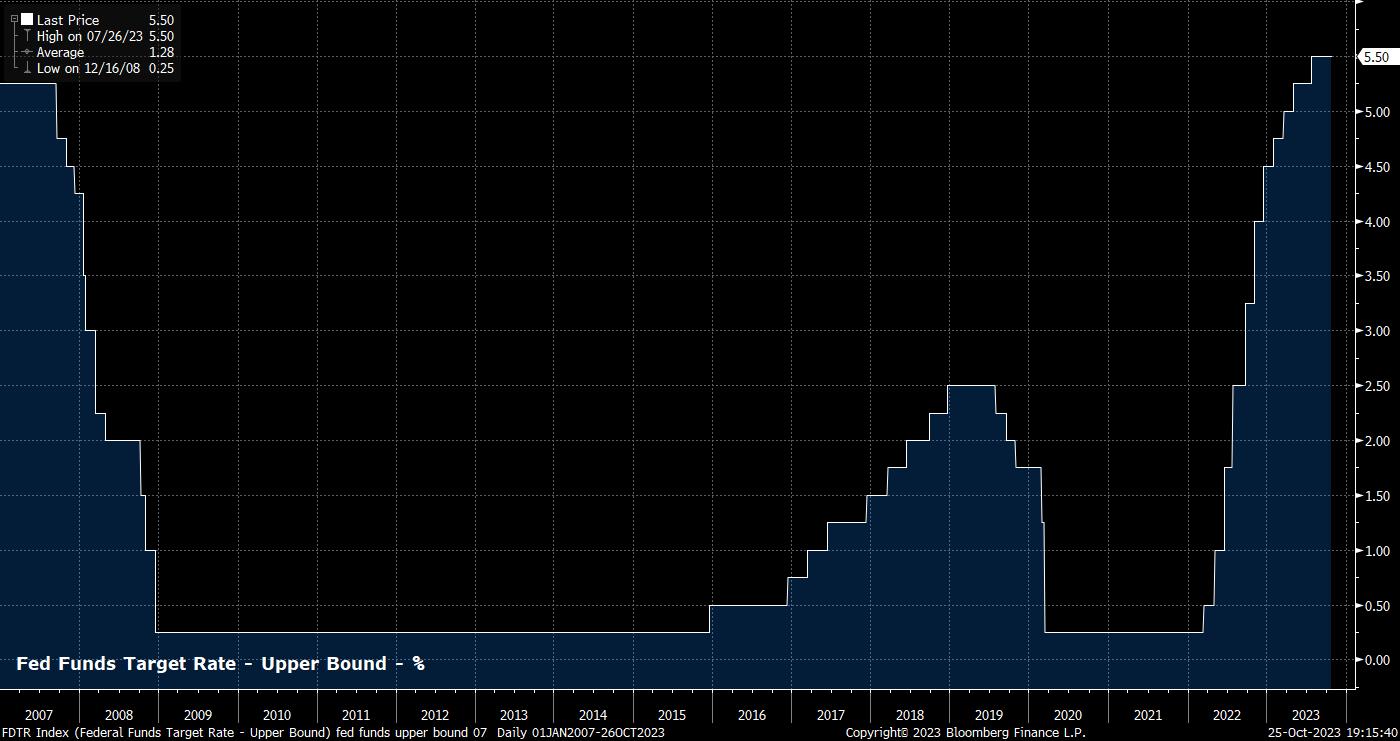

As noted, the target range for the fed funds rate is set to be maintained at 5.25% - 5.50% at the conclusion of the November FOMC meeting, in what should be a unanimous vote among policymakers. Markets are fully onboard with this view, as OIS prices next to no chance of any tightening this month, with just 6bp of hikes priced by the end of the year.

Despite having indicated in the September ‘dot plot’ that a further 25bp hike remains on the table before the year is out, financial markets have done a significant amount of heavy lifting for the Fed in the intervening period.

Long-duration Treasury yields trade around 60bp higher than at the time of the last meeting, while the curve has bear steepened significantly, as equities have continued to slip from their mid-summer highs. Altogether, this has contributed to a significant tightening in financial conditions, with Goldman’s index pointing to conditions being at their tightest in just over a year, despite nominal overnight rates remaining unchanged since July.

Numerous policymakers, including Chair Powell, Vice Chair Jefferson, and others, have noted the importance of the Fed taking into account financial conditions when setting policy – something which markets have taken as a firm nod towards the Fed not needing to hike further, with markets having done policymakers’ jobs for them.

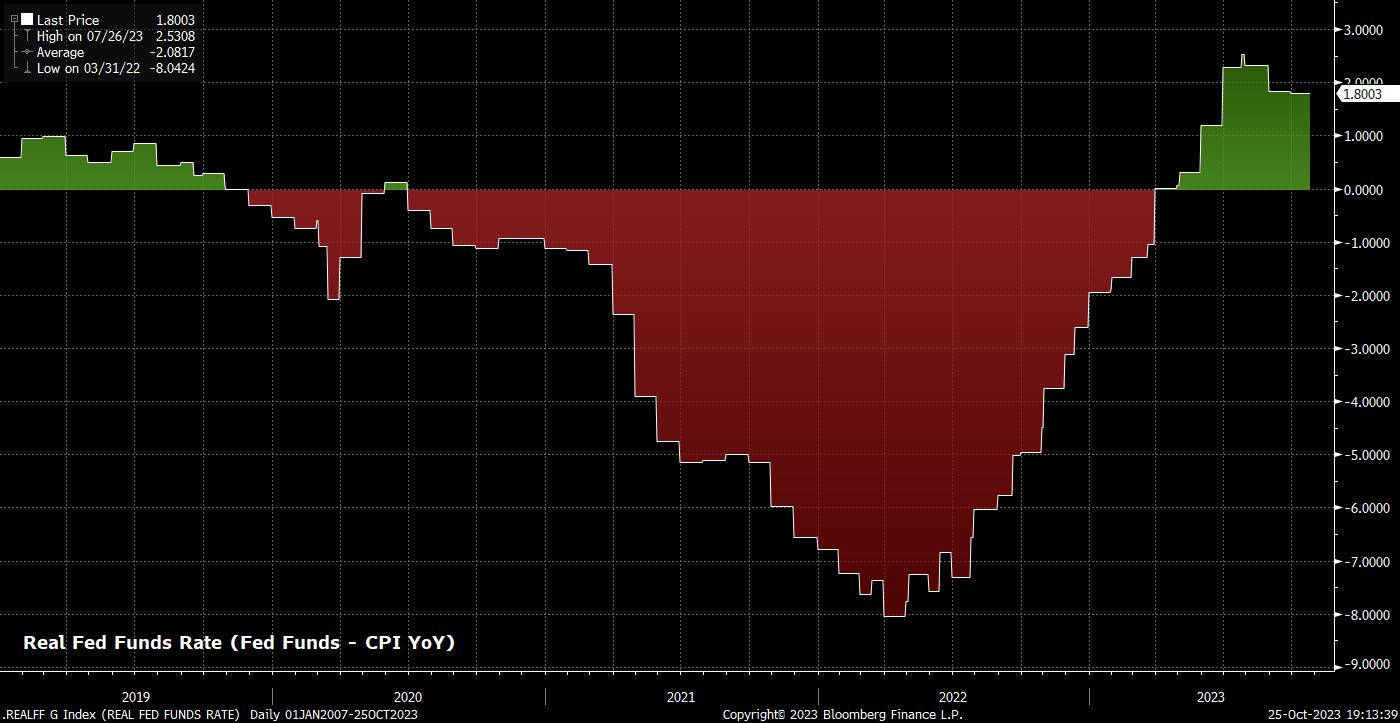

Financial conditions, and the relative policy stance, are factors that are likely to take on increasing importance moving into 2024. As inflation continues to fade towards the 2% target, as most forecasts imply, holding the fed funds rate steady would result in a relative, mechanical tightening of policy, via a higher real overnight rate. This is likely an increasing consideration for policymakers, particularly as the risk of overtightening increases towards the latter stages of the economic cycle.

Nevertheless, with the battle against inflation still far from being decisively won, and new upside risks emerging in the form of a potential energy shock resulting from rising geopolitical risks in the Middle East, the Committee are likely to maintain a significant degree of flexibility when it comes to future policy decisions.

Consequently, the policy statement should largely be a ‘copy and paste’ of that delivered in September, alluding once more to “the extent of additional policy firming that may be appropriate”, while reiterating a data-dependent stance continuing to incorporate incoming economic data, the cumulative tightening delivered to date, and the lags with which policy operates into policy discussions.

Despite this, markets are firmly of the view that the FOMC are done with hikes for this economic cycle, pricing a terminal rate just 10bp above the current fed funds rate, with many expecting the FOMC not to deliver the hike that the dots continue to imply.

Incoming economic data remains remarkably resilient, and permits the Committee to remain on pause, and proceed with the cautious optimism currently on display.

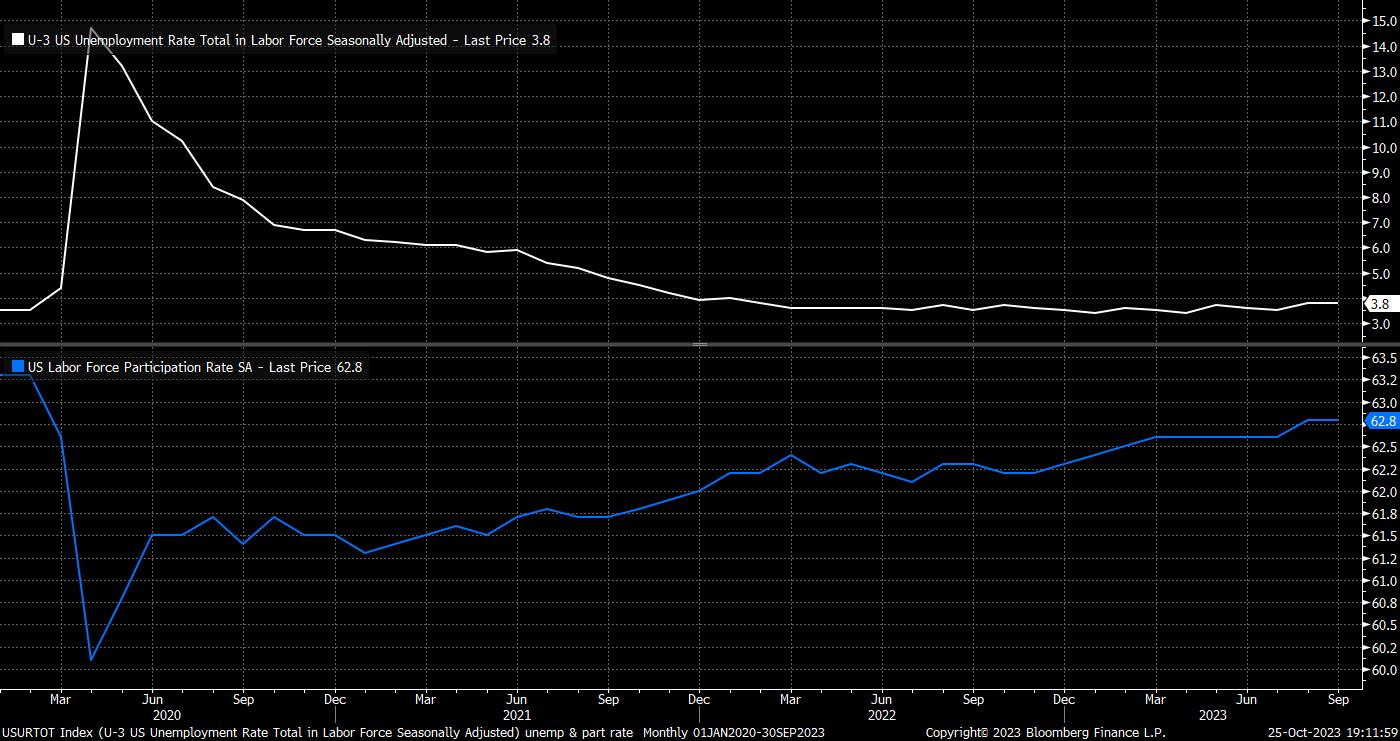

The labour market, in particular, remains incredibly strong, with headline nonfarm payrolls having averaged a gain of 266k in the third quarter. Unemployment, meanwhile, held steady at 3.8% in September, with the uptick from the 3.4% cycle lows printed in April being driven entirely by a rise in labour force participation – seen as a positive among Committee members – to 62.8%, while prime age participation remains at a multi-decade high 83.5%.

Furthermore, despite continued signs of labour market tightness, and arguably the market running much tighter than policymakers would ideally want, there continue to be few substantial upward earnings pressures. Average hourly earnings, for example, continue to rise by an average of approximately 0.2% MoM, with scant evidence of any wage-price spiral developing.

On the subject of inflation, price pressures continue to fade within the US economy.

Headline CPI remained flat at 3.7% YoY in September, as the impacts of the rally in crude and gasoline over the summer began to fade from the data. Nevertheless, removing both energy and food, core CPI continues to show solid progress on disinflation, falling to 4.1% YoY last month, a 2-year low. Similar signs of disinflation are seen in PPI, with factory gate prices being a useful leading indicator for headline CPI, as well as the Fed’s preferred core PCE inflation gauge, which fell to 3.9% YoY in August, on track for the FOMC’s year-end forecast of 3.7% YoY.

Data of this ilk permits the Committee to remain in ‘wait and see’ mode, particularly while safe in the knowledge that conditions will continue to tighten in the near future even as they sit on their hands.

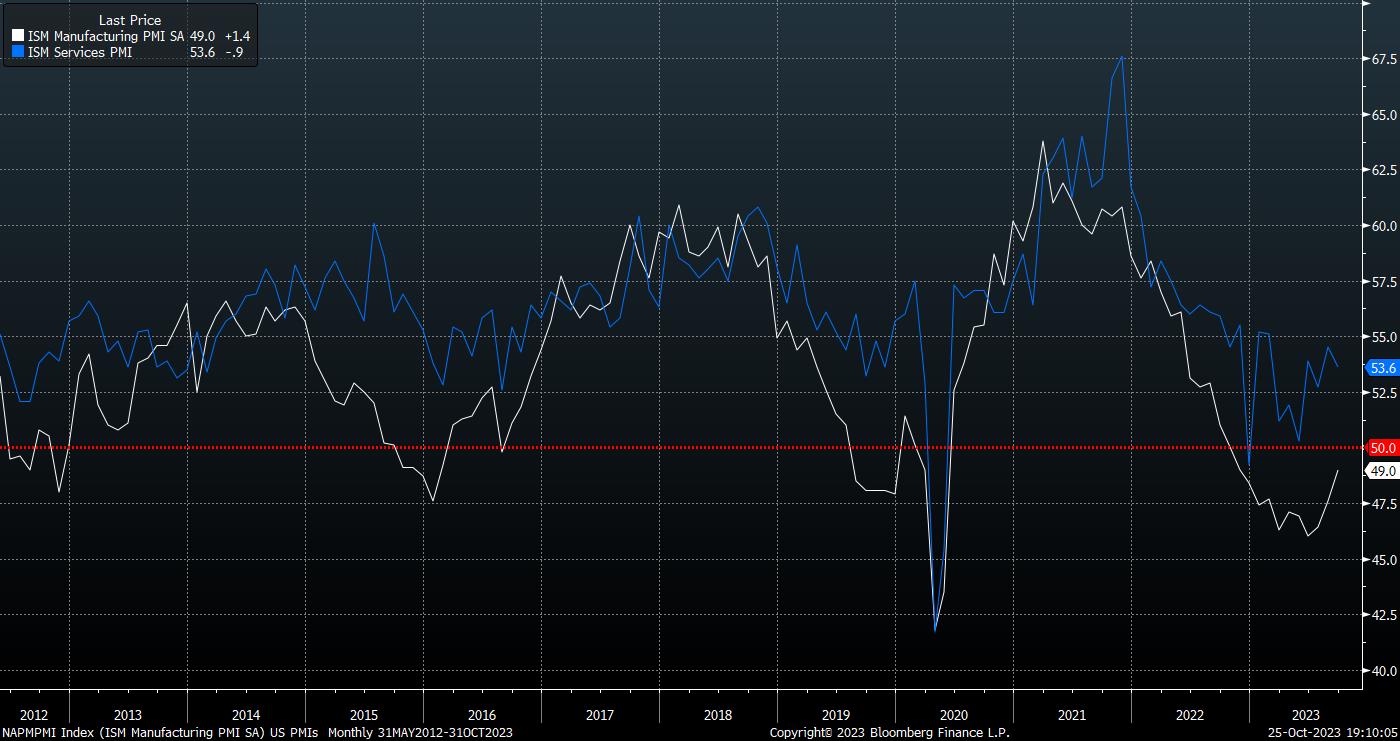

The growth backdrop also aids here, with GDP set to have risen by an annualised pace in excess of 4% in the third quarter, while the ISM services gauge continues to imply a strong pace of output growth, as the manufacturing survey recovers back towards expansionary territory.

Despite this, GDP growth may in fact be too rapid for the FOMC’s liking. Chair Powell has noted on numerous occasions the need for a period of “below-trend” growth in order to be assured of inflation returning to 2%, something which the economy is clearly not experiencing at present. Powell is likely to reiterate a desire to see such a slowing in economic momentum at the post-meeting press conference, while broadly sticking to his recent script – emphasising that moves in financial conditions can impact policy if persistent, while repeating that the Committee are not at a point where the timing of potential rate cuts is under consideration.

The key question for most observers over the presser will be whether the Chair is prepared to define the current policy stance as being ‘sufficiently restrictive’ – code for rates being at a high enough level to bring inflation under control, and the hiking cycle being over. Thus far, Powell has declined to use such terminology, noting that while policy is “restrictive”, it is not yet possible to say that is sufficiently so. A deviation from such a stance would be highly surprising at this meeting, though is plausible at the December decision.

As for financial markets, the risks to the dollar appear tilted to the upside into the FOMC, though with the geopolitical environment remaining highly uncertain and fluid, any high conviction views are hard to come by for now.

_D_2023-10-25_19-08-42.jpg)

However, with fed fund futures pricing more than three 25bp rate cuts before January 2025, and the FOMC likely to reiterate their ‘higher for longer’ stance, the buck may find some demand. The DXY has been trading in a tight range of late, between 105.50 – 107.20, with those levels marking out immediate support and resistance, respectively, with the 50-day moving average lurking just below the bottom of this range.

Meanwhile, in the equity complex, the bears have wrestled a greater degree of control over proceedings in recent days, with the S&P closing under the 200-day moving average for the first time since March, and testing 4,200. Risks over the FOMC appear tilted towards further selling, particularly given the relatively dovish nature of current market pricing.

To the downside, 4,100 then 4,050 stand out as the most significant support levels, the former being of more importance given the resilient way in which the level held firm in both Q1 and Q2 upon numerous tests. Above, reclaiming the 200-dma, currently 4,260, on a closing basis is needed to give the bulls back the upper hand.

Finally, one must consider Treasuries, given the rampant and aggressive sell-off that continues to take place at the long-end of the curve. Most would argue that this move is being driven more by rising term premium and fiscal concerns than anything linked to monetary policy, though the continued bear steepening of the curve continues to catch the eye, with the 2s10s close to flipping back above 0 for the first time in over a year.

Many are starting to consider whether the long-end presents a buying opportunity with both 10s and 30s, as near as makes no difference, trading at 5%. While compelling on a yield basis, a prolonged rally here likely requires a steep economic slowdown, or significant increase in geopolitical risk. That said, covering shorts at these levels makes sense.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.