- English

- 中文版

Timing – 31 Oct (no set time – likely between 1 pm to 3 pm AEDT)

The tide is turning in Japan and while BoJ policy change is glacial - especially when we consider the intense pace at which other G10 central banks have acted – we’re now hearing that Japanese pension funds are looking are re-weighting of domestic JGBs, with yields on long-end bonds more attractive than holding foreign bonds on a currency-hedged basis.

These future re-weightings will involve huge amounts of capital and increase the perception of JPY inflows, and a lasting process of capital moving back to Japan.

On the inflation front, we’ve seen Tokyo core CPI coming in line, or beating expectations, in all but 2 of the last 24 readings. With core CPI running at 3.8% and well above the bank's target of 2%, we’ll see some lumpy inflation upgrades tomorrow from the BoJ.

So why not start to tighten policy? The simple reason is they haven’t prepped the market fully, and they want to garner real confidence from the Spring Shunto wage negotiations – we should start to hear the outcome of these negotiations in the weeks ahead.

All eyes on changes to the YCC band

While no one is expecting a move in interest rates away from NIRP (Negative Interest Rate Policy) – that is an early 2024 story - Where we could see some policy change through the widening of the YCC (Yield Curve Control) band. At present, the BoJ cap 10yr JGB (Japan govt bonds) yields at 100bp (or 1%). If we were to see a test of the 1% cap in the near-term the BoJ would buy unlimited amounts of JGBs to confine yields to 1%.

Currently, we see the 10-year JGB at 89bp, with yields up 14bp since 16 October. So, sellers have pushed JGB yields towards the cap, with the more freely moving JP 10yr swap sitting above 1% at 1.10% - it’s, therefore, clear that some in the market has positioned for the BoJ to lift the cap to 1.50%, some may even be thinking it's removed altogether.

The market’s base case is for no change

While 34/45 economists expect no change, given the recent flow and positioning in the JGB market, if the YCC cap remains at 1% then we could see a spike higher in USDJPY and the JPY crosses – I would guess to the tune of 30-50 pips. I would be a buyer on that JPY weakness.

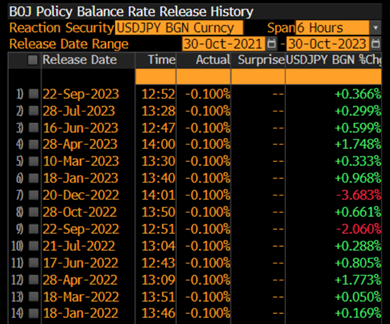

This fits in with the reaction we’ve seen in prior BoJ meetings, where since Jan 2022 the JPY has weakened in all but 2 meetings.

Could we see the cap lifted to 1.5%?

If the BoJ lifts the cap to 1.5%, one suspects this action will be accompanied by supportive rhetoric that they will continue to intervene intraday and buy JGBs to smooth out any overly violent moves. This action would see a more pronounced downside move in USDJPY, perhaps 50-70 pips (at a guess), although the likely accompanying language should limit the reaction.

As always, positioning will play a part – where we currently see leveraged funds short of JPY, while real money is modestly long, and retail aggressively long JPY and seeing greater downside risk in USDJPY.

One does question why the BoJ doesn’t just get rid of the YCC cap altogether. A scenario which isn't entirely impossible, but would likely send shockwaves through global bond markets, and by extension FX markets too. One could argue that YCC lacks credibility anyhow, given the BoJ seems to move the cap every time the market tests the limit. It simply results in them having to buy greater quantities of outstanding debt and cornering the market.

The trade?

Over the coming week or so, I see further upside risk in the JPY - My preference for the BoJ meeting though is to stand aside, but place limit sell orders above the market into the meeting. If the BoJ leaves YCC unchanged then positioning should be unwound and I get a fill - I suspect the move will be short-lived and the flow should reverse. CHFJPY is looking like one of the weaker crosses at this point, so selling spikes in CHFJPY looks compelling – and should we get closer to MOF verbal intervention I am on the right side of that too.

Japan’s 30-year yield relative to returns from foreign bonds with currency hedges is now appealing, and “we will gradually start purchases as yen bond returns have risen to quite attractive levels.” said Hiroyuki Nomura, operating officer and senior general manager of the investment planning department at Japan Post Insurance Co.

“We are investing in super-long debt with a relatively cautious stance,” Kenichiro Kitamura, general manager of Meiji Yasuda Life Insurance Co.’s investment planning and research department, said in a briefing in Tokyo on Wednesday. “The current yield levels are quite attractive, but they are likely to rise further and we don’t have to rush to buy them now.”

Below is a table showing life insurers’ second half plans and forecasts.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.