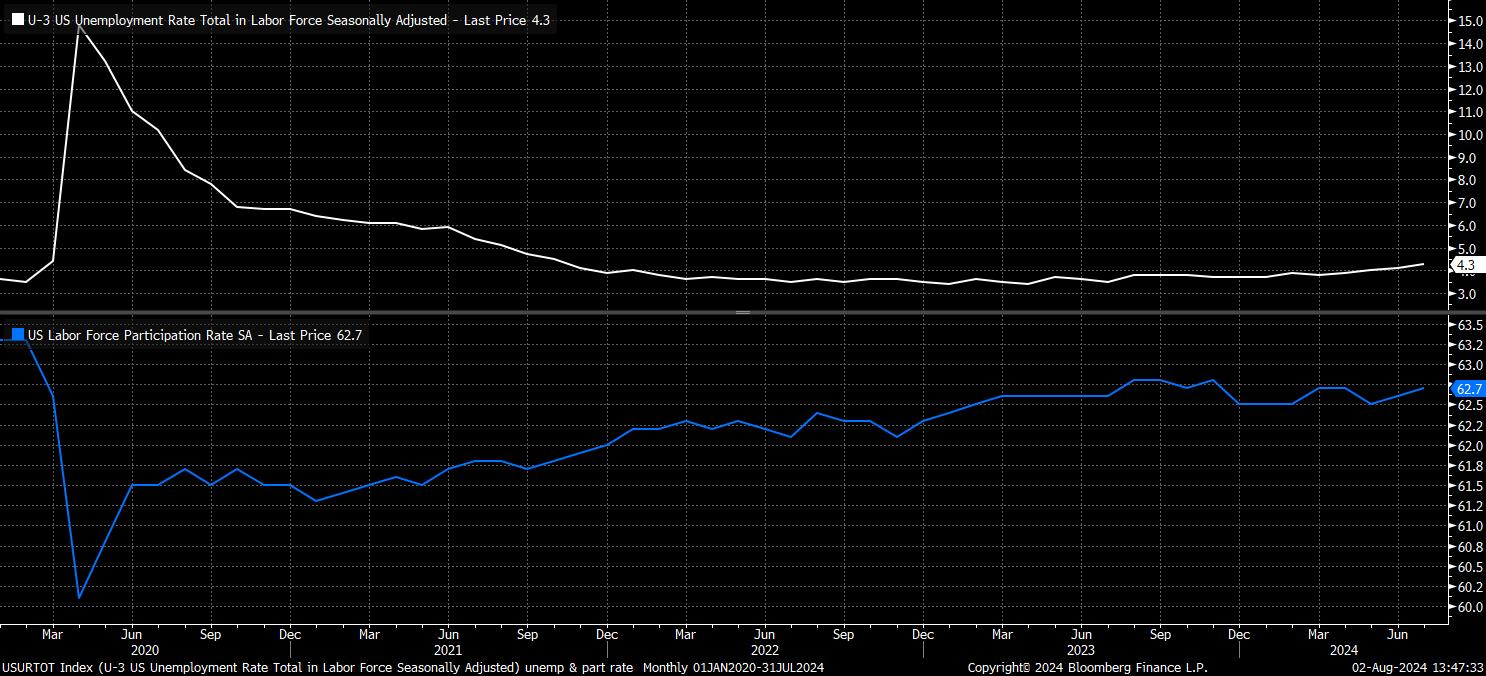

Turning to the household survey, and measures of labour market slack, headline unemployment unexpectedly rose to 4.3%, from a prior 4.1%, triggering the so-called ‘Sahm Rule’ recession indicator, whereby the 3-month moving average of joblessness is now 0.5pp above its 12-month low.

Some of this rise in unemployment, however, is due to the increased size of the labour force, with participation having risen 0.1pp MoM to 62.7%, while the reliability of such an indicator could well be called into question, especially when the economy just chalked up annualised growth of 2.8% QoQ in the three months to June, and has grown at a >2% pace in 7 of the last 8 quarters.

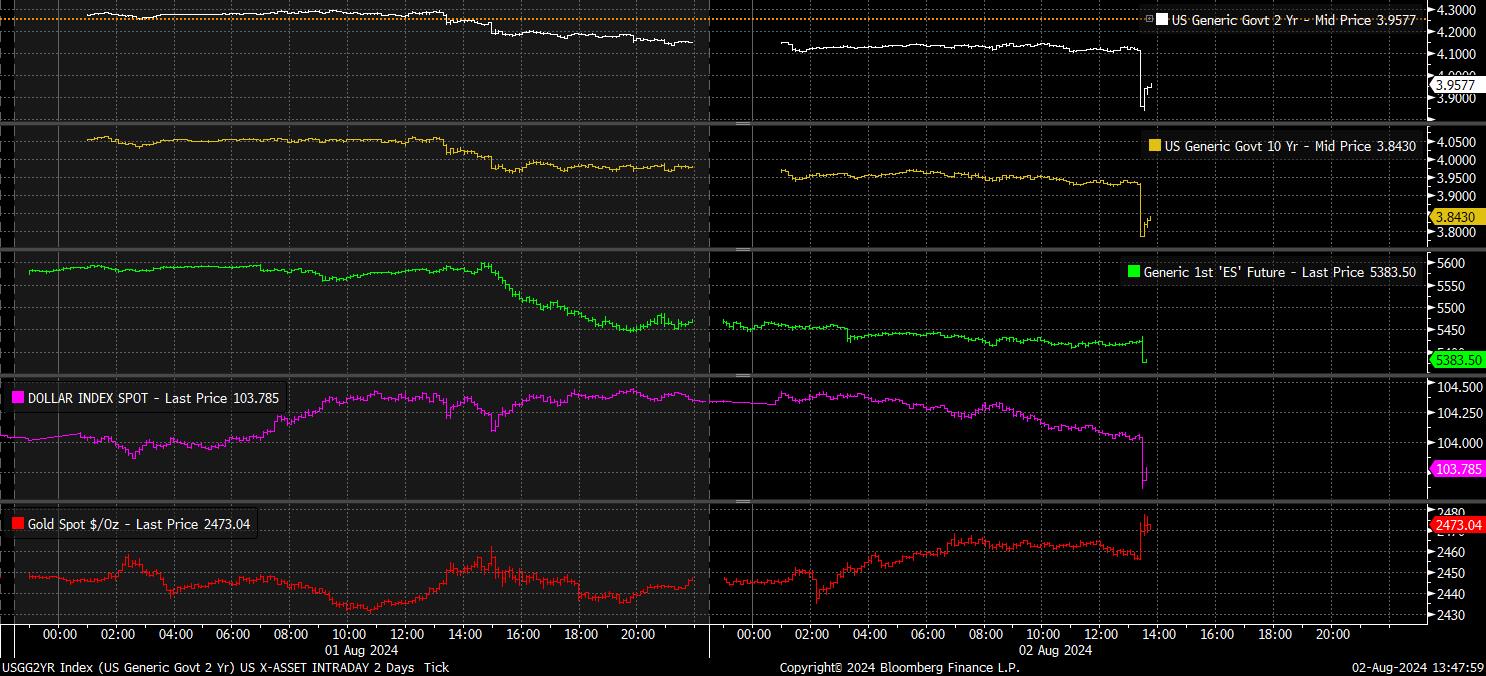

That said, the USD OIS curve immediately underwent a significant dovish repricing as the data crossed, with money markets now pricing a whopping 105bp of easing from the FOMC this year, around 20bp more than pre-NFP. Concurrently, the curve implies around a 62% chance that the Fed will kick-off the easing cycle with a 50bp cut in September, pricing around 40bp of cuts for the next meeting, approx. 10bp more than before the payrolls data dropped.

This dovish reaction was also seen in the Treasury space, with bonds rallying across the curve, led by the front-end, with the 2-year yield at one point falling over 25bp, and touching its lowest levels in a year.

Elsewhere, it was a case of ‘bad news is bad news’ for the equity market, with futures sliding to fresh day lows after the jobs print, including the front S&P contract dipping back beneath the 5,400 handle. Of course, the dismal data dropped into a market where risk appetite was already under considerable pressure, after yesterday’s significant downside ISM manufacturing surprise, and poor after market earnings from the likes of Amazon and Intel.

In the FX space, the USD softened across the board, losing ground against all G10 peers, as the DXY slipped back beneath the 104 mark, while the JPY outperformed, as USD/JPY extended earlier declines to 2 big figures on the day, likely aided by the carry unwind gathering some pace. Gold also rose after the jobs report, with the yellow metal gaining around 1%, benefitting from both the softer greenback, and rally in fixed income.

On the whole, there is little in this report that is likely to dissuade the FOMC from delivering this cycle's first 25bp cut at the next meeting in September, as was hinted at in this week's statement, and press conference, with the Committee now increasingly attentive to both sides of the dual mandate, as opposed to the prior laser-like focus solely on inflation.

Of course, there remains one more jobs report, along with two further CPI prints, before that decision, though a significant adverse data surprise would now be needed to deter policymakers from a cut next time around. Current market pricing, however, seems rather over-done, with the OIS curve now fully pricing 4 25bp Fed cuts this year. The Committee will be careful not to over-react to one data-point, as markets appear to have done so, instead preferring to normalise policy at a significantly more gradual, and steady, pace, barring external shocks.

In turn, the likely eventual pricing out of some degree of easing which the curve now discounts is likely to provide some support for the dollar while, despite recent weakness, the supportive policy backdrop - across DM, not only in the US - should continue to see the path of least resistance lead higher for equities over the medium-term.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.